In France, 61% of young children are looked after by one of the parents (according to a study by the Department of Research, Studies, Evaluation and Statistics), the others are looked after by relatives, a nanny*, to a nanny at home or assisted by a nursery or drop-in centre.

You may have already wondered how much it can weigh on your wallet having someone take care of your child. And since it is sometimes difficult to navigate the maze of costs and aids, which depend on so many personal and professional factors, we have decided to produce a series of articles on the subject.

Here’s the first where I offer you some tips and resources to help you find your way and budget to make the most of a babysitter.

How much does a nanny cost?

For the calculations that follow, I took the example of the Bon-Beurre spouses, a couple who each earn 21,713 euros a year (which corresponds to the disposable household income per capita in France in 2016). They have a child, little Jean, to take care of 35 hours a week in Île-de-France.

This article will give you an idea of the amount of child care and aid available, but it won’t allow you to set an exact budget.

In addition to the parents, it constitutes the reception with a licensed nanny modality of care mainly the most frequent and affects 19% of children.

According to a study published last August by yoopies.frcompany specializing in babysitter at home, it is the cheapest mode of care for a child alone. ” Adjusted for aid, France is the cheapest country among its European neighbors thanks to childminders “.

The stabilization of tariffs (the national average is 3.52 euros net per hour and per child, but this price varies according to the region) and the aid system make it possible to offer French families a cost almost 3 times lower than the average European .

But what about little Jean Bon-Beurre? Based on 35 hours of care/week with a rate of €3.94 net/h/child (which corresponds to the average net rate of Île-de-France according to Yoopies, i.e. around €5.05 gross), here is what is his parents should pay monthly (before help):

- Gross salary of the nanny: €768 (i.e. a net salary of around €590)

- Employer contributions: €314.88

- This is a total of 1,082.88 euros to be paid by the parents

Calculation to be carried out to obtain the gross monthly salary, including employee contributions: gross hourly rate x number of hours per week x number of weeks

Calculation to be made to obtain the net salary: gross monthly salary x (1-21.99% of employee contributions)

Calculation to be carried out to evaluate the employer’s contributions (corresponds to approximately 41% of the gross monthly income): gross monthly salary x 0.41

Maintenance allowance and additional costs

In addition to this salary, the Bon-Beurre spouses will also have to pay the assistant a maintenance allowance, which is used to reimburse the expenses incurred in looking after the child (childcare equipment, games, but also a share in the costs of electricity, water , etc.).

Its amount, framed by legal and contractual provisions, is determined by mutual agreement between the parents and their employee and is not subject to social contributions and contributions.

Minimum amount of daily maintenance allowance as of January 1, 2019:

- for less than 7 hours and 45 minutes of calls per day it is at least €2.65 (amount established by the collective agreement);

- over 7 hours and 45 minutes of call per day, is equal to €0.3422 multiplied by the number of call hours.

- for 9 hours of assistance it is €3,077 rounded up to €3.08 (85% of the guaranteed minimum)

If ever the child does not go to the nanny for x or y reason, these days will be deducted from the allowance. For the estimate, since the months do not all have the same configuration and the same number of days, the amount varies with each paycheck.

It is calculated as follows: number of days of stay x amount of daily allowance

In March 2019, Jean would be 21 days with his nanny. She, the latter, would therefore have had to receive a maintenance allowance of 55.65 euros for 7 hours of assistance per day if the minimum had been paid. (But it is normal for these maintenance costs to be much higher than the legal minimum, especially in large cities).

Other costs may also be included in the carer’s contract if she is the one to feed the child or if she has to take his own vehicle to transport him.

State aid to reduce the cost of childcare workers

To help families finance the hiring of a childcare worker, the state has established two-part support: the PAJE Child Care Choice Supplement (CMG) and employee and employee contributions. employer.

Free choice supplement for childcare

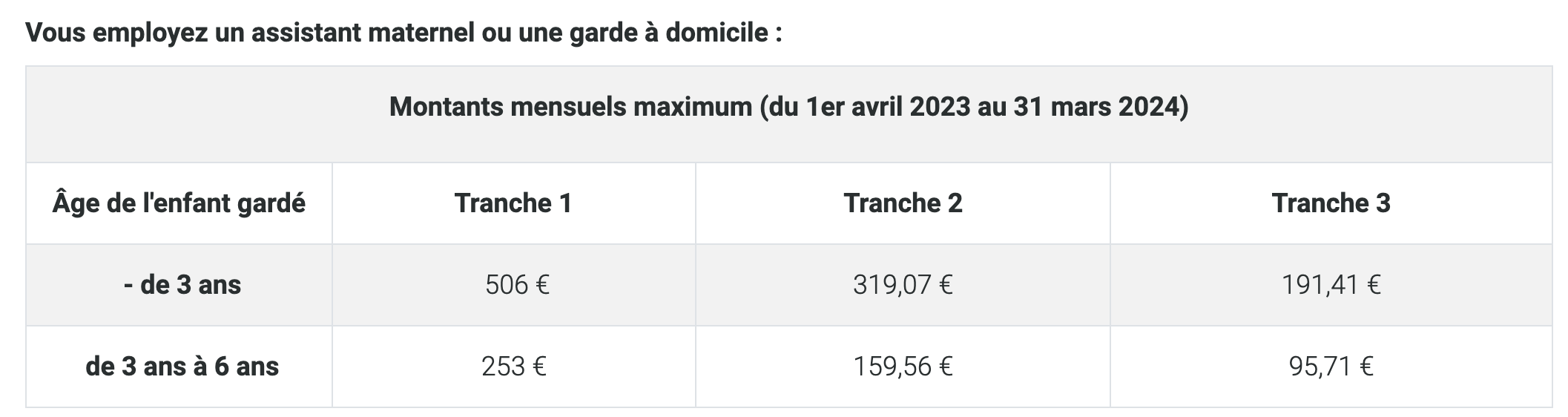

To all parents hiring a nanny, Pajemploi pays a financial help until the child is 6 years old. The aid varies according to the age of the child (full rate if aged between 0 and 3, 50% of the full rate if aged between 3 and 6), the assistant’s salary and family income.

The monthly allowance covers up to 85% of the childcare worker’s salary, up to a limit calculated on the basis of the household’s income. It is paid automatically at the end of each month, as soon as the Pajemploi declaration is validated.

To be eligible, certain conditions must be met: one or both parents must exercise a professional activity, a nanny must be employed, recognized by the maternal and child protection services, and the gross salary paid to him does not exceed 50 ,15 euros. per day and per child cared for.

CIF

Jean Bon-Beurre’s parents have a total annual income of 43,426 euros. They therefore belong to a segment of the population that can receive 319.7 euros of CMG per month. In the case of divorced or separated parents, only one of the two parents receives help from Pajemploi.

Payment of social security contributions by the CAF

For the use of a certified nanny, the CAF covers 100% of the employee’s and employer’s contributions, provided that the child is less than 6 years old and that the gross salary paid to the professional does not exceed €50.15 per day and per child cared for. It is the CAF which pays the amount of contributions due directly to the national center of Pajemploi.

In the case of divorced or separated parents, only one of the two parents benefits from the help of the CAF for the payment of social security contributions.

The tax credit

As an employer of a licensed nanny, you are also eligible for an annual tax credit equal to 50% of the expenses (salary, paid holidays and maintenance allowances) incurred in caring for a child under the age of 6 , up to a limit of 2,300 euros per child, or a credit (or reimbursement by the state) up to a maximum of 1,750 euros per child. Naturally, the various aids received (CMG, payment of social security contributions, etc.) must be deducted from the calculation.

As far as allowances are concerned, the actual amount of these reimbursements is not deductible: their amount is set at a flat rate of 2.65 euros per day of reception for the calculation of the tax credit.

In the case of divorced or separated parents, both benefit from the tax credit for home care and the reduction of the employer’s charges.

Additional aid to help fund childcare

In addition to the aid granted by the state, other small aids can help reduce the bill:

Some regions and departments can help financially families who have recourse to a nanny. You should therefore not hesitate to inquire to benefit (provided you meet the conditions for obtaining these benefits) from a few euros more. This is especially true in the case of Hauts-de-Seine and Hauts-de-France.

Some municipalities also offer financial aid to help families care for their little ones. Once again, do not hesitate to inquire at your local council: you are never safe from a pleasant surprise!

Finally, some companies or works councils (WCs) may give their employees financial aid to reduce childcare costs. This aid is limited to 1,830 euros (amount established by interministerial decree in 2019). If both parents work for the same company, they can accumulate this aid in the amount of 3,600 euros. Enough to put a little more butter in the sandwich.

The employment of a nanny for single parent families

In support of single parents, there are numerous aids and benefits that should allow adults to reconcile work and family life more easily.

For the purposes of calculating the Free Choice in Child Care (CMG) Supplement, the maximum amounts of childcare payroll are increased by 30% and the parental resource ceilings by 40%. The CAF also covers all social security contributions linked to the employment of the professional.

Single fathers or mothers of children under 10 who return to paid work (or undergo training) are also eligible for financial aid from the Pôle Emploi for childcare: AGEPI. This is a one-off payment which depends on the number of children they are caring for and their weekly working hours.

In addition to national aid, the CAFs have a social action fund in each department, which distributes subsidies to various structures, such as nursery schools, but also individual financial aid paid directly to families. Single-parent families can also access further aid: holidays, free time vouchers, accommodation, education, etc. You need to check with your CAF, terms and conditions vary from one fund to another.

Likewise, municipalities and departments can provide specific aid, often awarded based on the family ratio of the CAF.

*Since this profession is mainly exercised by women, we also use the term in the feminine sense if there are also childcare workers.

Do you like our articles? You will love our newsletters! Sign up for free on this page.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.