Talking about money is still taboo in France. However, it is a fascinating topic … and feminist, in some respects! In Settlement of Accounts, people of all stripes examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today it is Camille who has agreed to analyze her accounts for us.

- First name : Camille

- Age : 32 years old

- Occupation : Director of a center for asylum seekers

- Net salary before withholding tax : €1,947.69

- Net salary net of withholding taxes : €1,782.34

- People (or animals) living under the same roof : her cat Hercules

- Place of life : Auxerre (Yonne)

Situation and income of Camille

Camille has been the director of an asylum seeker center for a year and a half. She is inside CDI in this private for-profit company.

“I am happy that I left my previous job to go back to social work. I manage a small team of 3 staff and we welcome 90 guests. »

Single, the young is owner since February 2020 of an apartment in the city center of Auxerre, with an area of 68 m2.

“I had no problem buying myself, I had always had this project and I have set aside this purpose for years. When I received a raise in my previous job, I went to the bank and we discussed the rate, the price of the insurance, the deadlines… I was quite clear on how much I wanted to pay each month and the rate I had is very advantageous, me I understand it well. For the search it was a little more complicated, at the time there were few properties and I was systematically offered houses while I was clearly looking for an apartment. I was immediately happy with what I bought, and still is today. »

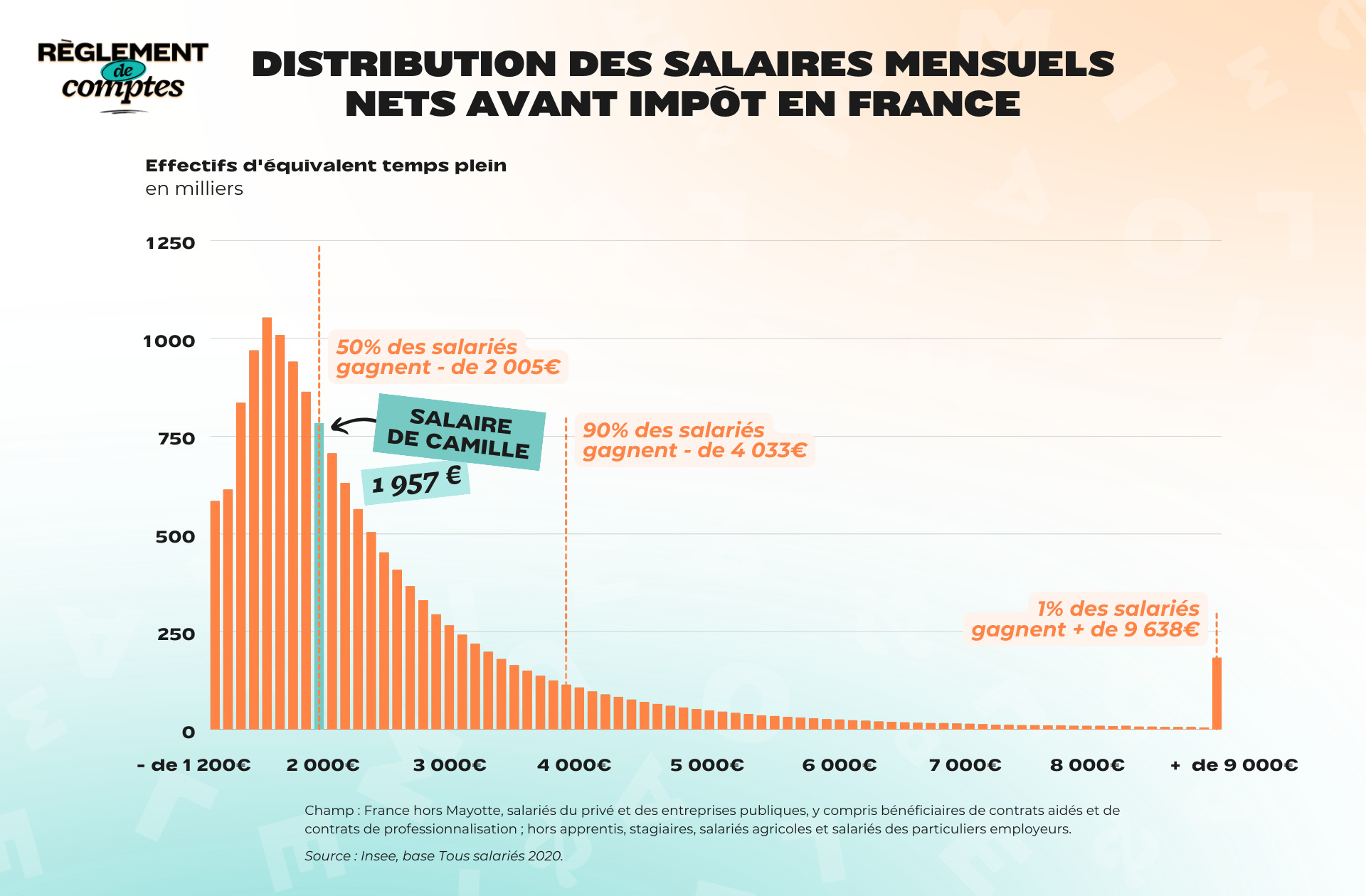

Although she is very happy with her job, Camille does not consider herself well paid for her responsibilities. “But I knew it when I changed jobs. »

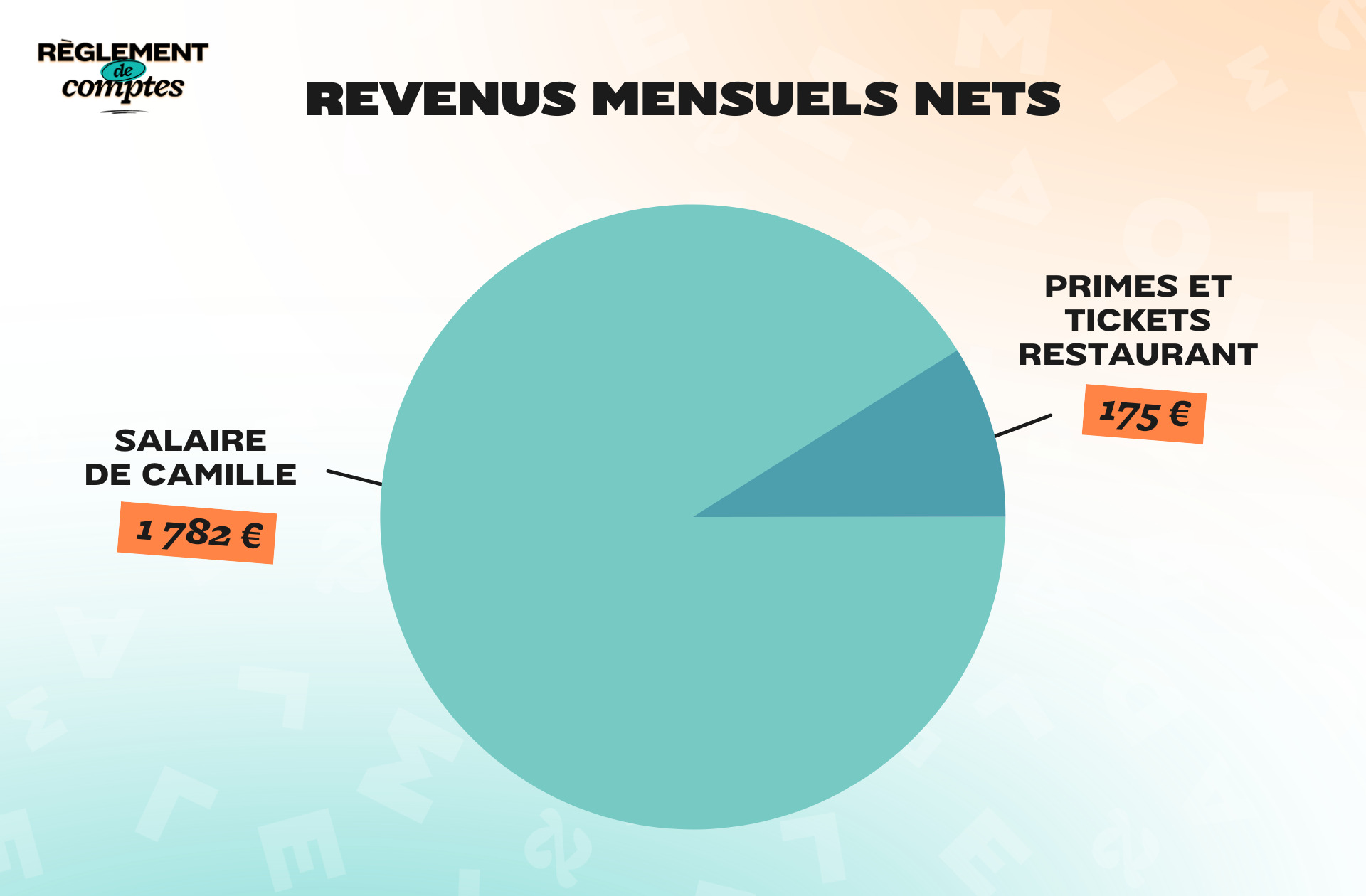

Today it’s up a net salary of €1,947.69. Once the income tax is deducted, he is left with it €1,782.34to which they add €175 From “prizes spread over the whole year and restaurant vouchers”.

Despite receiving a lower salary than her previous job, Camille has still gained in quality of living.

“I have all my weekends, I no longer work on holidays and when I leave work I forget about it. But given the price inflation, the end of the month is difficult. I consider myself in the low average and I know that during the studies and above all during the master’s degree we boasted of the salaries that we could have claimed once we graduated, the reality in the field is very different. »

Camille’s relationship with money and her financial organization

Camille grew up in a family “where we didn’t talk too much about money”, but she didn’t feel that she was missing anything. Thrifty, as soon as she started doing small summer jobs, she invested half of her salary in a Housing Savings Plan (PEL). This enabled her to make her first real estate purchase on her own at the age of 30.

” I had Contribution of 40,000 euros, if I hadn’t put it aside, it wouldn’t have been possible. My parents also put €50 a month into this account until I was 20 and as soon as I started earning, I fed him between €100 and €250 a month. I was very proud that I was able to save so much. »

Yet despite the savings accumulated over the years, Camille was faced with financial difficulties.

“Leaving my previous job, I lost 400€ of net salary. The year 2022 has been extremely difficult financially without the help of my family, I would not have made it. I think the problem is that I have maintained the same lifestyle when financially there is a huge gap. Before, I didn’t expect pay every month, today every expense counts and I look forward to the bonuses. »

It is defined as “a compulsive shopper” (“I don’t like waiting when I want something, I buy it”) but fight against this bad habit.

“I budget before each purchase. I am rarely exposed, except for major unforeseen events. I check my accounts every day, sometimes even several times a day. »

To avoid being cornered, Camille has also implemented strategies that are bearing fruit.

“Also I request more easily a schedule of my payments (insurance, quote, etc.) and for the last 4 months, I’ve set up the envelope system. It changed the way I spend and my relationship with money.

I realized that my expenses were much higher than my income. Having to pay in cash and being careful about how much money I have in my wallet makes my spending feel more real: it is palpable and visual. If I go shopping but only have €20 in my wallet, my limit is clear and defined. This system suits me, because I always indulge in leisure expenses and my end of the month is more often in the green. »

Camille’s expenses

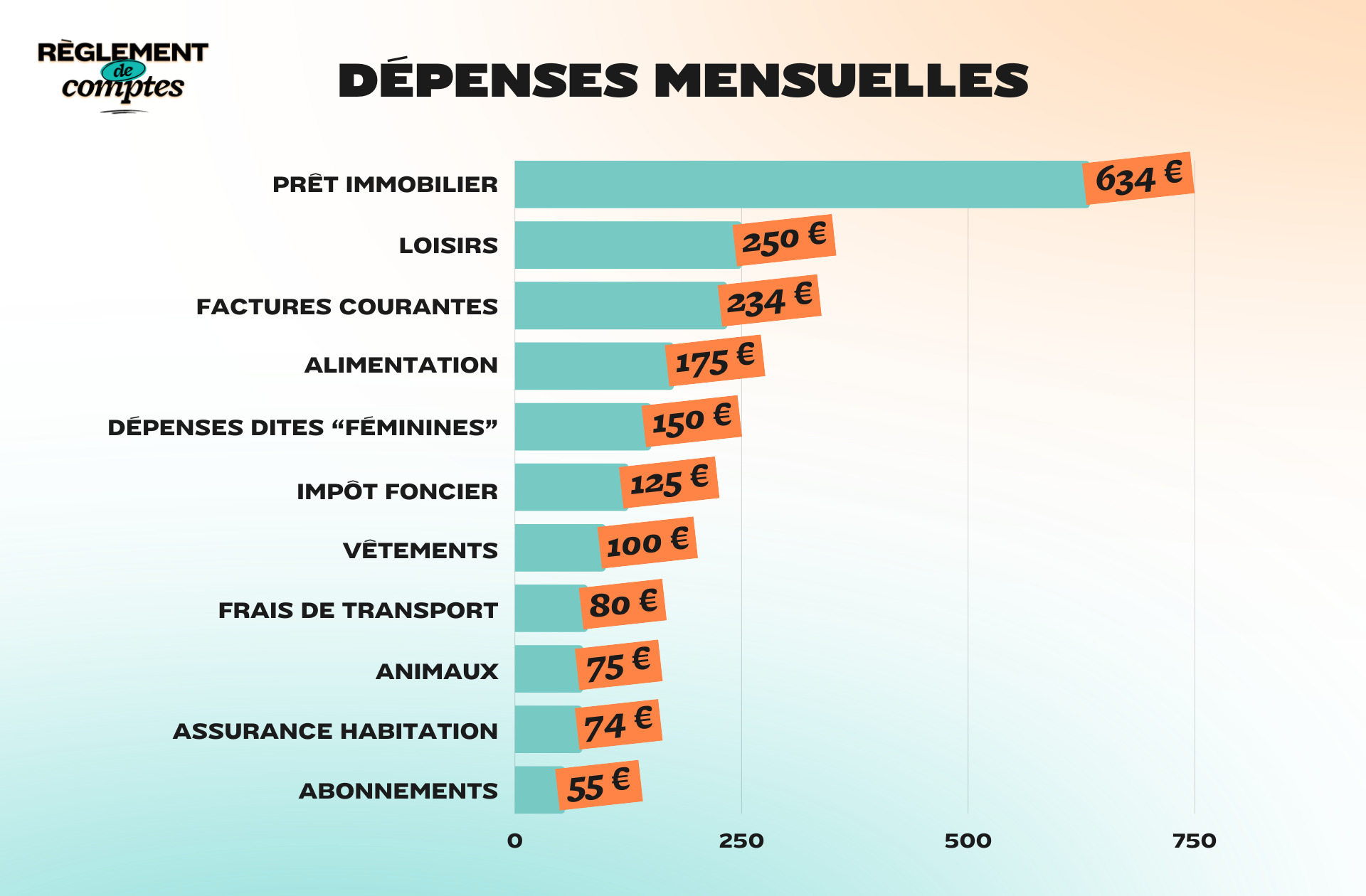

For her apartment in the center of Auxerre, Camille repays every month Mortgage loan of 634 euros. This is its main expense item. Added to this is the property tax, amounting to €125 per month.

Here are the various current invoices: €123.09 electricity AND Charges of €111.61. Totalizing €234.70.

For the insurance of her loan, Camille pays every month €11. She rules Car insurance €45 per month AND €218.47 per year for home insurance. Which amounts, leveled off during the year, to €18.20 per month.

On the other hand, it has no bank charges. “I switched to an online bank: boursorama to no longer have one. »

To get around, the young woman uses her personal car. But since she drives little, she only needs one full tank a month. She depends on him 80€.

Finally, its communication costs are moderate. For the telephone subscription and her Internet mailbox, Camille pays €55 per month.

“The problem with restaurant tickets is that they are not accepted in ‘discount’ shops”

Living alone, Camille does not have a large food budget: on average €175 per month.

“I shop mainly at Lidl and, thanks to the restaurant tickets, I go once a month to Picard and spend €25 for vegetables and meat. The problem with restaurant tickets is that they are not accepted in ‘discount’ shops and the shop that does accept them near me is much more expensive. »

Proud owner of a cat named Hercule, the young woman does not hesitate to spend on his well-being: approx. €75 per month.

“In this sum I count the croquettes, the litter box and what I set aside for one visit to the vet a year. »

As for the so-called “feminine” expenses, Camille appreciates them around €150 per month. These mainly include the application of semi-permanent nail polish and laser hair removal, which she provides thanks to the famous envelope system.

“Until now I was spending €25 a month on semi-permanent nail polish and I had a hair removal budget of €50, but I’ve just started permanent hair removal, so I spend €155 in 3 months for 8 sessions. »

This large budget is offset by a small make-up item: From €8 to €11 for the lipstick.

“For hygienic reasons I switched to menstrual panties a long time ago and haven’t bought any for a while. »

As for contraception, buy condoms.

Camille’s leisure expenses

As a compulsive shopper, Camille admits she has a hard time cutting down on clothing expenses. She dedicates herself an average budget of €100 per month. “And yet I know I’ve had enough. » Generally, “Slightly impulsive purchases could be reduced”the 30-year-old admits.

In addition to clothes, he estimates his leisure budget to be €250 a month. This includes trips, subsidized travel throughout the year and sports.

“I like going out with friends, going to restaurants and above all traveling. I don’t see myself reducing these expenses but for going out I can more easily tell my friends that it is financially complicated. So we reject or receive each other. As far as restaurants are concerned, restaurant tickets help me a lot. »

His latest big craze is a trip to the United States with his sister. “It put me in great financial trouble but I have no regrets! »

Camille’s savings and plans for the future

For Camille, the envelope system has really been a lifesaver. Although she hadn’t been able to save since she changed jobs, she managed the budget better than she did.

“This system has increased my awareness, has allowed me to reduce superfluous expenses and above all to save myself something that I no longer believed possible. I manage to save between 50 and 150 € per month. I’m currently saving up for Christmas presents and even a seat for the Olympics. »

In the near future, these are the trips that Camille will occupy: she plans to go to Vienna, Crete or Greece next year.

“For the future, in eleven years I will fully own my own house and I will see whether or not I buy a property for my holidays in Brittany. I am much happier in my current life despite having more financial worries than before at my old job. »

Thanks to Camille for opening her accounts for us!

read another one

Account settlement

-

Gwendoline, 4,004 euros for two a month: “We want to pass on to our daughter the taste for discovery and travel, and not just a life of work”

-

Laura, 3,120 euros a month: “I live very well, but I don’t aspire to maintain this pace throughout my career”

-

Clara, 1,475 euros a month: “Many graduates have lower salaries than one might think”

-

Gwen, 2,700 euros a month: “Being independent doesn’t prevent you from getting a mortgage”

-

Prisca, 2,525 euros a month: “I consider my salary mediocre”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.