Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Lola * who agreed to open her accounts for us.

- First name :Lola*

- Age : 30 years

- Occupation : controller of financial management

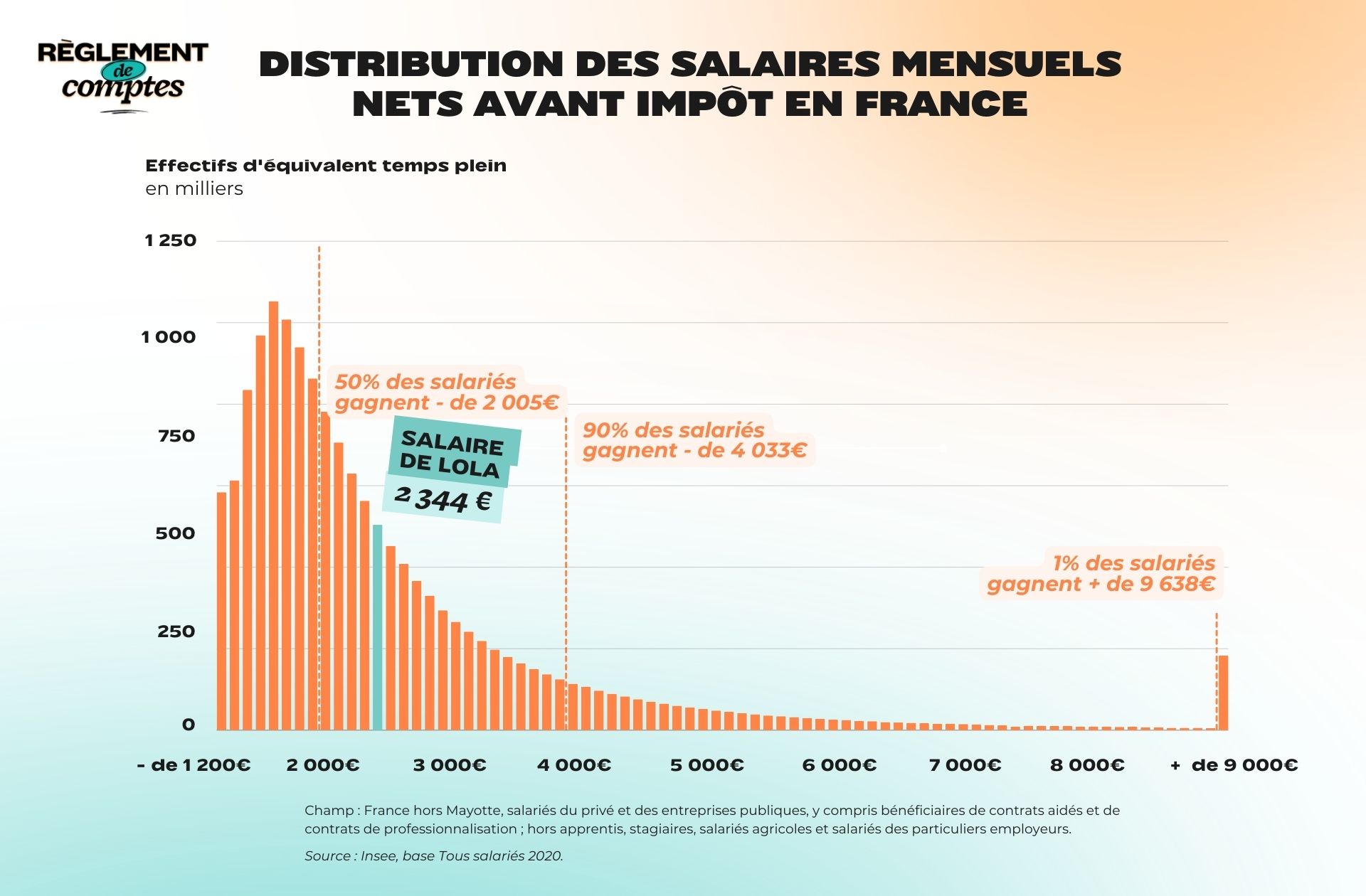

- Net salary before withholding tax : €2,344.24

- Net salary after withholding tax : €2,244.55

- Place of life : an apartment in Cergy (Val-d’Oise)

Lola’s situation and income

Lola is 30 years old and is controller of financial management. With a permanent contract he works in an advertising company that is part of the Vivendi group.

“It wasn’t my dream job, but I found balance there for several years. However, recently, I have started to undertake retraining to become a hairdresser, something I have dreamed of doing since I was 15. »

Single, Lola lives alone a two-piece of 50 m2 with balcony in Cergy, in the Val-d’Oise. She is owner since October 2019.

For her work as a management controller, Lola receives a net salary of €2,344brought to €2,244 once withholding tax has been collected of the income tax incurred. With this income, the young woman feels “average” and lives comfortably.

“On the other hand, I know I am below the average accounting/finance salary given my degrees and experience. I am currently at 35K and should be at 45K, like my classmates who work at other companies. »

Lola also knows that her career change risks losing her quality of life.

” Exists a notable gap between the salaries of the management director and the hairdresser: around 1,000 euros. To anticipate this, I intend to begin a gradual retraining from September 2024 by combining two permanent part-time contracts: one in accounting and the other in hairdressing. »

Lola’s relationship with money and her financial organization

Lola grew up in Benin with parents who didn’t have the same relationship with money at all.

“My mother was financially very comfortable but he raised us as if we had little, instilling in us the value of money. My father, who was self-employed, was very honest financially but he spoiled us whenever he could.

For my part, I also grew up in Benin during my early childhood. It was during this time that the fear of failure took root in me. Then in my turn, at the age of 18, I became the financial support of my father and brother when I started working as an apprentice. »

Lola feels that way today “a mix of the two models” given to him by his parents. “I pay attention to my finances without forgetting to live and enjoy the pleasures of life. Because as I like to say, we won’t take our savings to the grave! »

But this philosophy can also have its disadvantages… “I’ve already been discovered”admits Lola, who systematically compensates by making transfers from her savings account. “Tworking in finance, I’m one of the worst cobblers. »

In terms of financial organization, Lola has a checking account, from which her expenses are deducted, and two savings accounts. Thanks to professional training, the thirty-year-old has also developed an annual forecast table, which allows him to have a long-term vision of his fixed monthly expensesto better anticipate your expenses and income and thus avoid ending up in the red. “I adjust it as regularly as possible. »

Lola’s expenses

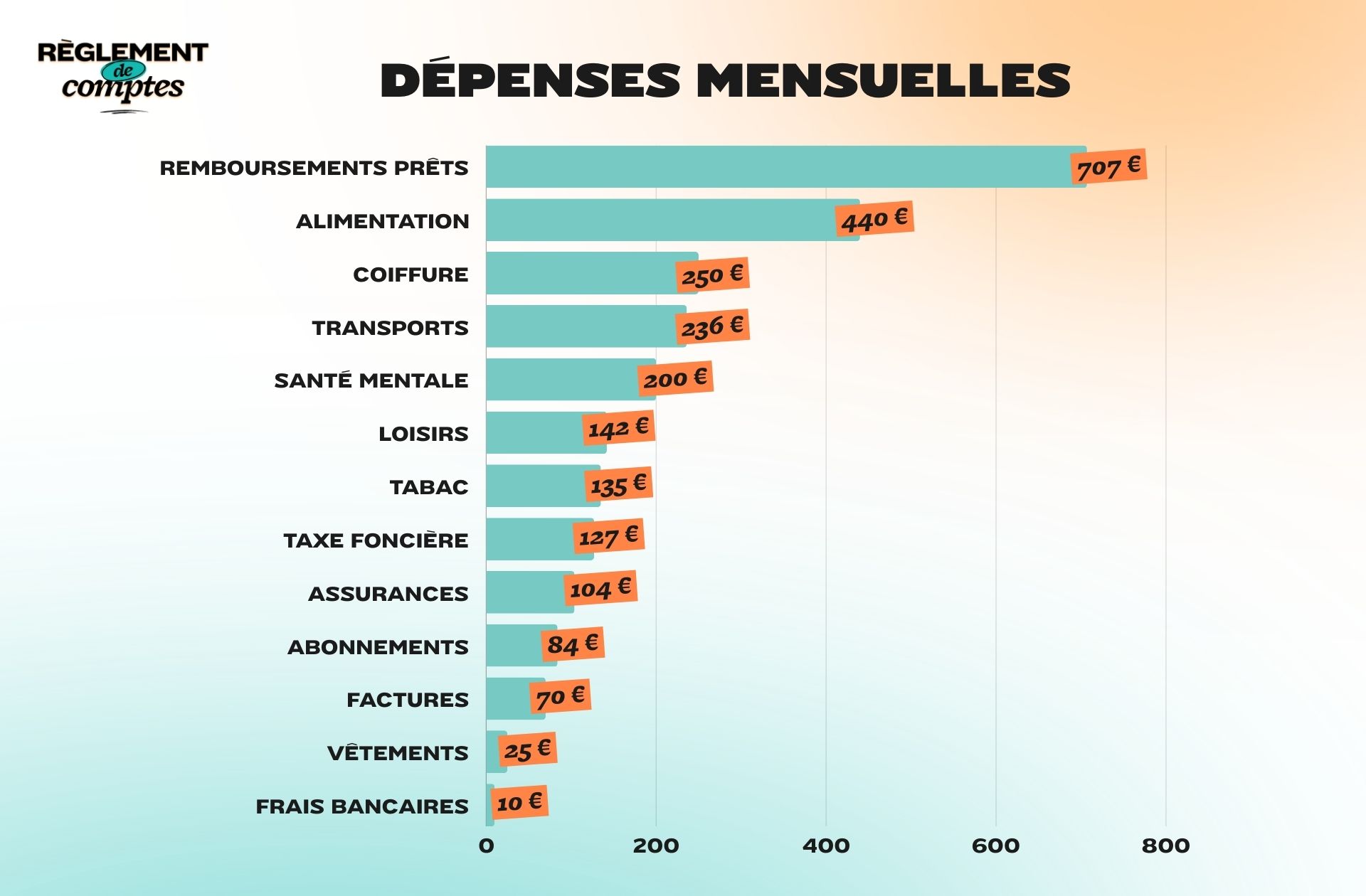

For her apartment in Cergy that she owns, Lola repays every month Real estate loan of €590. Through his company he also benefits from Action Logement (AL) which finances 1% of his employer and which reimburses up to €117 per month.

As the owner, she also has to pay property tax monthly €127.

Among other fixed expenses, Lola lists EDF (€70 per month), car and home insurance (€104 per month), your telephone subscription (€26) and the Internet (€36.50). She also subscribes to Netflix and Spotify (€11 each per month). Bank charges cost him €9.52.

To get to work, the thirty-year-old uses public transport. He therefore pays for a Navigo subscription, €86.40 per month. Plus, she has a car, which costs her money €150 per month for petrol.

He also takes care of his mental health as he spends every month €200 for four sessions with a psychiatrist.

“Buying cartons of cigarettes is my most expensive item”

In terms of food, Lola spends €340 per monthas well as Company restaurant €100.

“I shop in the local shops near me: Casino, Lidl, Carrefour Market. I prioritize price by choosing private label products as much as possible. »

He doesn’t have it no predefined budget for so-called “female” expenses. as they are included in your monthly “shopping” budget. Her health protections cost her almost nothing because she invested in menstrual panties a few years ago.

“For hair removal and beauty products like facials, I make a purchase about every quarter. I don’t spend anything on makeup because I wear makeup twice a year. »

As for contraceptives, she hasn’t used them for seven years, apart from condoms: ” For the last two years I have purchased them two or three times a year to anticipate times when my partners don’t have them. »

If Lola manages her budget well, there is one expense she would like to stop: tobacco, for €135 per month.

“Buying cartons of cigarettes has been the most expensive thing for me in almost two years. I stopped for eight years, then I started again following a difficult event in my life. »

Otherwise the young woman rarely allows herself to do so “moment of madness” :

“I’m scared to death of financial failure since my childhood. If I want something expensive, I’ll wait until I’ve saved up to buy it. »

Among the other occasional expenses listed by Lola in February, we highlight an osteopathy session at €80 and a massage at €150.

Lola’s leisure expenses

To socialize and clear her head, Lola takes gospel lessons. She depends on him €500 per year, shot for three quarters. OR €42 per month. She also has approx €100 per month of free time, for trips and restaurants.

But Lola’s true passion is hairdressing. She has just started a hairdressing post code and regularly shops for practice.

“Since December 2023, when I started my hairdressing CAP, I think I have spent almost 1,500 euros on materials and products necessary for the good progress of my training. This is clearly an investment and the equipment will easily pay for itself over the course of the year, or even the next few years. Therefore, I think we can easily extend this budget to 3,000 euros for the entire year 2024 ! »

Lola buys clothes, “but never in a frenetic way” like when he was 18.

“I am elegant and I like to dress well, but before making any purchase I always ask myself two questions: don’t I already have something similar and do I really need it? This quickly calms me down.

Consequently, not spending much on this item, I would roughly say that I have to spend a minimum of €150 and a maximum of €300 per year. »

Or paid in installments over the year, maximum €25 per month.

Lola’s savings and future plans

Lola recognizes that since she became the owner, She doesn’t have much savings left. That’s why he tries to save her as soon as possible. But it’s not always easy:

“After paying my monthly fixed expenses, I have around €200 or €300 left, which were often spent on trips and restaurants. Generally, my savings were to cover my overdrafts, plan for bumper purchases like birthday presents, or pay for vacations. »

This is why, as a good manager, and to “force” herself to save, she decided to start, in anticipation of her professional retraining, an automatic transfer of €100 every month starting from the 1stum March 2024.

Today becoming a hairdresser is Lola’s main project. “I think I’m 70% happy, I’ll be 100% happy when I live my passion as a hairdresser. »

Thanks to Lola* for opening her accounts for us!

* The name has been changed.

Read another one

Settlement of accounts

-

Aria and her partner, 4,296 euros per month: “We chose to save as much as possible”

-

Lucie, 4,363 euros for two a month: «Earning more than my husband, it seems natural to me to cover additional costs»

-

Nadège, formerly over-indebted at 1,766 euros a month: “I had to calculate everything down to the cent”

-

Anaïs, cross-border worker, 4,567 euros per month: “My income has tripled since I started working in Switzerland”

-

Elsa, 4 thousand euros a month: «I earn two-three times more than my boyfriend»

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Discover BookClub, Madmoizelle’s show that questions society through books, in the company of those who make them.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.

.png)