Netflix’s groundbreaking entry into ad-supported streaming, which began last November, is off to a “solid” start and will soon bring in at least $3 billion in annual revenue, executives said.

“The hardest step is the first step in crawling,” co-CEO Greg Peters said during the company’s fourth-quarter earnings call. Netflix’s decision last year to offer a cheaper ad-supported tier stunned the industry, as the company firmly asserted that privacy and other concerns prevented them from doing so.

While it’s “ridiculously early,” Peters added, “we’ve already learned a lot.” A key takeaway is that viewer engagement, he said, “is comparable to similar users on our non-ad schedules.” Take velocity and growth at the $7-per-month level is also “solid,” Peters said, “because incremental subscriptions are coming into the service because we have a lower price.” He reiterated the company’s position that it does not expect customers to change plans and cannibalize the existing ad-free subscription business.

“We’re just getting started,” Peters said. “We are constantly improving and see the way forward.”

The comments followed the company’s fourth-quarter earnings report, which highlighted a sharp increase in new subscribers, well above growth expectations by Wall Street analysts. Along with the figures, the company said that Peters, previously chief operating officer and chief product officer, has been appointed co-CEO, along with Ted Sarandos, who has held the title since 2020. Reed Hastings, co-founder and co-CEO, becomes executive chairman after 25 years in the corner office.

During the video interview, Hastings suggested that Peters and CFO Spence Neumann conduct an analysis of Hulu’s advertising business, which he reviewed in previous earnings commentary. They both laughed at his Socratic takeover of the conversation. Hulu was founded as an advertising joint venture in 2007, when most streaming was on laptops. Hulu today has about half of its 42.8 million on-demand subscribers taking out ad-supported subscriptions, bringing in about $2 billion in revenue for Disney each year.

“They had a long lead,” Neumann said, referring to Hulu’s sole reach in the U.S. compared to Netflix’s ad volume, which was in 12 global territories at launch. (The rapidly growing list of streaming ad providers includes Disney+, Pluto, Tubi, Roku and many others.) The CEO added that Netflix’s advertising will be a multi-year process. “We won’t be bigger than Hulu in the first year,” he said, “but we expect to be as big or bigger over time, certainly just in our US market and more from there.” Addressing his comments to Hastings, he added, “Of course we wouldn’t go into this business, Reed, as you know, unless it could be a significant part of our business.”

With total revenue approaching $32 billion by 2022, Neumann said ad-level threshold contribution will be about 10% of that total, or at least $3.2 billion, in the coming years. This guidance is broadly in line with the sentiments of a number of analysts and researchers who have attempted to provide numbers on the new effort.

When asked about the potential to introduce FAST, or free, ad-supported television (as YouTube and many others have done recently), Sarandos said the company has other near-term priorities. “We’re open to all these different models,” he said, “but we have a lot planned for this year.”

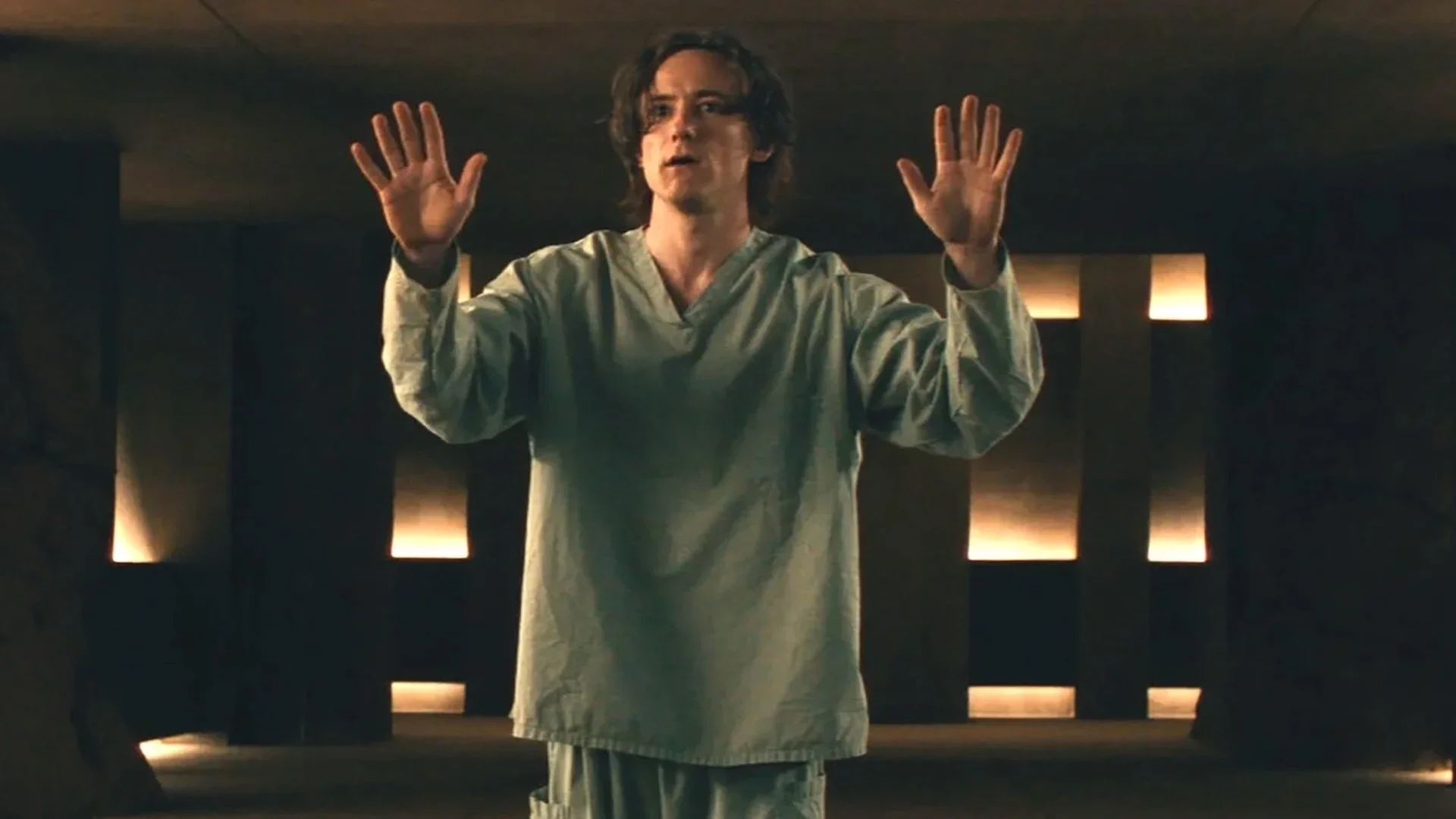

In addition to promotional efforts, to drive games forward and support the app pipeline, limiting password sharing is another key corporate initiative, Sarandos said. The company said efforts to recover lost share revenue would increase significantly in the current quarter, but executives did not disclose many details. Delivers prestigious series and films like Wednesday and Glass Onion: A Mystery of Blades, they said, will be key to combating password sharing. “The necessity of the content will make the paid share work, it will make the ads work,” Sarandos said.

Peters cited “informal sharing” as a primary goal, which he defined as situations where “people can pay but don’t have to, so they borrow someone’s password.” The company’s plan is to “give them a push and create features that will ease the transition to their own account.”

Author: father Hayes

Source: Deadline

Joseph Fearn is an entertainment and television aficionado who writes for The Fashion Vibes. With a keen eye for what’s hot in the world of TV, Joseph keeps his readers informed about the latest trends and must-see shows.