Talking about money is still taboo in France. Still, it’s a fascinating and feminist subject in some respects! In Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today Laure agreed to check her accounts for us.

- Name: Laura

- Age: 49

- Position: QHSE Assistant (Quality, Health, Safety and Environment)

- Net Monthly Salary: €1,550 over 13 months (i.e. €1,625 leveled over the year)

- Lives with: a 14-year-old girl and a cat

- Place of life: an apartment of 95 m² owned by him, in the Loire

Laura’s income

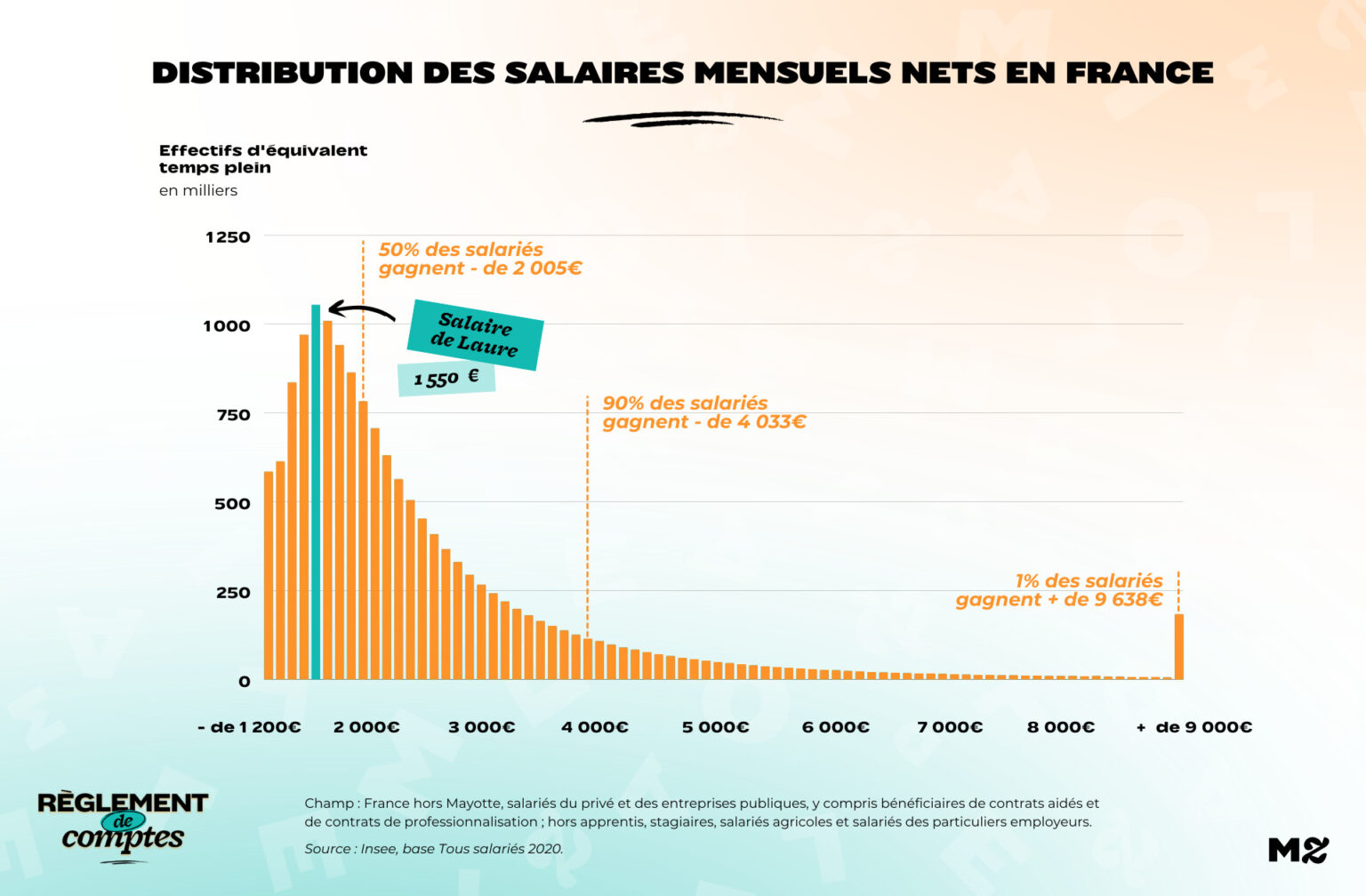

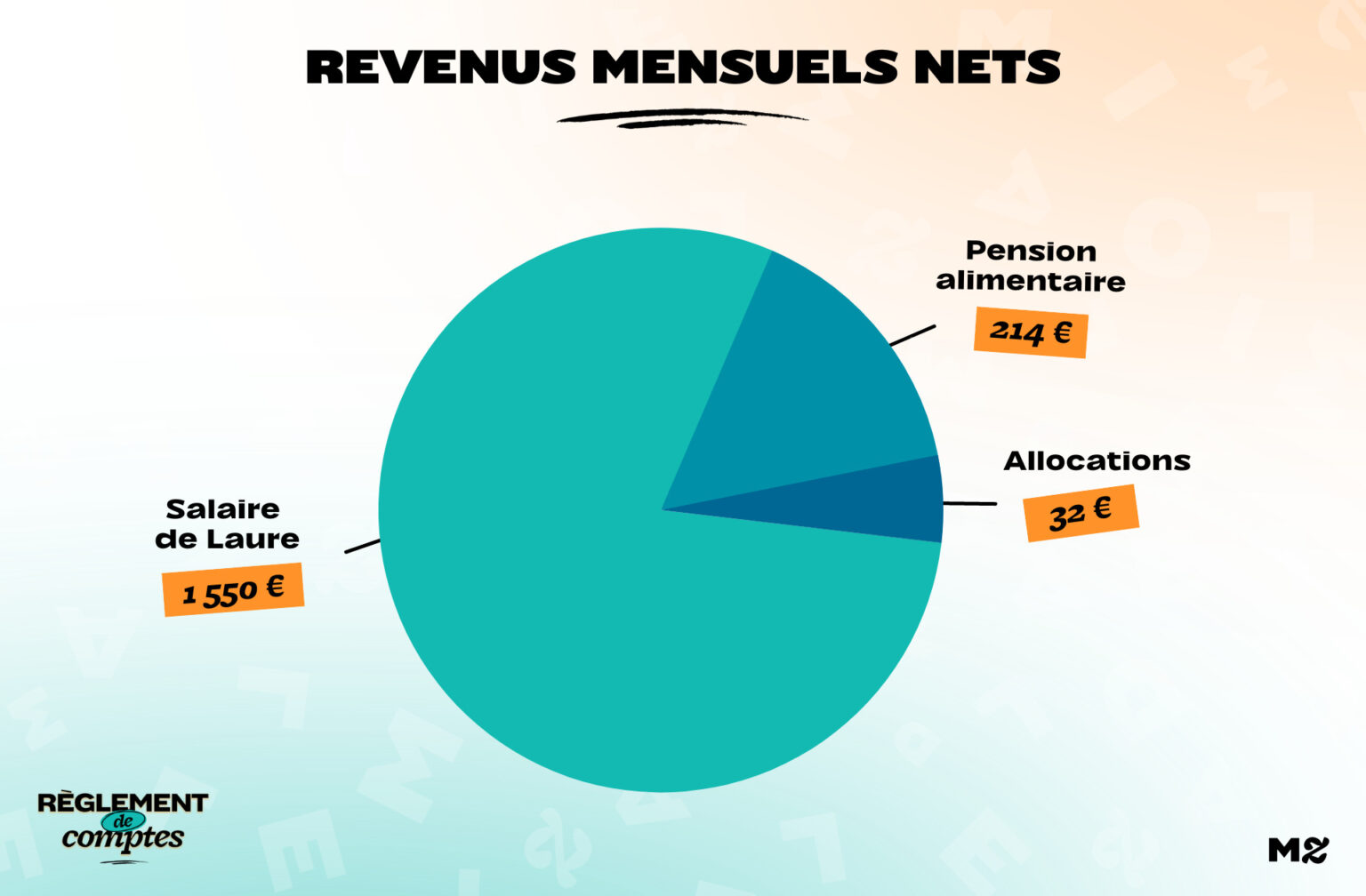

For her work as a quality, health, safety and environment assistant on a permanent contract, Laure wins €1,550 per month and reaches a thirteenth month. Smoothed out over the year, this represents €1,625 per month. It is considered in the low average:

“I think I’m paid moderately, because my financial situation is managed on a daily basis… But in the low average: the slightest difference can cause me an overdraft, and therefore bank charges. »

She is separated from the father of her 14-year-old daughter, with whom she had the main guard. As such, it pays for it €214 a month for alimony. His daughter is with her father every weekend and during half of the school holidays.

Finally, he is entitled to € 21 of APL and € 11 of employment bonus, ie €32 indemnity. In all, it manages a budget of €1,796 per month bonuses excluded.

Laure’s relationship with money

Laure describes her relationship with money as “strained”. She happens to be out in the open and that stresses her out a lot.

“My family lives only on my salary and it can be complicated. Alone we pay almost the same expenses as two: the rent, the bills… If I wanted to change jobs, I would have to think twice, for example.

The slightest problem, the slightest unforeseen expense and I can enter a hellish circle of overdrafts: I can’t afford it. When you’re alone, you can’t deal with it. »

Explain that a teenage girl is expensive and the alimony paid by her ex-spouse is not enough.

“His father pays 214 euros a month and nothing else. For him it is: “I give you alimony and you get by”. I pay for absolutely everything. For example, he doesn’t participate in her activities any more than he does. Luckily my mother is there to pay for certain things that I can’t buy it, give him a little pocket money… A growing teenager is expensive! »

Indicate your expenses daily and never pay later so you don’t lose control of your budget.

Laura’s expenses

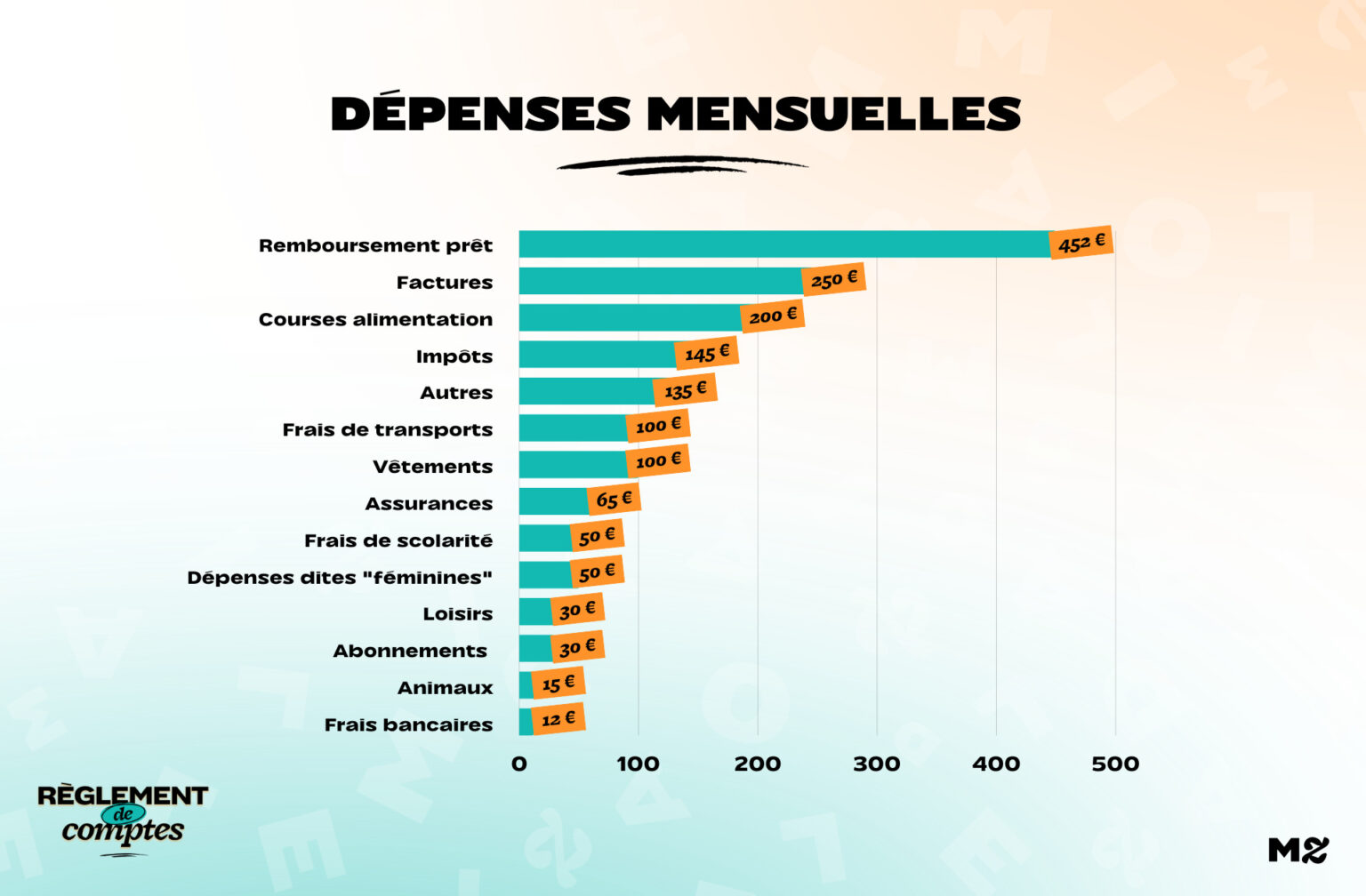

7 years ago, Laura bought an apartment of 95 square meters in an average commune of the Loire. It cost you 160,000 euros and you are paying it back in 22 years.

“My ex-wife bought me my share of the house, which allowed me to have a high contribution, approx €95,000. This allowed me to have slightly lower monthly payments: I pay €452 monthly repayments. It allows me to breathe a little, to pay less for accommodation. »

For her accommodation, she also pays €250 of fixed expenses per month: €30 for gas, €30 for electricity, €20 for water and €170 for condominium expenses.

She pays a thirty euro telephone subscription per month: €9.99 for your phone and €19.99 for your daughter’s.

“I have no other subscriptions. For wifi, I use my phone to share the connection”

Every month, his credit card costs him €12 and the cost of his insurance is €65 for his car and accommodation. She pays too €145 tax (€132 tourist tax and €13 audiovisual fee which will be canceled soon).

“I do everything by myself, there is nothing transformed in me”

Grocery shopping is the second item of current expenditure Laura’s tallest. For his and her daughter’s food, he relies on approx €200 per month.

“I do my basic grocery shopping at a drive-thru supermarket. For meat I go to my butcher, I buy tea and infusions in a specialized shop near my home. I buy my flour directly from a producer 4 kilometers from home, and my fruit and vegetables, I buy them from a group of producers 3 kilometers away.

I make absolutely everything myself, no processed products go home. Even bread, I do! I prefer quality over quantity. However, it takes a long time, but it’s worth it. »

For reasons of economy, but also to eat healthy, he arranges to prepare his meals and those of his daughter in advance:

“I prepare my meals on Saturday mornings and keep what is consumable fresh within three days. The rest I freeze. My daughter eats at home for lunch, so I leave her a plan with what she should eat based on the day of the week. I bring lunch to the office. It is cheap. I rarely go out for lunch. »

Save on gas bills, which amount to €100 per month, telecommuting one day a week and sometimes carpooling. His kibble and cat litter cost him around €15.

The tuition fees for your daughter, who is attending a private college, amount to €50.

“The rising cost of living worries me a lot”

For her free time, Laure prefers free occupations. With the cost of living rising in recent months, she’s been forced to limit herself to:

“I go running about three times a week, it doesn’t cost me anything. I can’t afford to join a gym. I also go to the media library to borrow books and cook.

I love to cook and before, for example, I made a lot of brioches. Today I stopped everything related to the throat: butter, the fundamental ingredient of pastry, has increased a lot, electricity also for bread-making… I’m very careful with this: when I have to cook things in the oven, I turn everything on at the same time so I only have to turn it on once. »

She explains that she is extremely concerned about the price increase:

“The rising cost of living worries me enormously, I don’t know how far this will go.

I would like my energy budget to go down, even if I’m already careful: at home I wear a sweater and fleece, and the temperature is 18-19 degrees at most. I put switched outlets on TVs and appliances, but I think sometimes we don’t pay enough attention. »

“We often talk about money with my daughter”

Laure and her daughter have no taboos on money. They argue about it regularly, and these moments are fine:

“We often talk about money with my daughter, and it’s not a tense topic at all. She knows I struggle sometimes and is good value for money. Our finances have been going through really tough times and she’s been frustrated, but that’s reasonable. At the moment my accounts are better but she knows that if I say no it’s not possible. »

She likes to please him, often with clothes: she matters €60 monthly expenses to dress the daughter.

“Like any teenager, she really likes clothes! I try to find her elegant clothes so that she is well dressed, without being too expensive. She has no sign. For occasions, for example, she likes things like perfume. »

Laura’s savings

Every month, Laura save €125. She puts 90 into a disposable savings account, which serves as an emergency fund in case she needs to get her car fixed, or to get a device changed, and 20 into a savings account for her daughter in anticipation of her driver’s license. She saves too €15 per month on life insurance.

In the future he would like to redo the bathroom, which he finds in poor condition.

Thanks to Laure for opening her accounts for us!

The Clearance of Accounts is always looking for new profiles. To participate, send us your short presentation to the email address: [email protected], with the subject “Account Settlement”! We will get back to you with the procedure to follow.

Photo credit: Jason Briscoe / Unsplash

read another

Settle accounts

-

Laure, single mother with 1,796 euros a month: “We often talk about money with my daughter”

-

Allyson, 2,010 euros a month: “I’m discovered every month”

-

Marine, 2,257 euros a month: “I do the garbage for the shopping”

-

Aimée, 2,422 euros a month: “I give money to my mother to have fun”

-

Cynthia, 2,044 euros a month in England: “With inflation at 9.4% I have reduced everything I could”

Source: Madmoizelle

Elizabeth Cabrera is an author and journalist who writes for The Fashion Vibes. With a talent for staying up-to-date on the latest news and trends, Elizabeth is dedicated to delivering informative and engaging articles that keep readers informed on the latest developments.

.png)