In this new episode of “When we love, we count”, it is Nelly, mother of two children aged 9 and 12, who participates in the exercise and opens up her stories to us.

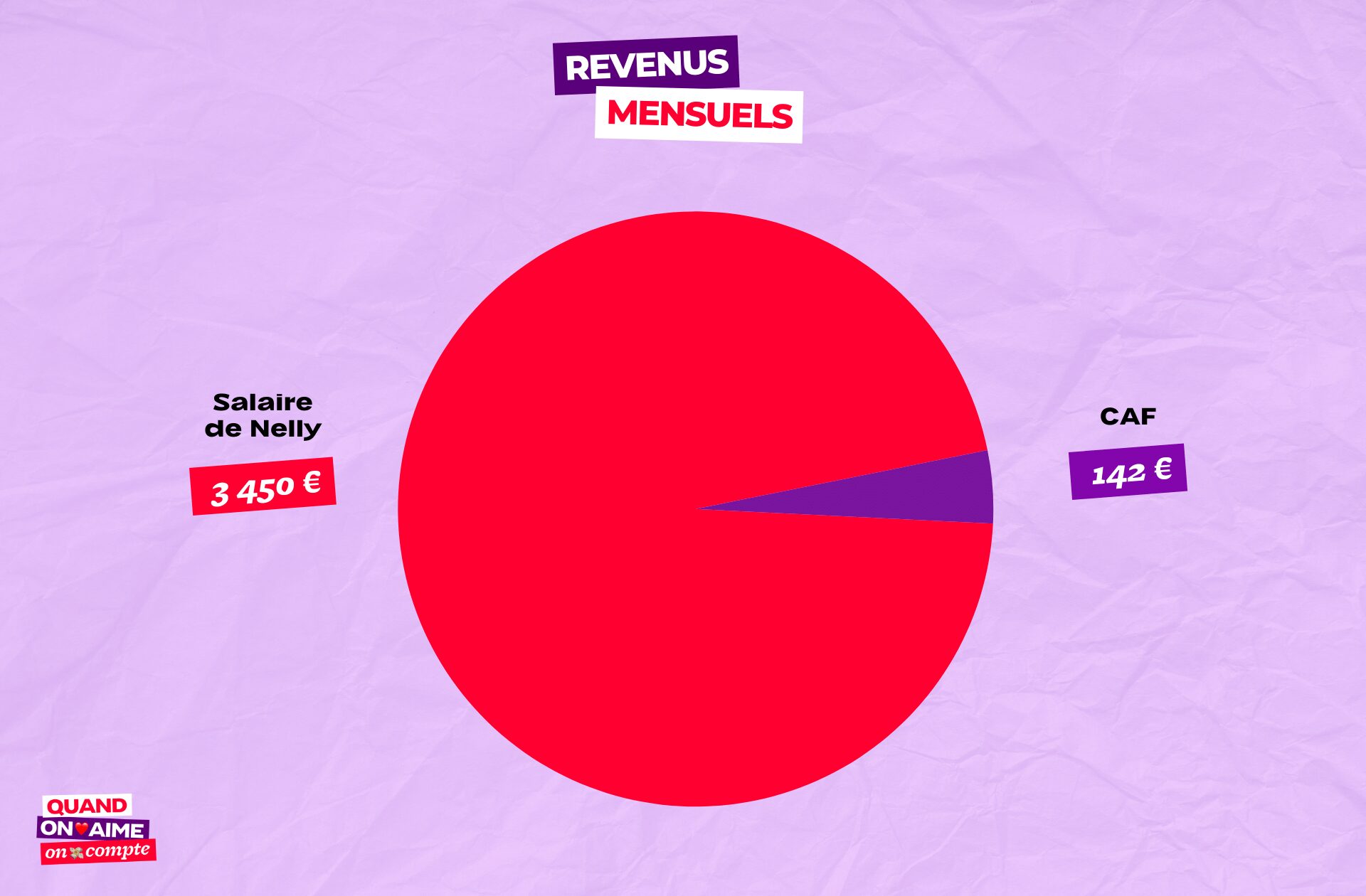

Nelly’s income, with two children aged 9 and 12

- First name : Nelly

- Age : 41 years old

- Work : Project Manager

- Total household net budget: €3,592

- Number of children: two children aged 9 and 12 in shared custody

- Place of living: Nantes region

Nelly is divorced from the father of her children and they share custody of their two children every two weeks. Nelly has a partner, but they don’t live under the same roof. She owns her house in the Nantes region.

I bought a house after my divorce. She is 100 m away2in a location in Nantes, with garden.

Nelly senses €3,450 salary, net of withholding tax. In addition to this sum, it receives an allocation from the CAF of €142. His total income is therefore €3,592.

Owner, does not pay rent, but repays a monthly mortgage loan of €1242. It also refunds €500 per month of family credits, and for the purchase of a car. In the end he spends 300 € current bills including electricity, water, telephone plan, insurance, bank charges and gym membership.

Childcare costs for two children aged 9 and 12

After explaining her total income, Nelly details the amounts she spent on providing childcare facilities for her two children when they were born, amounting to approximately €800 :

The equipment costs around 800 euros, including the high “sports” stroller, the car seat, the cot, the sheets, the duvet, the beanbag, the high chair, baby bottles and dishes. Everything was reusable (except the bottles), I sold the stroller and donated the cot to an association.

For birth gifts, Nelly received a little help:

They offered me the high chair, beanbag, car seat and some clothes.

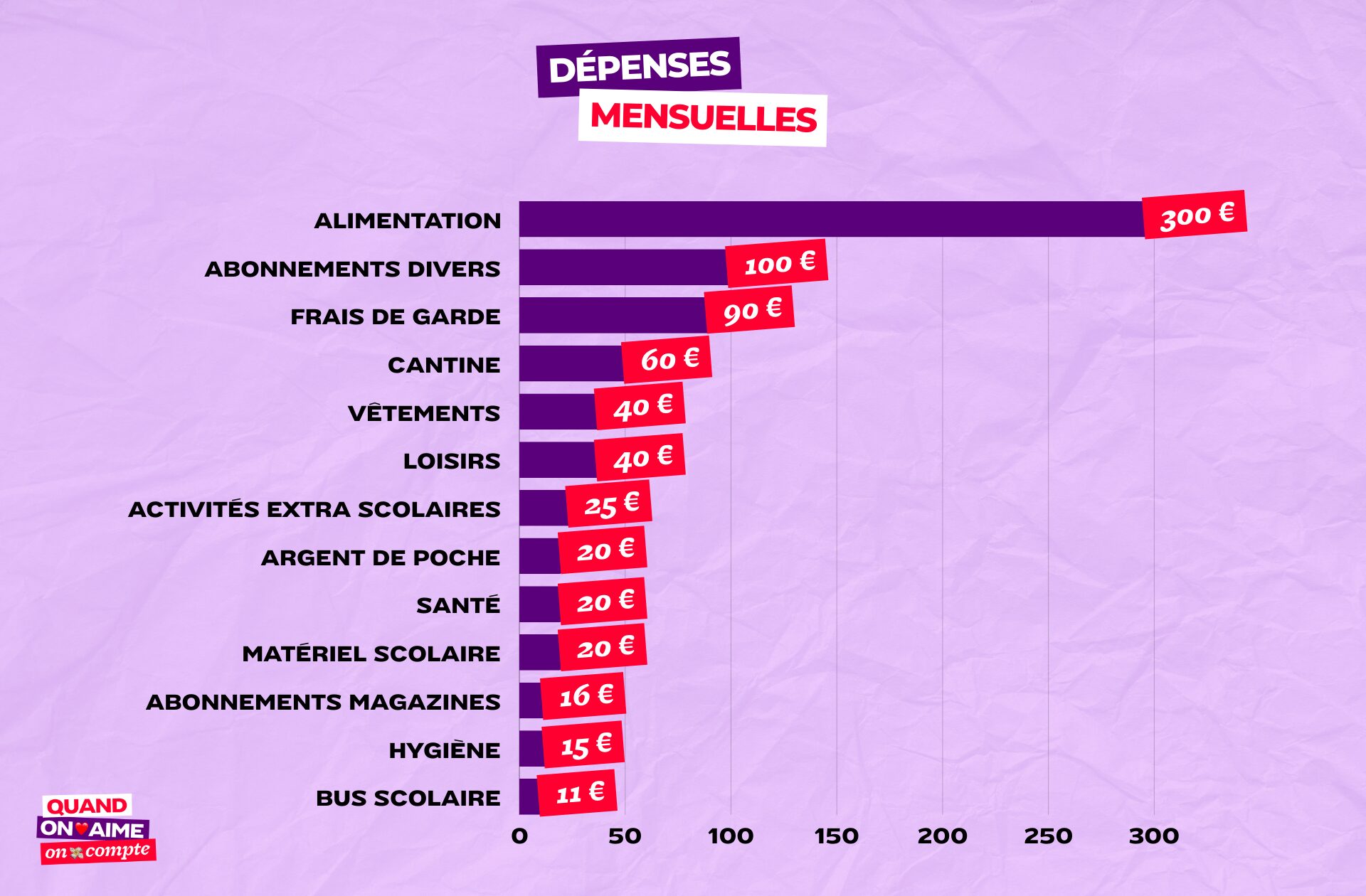

Hygiene sideNelly estimates her budget for her children at €15 per month :

My children are middle aged, so the hygiene budget is around €15 per month for both of us. In this budget I include toothpaste, cleansing gel for atopic skin, a haircut every three months and day cream.

When it comes to her children’s health, Angélique has a budget of approx €20 per month. This includes visits to the doctor and purchases at the pharmacy.

Food expenses for Nelly and her two children aged 9 and 12

Regarding the purchase of food for her children, Nelly spends approx €300 per month, just for them:

On the weeks when I have the kids, my shopping cart costs €120 and during the week I earn another €20 depending on what’s missing. I prepare (roughly) the meal list from Friday evening to Thursday evening (split assistance goes from Friday evening to Friday morning). They eat in the canteen at lunchtime and I offer the little one a snack. The grown-up snacks on a sandwich between coming home from school and dinner. The trolley can cost 140 euros if it also lacks laundry detergent, dishwasher tablets or other items, but it is mainly made up of food items.

Nelly doesn’t let her children convince her to go into supermarkets:

I’ve decided to do the shopping when they’re not around, on Fridays between noon and two, or on Saturdays when I’m at the football match. I avoid taking them to stores to avoid temptation.

As regards the type of stores in which he shops, Nelly explains his organization to us:

I shop at Super U. There are organic products, interesting prices and discounts thanks to the card which allows me to earn around fifteen euros a month for further shopping. I go to the market every now and then, but the prices have skyrocketed. I don’t take a tour, because I prefer to choose the products and prices directly. In particular with deadlines, to optimize refrigerator management.

The cost of clothes and toys for two aged children 9 and 12 years

As for the budget clothing Of her children, Nelly mostly buys new clothes. Smoothed out over the year, the budget is approximate €40 per month :

For clothes, I set a budget for the change of season. I mostly buy new things, but the big boy’s clothes can go to the little one if they are not damaged. I buy branded clothing through private sales or through second-hand platforms.

About toys AND GamesNelly created a system with his children:

The toys are only offered on Christmas and birthdays. I leave them both with a budget of €10 per month if they want to have Pokemon cards or purchases on Switch. During the summer holidays they have 20 euros each to buy what they want.

As for the budget booksNelly explains that her children have magazine subscriptions, a €16 per month.

The budget for activities for your children and childcare arrangements

Nelly’s children are at school. She spends €60 cafeteria, €20 school supplies, €11 school bus for the eldest son, e €90 after-school costs, university and school fees:

My oldest (in college) no longer has child care, I adjust my professional schedule to not be home too late on weekday evenings, and, on Wednesday afternoons, he goes to soccer. The little one goes to after-school care in the evening and to nursery on Wednesday morning.

I pay around €45 a month for the child’s extracurriculars (my share). Apart from basic CAF allowances, I have no help with this.

Nelly rarely uses a babysitter:

Having kids every other week, I arrange so that my personal outings or professional trips happen during my child-free week. Otherwise, friends or my partner can help me.

As for her children’s activities, Nelly enrolled them both in soccer:

They both play football. For both of us they charge €140 for the license (my share, dad pays the other half) and around €100 per year for equipment (crampons, winter clothing).

Leveled over the year, this budget amounts to €25 per month. Ideally Nelly would like to reduce the expense item for additional expenditure:

I would like to reduce the family budget for extracurricular activities like laser tag or the trampoline room. In winter it is easier to go there to change the usual activities, but it is expensive. I don’t really have a crush on kids, but they wear out their sneakers really quickly and sometimes that’s enough to blow the budget.

This budget hobby is estimated at €40 per month. They also add to this €100 Fromsubscriptions to Deezer, Netflix, the Internet and even his teenage son’s phone.

Pocket money and the transmission of the value of money

Nelly talks about the relationship with money in her family, what was passed down to her and her current relationship with her children.

I come from a modest family where to have money you had to work and above all avoid spending this money haphazardly.

My paternal grandparents were poor, while my maternal grandparents were workers. When they were young, my parents experienced deficiencies.

My sister and I never suffered from lack of money, but I took out loans to pay for my studies and did many odd jobs to go out with my friends and pay for groceries.

My parents didn’t hide anything from us and sometimes we knew that for a few days we had to pay more attention to the “fridge”, because the salary hadn’t been paid and therefore the shopping wasn’t done immediately. “End of fridge quiches” were standardized.

Budget management was a topic. Today my parents live well, because as children they were attentive, but there is always this ‘if you can do it on your own, do it’.

For example: I’m renovating the house I bought, so I always think about DIY rather than buying or using artisans (when possible).

Nelly talks openly about money in front of her children and tries to teach them the value of things, at their level:

I don’t have the same financial situation as my children’s father, so they know that life isn’t the same from one week to the next. With them I talk about budget, in simple words.

With their monthly allowance, they know they can use it or put it aside to accumulate several months. They also know that “the house has no credit” so if it exceeds the monthly budget they have to wait. Not always easy!

We also treat ourselves to one fast food outing per month: they choose the date and the note on the program. And we have the right to change, if we are too lazy to cook, for example.

To materialize the expenses they don’t see or imagine, I used BonnePaye tickets, explaining “this is what mom earns, this is the price of water, the price of electricity, insurance, car, housework… so this is all that’s left!’ it’s super informative.They realized that everything I earned couldn’t be used in games.

Your children’s pocket money is counted, in total, at €20 per month.

I can even give €5 for football tournaments, even if I prepare sandwiches for them, they like to buy chips or drinks there.

Nelly opened bank accounts for his children:

They have a bank account where I put the checks they receive on their birthdays or Christmas. I also put some of the money I received after selling the house I had with my ex-husband, to fund their once big plans.

At the end of the month, the amount left over by Nelly is used for his own expenses, personal expenses and savings.

When you add up all the sums spent on just her children, Nelly spent on them €757 monthly.

Thanks to Nelly for answering our questions!

Don’t forget, in the comments, that the people who participate in the column are likely to read you. Thanks for remaining kind.

If you also want to participate, nothing complicated: send me an email by hand[@]madmoizelle.com with subject “When we love, we matter” or use the form below and I will send you the questionnaire and instructions.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

We accept applications from all over France and also from all over the worldas long as you know how to answer the questions you will be asked, and fill out a very small Excel table (we promise it won’t scare you).

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Add Madmoizelle to your favorites on Google News so you don’t miss any of our articles!

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.

.png)