Talking about money in France is still a taboo. However, it is a fascinating topic… and feminist, in some respects! In Settling the Accounts, people of all kinds examine their balance sheets, tell us about their financial organization as a couple or alone and their relationship with money. Today it was Gabrielle * who agreed to analyze her accounts for us.

- Age : 33 years

- Occupation : administrator in a small cultural structure

- Net salary before withholding tax : €1,707

- Net salary after withholding tax : €1,648

- People (or animals) living under the same roof : 2 other roommates

- Place of life : an apartment in the 20sAnd neighborhood of Paris

Gabrielle’s situation and income

Gabrielle works permanent contract for 3 years AS’administrator of a cultural association.

“I really like my job and the purpose of the association I work for. I find real meaning in it and am happy to go to work every day. »

Single, the young woman currently resides on the 20thAnd neighborhood with two roommates. “The apartment is 78 m2 for 4 pieces. »

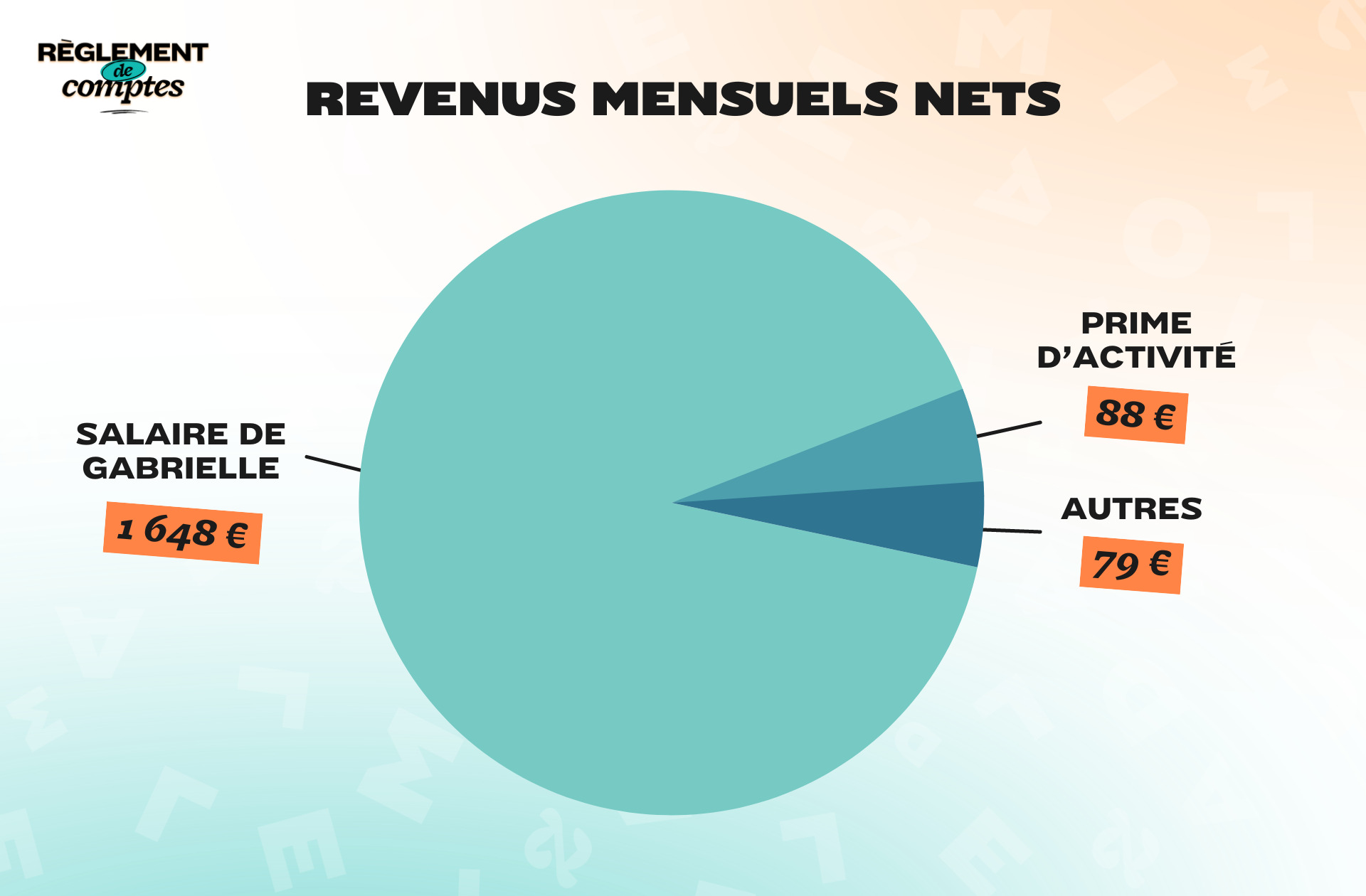

For her work in the associative cultural sector, Gabrielle receives a net salary of €1,707brought to €1,648 net of withholding tax. In addition to his salary, he receives every month Activity bonus of €88 from CAF.

When we ask Gabrielle if she considers herself well paid for her work, she admits that she does “difficult to answer the question”.

“I work in the cultural volunteering sector where I know people who are much less paid, and others who are much better paid. I think that This is fine with me for now because I can save money. »

However, he does not consider “you become rich with this salary”even more so when you live in the capital where rents and the cost of living are very high.

“But I am lucky to have received a donation from my family and to accumulate funds to buy soon. »

Gabrielle’s relationship with money and her financial organization

Gabrielle grew up in a family that, although she had “the means to afford more things”he was careful with his expenses.

«I was taught that it is important to save every month, especially to be able to buy a property later, for example. »

Today the thirty-year-old estimates he has a relationship with money “very healthy” and it is never discovered.

“I have been paying rent and managing myself financially for over 12 years. So I know how to estimate how much I need to live happily. »

Affordable without feeling like she’s holding herself back, Gabrielle has no particular organization to stay afloat.

“There are many expenses that don’t interest me and in which my purchases are limited, such as clothes. I never do my math. I have to log into my bank account about every 10 days., in particular to check the transfers of my roommates or owners. Since budget management is part of one of my work missions, I don’t want to apply it in my personal life because I feel like I don’t need it. »

Gabrielle’s expenses

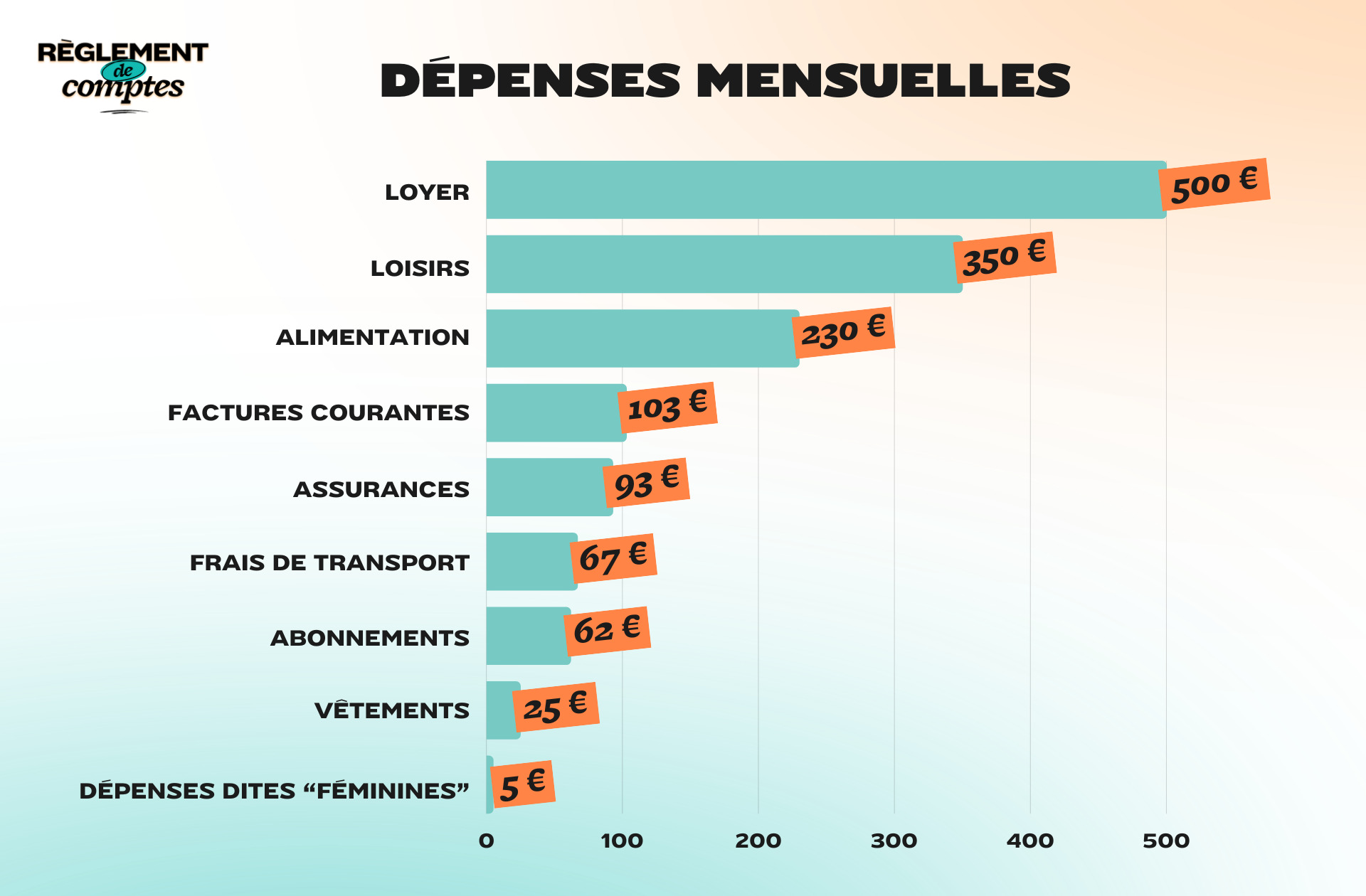

To stay in Paris on her salary, Gabrielle did the choice to live in shared accommodation rather than in a small studio. He then pays a third of the rent on his apartment every month by the 20thAnd constituency, i.e. €500. This is the main fixed expense item.

Whoever says shared accommodation, says division as a result of other expenses related to the apartment. The young woman rules €83 per month for expenses (set at €250 per month), as well €20 for electricity. Same principle with internet subscription of €35 which is divided by 3 (€11.67 each) and for home insurance which amounts to a total amount of €280 (i.e €93 per roommate).

Gabrielle’s phone plan is 50% covered by your employer and therefore costs €5 per month.

“My job also requires covers 100% of my Liberté+ package [qui permet de voyager librement en validant son passe Navigo pour chaque trajet,ndlr]. I have an average of €60 per month, which I pay via expense report. »

“I don’t buy products that I find expensive”

Even though she lives in a shared apartment, and especially because she lives in Paris, Gabrielle’s food budget is very well controlled. Every month, spends an average of €230 on foodmostly in organic shops.

“I’m vegetarian outside and vegan at home. I go to the grocery store at the beginning of the week, where I buy all the fruits and vegetables I need for the week. »

To pay as little as possible, Gabrielle does not hesitate to do so compare prices between different brands and go shopping in two or three different stores.

“I’ve never been a big eater. I don’t mind eating pretty much the same thing year round (excluding seasonal fruit and vegetables). I don’t buy products that I find expensive. I buy very few processed products but I consume tofu in all its forms at every meal. »

Even so-called “female” expenses don’t have much of an impact on Gabrielle’s budget: on average €5 per month.

“I don’t have a budget for contraception, I wear a cup and very rarely buy beauty products. I estimate the expenses at €60 per year, especially for the same two treatments/creams that I buy every year and that my skin tolerates quite well. »

Gabrielle’s leisure expenses

For Gabrielle, who works in this sector, cultural trips are essential. “I do at least 3 a week. » And this comes at a certain cost:

” Lately I spent 350 euros for around thirty shows for the 2023-2024 season. I have several subscriptions and find the price pretty fair for the number. Being passionate about live shows, I’m looking for which subscription is the most advantageous. I will also see a lot of free shows because Paris is full of very different offers. I know the annual programs quite well having gone there. »

Gabrielle also has a UGC subscription to go to the movies, which costs her €22 per month. “It pays for itself very quickly. »

The young woman also treats herself to one visual yoga class per week, which is offered to her €5 per lesson. “I don’t have time to go to the studio and I want to do these lessons only with my great teacher. »

As for his other outings, they are mostly local restaurants, where he goes with friends once or twice a week and where She “It comes out for €15 or €20 maximum”.

“It’s very rare that I spend the whole evening in a bar, but if I do I have a drink or two because I’ve always considered it an unnecessary expense. I prefer to invite my friends to my house for snacks/board games or prolong an exposure for example with a drink at the end of the afternoon. »

The other item that weighs on Gabrielle’s budget is train tickets to visit loved ones. This year he dedicated 800 euros to it, i.e €67 per month.

“Ideally, I would like to reduce this budget but this seems impossible to me with inflation. However, I already feel pretty organized, getting them as soon as possible and having a discount card. Without my asking, my parents spontaneously sent me small sums of money, mostly to help me pay for train tickets when I returned to my home region. »

Always reasonable, Gabrielle finally spends little on clothes: average €25 per monthalways second hand.

Gabrielle’s savings and future plans

Every month, Gabrielle manages to put aside between 300 and 400 euros. A sum that he uses to take a nice trip once a year.

“I have fun without putting anything in the budget but I still remain reasonable by only going to the dormitories of a youth hostel for example, because I’m used to doing it. »

The rest of his savings will allow himincrease your contribution for the next purchase of an apartment in the Paris region.

“I am very happy with my daily life, especially because I have no dependents, so I only worry about myself. I feel fulfilled and quite free to do what I want. »

Thanks to Gabrielle* for analyzing her budget for us!

* The name has been changed.

Read another one

Settlement of accounts

-

Camille, 1,782 euros per month: “The envelope system has changed my way of spending and my relationship with money”

-

Gwendoline, 4,004 euros for two a month: «We want to pass on to our daughter the taste of discovery and travel, and not just a life of work»

-

Laura, 3,120 euros per month: “I earn very well, but I don’t aspire to maintain this rate for my entire career”

-

Clara, 1,475 euros per month: “Many qualified people have lower salaries than you might think”

-

Gwen, 2,700 euros per month: “Being independent does not prevent you from obtaining a real estate loan”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.