Don’t forget, in the comments, that people who participate in the column are likely to read you. Please be kind.

How much does it really cost to take care of one or more children each month? What is the parental budget? Do the costs incurred vary according to the age of the children? Every two weeks, in our meeting “When we love, we count”, parents open their accounts and share with us how much one or more children cost them, monthly.

This week it is Alma who lends herself to exercise.

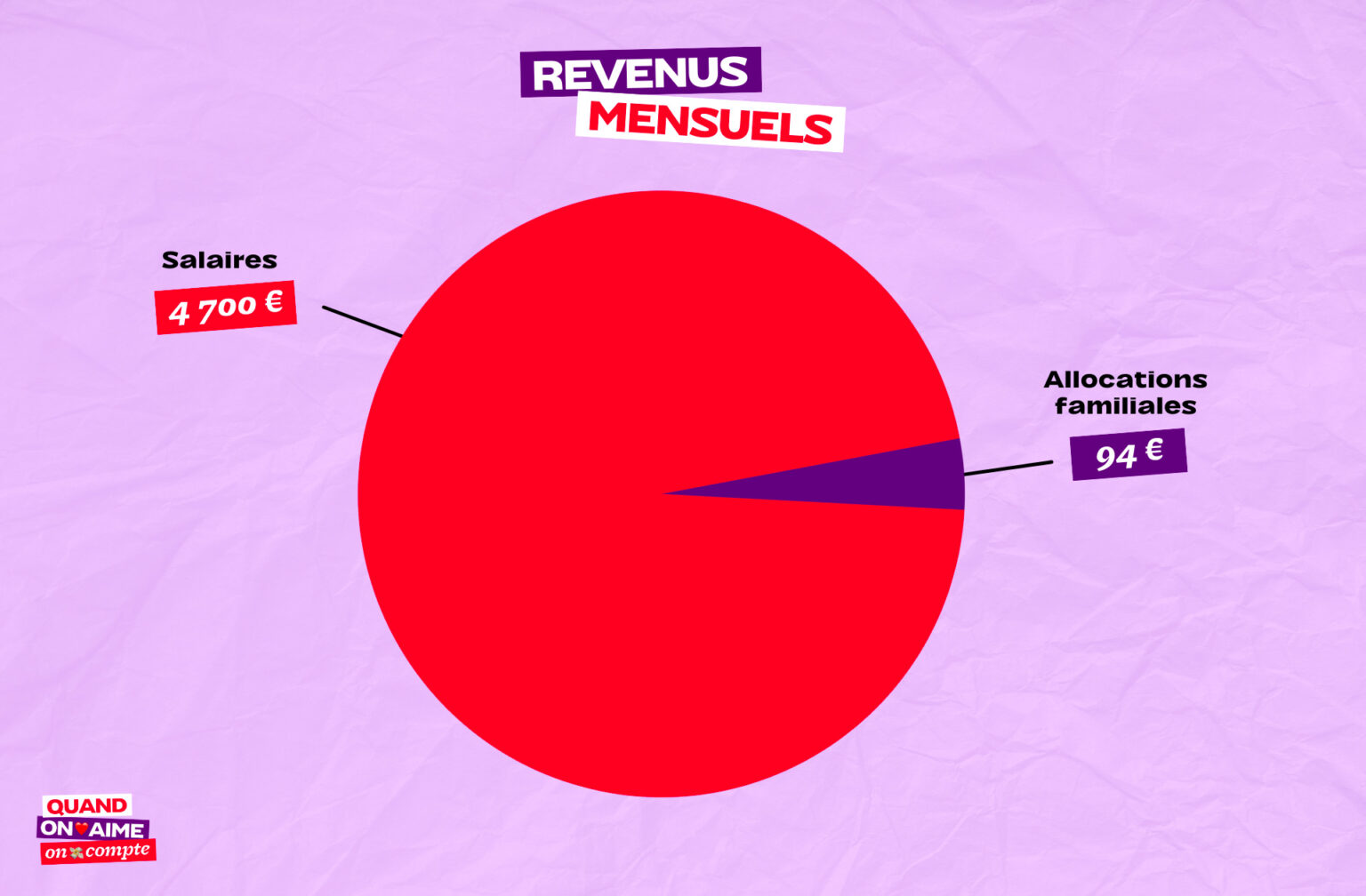

The income of Alma and her husband, parents of a one-year-old boy

- First name : Alma

- Age : 34 years

- Work : public finance inspector

- Number and age of children: a one year old girl

- Net household budget in total: €4794

- Place of life: suburb of Lyon

Alma and her husband have a one-year-old daughter and they all live under the same roof. They live in a house in a residential suburb of Lyon, which they own. They pay a €1000 credit per month.

After moving around quite a bit, we wanted somewhere we knew we could settle down for several years. Even the choice of a house with a small exterior is a consequence of the birth – we bought it in 2021, I was already pregnant. With children, we preferred to have space.

I experienced part of the Covid crisis in a 12 m² room of a Parisian maid, and clearly my goal was to be able to escape it in the future, and also to allow my loved ones to escape it. Hence the house, with the possibility of hosting friends and relatives if necessary.

Monthly, Alma and her husband receive everything 4,794 €including their net salaries of €4,700 between them, and €94 allowance. As for her, Alma explains that she is not sure of the amount she receives from her family allowances, having noticed a different payment each time, since the end of the eight-month parental leave that she had shared with her husband.

After 8 months of shared parental leave between my husband, we both returned to work in September. I guess these 94 € must be the amount we will now receive. Furthermore, apart from the “monthly” expenses for me, the first cost for my daughter was the parental leave. We have shared these months with my husband, without regrets. But during these 8 months, the loss of salary was compensated by our savings. We’re back to two paychecks today, and clearly the aim is to replenish savings, particularly to finance some work around our house in the years to come.

Alma adds, regarding the parental leavewhich each parent who took it only received €400 monthly net during this period: 5 months for you, 3 months for your spouse.

The couple also have a monthly credit of 230 euros for the purchase of a car and spend 240 euros on domestic utilities, including electricity, gas, water and pellets for the stove. He says pellet prices have doubled this year.

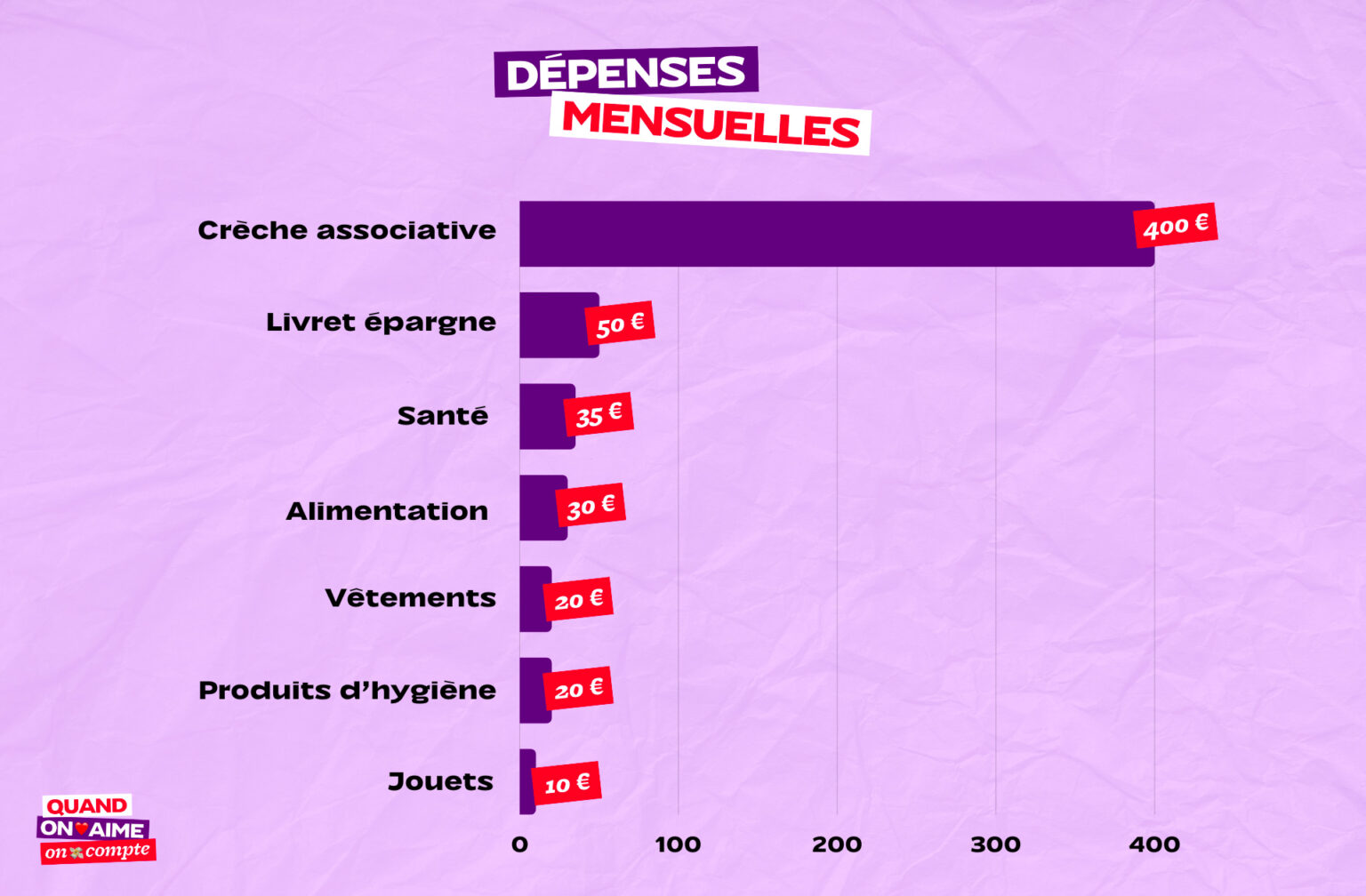

Childcare and hygiene costs for your one-year-old

After explaining her total income, Alma shares the amounts she spends on her child.

When her daughter was born, Alma spent the sum of approx €400 to equip yourself with equipment for children second hand, including a bed for your baby, a co-sleeper, a nursing chair, a baby carrier, a changing bag, a chest of drawers and small containers, a small bathtub, a stroller and a high chair . As for the new purchases, Alma explains that she made a changing table with a few boards, from which she bought a mattress €50a diaper bin for €30and small equipment such as baby nasal aspirator, scissors, bath thermometer, pacifiers and bottles.

Their relatives and families have given them a number of things:

We are very fortunate to already have many relatives with young children. We have been lent a lot of clothes, blankets, sleeping bags, some childcare equipment, toys.

Also, she’s my in-laws’ first granddaughter and they spoiled her a lot, and so did we. They offered us the car seat, which is a nice saving.

Hygiene sideAlma spends a budget of €20 a month for your child, used for disposable diapers (those that the daughter wears during the day at the nursery are provided by the facility and included in childcare costs) and other care products:

We buy disposable wipes, but I alternate them with wipes I’ve made from old sheets. We don’t use a lot of saline, especially when she has a cold, but I buy big liter bottles for those cases.

Since its inception, we’ve had to spend two bottles of liniment and two baby shower gels. When we finish the current one, we will wash it with our own shower gel, which is hypoallergenic. There are also diaper trash bags in this budget.

For the health budgetAlma spends €30 health insurance for her baby, and had some one-off expenses such as osteopathy sessions reimbursed at 100%, purchase of vitamin D, probiotics for infantile colic, homeopathy for teething and paracetamol bought without agreement .

The clothing and toy budget for a one-year-old

As for the clothes for her daughter, Alma buys many second-hand products:

I buy second hand, both for reasons of economy and for the conservation of resources. I think it’s a waste to buy new clothes that will only last a few months. They lent me a lot of clothes when my daughter was born, and I, in turn, gave her undersized clothes to a friend who gave birth to her almost a year later.

I find many clothes of the desired size/season, often on Leboncoin. And then I complete by buying new what I can’t find. Since new, I only bought shoes, because sometimes I couldn’t find what I wanted.

For the toysAlma works on the same principle:

I also buy them used: it clears out the garages of friends and neighbors and I know that when my daughter doesn’t use them anymore, I could always resell them or give them to someone.

Parents think they are spending €20 of clothes per month, e €10 of toys.

Food expenses for a one-year-old baby

Alma’s daughter was exclusively breastfed until she was 6 months old, and as she is cared for in the nursery 5 days a week where lunches and snacks are taken care of and included in the childcare budget, the food budget only for his daughter it’s short. In fact, Alma considers the expense €30 a month for meals at home, which includes powdered milk for the morning and evening bottles, jars when the child cannot eat the same meal as the parents, ladyfingers and biscuits.

As for food shopping, Alma explains that she buys her vegetables from the local greengrocer and buys meat and fish from the market. For the rest he goes through the classic mass distribution in brands such as Carrefour, Lidl or Grand frais.

We cook a lot, so most of the budget is raw produce from the greengrocer, butcher and fishmonger. We have always tried to favor fresh, local, seasonal products. Not necessarily organic, not being convinced that there is a big difference with conventional products. Since the birth of our daughter, we have also paid a little more attention to the price.

Alma explains that she would like to reduce the family budget for food:

I find that we still throw away too much damaged or expired food because we weren’t careful. I am very greedy and I fall in love with cakes or sweets easily, I find less time to make them at home since I got back to work. I would like to plan for more homemade and stop buying factory cookies.

Childcare expenses for Alma and her one-year-old daughter

Alma’s daughter is held in a associative nest5 days a week, for approx €400 per month, depending on the number of hours of assistance which may vary according to the needs of the family. Since it is an associative crèche, it is the structure that receives aid directly from the CAF based on the family ratio of the children welcomed.

Alma explains that she never uses a babysitter in the evening, ad hoc:

Our parents don’t live far away, they are the ones who took care of our daughter the few times we needed them.

Transmission of the value of money and pocket money

Alma tells what was the relationship with money in his familywhat was passed on to him and his current relationship with his daughter:

My family didn’t really talk about money. We never lacked anything, but when something cost too much my parents said it without problems.

I had pocket money quite young (in elementary school) and I think it’s good to learn how to manage even a small amount. On the other hand, I always had the impression that my parents had little savings and were in trouble in case of a big unplanned purchase (household appliance breakdown or similar).

So for me it has always been a matter of course to put money aside and be able to deal with unexpected expenses. My parents were very compulsive in their daily purchases: no big crushes, but many small “pleasure” purchases that ended up weighing on the budget.

The couple opened a savings account for their daughteron which they put €50 every month. Explain the purpose of opening this account:

If her grandparents or other relatives want to give her money, it will go into this account until she is old enough to handle pocket money on her own. The goal is for her to have a small nest egg for projects when she’s older.

Since Alma’s daughter is still very young, many items of expenditure do not yet concern her, such as activities or hobbies dedicated to her, or school supplies and canteen expenses.

At the end of the month, 3,334 euros remain to the couple. An amount they use to pay property tax, bank charges, mutual insurance, car credit, food budget, telephone bills, Internet subscription…

Adding up all the money spent on the daughter alone, Alma and her husband spend 565 euros monthly.

Thanks Alma for answering our questions!

“When we love, we count” how to participate?

If you also want to participate, nothing too complicated: send me an email to manon[@]madmoizelle.com with subject “When we love, we count” or use the form below and I will send you the questionnaire and the procedure to follow.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

We accept applications from all over France and even from all over the worldas long as you can answer the questions you’ll be asked and fill in a tiny Excel table (promise, don’t freak out).

Photo credit image of one: Getty Images

Source: Madmoizelle

Elizabeth Cabrera is an author and journalist who writes for The Fashion Vibes. With a talent for staying up-to-date on the latest news and trends, Elizabeth is dedicated to delivering informative and engaging articles that keep readers informed on the latest developments.