Very soon, it will be possible to count exactly three months from February 24, which changed the lives of many, if not all, 180 degrees. During this time, about 300 companies suspended their activities in Russia, partially or completely, and this number continues to increase almost daily so far. Now fashionable Russia has been canceled and Zara and Uniqlo shopping centers closed (representatives of the company first announced that they would stay in the country, but changed their mind after a wave of criticism from the West), McDonald’s and Starbucks disappeared from food courts ”, Apple Pay disappeared from “apple” smartphones . And the sanctions in the luxury segment turned into a scandal: in a flash, the Network was blown up by the news that Chanel stopped selling brand products to buyers with Russian citizenship, in other words, refused to buy on a national basis.

Of course, most of the high-profile announcements about separation are politics and the inability to resist international pressure, which sometimes takes the form of a farce and far from business. Speaking in the language of facts, the same Inditex (Zara, Pull & Bear, Massimo Dutti, Bershka, Stradivarius and Oysho) operated 500 stores in Russia – this is the second largest market for a retail chain with a share of 8.5 after home Spanish. % of operating profit. Now, financial conglomerate Credit Suisse, in its report, predicts a 7% drop in similar sales to Inditex; this equates to around two billion euros, up from the 27.7 the retailer earned last year. Adidas has no less sad forecasts: according to the company’s analysts, the cessation of operations in Russia and Ukraine could lead to a loss of 250 million euros. The loss in sales will account for 50% of total revenue in the CIS and 1% of total global revenue.

In addition, according to the British publication Drapers, global sanctions against Russia and the suspension of foreign companies will lead to higher transportation costs and delays in the supply chain, inflation in clothing prices, reduced consumer demand and higher raw material prices. “For a number of major European brands in the mass segment, this share is already more significant and can reach 10% to 15%,” says Anna Lebsak-Kleymans, CEO of Fashion Consulting Group.

And while Russia and Ukraine, for example, make up only 1 to 2% of the global luxury market (twice that if you add Russian purchases abroad), the current situation for him either – due to the slowdown – will go unnoticed. In global macroeconomic growth on the backdrop of sharp rises in energy and commodity prices. Bernstein Senior Global Luxury Analyst Luca Salk confirms this.

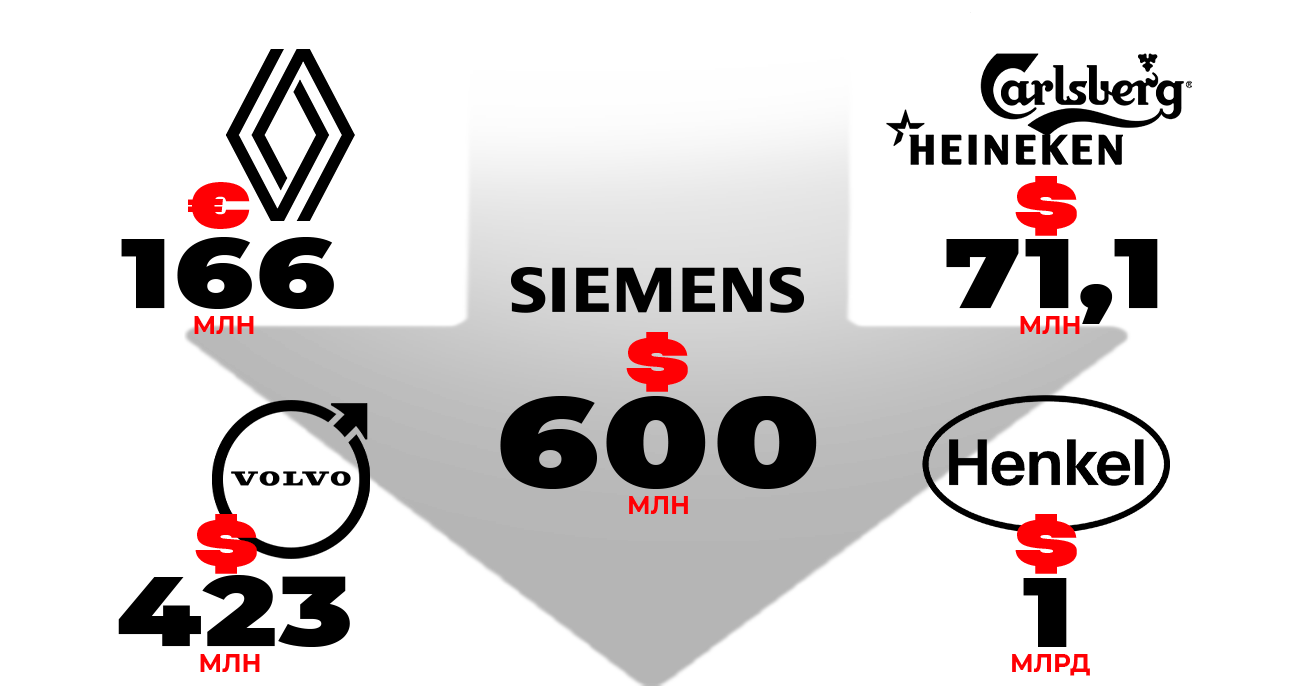

And while there aren’t many official figures yet (only a few of all companies leaving the market have financial statements or accurate estimates), there are enough unofficial estimates. For example, Reuters estimates that the French company Renault will lose 166 million euros in the first quarter of 2022 (for the company Russia was the second largest market after home), and in the case of Swedish automaker Volvo, 423 million dollars after the shutdown of operations in the country. German company Henkel is poised to suffer from annual sales of 1 billion euros, according to the agency. There are also data on Siemens, which lost 600 million euros in the second quarter, and 71.1 million dollars in Carlsberg and Heineken.

How much will leaving Russia cost this and other companies in different segments? We show (and say) openly.

McDonald’s

In early March, the company announced the temporary closure of 850 fast food restaurants in Russia – the then CEO of the company, Chris Kempchinski, noted the lack of the ability to “guarantee the uninterrupted operation of the main directions, the maintenance of the switch.” The reason for the variety of products in network businesses and the high quality standards that guests are accustomed to.. At the same time, approximately 62,000 employees continued to receive salaries.

At the end of April, the company released a financial report in which it learned about the loss of $ 127 million after leaving the Russian market. Of that, 27 million was spent on rent, payroll and vendor fees, and the remaining 100 million was written off as unsold stock.

In mid-May, McDonald’s announced that it was withdrawing from the Russian market and selling its business in the country. At the same time, it later became known that in mid-June the company will continue to operate under a new brand, preserving both the team and the restaurant chain and the menu. Sales of the business in Russia will result in costs of up to $1.4 billion, according to Reuters.

Walt Disney

In May, the company published a report estimating the loss due to impairment of intangible assets in Russia at $195 million for the second fiscal quarter of 2022, which only applies to Disney Channel-related expenses. Earlier, in March, Walt Disney suspended its activities in the country, including the broadcasting of the channel of the same name and the release and distribution of new films.

Netflix

At the end of April, the streaming platform reported a drop in total subscribers for the first time in 10 years – the service lost 200,000 quarterly users. Mainly, of course, due to the withdrawal from the Russian market, as well as higher subscription prices in the USA and Canada. Then, within an hour of the report’s release, company shares fell 27%, almost back to their December 2017 level, and continued to drop to 36%.

Shell

According to the company’s financial report for the first quarter of 2022, the British oil company lost $3.9 billion after taxes (or $4.2 billion before taxes) due to exit from joint projects with Russia. Shell announced its exit from Russian projects at the end of February, and in March the company also decided to stop buying Russian oil and renew fixed-term contracts – losses at that time were estimated at $ 4 to 5 billion. In May, it was learned that 100% of the company’s shares were sold to Russian Lukoil.

Visa

The international payments system in a quarterly report estimated the loss from the company’s departure from the Russian market at $60 million, of which $35 million was spent on the “deconsolidation” of the Russian subsidiary, and $25 million on supporting Russian and Ukrainian staff.

At the same time, last year’s revenue from the Russian business amounted to 4% of total net income – $3.6 billion, according to Visa’s report. In early March, the company suspended its activities in Russia: cards issued by Russian banks stopped working abroad, and cards of foreign banks with Visa stopped working in the country.

MasterCard

According to Mastercard’s first quarter 2022 report, the company estimates losses from leaving the country at $34 million – mainly administrative costs related to reserves. True, at the same time, the payment system received a net profit of $ 30 million in Russia, which partially compensated for the losses – as a result, the net loss from working in the country was only $ 4 million.

Like Visa, Mastercard suspended work in the country in March: they stopped serving cards abroad and cards of foreign banks in Russia.

asos

In his speech to the shareholders, the management said that the store will lose one-tenth of its profits due to exit from the Russian market. The company forecasts sales growth to slow by 2%, and total losses over the next six months are estimated at approximately $18 million.

The British platform has been operating in the country since 2013 but suspended sales in early March.

Source: People Talk