Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settlement of accounts, people of all kinds check their budget, tell us about their financial organization as a couple or alone, and their relationship with money. Today it is Sylvie who has agreed to analyze her accounts for us.

First name : Sylvia

Age : 45 years

Occupation : hospital technician

Net salary : €2,700, plus a €350 bonus distributed between the end of November and the end of December

People (or animals) living under the same roof : 1 15-year-old teenager, 1 dog

Place of life : a detached house in an allotment.

Sylvie’s situation and income

Sylvie is a laboratory technician in a hospital center and has the status of a civil servant. Separated for 10 years lives with his 15-year-old son in which he has primary custody. They both live there a house in a lot of 100 m2 with a garden of 500 m22of which Sylvie has been the owner for 12 years.

“Thanks to a large personal contribution and my grandmother’s inheritance, I have almost no credit to pay back on the house. »

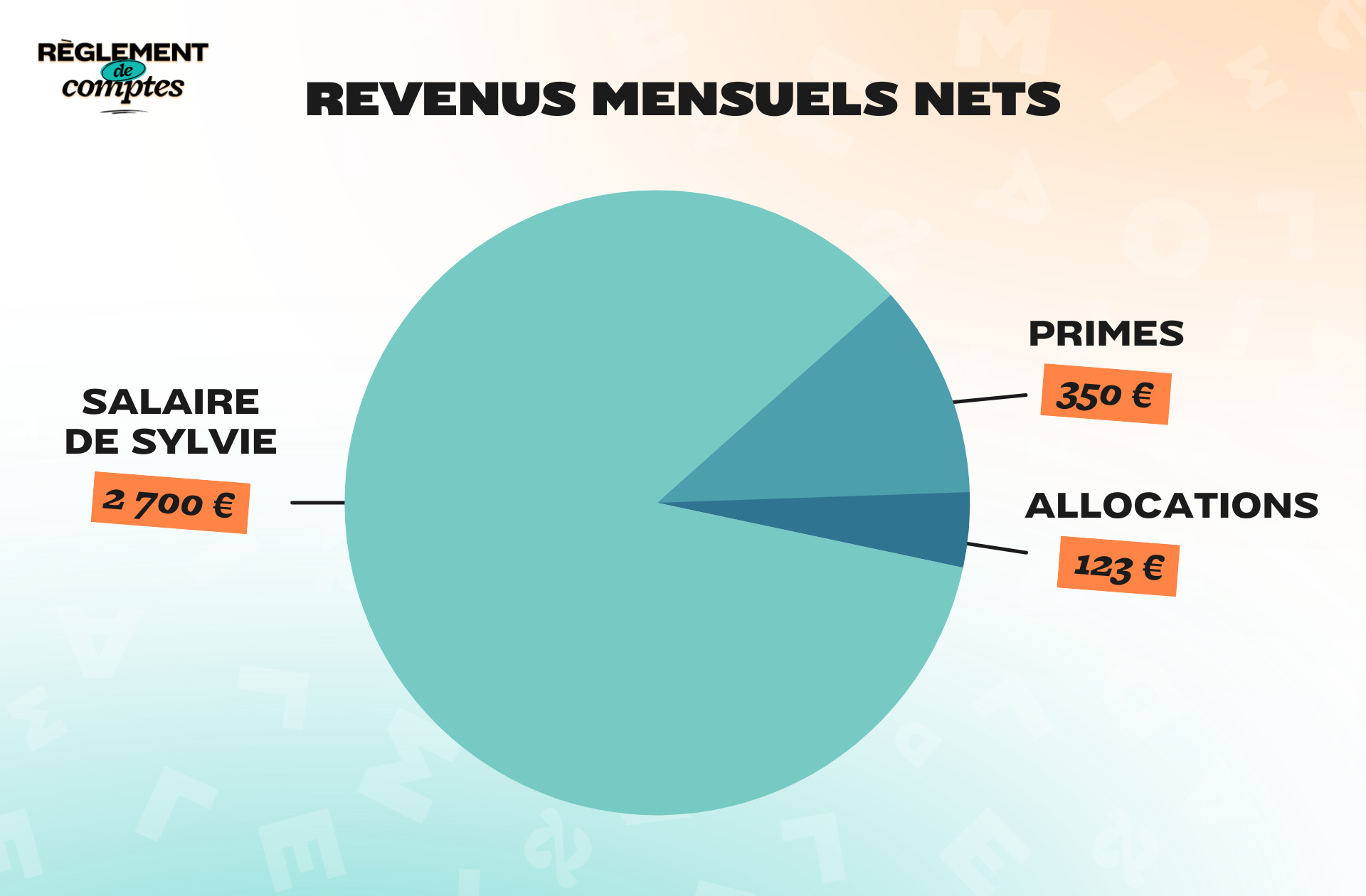

For her work in the hospital function, Sylvie receives every month a net salary of 2,700 eurosto which they add two bonuses for a total of €350which receives in November and December as well Family allowance of 123 euros (reserved for separated parents).

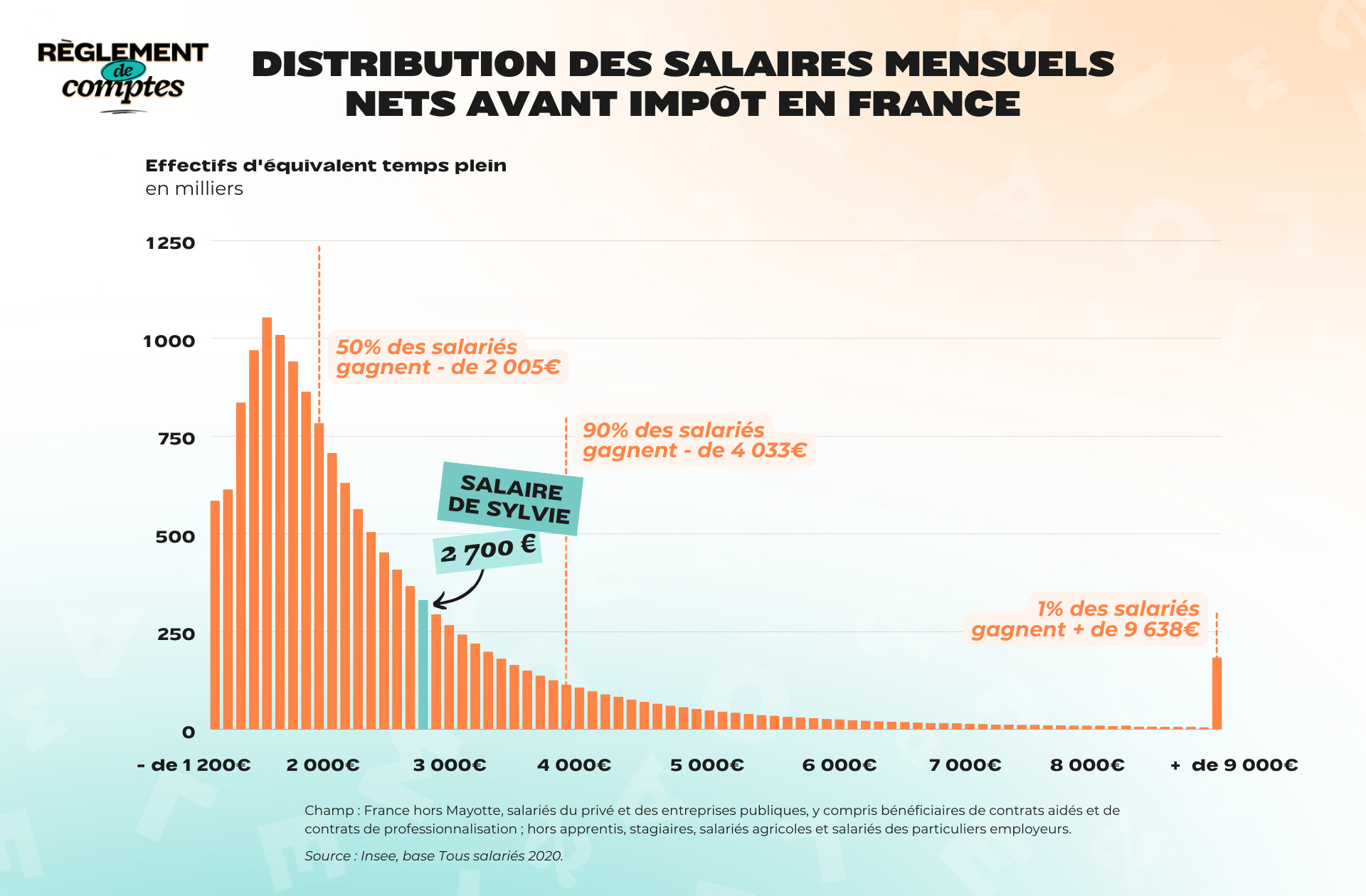

For this fee, Sylvie respects herself “very well paid”although he stresses that this is counterbalanced by the constraints imposed by his job: staggered hours, weekend and public holiday shifts.

“My situation has evolved a lot with Covid, with the Segur award (€238 gross per month, ed) and my passage to category A of the Federation of private hospitalizations. I consider myself upper middle class, I can treat myself well. »

Sylvie’s relationship with money and her financial organization

Sylvie grew up in a modest family, with a working father and a housewife mother, who taught her the value of money at an early age.

“I’ve always seen my mother doing accounts in a notebook. My parents saved up to buy a house, had few hobbies, never went on vacation. I missed it as a child, my passion for travel must come from there. »

Sylvie inherited this rigor for managing her money.

“Since I have a salary, I also do my accounts the old-fashioned wayin small notebooks. I get paid monthly on almost all of my expenses and every day I look at my accounts to see if there are any fraudulent transactions. »

Sylvie’s expenses

Owner of her house for 12 years, Sylvie is lucky to now have a very low mortgage to repay: €200 per monthto which are added, on the tax side, 160 € property tax. He also contracted a consumer loanwhich reimburses up to €60 per month.

As for the current bills, Sylvie has to pay every month 90€ for electricity, €30 for water and €10 for supplies for the residential complex in which it resides. Also rule €100 per month for communication expensesnamely his internet box, two phone plans, a subscription to Netflix and another to PlayStation Plus.

The mother of the family has taken out three insurance policies: home, auto and civil liability, which come to her €70 per month. His bank charges are quite high: €14 per month.

“At the supermarket I always take the brand at the intermediate price”

For her professional and personal travels, Sylvie uses her car. These trips cost him approximately €100 of petrol per month for about thirty kilometers traveled every day. “It’s still reasonable. »

As for food budgeting, Sylvie calculates her expenses at €350 for twoplus canteen costs for her and her child (60€ each on average).

“I shop at a big chain store, in-store or a drive-thru because I hate shopping. In order not to spend too much, I always take the brand at the intermediate price. »

Sylvie and her son are the proud owners of a dog, which costs them approximately €100 per month food and veterinary expenses.

As for the so-called “feminine” expenses, Sylvie roughly estimates them €50 per month. This includes hairdressing appointments and various hygiene products, including creams.

“I don’t wear much makeup and I don’t go to the beautician. »

Although Sylvie’s day-to-day expenses are under control, she occasionally has unforeseen events that take a toll on her budget. So the month you responded to us, you disbursed €250 for health insurance costs, for the orthodontist and for the son’s acne cream.

Silvia’s hobbies

As a single parent, says Sylvie “go out a little” and have hobbies that he shares with his son.

“We have one cinema a month and about 2 fast food restaurants. It costs us about 150 €. »

She is also enrolled in a gym, which pays €30 per month.

The rest of his leisure budget is spent on travel. To be able to leave every year with his son, Sylvie sets aside 500 euros a month.

” I spend between €6,000 and €7,000 per year for travel. It’s my way of relaxing and a passion I share with my son. »

The other passion that unites mother and son is clothes. Sylvie calculates her expenses at €1,000 per year for her child and €2,000 for herself. What amounts, when smoothed over the course of the year, to €250 per month.

“I think my budget is balanced, but I spend too much on clothes. I break regularly when I don’t need anything…”

Sylvie’s savings and plans for the future

Every month, Sylvie manages to save around 500 euroswhich puts in a livret A in anticipation of future large expenditures such as “a new car, appliances or some other major unexpected event for the house”.

Her son also has a savings account, which he replenishes with the money he gets for Christmas and his birthday. “He has about 4,000 euros saved up. »

In 2 or 3 years, Sylvie intends to change cars, hence the savings she is accumulating because she wants to “pay in cash” and thus avoid taking out a new loan.

Finally, he plans in the near future to go on some wonderful trips with his son, “like New York and Mexico”.

Thanks to Sylvie for going over her budget for us!

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

Do you like our articles? You will love our newsletters! Sign up for free on this page.

read another one

Settle accounts

-

Lucie, 3,200 euros a month: “I know that 400 euros of restaurants a month is a lot”

-

Alexandra, 2,530 euros a month: “I save about 15,000 euros a year”

-

Palin, 1,950 euros a month: “I have a very free relationship with money, I’m often discovered”

-

Jeanne, I study-work for 900 euros a month: “I went from eating organic and local at my parents’ house to eating Lidl!”

-

Keizya, 2,884 euros a month: “The financial crisis has significantly reduced my standard of living”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.