Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today, Salma agreed to check her accounts for us.

- Name: Salma

- Age: 27 years old

- Profession: in the cultural sector

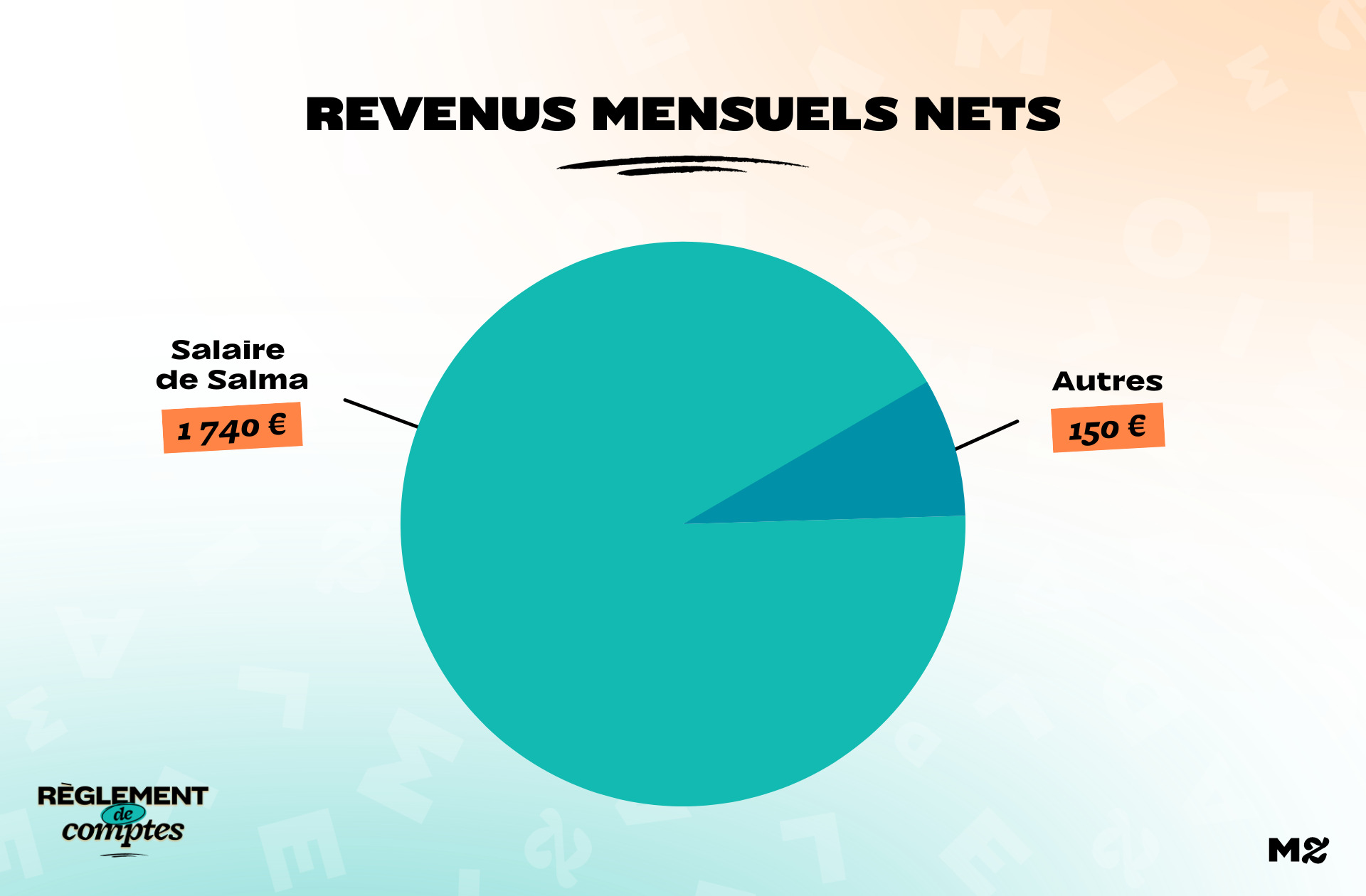

- Net monthly salary: 1,740 euros and about 150 euros in meal vouchers

- Place of life: a studio of 24 m2 for rent in Paris

- Lives alone

Salma’s earnings

Salma works in the culture sector, but does not want to specify her profession so as not to be recognizable. However, he adds that this is an area where opportunities are rare.

“I started working three years ago, and I was a freelancer at the time. The beginnings were complicated, with very unstable incomes that could go from €0 to €3,000 in certain months. I had to live with my parents.

Gradually, things started to stabilize. I chained the regular missions, and I started earning a salary that allowed me to save: I rarely received less than €2,600 net a month. But in the end I didn’t like what I was doing anymore and the possibility of my contracts ending overnight worried me a lot.

I found a CDI in an environment that I like best and that allows me to be much more stable. But for this I accepted a much lower salary: for me, I bought my stability. »

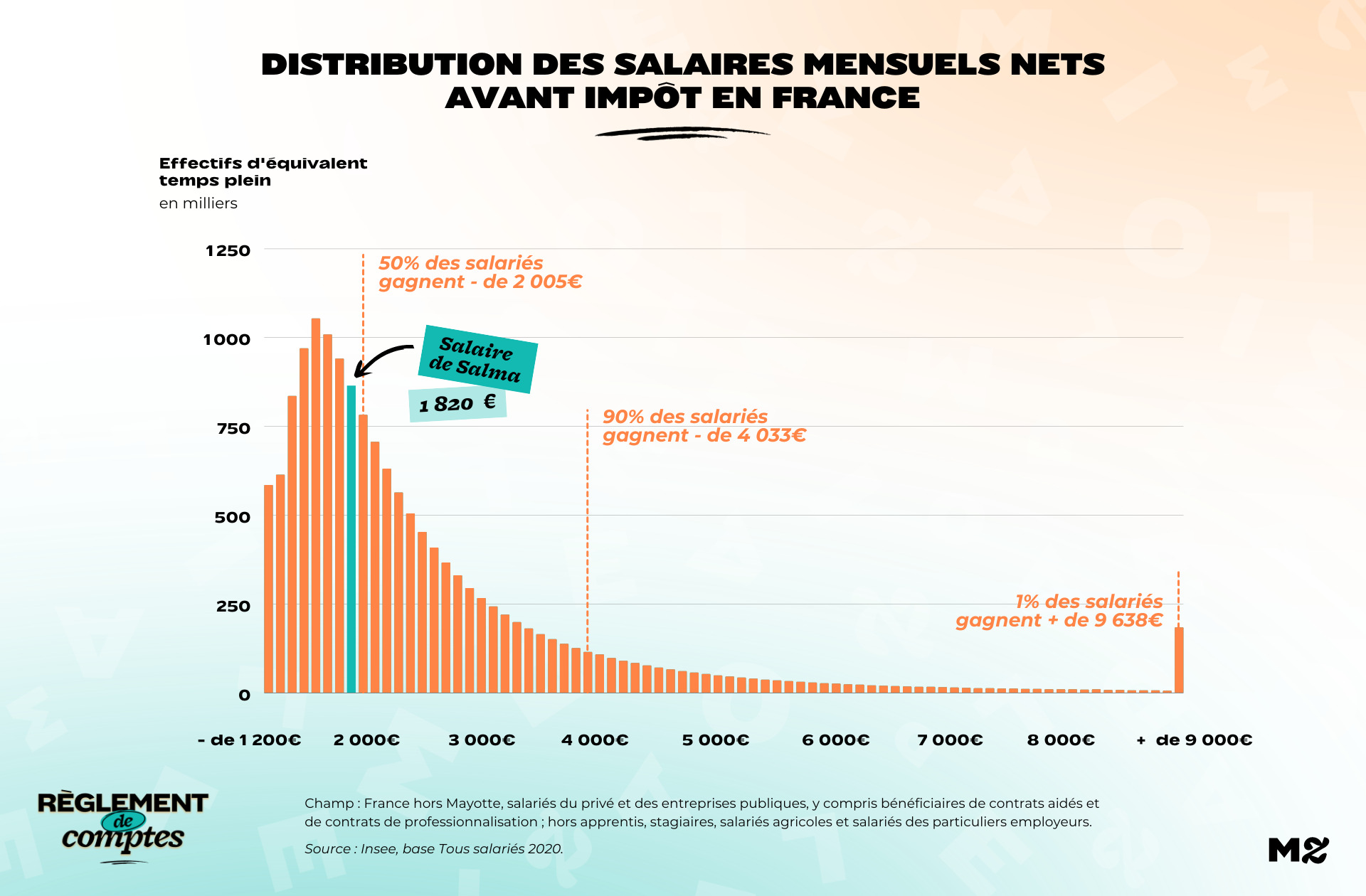

With a permanent contract, earns 1,740 euros net per month (1,820 euros per month gross of withholding tax), to which are added about 150 euros a month in restaurant vouchers.

” I don’t think I’m paid well for my position. Especially since I’ve invested in studying abroad, in a fairly prestigious graduate school for which I still pay student credit…

I think so anyway in the sector in which I evolve, it is an average salary. There is a real salary assessment problem in my job: I have girlfriends, in other circles, who fight for a salary of 40,000 euros a year, because they think it is too low. »

However, Salma considers herself privileged on certain levels:

“My parents are part of the upper middle class, and even if today they earn less than before, they managed to pay for part of my studies and I’ve never had any shortages. So I feel privileged, thanks to the environment in which I grew up. »

Salma’s relationship with money and her financial organization

Salma describes her relationship with money as ” fatigue », and he explains that it comes from his father:

“I am an anxious person and my father passed on his stress to me about money. He really struggled when he was younger and was always afraid of missing out. Even when he was earning a good living, he was very afraid of precariousness. However, we never lacked for anything and he is a very generous person, but he conveyed his stress to me.

Paradoxically, I too am in denial. My rent there is too high for what I earn, but I’m an ostrich. I’m careful never to spend too much at once, but at the same time the small amounts pile up and I spend a lot… And even though I earn less than before, I’ve been much calmer since I started. I have a CDI. »

She owns a deferred debit bank card: all your expenses are debited from your account at the end of the month, on the same date. This allows him, if necessary, to draw on his savings to cover the extras without ever being caught.

“It’s a security issue, so if my card is stolen, they can’t empty my account. But I don’t know what I’m spending in real time. »

Salma’s expenses

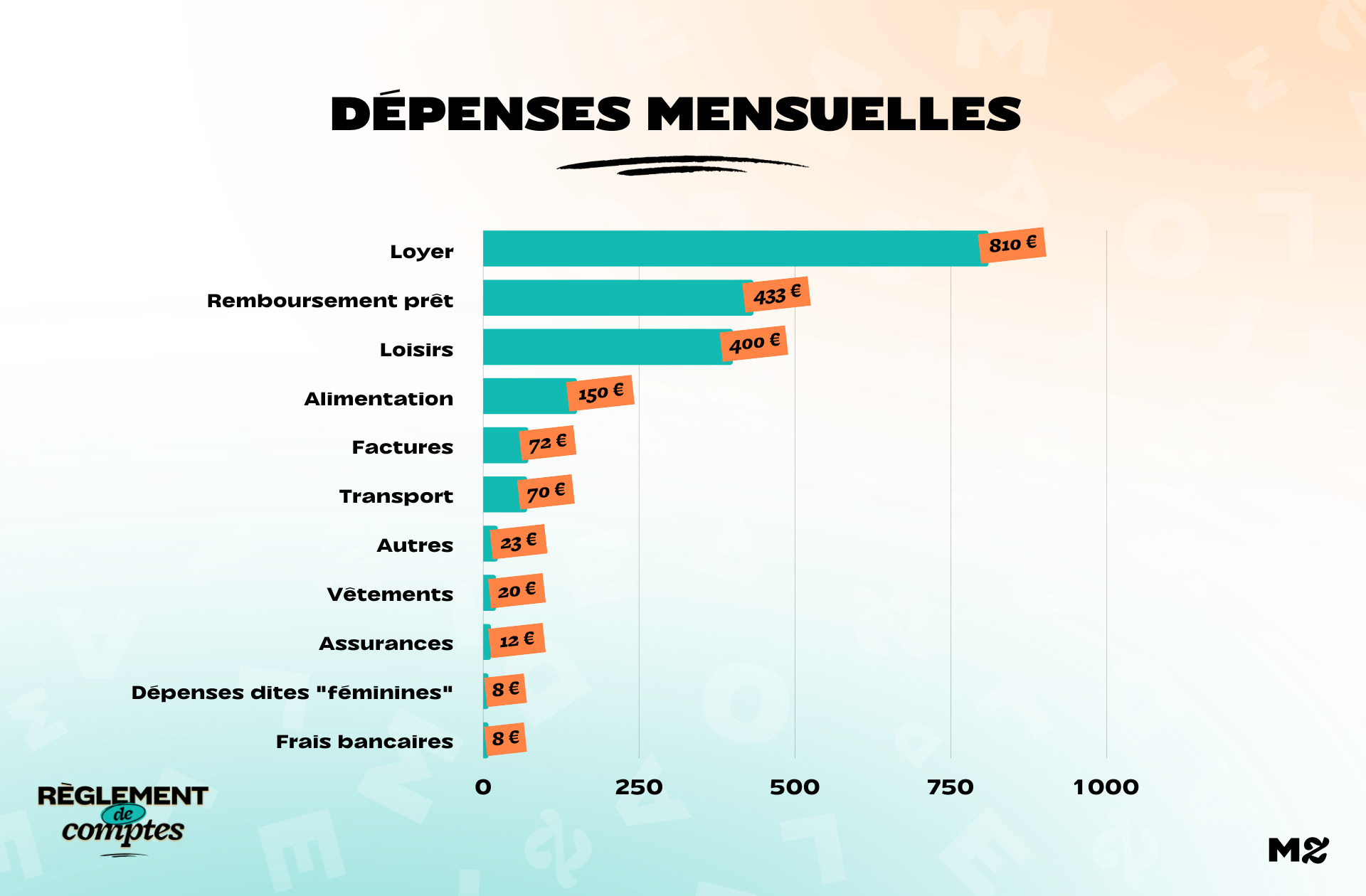

Like most Parisians, rent is Salma’s main expense. For the 24 m² studio that you have been renting for a few months, you pay a rent of €810 per month, bills included.

“I found this apartment by accident. When I was independent, nobody wanted my file. I managed to get this studio because his owner rents another property of his to some of my relatives that he really appreciates, and so he decided to rent it to me despite my somewhat shaky resume.

I really like this apartment and I’m comfortable in it, but it’s expensive. With my old salary I could easily pay the rent, but that’s not the case anymore. »

She pays too 72 € of bills every month for water, electricity and heating.

His second largest monthly expense is the student loan payments, which cost him €433 per monthand to which she is engaged for another three and a half years.

His spending costs him €150 per month.

“I shop at the supermarket near my house. I’m not a vegetarian, but I hardly buy meat anymore because I think the price is so high.

For my vegetables I go to the market once a week, it’s much cheaper and better than in the supermarket. I think that I should spend a little more on groceries, to eat a little less out of the house. If I shopped smarter, I’d have fewer “leisure” expenses like a tray of fries at the bar. »

“My bank charges are expensive, I think I have all the insurance in the world”

Salma’s fixed costs also include 12 euros for home insurance, 23 euros for the health insurance and 70 euros for a public transport pass. He pays the equivalent of 8.3 euros in bank charges per month (100 euros rounded off in the year), a figure he finds too high:

“This sum is charged to me once a year and I find it very high. Recently, I made an appointment with my bank to change it, and They completely amazed me: they explained all the advantages of the card, explaining to me that if I got sick, broke my leg and missed a train, I would have all the insurance in the world. I’m not very good at negotiating and I let myself be cajoled.

At the same time, I have a friend who has the same card and managed to get the entire trip reimbursed, because her boyfriend fell ill the day before departure. Maybe she will recoup those costs…

Her phone subscription is paid for by her parents, and she uses it to have internet at home, connection sharing.

Salma’s hobbies

Each month, Salma has a leisure budget of €400. A budget that she finds high, but which she is fond of:

“I’m a very social person, and for me it’s important to go out, do things, see people… I struggle to be locked up all day.

I go to the cinema regularly, more rarely to see shows or to the theatre. I also have a budget of €20 a month to do sports sessions every other week with friends. But the biggest part of this budget, I’m a little ashamed of it, but it’s the beers on the terrace.

Rather than depriving myself of going out, I try to be careful where I go out: I choose cheap bars, cheap restaurants… If I have to eat out, I don’t spend €40 in a restaurant, for example. but that doesn’t stop me from going out for a pint every night because they cost only €3.50. Except that put an end to the end, expenses pile up! »

She also likes walking, walking around Paris for free or within reach of public transport. When her budget allows, she also goes on weekends to other cities with friends. But in a group the question of money is not always easy to manage:

“I’m surrounded by people who make way more money than me, and sometimes I just can’t keep up. For example, for holidays, I’m the type to avoid spending on accommodation and this has occasionally created situations where I felt too bad and pissed off everyone. I was faced with people who earn a lot more than me and they said “We want to have fun, it’s our only week of vacation, so we will spend a lot on a large villa” for example…

I love them, but I met them in another context, our relationship with money is not the same. »

Salma’s savings and future plans

After calculating, about €80 a month missing to Salma to meet her expenses. An amount she gets from his savings, accumulated when he was earning more:

“When I was independent, I saved a lot on an A-book and a brochure on sustainable development. When I was 18, my banker also made me open a liquidity PEA in which €500 had been invested, but which was useless, because this account had no interest. Apparently, he will help me if one day I want to set up my box, but I’m not sure if he will help me …

At the moment my savings are mostly used to absorb my declining income, but I hope to do better in the coming months. Make me tupperware at noon to save money and avoid eating out, for example! »

In the future, he would like to take a few months off to travel.

Thanks to Salma for answering our questions!

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

read another

Settle accounts

-

Pamela, 4,015 euros a month for two: «Some months I save up to 1,000 euros»

-

Karine, 2,157 euros per month: “Being as a couple but living apart has advantages”

-

Asmahan, 756 euros a month: “I worked for two years without being paid”

-

Lina, 1,863 euros a month: “Compared to my peers, I consider myself very high average”

-

Assia, 2,318 euros a month: “I don’t understand why I’m always in the red”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.