Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settle accountspeople of all stripes examine their budget, tell us about their financial organization as a couple or alone, and on their relationship with money. Today it is Jeanne who has agreed to analyze her accounts for us.

- Age : 30 years

- Occupation : French teacher in a middle school

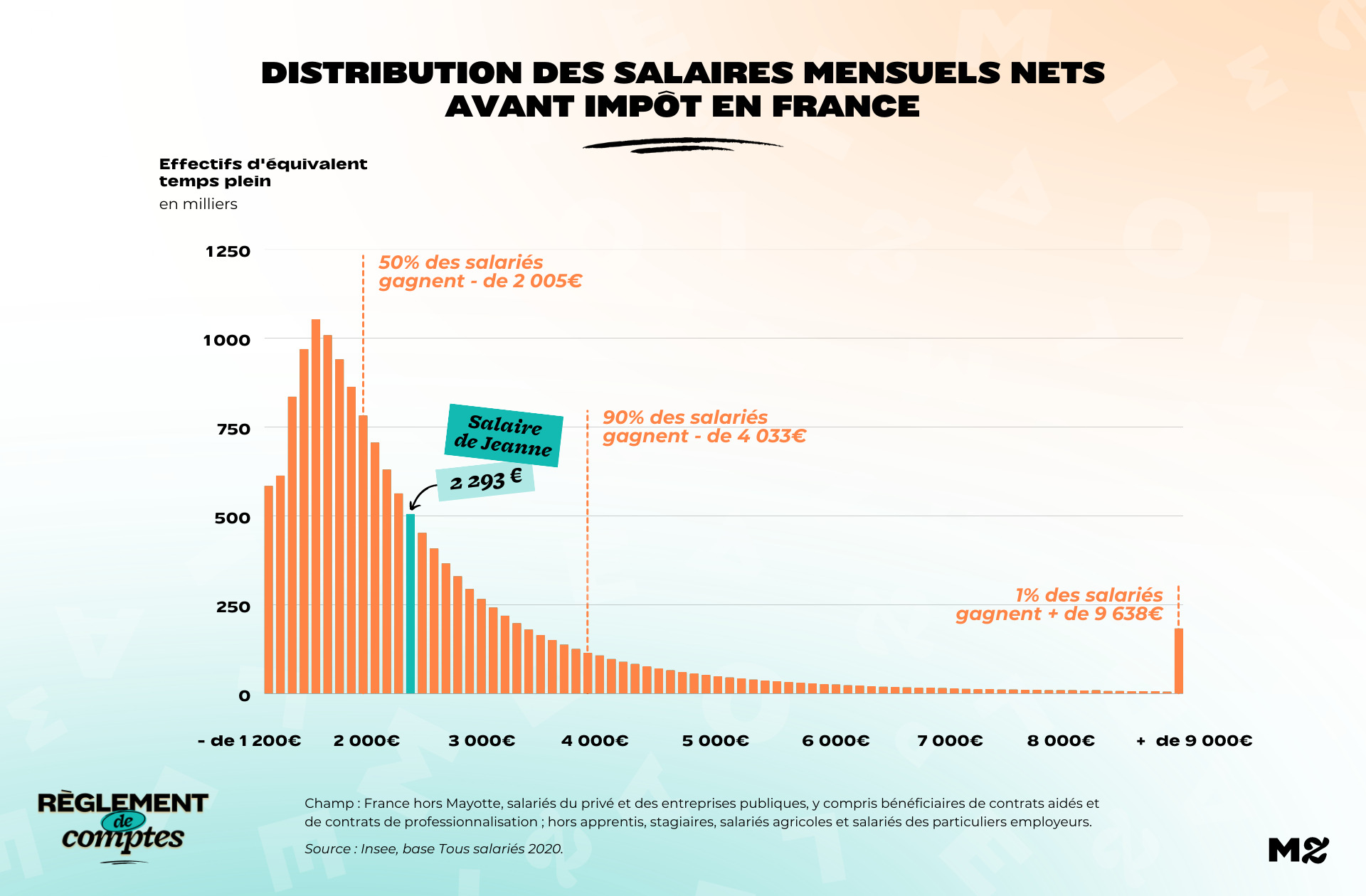

- Net salary before withholding tax : €2,293

- Net salary after withholding tax : 2 157 €

- People (or animals) under one roof : 1 snake

- Place of life : an apartment of 77m² owned by him, in Meaux (77).

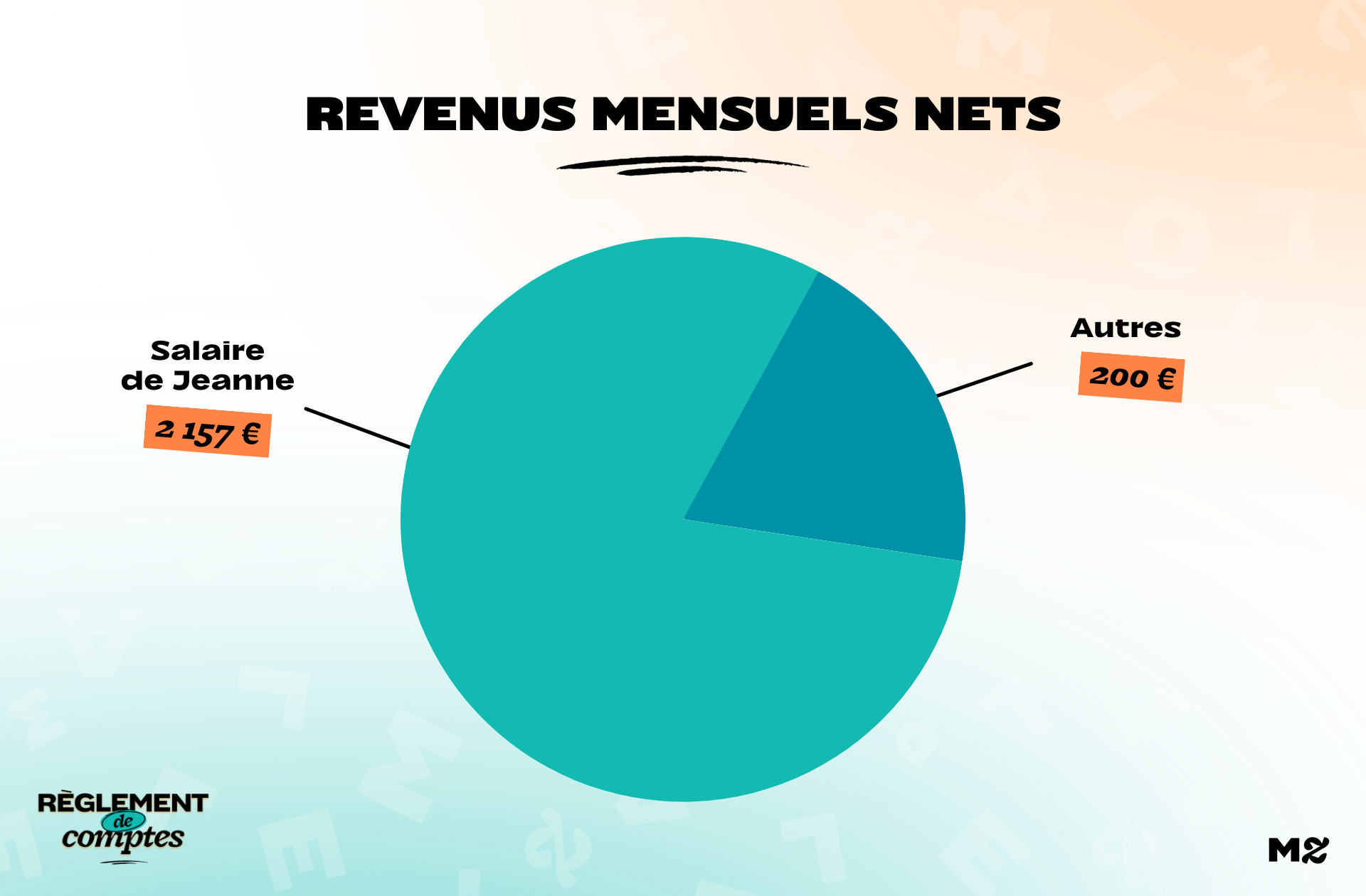

Joan’s income

Jane is French teacher in a college REP (Priority Education Network) for 8 years. As a couple, she does not live with her partner and has no children.

She became the owner in May 2021 of a 77m apartment2 in Meaux (Seine-et-Marne), “in a so-called “difficult” neighborhood”.

“The only changes I’ve made that are still in progress are the paint and the furniture. My apartment is a 3-minute walk from my college, which is very convenient. The big downside is that I meet my students. »

After the deduction at the source, Jeanne receives a monthly salary of €2,157. This includes a REP prize of €144 because he teaches in a difficult institution and a management bonus of 100 euros. Added to that is approx €200 for overtime performs, between 1 and 10 hours a month.

“Living alone, my salary is totally mine. However, during joint errands or outings with my partner, we each spend our shift, making sure that one does not spend more than the other. If there is an imbalance, we make transfers. »

Jeanne’s relationship with money and her financial organization

With his monthly salary of €2,293 before withholding taxthe thirty-year-old considers herself “financially average” because his income allows it live decently, buy property and not worry excessively about one’s expenses”.

“However, in view of my studies (Bac + 5 and competition), my status (A framework) and the teaching conditions which are deteriorating more and more, I don’t consider myself well paid. Without the REP bonus, principal bonus and overtime, my salary would be around €1,800. »

This financial situation drives her to work many overtime hours during the school year.

Jeanne says yes A “very careful relationship with money”. Coming from a middle-class family, on a scholarship during his studies, he believes he has unknowingly inherited his parents’ relationship with money.

“I think it’s important to build up savings to limit inconvenience, but it’s just as important to take advantage of the salary you earn when possible. »

However, Jeanne experienced very badly in her second year of teaching, a slight overdraft over several monthsdue, in her opinion, to “mismanagement of his money after a big trip”.

“It was very difficult to live with this period and I promised myself never to be discovered again. »

Joan’s expenses

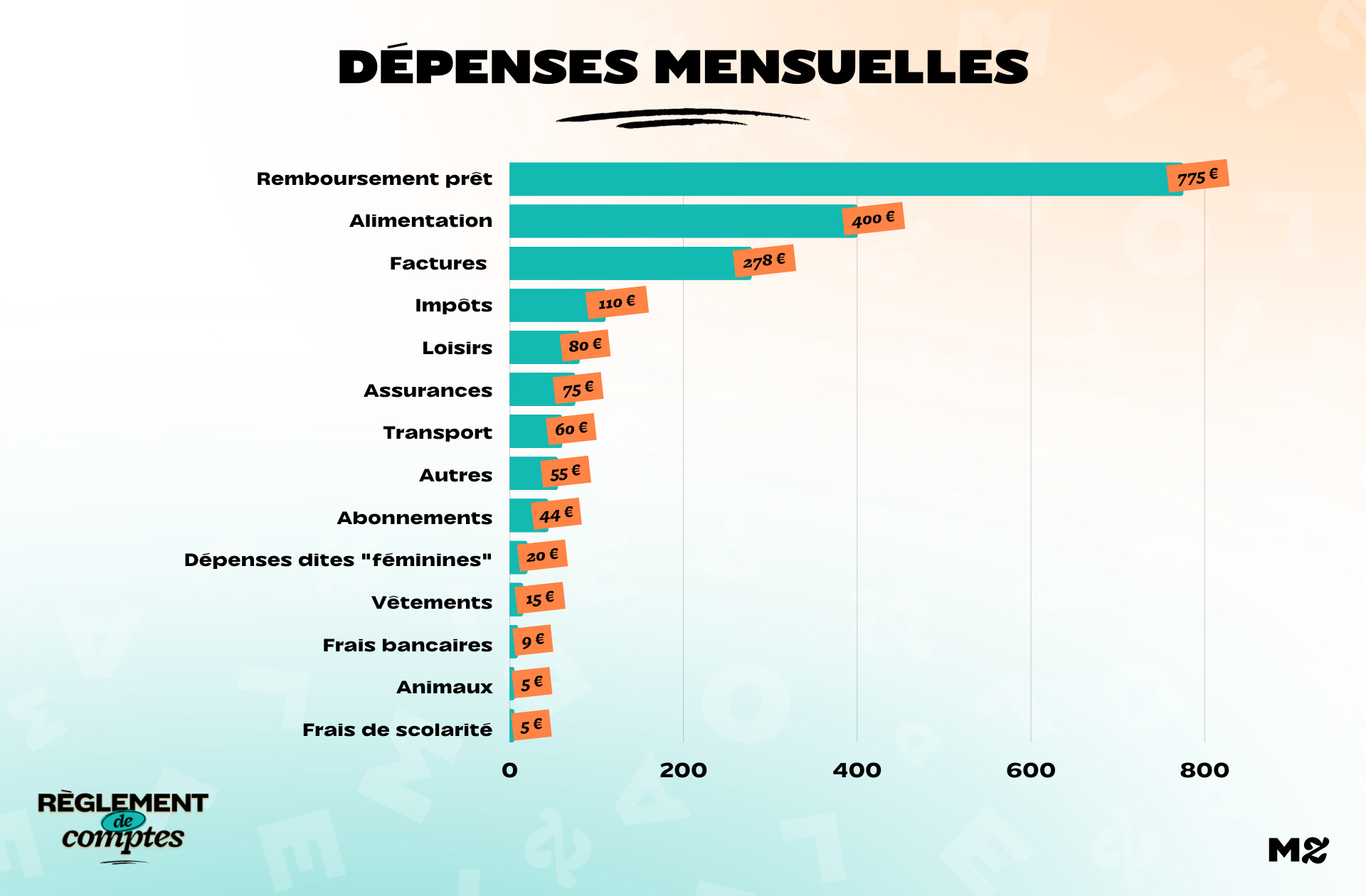

Every month, Jeanne’s main expense is repaying respectively the 3 mortgages she has taken out €533.88 ; €102.23 AND €138.89. OR €775 after all.

” The purchase of my apartment was also catastrophic and is a cause for great concern even now. I think I was advised very badly by my broker, so much so that I end up with three different loans and a debt-to-GDP ratio above the limit. For several months I dutifully kept my accounts and tried to save as much as possible. »

Among her other fixed costs, Jeanne lists €245 monthly for condominium expenses, €33 electricity, €27 insurance for your loans, €30 Car Insurance, €18 home insurance e €55 of mortgage.

She spends too €6 per month for a streaming platform, €27 for your TV/internet/phone subscription e €10 for a music platform.

“Budget for contraception will soon be history”

It costs food budgetJeanne values it around €400 per month. This includes his groceries in a supermarket, as well as the fruit and vegetables he buys in another, more expensive shop specializing in fresh produce.

“I mainly focus on quality. I avoid prepared and industrial meals. I try to buy fresh produce as much as possible, which sometimes leads me to go to the supermarket three times a week. »

These two shops being close to her home, just like her workplace, Jeanne spends very little on her transport: 60 euros per month of petrol. “I fill about a whole month or a month and a half. »

However, Jeanne would like to reduce this shopping budget, which she considers too high.

“I spend on average €100 per week in groceries and various products, which I find too much. I tell myself that this large expense is compensated by a lot few purchases of clothes (estimated at 200 euros per year) or so-called “pleasure” purchases. Also, I don’t have children, which also saves me money. »

As for the so-called “feminine” expenses, the young woman thinks of dedicating herself €20 per month. This includes waxing at a salon every two months or so and the occasional makeup and beauty product purchase.

“I use a menstrual cup which saves me a lot of money on health protection!

I have not used hormonal contraceptives for some months and I am in a personal voluntary sterilization process which will materialize very soon. The balance sheet of contraception will therefore be ancient history for me. »

Joan’s hobbies

For 8 years, Jeanne has been practicing one riding lesson a week. “In the Paris region, sessions are expensive, but I consider myself lucky to have found an equestrian center whose prices are reasonable for the surrounding environment. » This hobby costs him €684 per year.

He also practices bodybuilding 4 times a week at the gym, which pays off €280 for the year.

“It costs me less than a month. The practice of sport is very important to me, it allows me to disconnect and spend my time, even if my job isn’t exactly sedentary.

I also love to read. I buy a lot of used books but these expenses are offset by the sales of old books that I no longer read. »

Much of Jeanne’s leisure budget corresponds to the journey, it does in the summer.

“As a teacher I’m lucky enough to be able to leave in July or August, but always in the high season. Therefore I pay very expensive every time to be able to enjoy a few days at the beach, I don’t really like the Parisian landscape during the summer holidays. »

Savings and plans for Jeanne’s future

Despite a debt-to-GDP ratio that she considers too high, Jeanne usually succeeds save €300 a month : 150 € go on a booklet A which serves as emergency savings, 150€ goes on an LDD which will later be used to finance laser hair removal, a computer or a new riding saddle.

“During a few months when I’ve done more overtime, I can save up to 500 euros, but this is extremely rare. From August to November, when my salary is lower, sometimes I save only 100€. »

In the long run, Jeanne hopes she can get her transferred to be able to do this settle down with your mate in the Wastes and so buy a house together.

Thanks to Jeanne for revealing her bank account!

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

read another

Settle accounts

-

Diane, 1,649 euros a month: “My mother thinks I save too much”

-

Elise, 2,637 euros a month: “My home is a sieve of energy”

-

Lina, 2,798 euros a month for two: “When you have two very different incomes it’s not easy”

-

Salma, 1,890 euros a month: “My bank has completely changed my mind”

-

Pamela, 4,015 euros a month for two: «Some months I save up to 1,000 euros»

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.