Talking about money is still taboo in France. However, it is a fascinating topic … and feminist, in some respects! In Settlement of Accounts, people of all stripes examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today Laura agreed to analyze her accounts for us.

- First name : Laura

- Age : 30 years

- Occupation : Responsible for the sector market

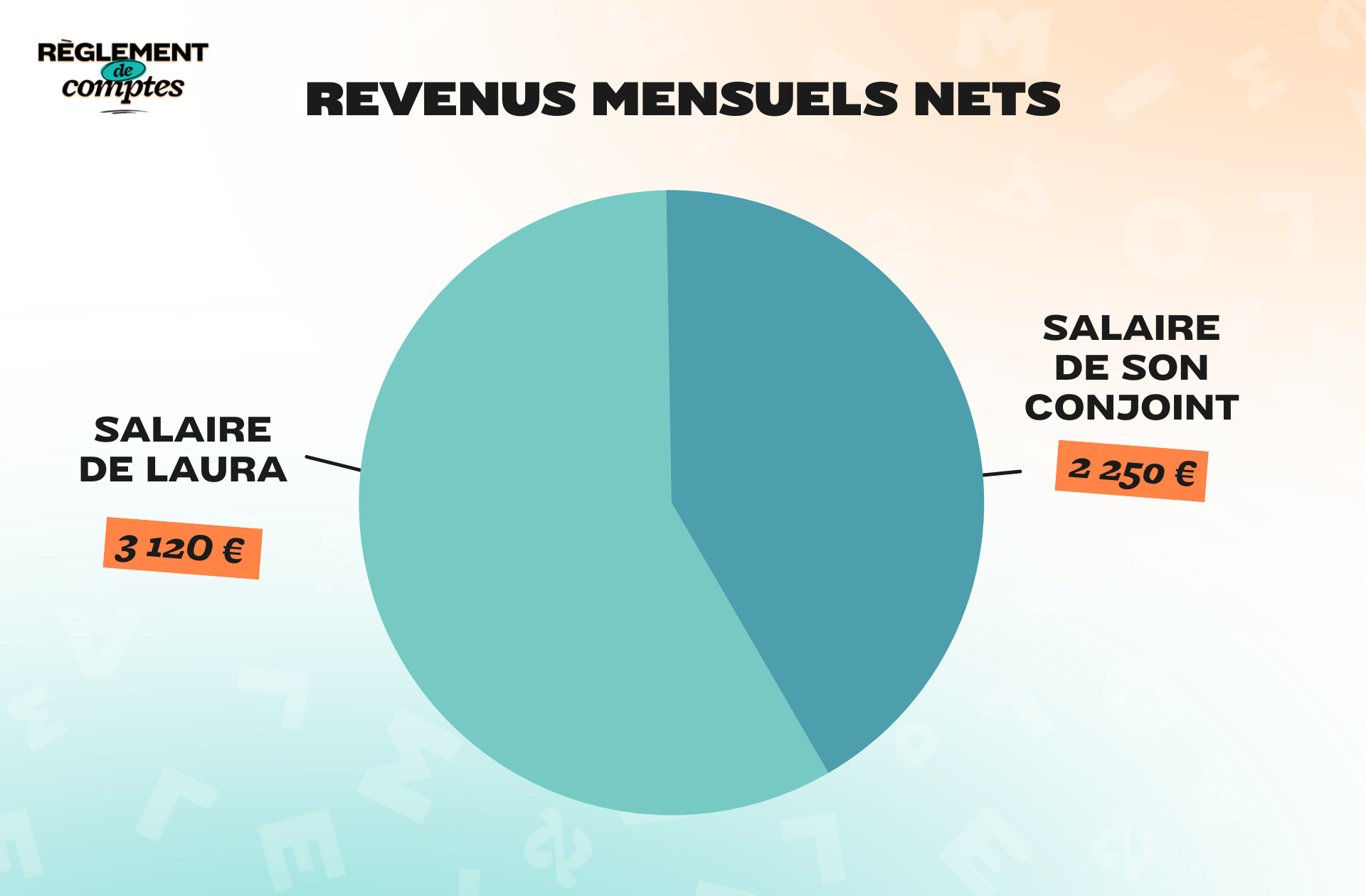

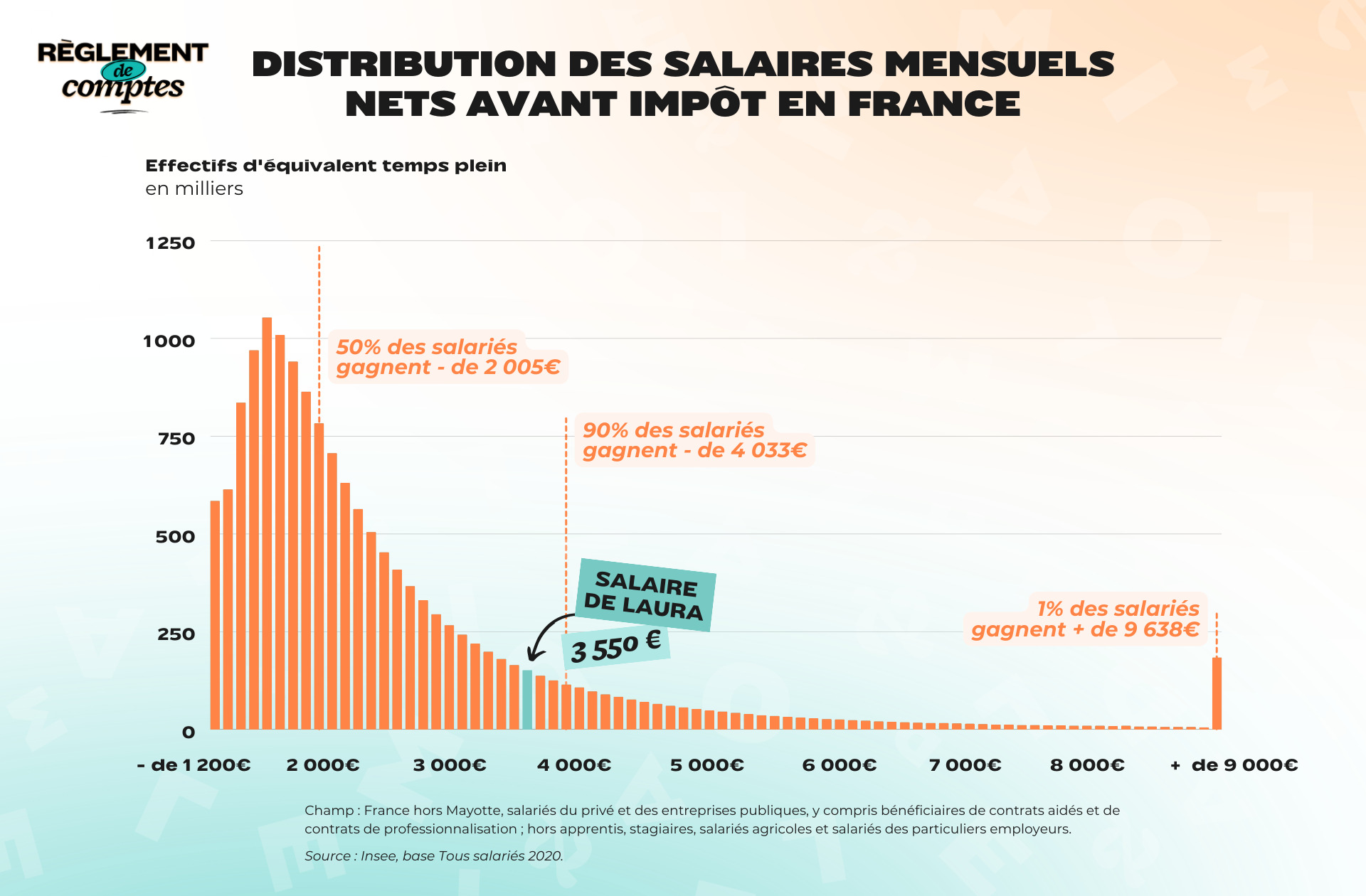

- Net salary before withholding tax : €3,550

- Net salary net of withholding taxes : 3 120 €

- The salary of the spouse : €2,250 net after tax

- People (or animals) living under the same roof : his spouse and their cat

- Place of life : on the outskirts of Lyon (Rhône)

Laura’s situation and income

Laura, 30, is permanent employee in a large international industrial group. He holds the position of market manager.

“I am an engineer and my job is to establish the marketing strategy of the products and follow up on the projects. »

Married and childless, she lives with her husband in a new T3 apartment of 65 m2 which is located in the immediate suburbs of Lyon.

” We are owners of our apartment since 2020. Living in the new allows us to consume little energy. »

For her work in the sector, Laura receives a good salary: 3,550 euros net, reduced to 3,120 euros per month once the withholding tax has been applied. To this income is added approximately Net prize €900 paid once a year (variable depending on the goals) e Gross annual bonus of 20,000 euroswhich match profit sharing and profit sharing based on group performance.

For his part, Laura’s husband perceives a monthly salary of 2,500 euros net of withholding taxes, 7,000 euros net of the annual bonus and 2,000 euros gross of equity investments and profit sharing.

These sources of income allow them to live very comfortably, the young woman acknowledges.

“Yes, I consider myself well paid, the business sector in which I operate is quite profitable. I don’t have to worry about the end of the month and I can go on fun activities so I think I belong to the category of rich people. My salary also allows me considerable savings. »

However, she tempers, this salary is worth her investment, “especially in terms of the number of hours worked, mental load and in relation to travel and responsibilities. It allows me to put money aside for projects but I don’t aspire to maintain this pace throughout my career.”.

Laura’s relationship with money and her financial organization

Laura grew up in a family from “wealthy middle class”.

“As a child I lacked for nothing, we went on holidays and did activities. My parents instilled in us to save before buying, not to have overdrafts, to manage the budget and do the accounts, to buy quality, to fix and not replace something that works. »

Today, he still practices these good financial habits and even admits that he has one “reasonable relationship with money”.

” I’m stressed as soon as I drop below €1,000 in my account or joint account. I think about it a lot before making a big purchase and I prefer to buy quality to keep for a long time, and even French if I can. Almost every day I look at my bank’s app, to verify that the payments have been successful and that there are no strange transactions. My spouse was double charged for a purchase a while back so I’m checking. I very rarely have cracks and have never been exposed. »

As far as day-to-day financial arrangements are concerned, Laura and her husband each have an individual bank account, into which they receive their respective salaries. They then pay 40% of their salary (excluding variable bonuses and bonuses) into a joint account.

“The joint account allows us to pay all our common expenses: the loan, the insurance, the expenses, the common outgoings, the subscriptions, the miscellaneous expenses…

What remains on our individual account, everyone uses according to their own choice. At the beginning of our career we were 50/50, but since then I’ve changed positions and my salary has increased. We therefore switched to this more proportional mode. »

Depending on the amount of her annual bonus, Laura may also be responsible for certain expenses, such as booking holiday accommodation.

Laura’s expenses

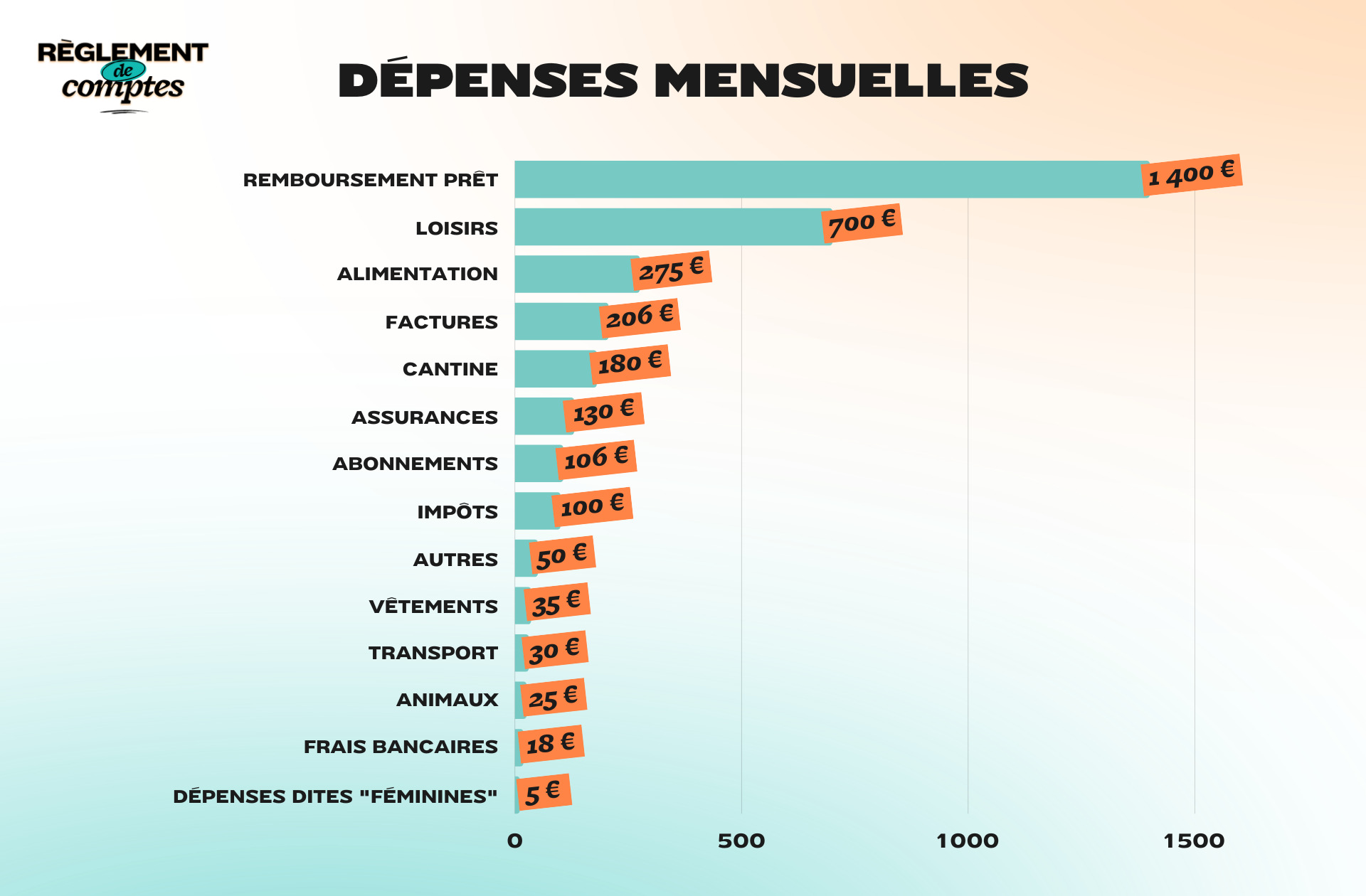

The first item of expense for Laura and her husband is, as for many French people, housing: they pay for it every month Home loan of 1,400 eurosand also satisfy 120€ of condominium expenses.

Other fixed expenses for the couple include gas and electricity (€86 per month), €130 for various insurances (loan, home, life insurance, legal protection), €106 phone, internet, Disney+ and Spotify subscriptions e €18 Bank charges.

Because they are owners, Laura and her husband also have to pay each month 100 € property tax.

The spouses also have recourse to domestic help which, after a tax deduction, reaches them €50 per month.

Purchase but also insurance, maintenance, fuel, tolls… Driving a car is expensive. Hence the choice of Laura and her husband to do without it. Daily, the young woman travels by bicycle. “I try to limit my carbon footprint as much as possible”, explains Laura, while her spouse owns a company car for which she has no expenses. Honed over the year, moving down to €30 a month, mainly in maintenance costs for your bike.

Favor organic, seasonal and short-circuit products

Laura estimates the food budget for her and her husband a €275 per month. It divides it into three distinct brands:

“The first and most important is the producer’s shop, there are many and this allows access to quality, seasonal local products, without packaging and to remunerate the producers correctly. The prices of the products are correct (cheap unprocessed products, quite expensive processed products). For products that aren’t available there (tofu, seitan, bulk grains, oilseeds, etc.), I go to La Vie Claire and top up once a month with a drive-thru for products I can’t find. »

A controlled budget, therefore, to which we must add €30 per month for company catering. Also, the couple spends €25 per month (in veterinary fees and food) for their cat.

In general, Laura is concerned with consuming in the most reasoned and ecological way possible: no superfluous expenses or significant environmental impact. In addition to the attention to the purchase of short and organic food products, the 30-year-old is also attentive to the consumption of clothing. Recall that the textile industry is responsible for 10% of global greenhouse gas emissions, making it the fifth most polluting consumer sector.

To get dressed, Laura therefore sticks to her small budget: €35 on average per month (polished during the year), exclusively made in France or second hand. As for the so-called “feminine” expenses, they represent a “really small” budget of about €5 a month.

“A few years ago I bought menstrual panties and sanitary pads. The investment was supposed to be 150 euros (but in several tranches). I wear very little makeup. If I buy something, it goes into the race budget, so it gets paid jointly. At the moment I have no contraceptives and before I had a pill reimbursed by the Social Security. »

“Eschewing the plane, there are tons of incredible destinations within reach of the TGV”

In the same approach of not excessive consumption, Laura’s hobbies are mainly focused on sports and outings. However, they represent a significant budget: average €700 per month.

«It’s mainly about evenings, aperitifs with friends, family lunches. So it’s really important to us there really is no dedicated budget, excluding food and drink. Otherwise we go to the theatre, cinema and concerts regularly. And we also do escape games, workshops with artisans, video games and travel. Avoiding the plane, there are tons of incredible destinations within reach of the TGV). »

As for physical activity, in addition to cycling, Laura practices yoga 2 hours a week, which is equivalent to €250 per year.

“Cycling gives me a sporty experience, especially during my business trips, and yoga is also a core job, which helps me deal with stress, calms my mind and helps me work on some flexibility, balance and breathing. It’s really a relaxing interlude. »

Another major leisure expense for Laura and her husband: restaurants. They are dedicated an average budget of €150 per monthand don’t hesitate to have fun sometimes!

“Our latest craze is an incredible restaurant run by a Michelin-starred chef for my birthday. »

Laura’s savings and future plans

Thanks to her salary, bonuses and bonus, Laura recognizes that she can save a lot of money.

“I save €10,000 net premium per year after tax (on a PEL), €20,000 gross bonus per year (on a company savings plan) and €1,100 on my monthly salary. But the prize and the bonus are very variable, this year it represents 10 + 20, but next year it could be half or a quarter. Over the course of a continuous year this represents a saving of €43,000 per year, or €3,600 per month. »

The couple, who eventually plan to have children, would like to use these savings to build a passive house (the concept of passive house or passive construction refers to a building whose energy consumption per square meter is very low, even zero or positive), a little farther from Lyon than now.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

read another one

Account settlement

-

Simba, 1,475 euros a month: “Many graduates have lower salaries than you think”

-

Gwen, 2,700 euros a month: “Being independent doesn’t prevent you from getting a mortgage”

-

Prisca, 2,525 euros a month: “I consider my salary mediocre”

-

Tahiri, 4,482 euros for two a month: “As soon as I have only 700 euros left in the account, I panic”

-

Sylvie, 2,700 euros a month: “I spend between 6,000 and 7,000 euros a year on travel”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.