Talking about money is still taboo. However it is a fascinating topic… But also feminist! In Settlement of Accounts, people of all stripes check their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today it is Lauriane who has agreed to analyze her accounts for us.

- First name : Lauriane

- Age : 29 years old

- Occupation : responsible for supporting social entrepreneurship in an association

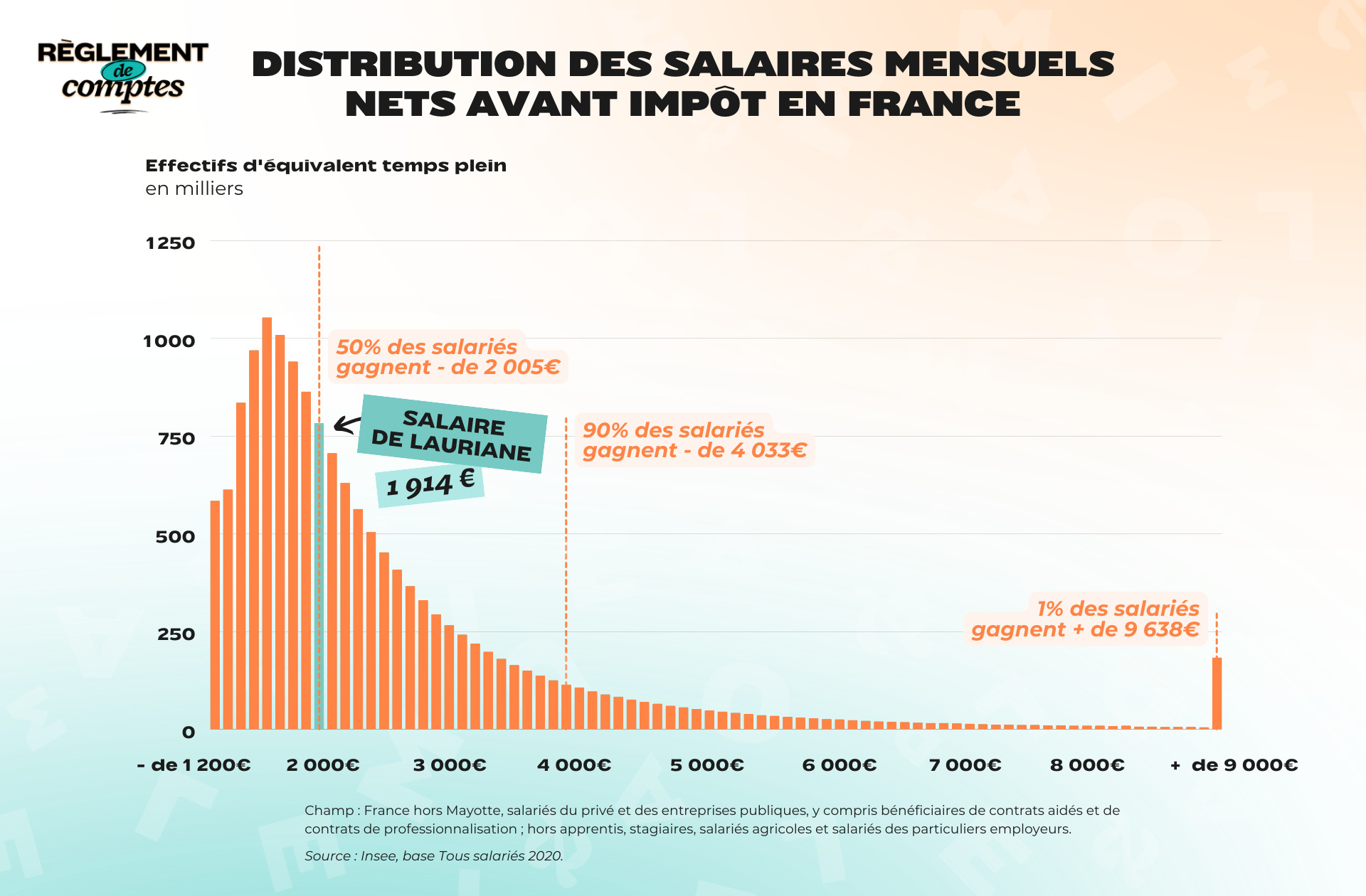

- Net salary before withholding tax : €1,914

- Net salary after withholding tax : €1,846

- People (or animals) living under the same roof : her lover and her cat

- Place of life : near Nantes (Loire-Atlantique)

Lauriane’s situation and income

Lauriane is permanent employee in an association that helps people who want to launch their solidarity business project. This is a post “at the crossroads between the entrepreneurial world and the associative and militant world”.

covenant, lives with partner, currently unemployedin an apartment of almost 100m2 in the suburbs of Nantes, in an apartment they love.

“We bought this flat last year, it was a big step and the buying window was quite tight: finding the ideal flat while my boyfriend was still on a permanent contract and before bank rates went too high. The price of the apartment was quite low compared to the very tight real estate market in Nantes, but our rates are very high. »

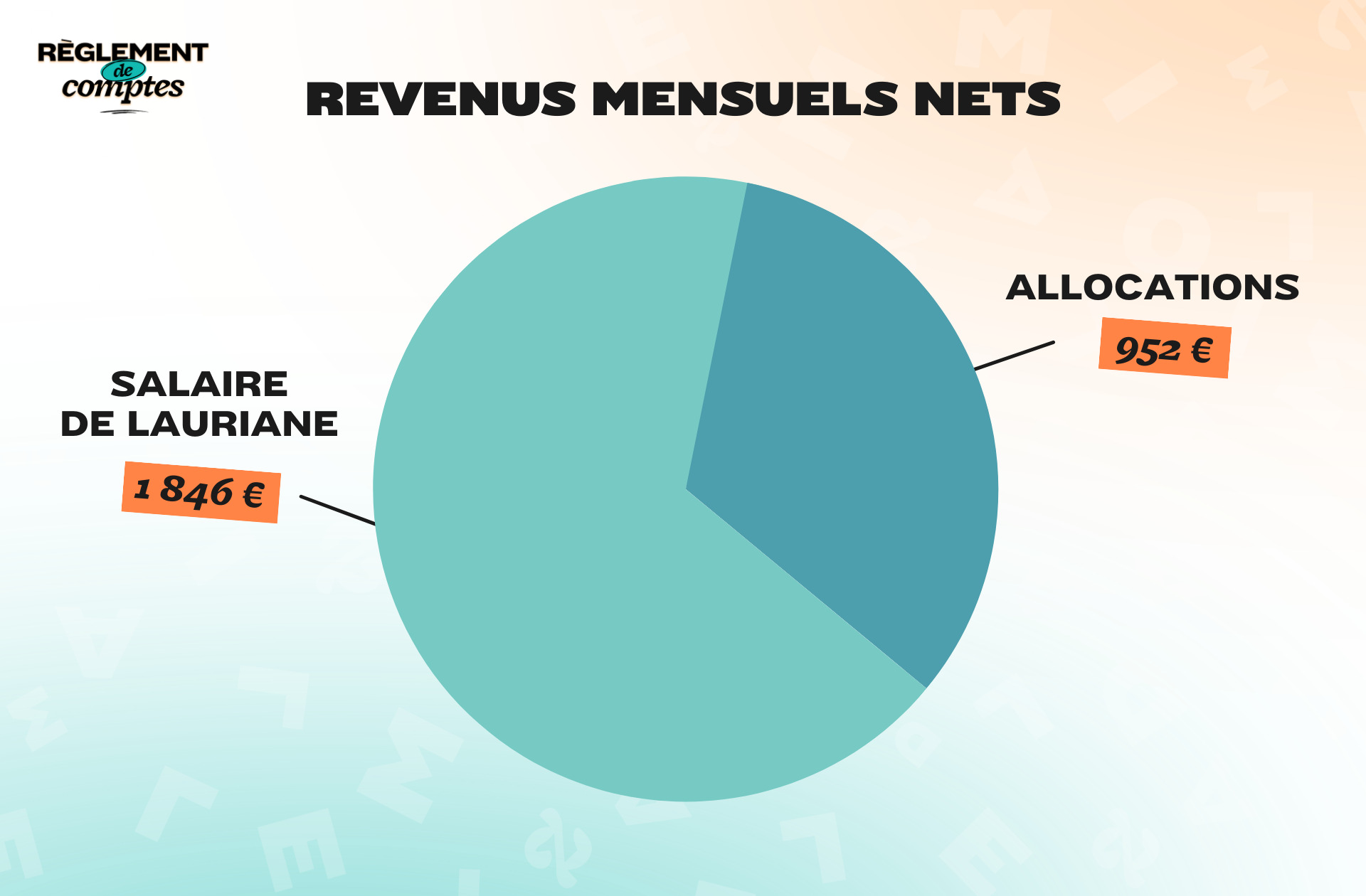

Before withholding, Lauriane earns a net salary of €1,914, which drops to €1,846 after income taxes are deducted. His boyfriend is touching 952 euros of unemployment benefits. The couple’s income is therefore close €2,800 per month.

“I think I’m pretty well paid compared to other employees in the corporate world. On the other hand, if I compare my salary with the income of consultants/entrepreneurial experts… I know my income is much less. »

Lauriane’s relationship with money and her financial organization

Prudent in her relationship with money, the young woman explains that she comes from a family “rather thrifty”Who “think before you buy, compare prices”.

“My financial independence was achieved in a very gentle way: very little pocket money up to the age of 18 (from 5 to 20 euros a month), a precise budget when I was a student, then assistance depending on my internship income to get to the day in which I paid the rent directly to the landlord! »

Even if his salary is comfortable, Lauriane is always afraid of “spend too much” and try to save as much as possible. She admits, however, that it’s more difficult to save money since he owns her apartment than he does. Almost never discovered, it happens, if it’s in the red, a fill the missing euros with the savings in his booklet A.

With his spouse he has set up a well-defined organization to avoid any financial problems: everyone receives their income in their personal account, and earns at the beginning of the month automatic transfers proportional to your income to a joint accountfrom which the condominium expenses are deducted.

Lauriane admits, however, that it’s not not necessarily the fairest possible distribution, since her boyfriend receives a check for less than 1,000 euros. They are therefore considering another organization.

“We created a tracking table to automatically calculate the fair distribution of fixed expenses. Today, that gives a distribution of 66%-34%.

After repaying the loan and deducting the fixed costs, I have €1,140 left and he €420 per month. There, variable expenses are a little more casual. We thought we were going 50/50 but it doesn’t really work… It’s not always easy to have a big difference in salary and determine what goes into the common fund! For me, the most important thing is that you participate in the repayment of the loan. It’s very difficult to measure how much I take from my salary in terms of free time to make us happy without paying for everything! »

Lauriane’s expenses

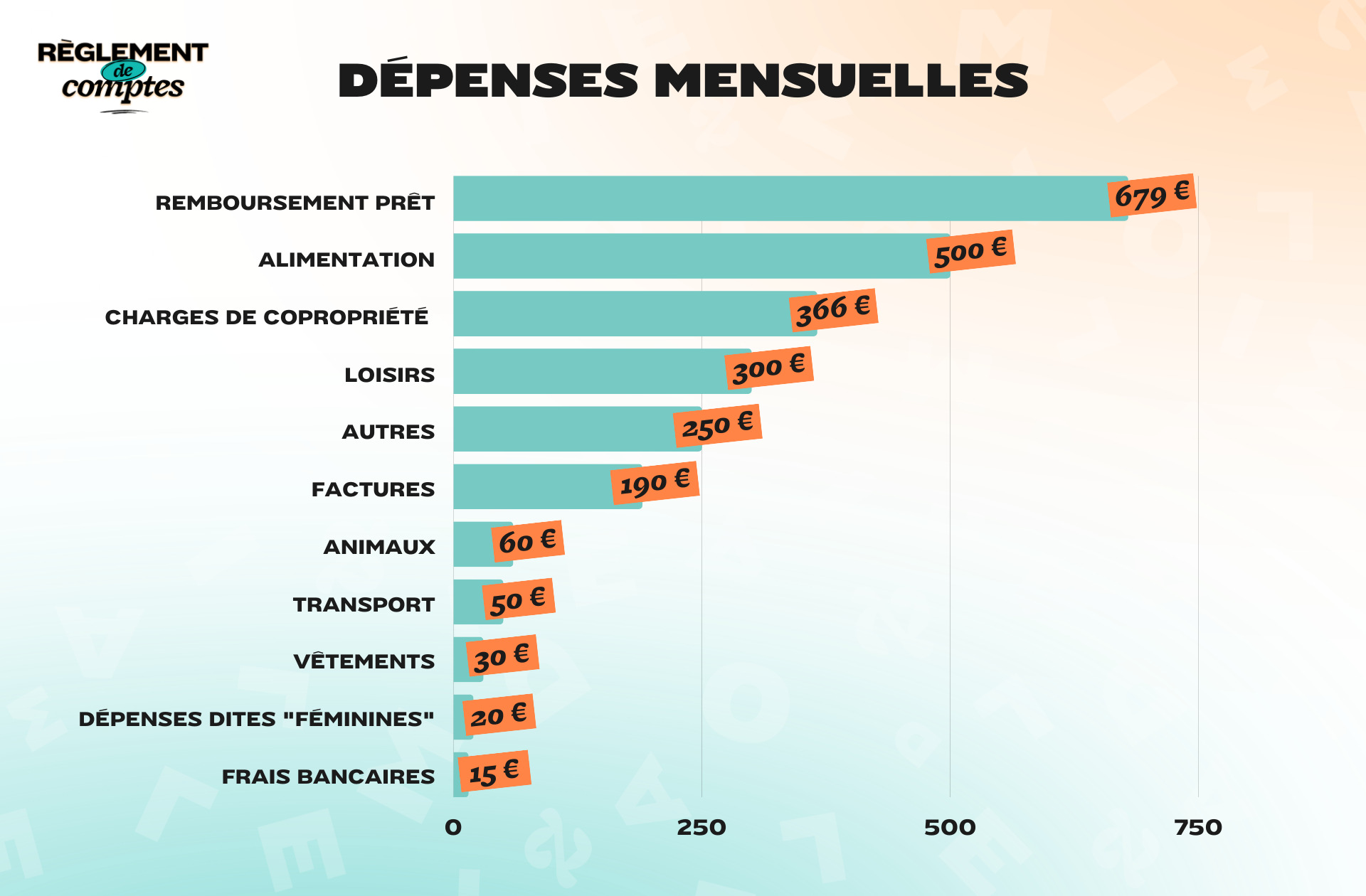

Among the expenses that Lauriane and her partner share each month there is therefore above all the repayment of the mortgage, equal to €679.73 per month.

“It’s the one expense we earn 50/50 on because it’s super important to us to be the same height. »

The couple also rules € 366.04 of condominium expenses, which include the common areas, heating and a work fund to which he must contribute on a monthly basis. Lauriane and her boyfriend also have to pay €190 per month to pay your insurance bills (loan, home, car), electricity, internet and water.

Their other fixed expenses include €15 bank charges for their three accounts and their two bank cards, and approximately €60 a month for their cat.

“That includes his food and medicines, but we’re not immune to a big veterinary bill like €2,500 for an operation last November. »

Their travel expenses are estimated at €50 per month.

“I travel mainly by bicycle. We spend around €20 a month on transport for two, plus €30 on petrol. »

To feed themselves, Lauriane and her boyfriend have a big budget: €500 a month for two.

“Ideally, I would like to buy 100% local but in practice this is not the case ! Not for a matter of budget but rather for a matter of practicality… The supermarket closest to us is a large hypermarket, and we cannot organize ourselves to go to the market and avoid this large shopping centre. On the other hand, I buy all my vegetables from the producers who come once a week to my work and our building. »

It is an expense that the young woman would like to reduce, ignoring the processed products, but also reducing the restaurant’s budget.

As for the so-called “female” expenses, Lauriane explains that she spends approx €10 per month for his periodic expenses, and approx €40 beauty products (creams, shampoos, make-up, etc.) every three months. She has no budget for contraception because she is fully reimbursed by social security.

Lauriane’s hobbies

For her hobbies, Lauriane does not hesitate to pay the price: €300 per month. This amount includes an annual membership of €200 to a dance association and the practice of film photography.

“I don’t develop my photos myself at the moment, but it will come! So I have costs for the purchase of film and the development of about 15 € per month. Otherwise we have a budget of around fifty euros a month for theatre, concerts and cinema. »

The rest of this budget goes to “trips to bars and restaurants with friends”.

In terms of clothing budget, Lauriane estimates that it is €30 per month, leveled off over the year. Far from the big cracks, so… Except when it comes to big occasions.

“I offered myself a €300 dress for my sister’s wedding… But it’s the creation of a small, sustainable and responsible brand, and I’m happy to set aside this budget for an important event! »

Also anticipate a looming anniversary budget. “This year a large number of my friends will turn 30: every month I will have a nice item of expense for weekends, parties, gifts to celebrate! »

It also reserves €250 a month to finance “holidays, weekends with family or friends”.

Lauriane’s savings and future plans

If before becoming owner Lauriane could easily put aside 500 euros a month, now it’s more complicated.

“Since we got the loan, it’s been quite random from month to month, around 200 euros a month. »

He deposits this money into his savings account A, which he draws from for his holidays or larger shopping plans.

In the long run, she and her boyfriend would like to renovate their apartment to their liking, renovating the kitchen, bathroom.

“These are dedicated budgets that we will have to think about. Our co-professional will also have big expenses on the facelift, we don’t really know what sauce they’re going to eat, it’s a bit stressful but there might be a second loan to plan! »

Finally, Lauriane and her boyfriend have travel plans across the Atlantic.

Thanks to Lauriane for bringing her budget down for us!

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

Do you like our articles? You will love our newsletters! Sign up for free on this page.

read another

Settle accounts

-

Émilie, 1,036 euros a month: “They’ve already told me: ‘I don’t understand why I have to pay you, it’s a passion job'”

-

Clémence, 3,100 euros a month for two: “We can’t have everything in life, at the moment money is not the priority”

-

Flora, 2,184 euros a month: “I think I’m paid too well”

-

Agathe, 2,100 euros a month: “My husband is paid more than me for an equivalent position in the same company”

-

Audrey, 1,878 euros a month: “My spouse contributes 50% to the purchase of health protection”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.