Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Paloma who agreed to open her accounts for us.

- First name : Paloma*

- Age : 29 years old

- Occupation : Psychologist

- Gross salary : €3,812

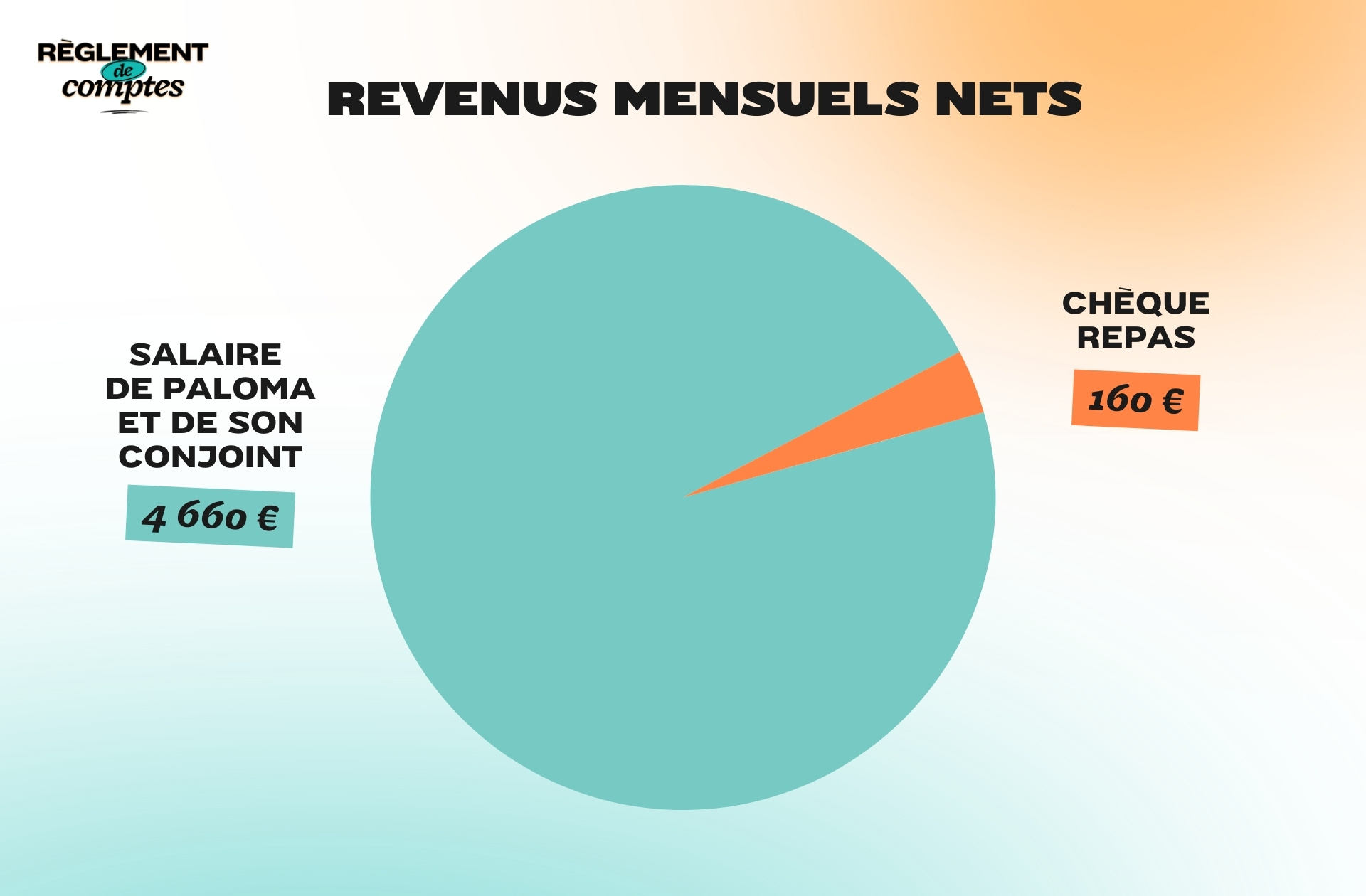

- Net salary : 2,468 euros and 160 euros of electronic meal vouchers

- People (or animals) living under the same roof : his partner

- Place of life : an apartment in Liège (Belgium)

Paloma’s situation and income

Paloma is 29 years old and is psychologist in Belgium in a mutuality, where he has a permanent contract. In France, a mutuality corresponds to health insurance funds responsible for the reimbursement of medical expenses.

“I like my job for the autonomy it gives me in managing my tasks but also for the work-life balance it gives me. Furthermore, every week I see so many people pass by with their unique life stories, which is very enriching on a human level. »

Paloma lives with her partnerwho is a worker in a plumbing company, in an apartment of 150 m22 on the outskirts of the city of Liègeof which I am owners since March 2023.

“It is a place very accessible by public transport and very close to the main highways, which is practical for my work where I move a lot both in the city (by bus) and in other parts of the province (where I go by car) .

We no longer dared to dream about the place we currently live in after two years of fruitless searches. We are really close to everything, with several supermarkets within walking distance, a train station serving Brussels just a few minutes walk away, the center of Liège less than 3 km…”

Paloma and her partner own their apartment 50-50, value of approximately 200,000 euroswho bought half with a 15-year loan and half with their savings.

For her position as a psychologist in a mutual fund, Paloma receives a net salary of €2,468 and also has meal vouchers worth €160 per month. His partner receives a monthly salary of around 2,300 euros. Which brings their total income to around 4,930 euros per month for two.

“I appreciate myself paid my master’s degree correctly. This is the first time I have received master’s compensation. I believe we are in a good financial situation, especially since I took this position. We have no problem going on vacation, we can have meals delivered almost every week… I doubted for a long time whether I could afford this kind of lifestyle, almost at the level of what I knew as a child. I spent a lot of time without work, with a fixed-term part-time contract for a few months, then a permanent part-time contract after studies. But luck smiled on us in the end. »

Paloma’s relationship with money and her financial organization

Paloma has grown up in a bourgeois familywith parents who made a good living.

“We went on vacation for two weeks every summer and money has never been a problem. However, they did not spend haphazardly and had no interest in trends or luxury. We only bought devices if the old one no longer worked and not if there was much more revolutionary technology on the market. We didn’t even buy designer clothes. And gifts have never been very expensive. »

“My parents always did a thoughtful relationship with money when thinking about investments. My father likes to invest and he encourages me to do the same. »

When she tried to become a homeowner, Paloma was able to count on her parents to help her increase her contribution. “ I am much luckier than many others and I am aware of it : being born into an economically comfortable family that taught me not to try to reproduce a lifestyle just for appearances. »

Today, in her adult life, Paloma believes she has a pretty healthy relationship with money:

“I tend to spend to tide myself over, without even spending a fortune. For larger expenses I spend a lot of time evaluating the best value for money (with Excel tables). »

However, that doesn’t stop her from getting stressed when she sees her checking account balance decrease. “ I can’t stand having less than 100 or 200 euros in my account. I don’t really know where it came from, having never had any real financial difficulties. »

Organizationally with her partner, Paloma and he each have a personal account, in addition to the joint account. Paloma receives her salary into her own account, then pays around 1,200 euros a month into the joint account. For her partner it’s the opposite: her salary is paid into the joint account and she lets Paloma transfer half of her salary into her personal account. “ I am primarily responsible for all administrative matters. » The joint account is used to pay the couple’s expenses, while the personal account is dedicated to personal expenses (car, taxes, etc.).

Paloma’s expenses

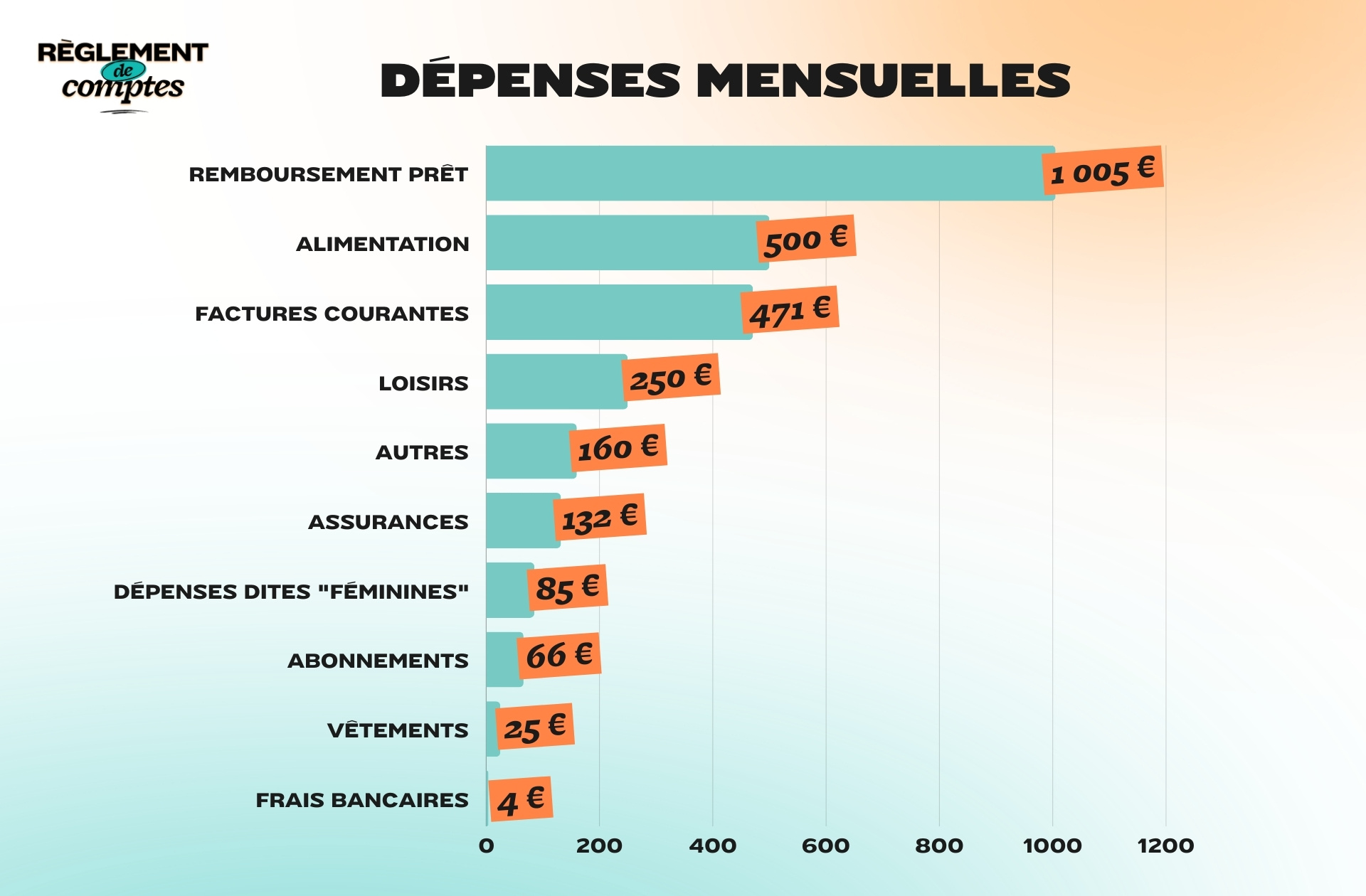

The young woman and her partner repay every month Mortgage loan of 1,005 euros for their apartment in Liège. This is their main expense item.

Current bills are owed to them €471 : €460 quarterly for gas and electricity, €123 quarterly for water and €277 monthly for co-ownership expenses.

The internet subscription, Paloma’s phone subscription and the Disney+ subscription are theirs. €66 per monthwhile they pay Insurance €132.50 (€10.50 from the health insurance, €28 from hospital insurance, €54 from car insurance taken from the Paloma account and €40 from home insurance, from the joint account).

Good news for Paloma: every year,The taxes give him 1,000 euros. “I have a mortgage tax deduction and too much is taken out of my paycheck. »

Bank charges are €4.50 per month.

Grocery shopping costs money every month €500 to Paloma and its partner, mainly in Belgian Colruyt supermarkets, via click and collect.

“It is the most interesting brand in terms of promotions and this ordering method allows us to fall less into products we don’t need. However, we don’t buy fresh ones during these competitions because, otherwise, we tend to let them rot before we want to prepare them. »

For expenses, Paloma goes shopping every day, in various shops, and pays with the money from the joint account. «At lunchtime I pay with meal vouchers and go to get food near my workplace. »

As regards the so-called “female” expenses, they amount to approximately €85 per month to Paloma. It includes 80 euros of contraception per year, a low-cost laser hair removal cycle (30 euros per month) and nails (35 euros per month). “It’s a comfort I offer myself because done nails give a shinier look effortlessly, I find. »

Paloma’s leisure expenses

To recharge your batteries, take time with your loved ones and relax, Paloma spends around 250 euros a month on her free time. This includes holidays, sports, restaurants, smoothed out throughout the year.

His main (and most expensive) hobby is horse riding : this costs him €800 per year and this, even though since she bought the apartment she has reduced herself to just one session a week. “I would like to have a second lesson a week and/or half board soon, which will cost me more. »

The young woman also practices dance, for which the membership fee is paid €200 per year and has a €25 per month gym membership.

“But I’m hesitant to stop because I’ve started running again and I don’t find much pleasure in going to the gym anymore. »

Sport aside, Paloma confides “don’t go out much” and afford two or three restaurants a year. “We’re going on an all-inclusive holiday this year, but it’s the first time in a long time. »

In general, she would like it “reduce emotion-driven impulse purchases”not only because they represent a drain on his budget, but also because “because it’s not very eco-friendly and doesn’t clutter my apartment at all”. His latest folly? “An order from Shein because I had a bad week. And I’m ashamed of it. I never order from this site but I couldn’t find what I liked anywhere else. I already regret it before receiving it. »

Paloma’s savings and future plans

Once all these expenses have been paid, Paloma and her partner have around 2,000 euros left. “In my treasury account there are 1,100 euros and in the joint account there are around 300.”

At the moment Paloma does not have a specific savings budget.

“I use the Plum app, which charges me based on what I have in my account to put aside each week. I’m saving around €100 a month, which I deposited into my savings account. I put myself aside especially in case of unexpected expenses like a car problem. »

In the future, if her budget allows it, Paloma would like to be able to buy a horse. “ But I need to learn to manage my budget differently. Between buying the apartment and my new job, my budget has changed too much to know how to manage it well yet.. The priority will however go to the renovation works that we want to do in the apartment (install a pellet stove and modify the bathroom to have a shower and VMC). »

Thanks to Paloma* for analyzing her budget for us!

* The name has been changed.

Read another one

Settlement of accounts

-

Laura, 4,911 euros between two: “I saved 9,000 euros in 8 months thanks to the envelope system”

-

Ava, general practitioner at 4,316 euros per month: “My strong point is minimalism”

-

Virginie earns 2,389 euros a month: “I was able to buy my apartment also thanks to donations from my parents”

-

Agostino and her husband, 5,400 euros a month: «I find I wear out too many clothes»

-

Manon, 1,874 euros per month: “Since I separated, I earn much more from my money”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Discover BookClub, Madmoizelle’s show that questions society through books, in the company of those who make them.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.