Talking about money in France is still a taboo. However, it is a fascinating topic… and feminist, in some respects! In Settling the Accounts, people of all kinds examine their balance sheets, tell us about their financial organization as a couple or alone and their relationship with money. Today it was Lina * who agreed to analyze her accounts for us.

- Age : 26 years

- Occupation : communications manager

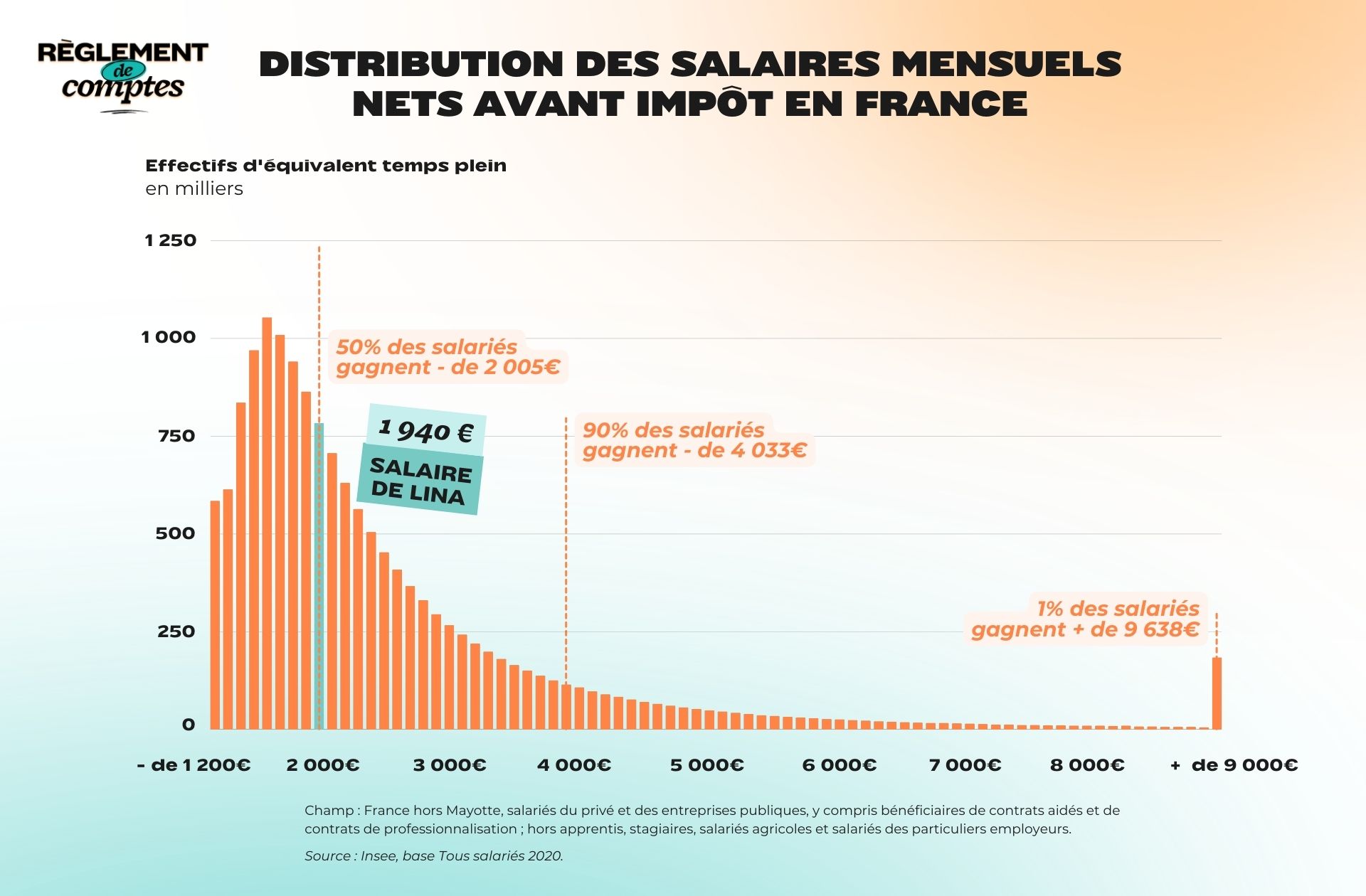

- Net salary before withholding tax : €1,940.40

- Net salary after withholding tax : €1,854.57

- Place of life : Paris intramural

Lina’s situation and income

Lina, 26 years old, works permanently in a large jewelry company, in the Marketing area as web communication manager. As a couple, she lives alone in Paris in a ” small flat “ of which she has been a tenant for several months.

“I lived in shared accommodation for a long time to minimize costs before finding my first home. This obviously generates additional costs but I wanted to start and live on my own. »

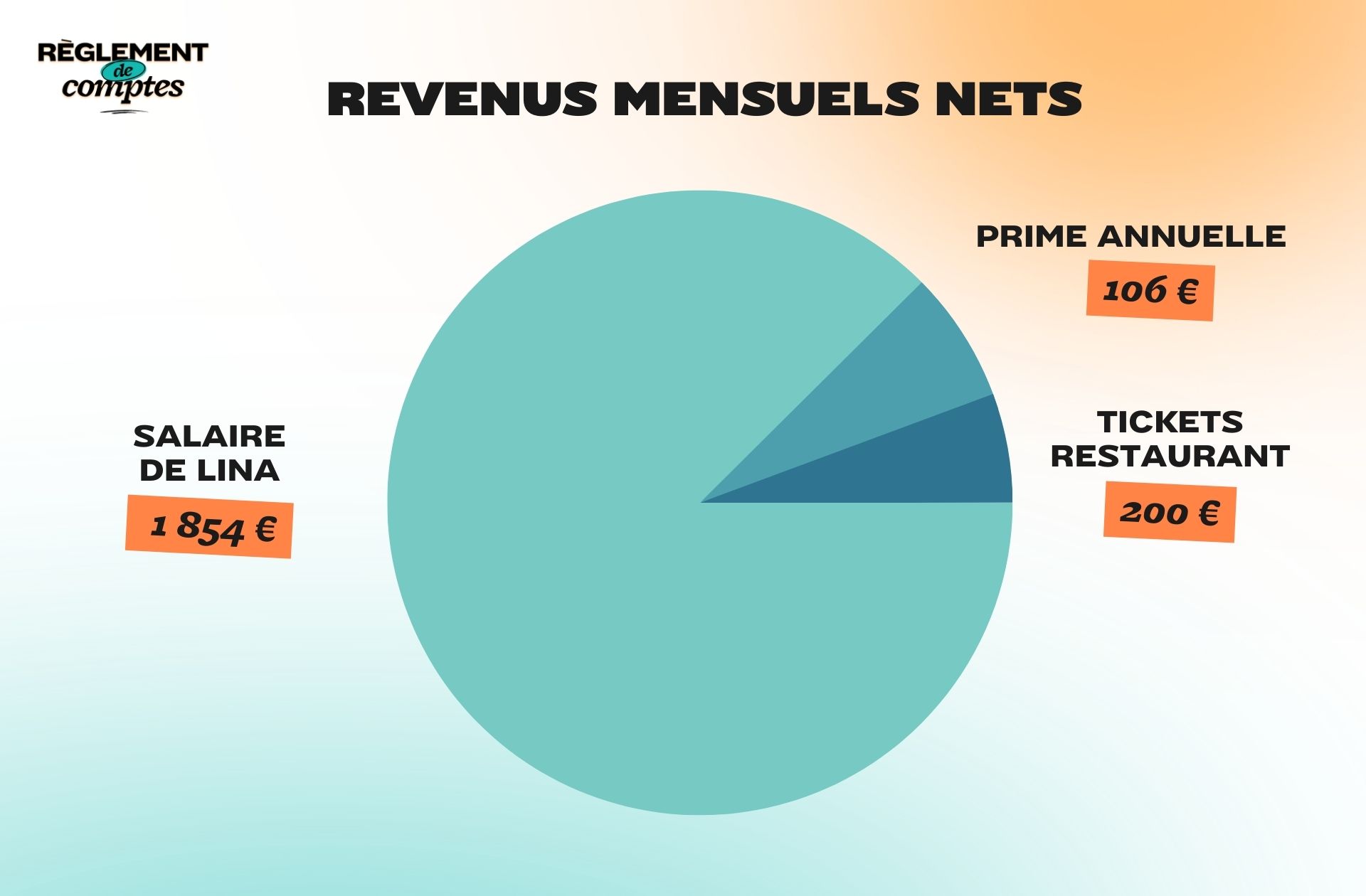

For her work as communications manager, Lina receives a net salary of €1,940brought to €1,854 net of withholding tax. She perceives too a bonus of €1,270, spread over the months of September and December. Ultimately, it benefits Monthly restaurant vouchers of €200.

“Like many people, I don’t consider myself paid enough, considering the work I do, the number of hours worked each week, my degrees. The company does not compensate by offering, for example, telecommuting, RTT or even a CE voucher. »

For Lina, reflects his situation “the reality of the labor market” Todaywhere young people entering the job market benefit from neither the advantages nor the recognition that their elders enjoyed.

“I went to a top business school and they sold us incredible salaries after leaving school, when the reality is very different. Particularly in communication professions. I still consider myself average and satisfied with what my salary allows me to live in the capital. Ah, remarkable fact: I love my job and this helps too! »

Lina’s relationship with money and her financial organization

Lina grew up with parents who “inculcated a reasonable relationship with money : it’s not because we have the means that it’s right to buy this or that thing”.

“Even in difficult times we never lacked anything and my parents gave us a taste for simple pleasures and for second-hand goods. I try to do the same and have a good balance between taking care of myself and saving money. »

Today Lina feels she manages her money well. “Never discovered”he never chose the overtaking option “don’t have any unpleasant surprises”.

To ensure she accumulates savings, she sets aside the same amount at the beginning of each month and uses it only in case of emergencies. “For example if I have medical expenses to pay in advance. » He also puts another amount aside in his online bank which he can access if needed. This operation allows it ” having a good balance between pampering yourself and saving money ».

As for the financial organization, he has a checking account with a bank card and two savings accounts.

“Having taken the cheapest offer from my bank for the bank card, I signed up to an online bank with a free card that I use abroad so as not to have additional costs. »

Lina’s expenses

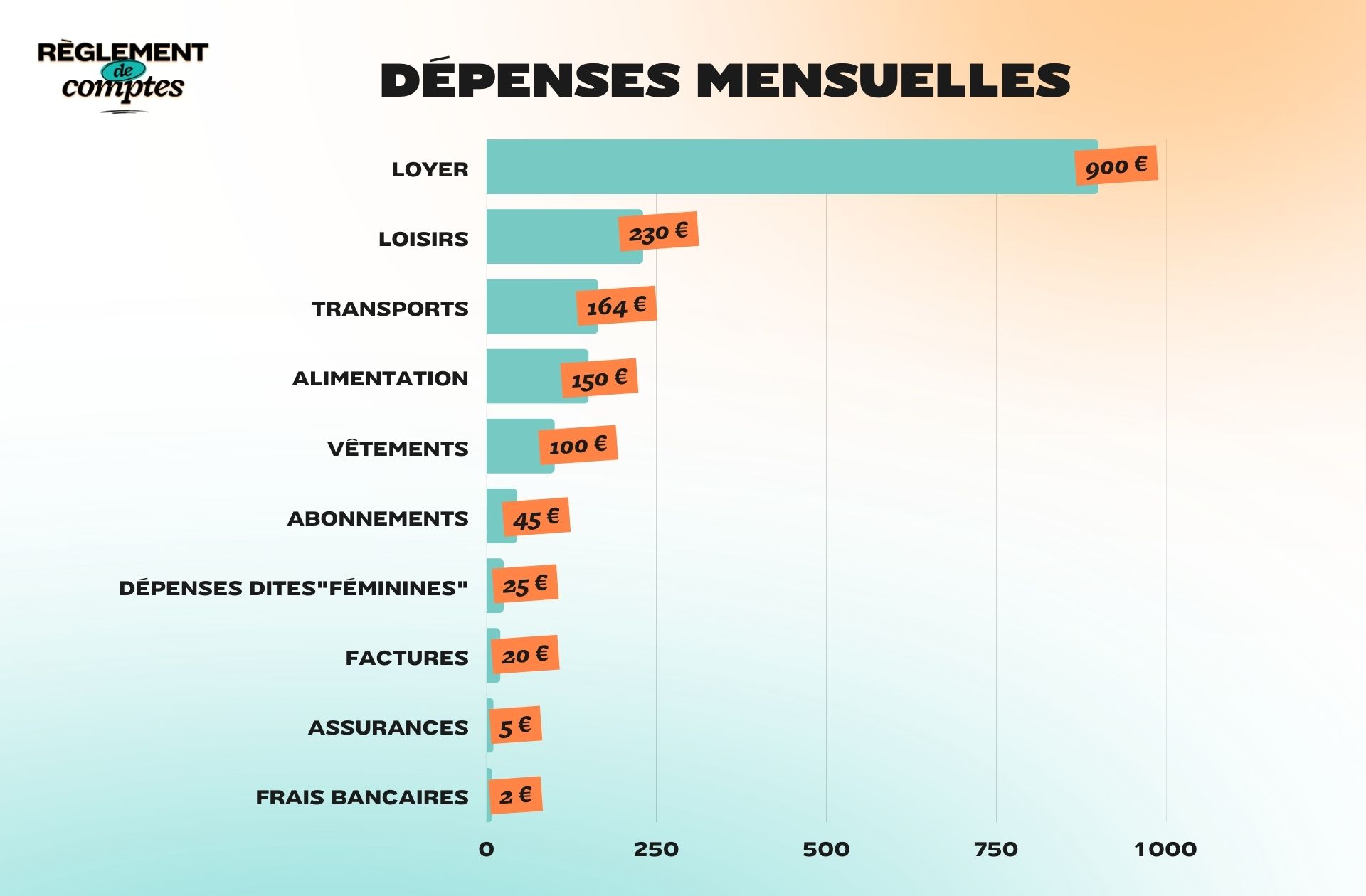

For his small rented apartment in the center of Paris, he pays Lina a rent of €900. As with many French people, this is by far their main expense item.

Since hot water, cold water and heating are included in the rental price, Lina only pays for electricity consumption, estimated at €20 per month.

His other fixed expenses include the payment of his Internet box (15 euros), his telephone plan (15 euros), the Netflix subscription (8.99 euros) and the Spotify Family subscription (5.99 euros). Totalizing €44.98.

The young woman’s bank charges are very low: €2 per month, just like your home insurance. Smoothed out over the year, this equates to €5 monthly.

To get around Paris, Lina uses public transport and therefore has a Navigo card, which she pays for €84 per month. This expense is added €80 trainwhen he returns to his family two weekends a month.

“With inflation, prices rise quickly”

To do her shopping, Lina mainly goes to supermarkets. She believes his food expenses at €150who pays mainly with the restaurant card.

“I try to be careful to buy seasonal things and I pay close attention to prices because they rise quickly with inflation. I, on the other hand, don’t do a lot of shopping, I go there once or twice a week. I often prepare meals in advance, especially for lunch at work. »

Even though eating expenses are already under control, Lina would like to reduce costs further “or at least improve the way I shop”.

“Brands in Paris are expensive and I choose locally based on prices and availability. I eat very little meat because the prices are too high and I often feel like I’m shopping in all directions and not eating much variety (team shellfish-ham-cheese). On the other hand I am proud of myself because I produce my own household products and shampoo bars. »

As for the so-called “female” expenses, Lina estimates them at around 25 euros per month. This includes around twenty euros for hair removal sessions, which she schedules in spring and summer, and skin treatments “a little expensive for acne”.

“I used to do my own nails, but I invested in a machine to do semi-permanent nails myself. I also personally make some skin care products such as solid shampoos, make-up remover oil…”

Lina’s leisure expenses

To go out, relax and travel, Lina has around 230 euros a month – an expense amortized over the course of the year.

The young woman favors free or inexpensive entertainmentsuch as sports at home, running and reading.

“I read a lot but I exchange books with my friends. Before the age of 25 I took advantage of the free museums and exhibitions to go out. Now I wait for the first Sunday of the month where I mainly look for free exhibitions. »

Otherwise she likes to go out with her friends at a bar or restaurant, but again her expenses are under control.

“I set a budget not to exceed and these are never very expensive places. »

In fact, most of his leisure budget is spent on weekends he spends “hanging out with friends.” On the plane, the young woman prefers the train and finances holidays abroad with the annual bonus.

«It is a ‘social life’ expense item that may seem important but is part of my lifestyle. »

Finally, Lina admits that she loves clothes. And even if prefers used Vinted, spends on average one hundred euros a month on clothing. An expense item that he would like to reduce.

“At the beginning of the season I fall in love with different things that I don’t necessarily need. My latest breakdown? For my birthday: A Chloé bag, always second hand. »

Lina’s savings and future plans

Although his expenses vary, particularly due to the weekends he regularly attends, Lina manages to save around €400 a month. “Sometimes it’s more, it depends on the moment. »

The young woman already has an idea of the next “big” expense for which she will draw on her savings: the purchase of a washing machine.

In the long term, he would like to leave Paris and return to his hometown to invest in real estate.

“But the thing is still a bit unclear because I wouldn’t be able to repay the loan by not living in the property I purchased. »

Thanks to Lina* for opening her accounts for us!

* The name has been changed.

Read another one

Settlement of accounts

-

Salomé, 1,667 euros per month: “With my boyfriend we don’t do 50/50 because he earns double my salary”

-

Marlène, 4,880 euros for 5: “Our wealth comes from the help we received from our parents”

-

Nour, 3,300 euros a month and 3 children: “I regularly draw on my savings without being able to replenish them”

-

Living on 1,950 euros a month: the daily financial life of Palin, her family and her 10 gerbils

-

Nessa, between 1,080 and 1,680 euros per month: “I have the problem of not belonging to my parents’ social class”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Do you like our articles? You’ll love our newsletters! Sign up for free on this page.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.