Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settlement of accounts, people of all kinds check their budget, tell us about their financial organization as a couple or alone, and their relationship with money. Today it is Simba * who has agreed to analyze her accounts for us.

First name : Simba*

Age : 38 years old

Occupation : Auditor of social security legislation at CARSAT

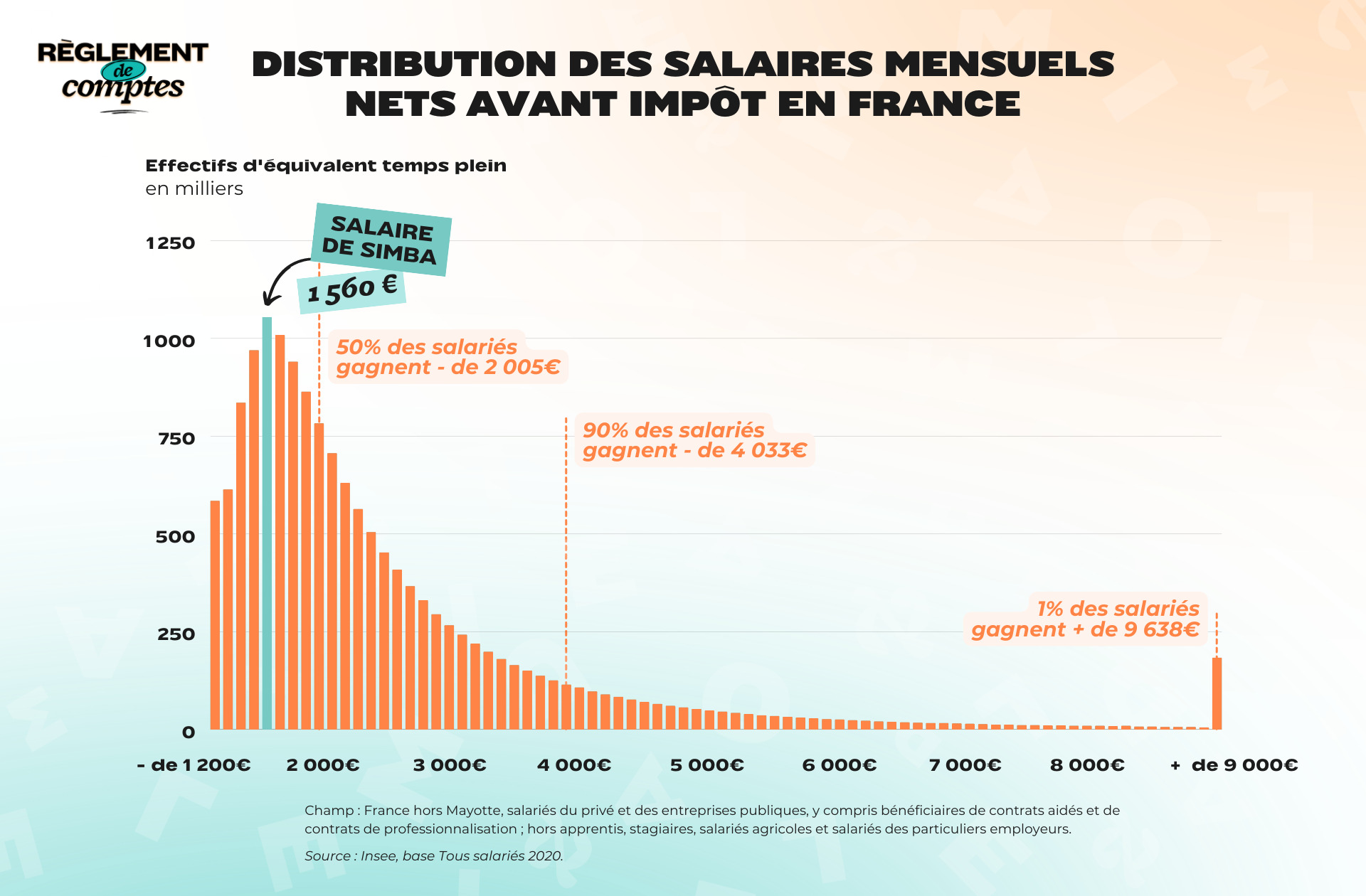

Net salary before withholding tax: €1,560

Net salary after withholding tax: €1,475

People (or animals) living under the same roof : her partner and their cat

Place of life : Nancy (Meurthe-et-Moselle)

Simba’s situation and income

Simba worked for 8 years at Social Security, on a permanent contract. Initially connected to the telephone reception of the CPAM de Moselle in Metz, she has been officiating since the end of 2019 at the CARSAT (occupational health insurance and pension fund) in Nancy, where she held the position of controller.

She lives with her husband in Nancy, IN 5 bedroom apartment of 94 m2 “with parking space and cellar”of which they have been tenants since December 2022.

“We live 5 minutes walk from the city center, I like living in the city and having everything close. »

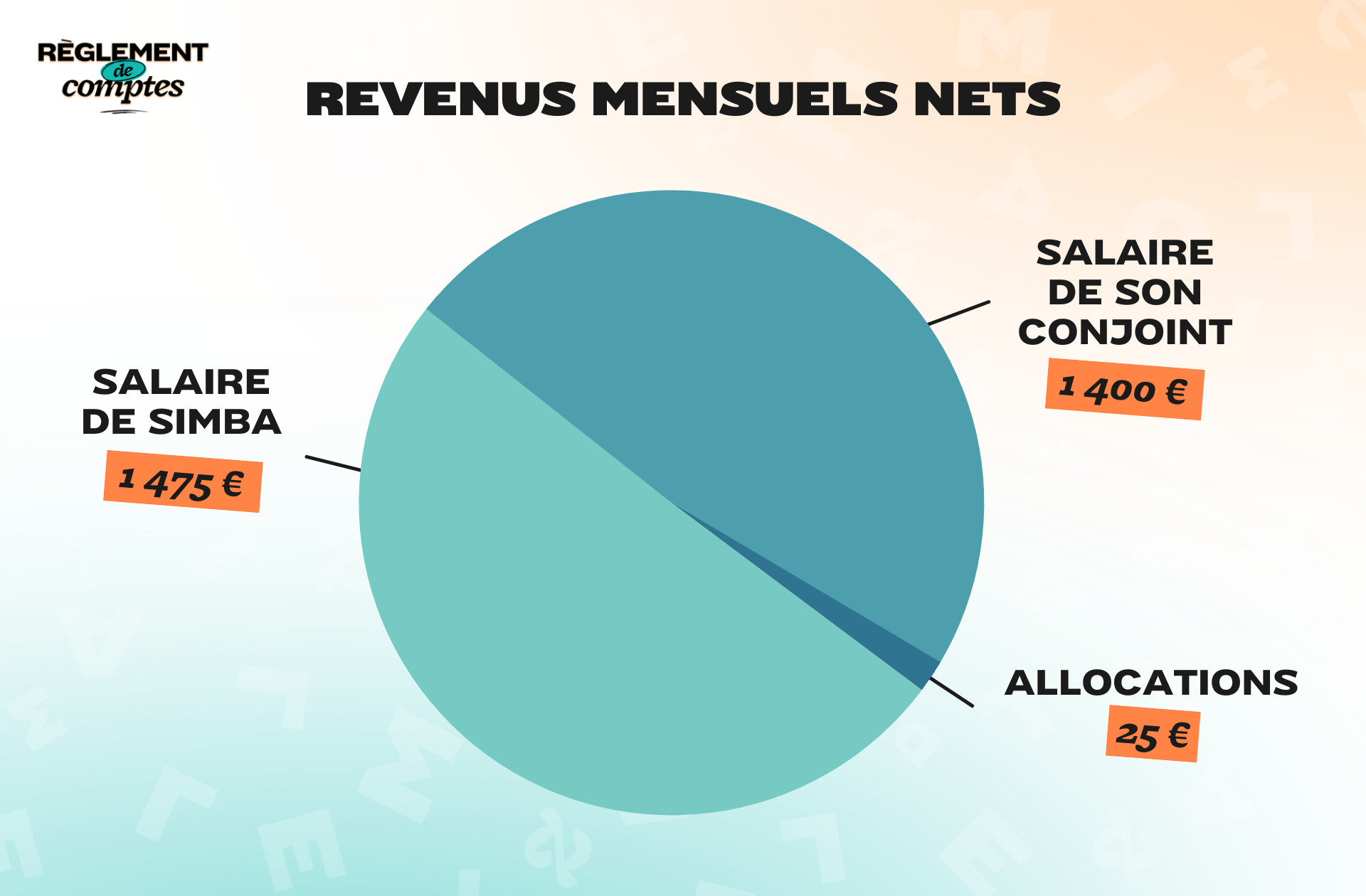

For his work as a statutory auditor at CARSAT, Simba receives a net monthly salary of €1,560brought to €1,475 after withholding taxes income tax. Added to this Couple activity bonus of € 25. “It’s actually not much, let’s say 50 euros on average for two. » A situation that Simba does not consider up to his level of studies.

“I respect myself rather poorly paid because before that I did a master’s degree complemented by a professional license to work in the cultural field. I persisted for several years in wanting to work only in this sector. Arrived on my 30th birthday, still being inside a very unstable situation professionally and financially, I decided to broaden my search to ‘least nuisance’, while remaining in line with my values, human above all else. »

Simba therefore kept volunteer as a journalist in a paper magazine specializing in reggae music, while working at the Social Security, where she trained internally.

“I’m still in training in the control department, because the modules are spread over 18 months. Eventually I will reach level 4, a slight increase. »

Though she wishes to be paid better for her work, Simba still finds her situation “normal” compared to those around her. “Many graduates have lower salaries than one might think. »

Simba’s relationship with money and his financial organization

Simba grew up with parents who gave him a relationship with money “rather reasonable”, i.e. “live comfortably every day, but not in excess”.

“They were able to allow my sisters and I to do each of the long studies without having to work separately, making us responsible for money. I remember when I was a student I had €300 a month to go out, eat and have fun, and I was trying to manage this budget precisely! »

Today, the young woman considers having a “relationship with money really in the present” after knowing a time when he was often out in the open.

“During this volatile period before age 30, I used my authorized credit every month, without worrying too much about itbut without going too far. I’ve been in the nails for about 4 years now, I manage to modulate the pleasure budget if necessary to stay positive. »

As for his financial organization, Simba had to redefine it after moving in with his partner last year. They opened a joint account that allows them to pay their bills together (rent, gas, electricity, home insurance, internet, Netflix, etc.), and each kept their own checking account and savings account.

“We share groceries and we both have restaurant cards. If we have an expense for the apartment, we share it. Then each of us does what he wants with the money we have left. »

Simba’s expenses

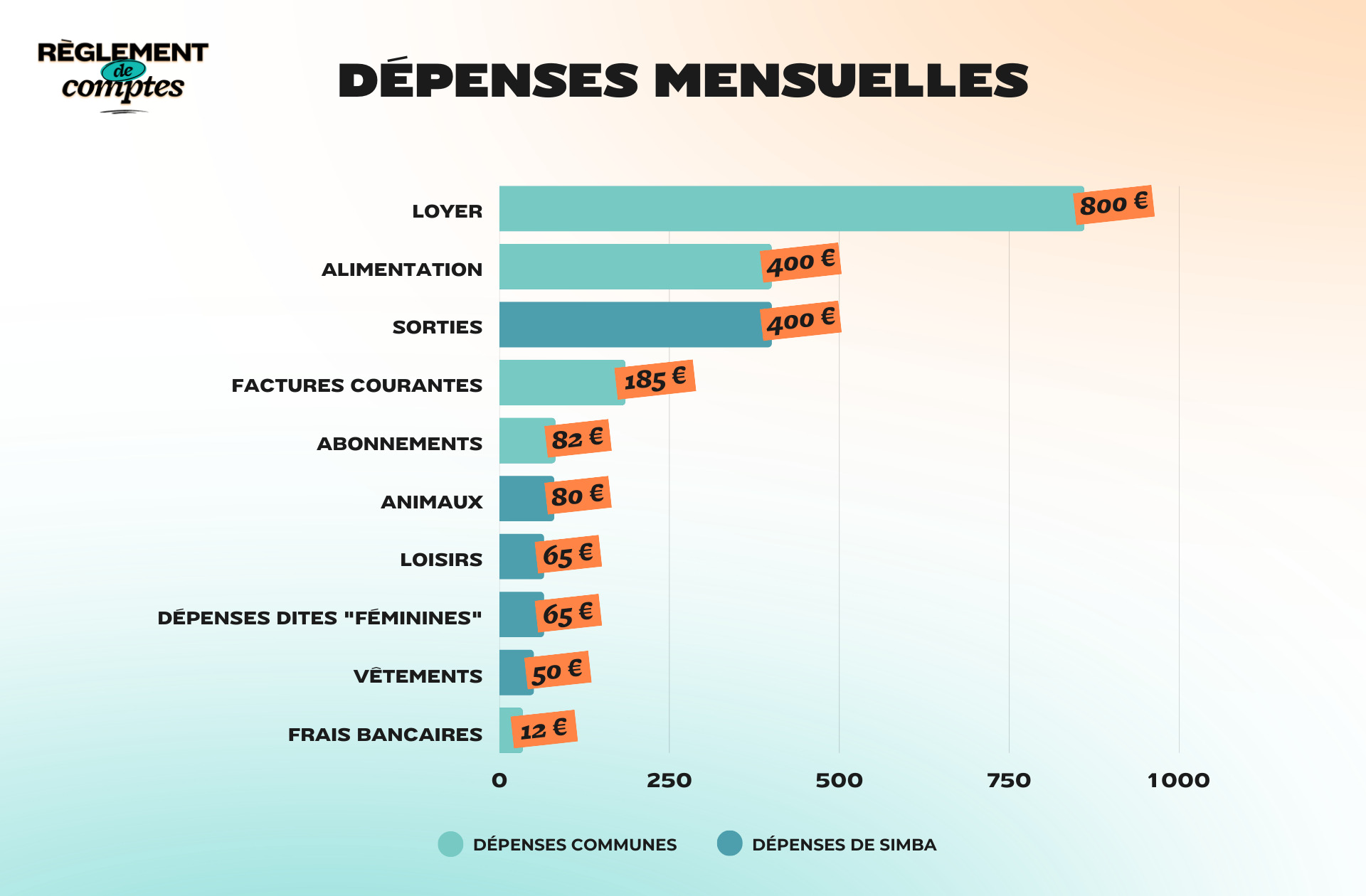

For their F5 in downtown Nancy, Simba and his partner pay a rent of 860 €of which each pays half (€430 for Simba, therefore). This is their largest expense item.

Current invoices follow (185€ for gas and electricityand that Simba pays up to €93 a month), €34 home insurance (€17 each), €12 bank charges.

For their internet subscription, as well as Netflix and Disney+ streaming services, the couple pays €82 per month. Simba also pays for his personal telephone (€30 per month).

Simba’s boyfriend has a car but while walking to work, the 30-year-old has no travel expenses, aside from a 10-trip pass that she pays for. €11 and that he uses for 2 or 3 months.

“I easily spend €50 a month on beauty products”

In addition to the restaurant vouchers, paid at 50% by their respective employers, Simba and his partner spend 400€ for foodthat everyone pays half, especially in supermarkets.

“I shop more often at Leclerc, sometimes at Auchan or Carrefour. We have several similar brands in our industry and since we both have a restaurant card, we don’t hesitate to use it mainly for shopping and occasionally in restaurants or fast food outlets. »

However, the young woman would like to reduce this budget, which she considers too high. “But it is true that we like to have fun and take quality and varied products. »

Another Simba insured expense: that relating to your cat, and estimated at approx €80 per monthmainly for croquettes, litters, but also accessories and veterinary expenses once a year.

“I manage the budget for our cat because it was mine to start with. My boyfriend takes care of the car, I take care of the cat, and it’s true that he’s spoiled…”

As for the so-called “feminine” expenses, Simba estimates them a Approximately €65 per monthso divided:

“Sanitary pads are light budget, approx €5 per month. For the hair removal, the same, I do it at home and it doesn’t cost me more €5 per month, especially for depilatory creams and razor blades, otherwise the epilator remains the best for the legs. I’ve had mine for several years, so the purchase price pays for itself quickly.

For contraception, we use condoms and share this budget, let’s say €10 per month. I spend a lot more on beauty products and makeup, it’s one of my little pleasures to pamper myself. I already have a lot, so I’m more reasonable than in the past, but I easily spend 50€ a monthfor make-up, creams or masks…”

Simba’s hobbies

For Simba, participating in the cultural life of his city is something important. Inevitably, this takes its toll on his leisure budget. In addition to magazine subscriptions and regular book, vinyl and CD purchases (Approximately €65 per month), thirty-year estimates 400 € his monthly expenditure in restaurants, bars and concerts. This amount also includes your tobacco and CBD consumption.

“Before giving birth, I went a lot to concerts and cultural events. I had been counting on an almost incompressible budget of €100-150 a month for this for about fifteen years! Now, the pace hasn’t quite picked up at that level. The time of 3 or 4 concerts a month accompanied by small parties in bars or clubs almost every week seems far away! I keep an exit budget of €100 per month when I make my forecasts, but I don’t always hit it. We also go to the restaurant once or twice a month. »

Another budget to consider for Simba: that of clothes, which she estimates €600 per year. That is, honed over the year, approximately €50 per month.

He would also like to reduce this expense item for small daily pleasures, which are not exactly essential.

“In general, I love shoes. I bought 3 pairs at once last time for almost 350€! »

Simba’s savings and future plans

With his salary, Simba admits he doesn’t have enough to spare, “just what you need to be in the green”.

“Mostly I save during the 13And and 14And month and the incentive bonus. When the bonuses go down, I try to save at least half of them. »

With his money, Simba above all has the ambition to do it ” seize the day “.

“We don’t have a child project, so we want to enjoy everyday life together, continue to explore culture, travel, meet people, live and have fun…”

Thanks to Simba* for checking his accounts for us!

*Name has been changed.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

read another one

Settle accounts

-

Gwen, 2,700 euros a month: “Being independent doesn’t stop you from getting a mortgage”

-

Prisca, 2,525 euros a month: “I consider my salary mediocre”

-

Tahiri, 4,482 euros for two a month: “As soon as I have only 700 euros left in my account, I panic”

-

Sylvie, 2,700 euros a month: “I spend between 6,000 and 7,000 euros a year on travel”

-

Lucie, 3,200 euros a month: “I know that 400 euros of restaurants a month is a lot”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.

.png)