Talking about money is still taboo in France. However, it is a fascinating subject, and in some respects… feminist! In Settle the accounts, people come to review their budget, talk to us about their financial organization (as a couple or alone) and their relationship with money. Today Justine agreed to answer our questions.

- Name: Giustina

- Age: 28 years old

- Profession: social worker

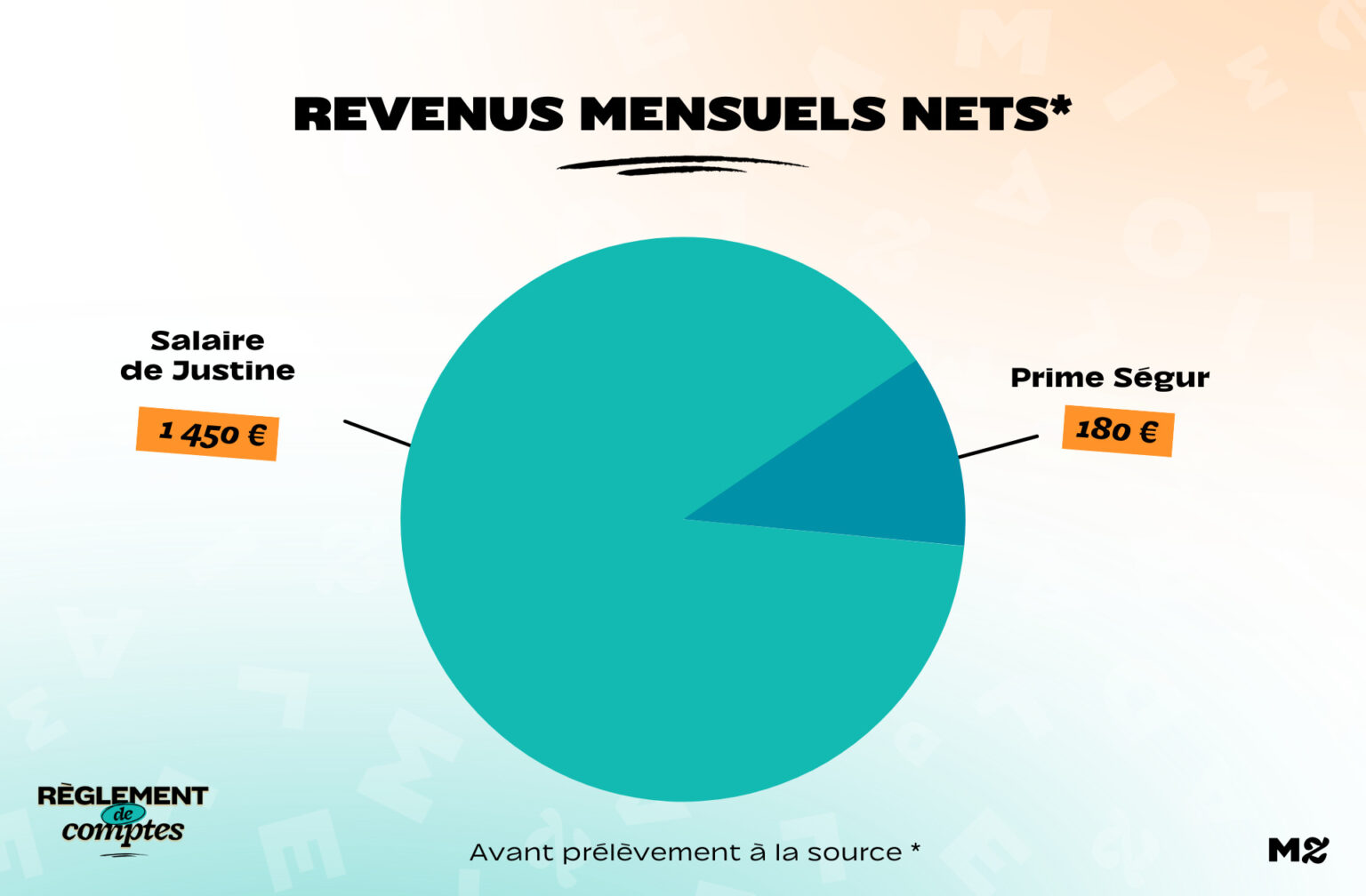

- Net salary: around 1,450 euros per month, of which 180 euros per month of SEGUR bonus

- Lives with: a one and a half year old cat

- Living area: a 25 m² apartment of which she is tenant in Lyon, in Croix Rousse

Justine’s income

Justine is a permanent social worker within an association: she accompanies young people aged 18 to 25 housed in a shelter. Given the difficulty of her job, she does not consider herself paid enough:

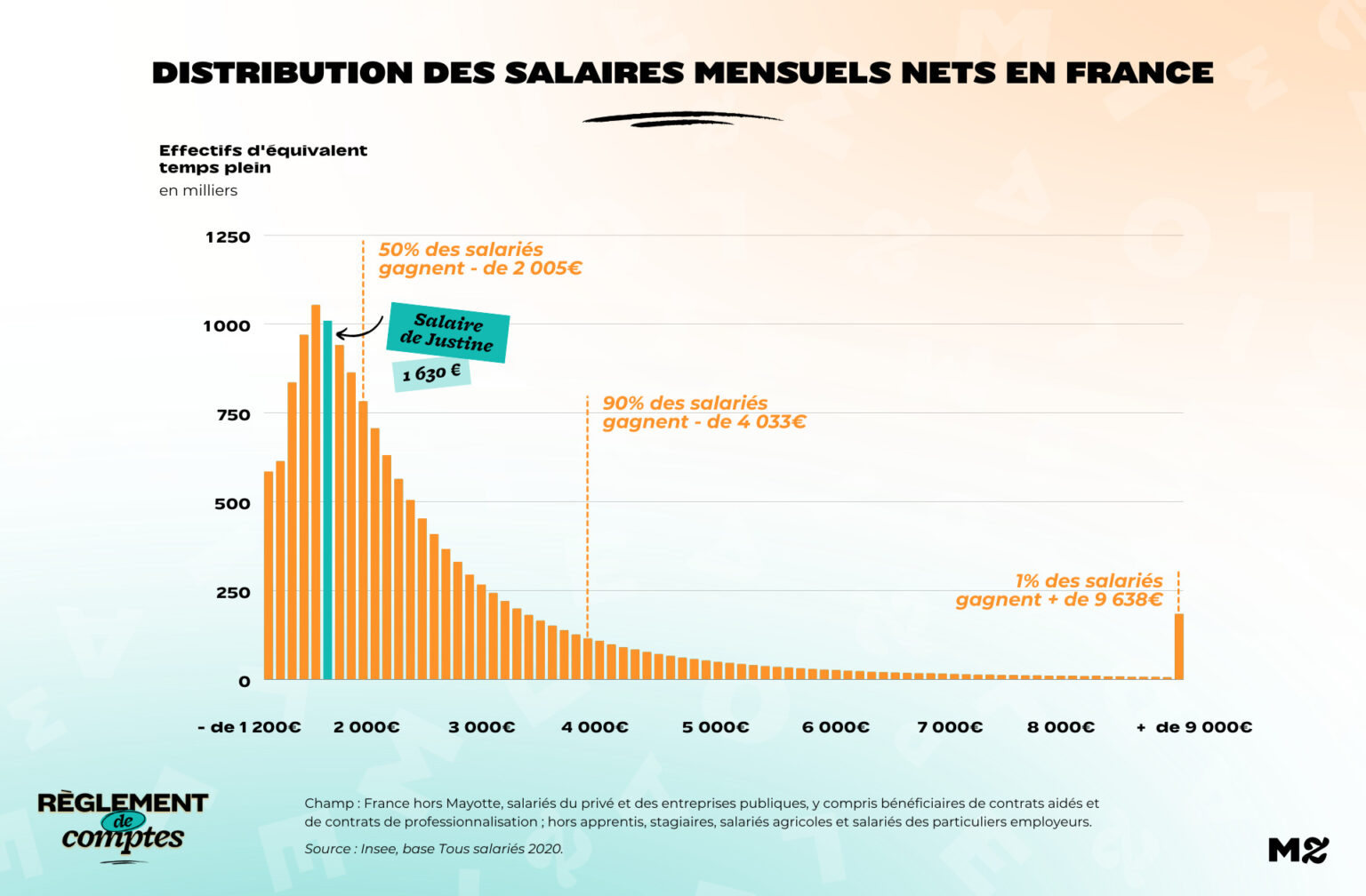

“Given the level of responsibility and skills required, I feel rather underpaid, especially as my job is still difficult. In general, I find that social professions are not recognized for their proper value. € 1,400 is not really that much. ”

His monthly net salary ranges from € 1,400 to € 1,500. per month, depending on the Sundays or holidays worked. This amount has not yet been deducted from the withholding tax, because Justine started working in 2021. A salary that she finds low, to which a SEGUR bonus has been added since June:

“This award of 180 € per month it was initially granted to medical personnel after Covid, to reward their efforts. We social workers have shown a lot why this bonus was paid to us too. Since then, my salary has increased to 1,630 € per month approximately, e Finally I can have fun, do things, put aside.

On the other hand it is a bonus and not a salary increase: it can be taken away from us. “

Justine’s organization and relationship with money

To manage her income, Justine sets herself a “ladle” limit: she obliges herself not to spend more than 150 euros a week for all current expenses.

“I check my accounts every day because I am quite stressed and I like to know where I am. Otherwise I go to the market, look at the price per kilo of what I buy … But I’m not a budget professional: I really don’t have a method! ”

She explains that she has never been exposed, at least from the increase in her income:

“When I started working, I happened to exhaust myself to please myself, in clothes, in restaurants, in decorations … Now I try to regulate myself and make more thoughtful purchases, to limit compulsive shopping as much as possible. before doing a big shopping, I am more careful when I do the shopping … ”

A change in the relationship with money linked to his education, but above all to his profession:

“My parents tried to instill in me a certain responsibility for money. Though comfortable, they are always alert and “We are not Rothschild” is their favorite phrase. But the opposite worked for me: as soon as I had the money, I sometimes wanted to indulge myself to excess.

What has strongly shaped my relationship with money is my daily professional life: I have seen many people find themselves in complicated financial situations and this vaccinated me. Also, since I work a lot on budget issues with the people I accompany, I have to be consistent with myself! ”

Justine’s expenses

After a breakup, Justine has settled down on her own and describes it as a relief:

“I’ve lived up to now with someone who has managed their budget very badly, and that obviously had an impact on mine. ”

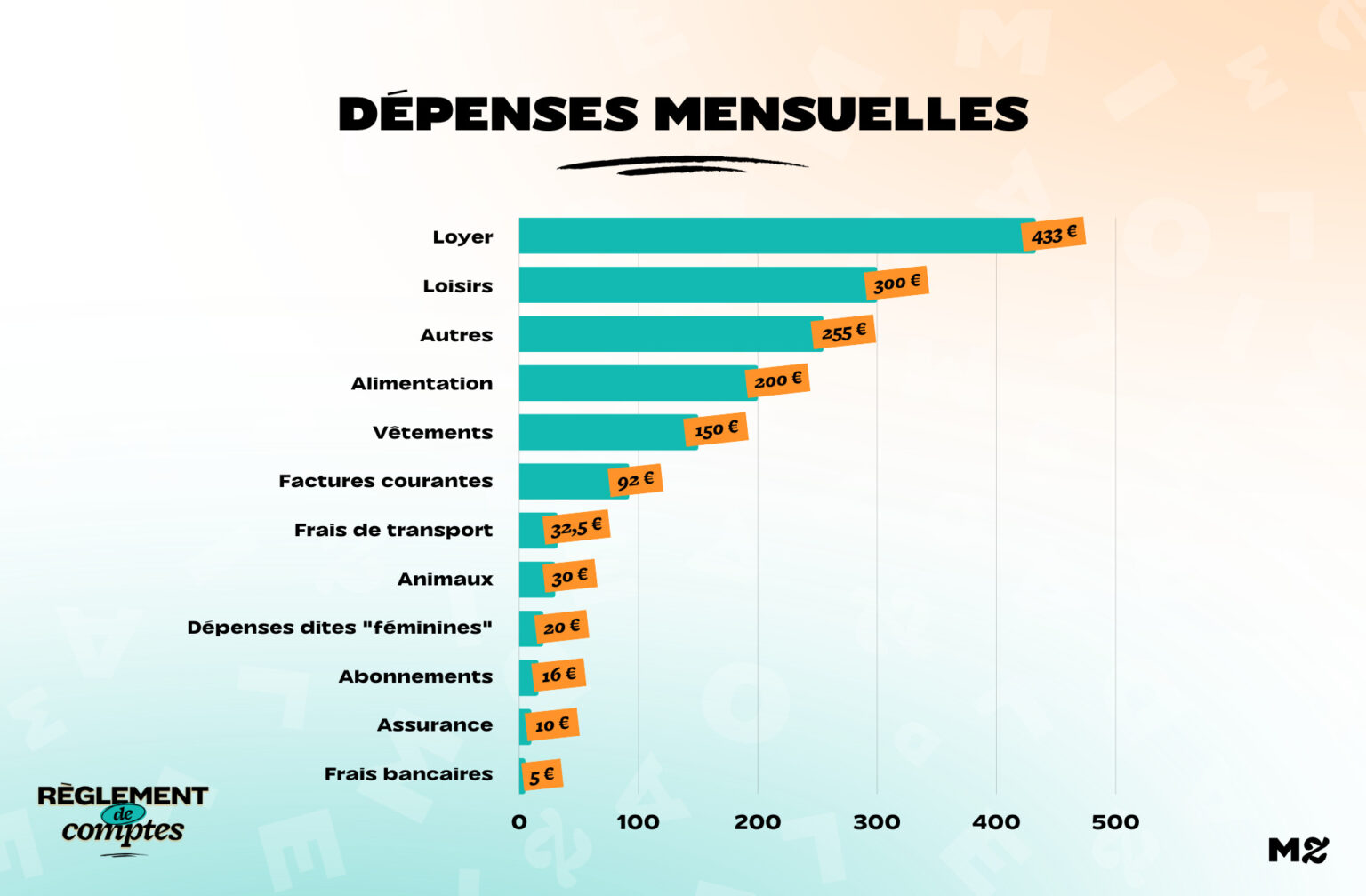

His main expense is the rent, which amounts to 433 euros per month for a 25 m² apartment in the affluent neighborhood of Croix Rousse.

“It’s a fairly expensive but very pleasant neighborhood to live in, where I have my habits and my friends. I would like to stay there.

There I live in a small 25sqm apartment with a loft and I like it, but I would like to have an apartment with a closed one bedroom, even a small one… A small exterior would be great, but it is absolutely inaccessible. ”

She spends € 12 per month of water bill and € 80 per month of electricity:

“It’s a canut apartment [logements des ouvriers tisserands lyonnais du XIXᵉ siècle, dans lesquels on plaçait des métiers à tisser très imposants]hence very high ceilings in an old building. It’s nice, but I’d rather live in a less nice place that consumes less …

I think it is an energetic and very little insulated sieve, because it is a very old accommodation. “

His home insurance costs him 10 € per month. When it comes to shopping, think about spending € 200 monthly to ensure his daily life, largely in a solidarity grocery store:

” This is a solidarity grocery store that sells cheaper products because recovered from the unsold. It is a shop open to everyone, different from social grocery where it is based on income. It’s great, the products are very good and the prices are really low. Since you don’t find everything there, I also do my shopping in a supermarket in my neighborhood which is quite expensive, I would like to stop going there.

I am also lucky enough to have a market 6 days a week where I live, and I often go there to buy fruit, vegetables and cheese. I never buy meat or fish because it is too expensive, but I eat it when I go to a restaurant or when I am invited. “

To these races are added € 20 per month of so-called women’s expenses (menstrual protection, hair removal costs, make-up, etc.):

“I invested in last year vintage panties, which was a great investment, but very profitable! And most importantly, very practical now. Apart from that, I would say that I spend around 15 euros a month for waxing, maybe 30 euros a year for make-up… And also around 35 euros at the hairdresser, three times a year. “

You spend around 20 € per month for your cat including her kibble, her litter and one-time veterinary expenses.

Your fixed monthly costs also count € 5 Bank charges, € 32.5 public transport pass in your city, e € 16 subscription to streaming services video.

Justine’s hobbies

In Justine’s budget, free time occupies an important place: she counts € 300 a month to have fun.

“I often go for a drink with friends, or to concerts (not necessarily well-known artists, they can be small concerts in bars).

I go to the theater a couple of times a year and see exhibitions, and I buy about a book a month. I also really like sports in the middle of nature, even if I only do it from time to time: trekking, kayaking, paddleboarding …

Hobbies are very important to me. It allows me to breathe in relation to work, meeting people, having fun … Also, I am quite a sociable person who likes to see people. ”

He also tells himself to be a bit addicted to shopping, but try to reduce “ : her clothing budget is approx 150 € per month.

Finally, it counts 255 € per month for various expenses: Internet and telephone subscriptions, train tickets for the year and … cigarettes, the expense that he would like to reduce par excellence:

“Obviously I’d like to reduce your cigarette budget, because I objectively find that it is a little nonsense to spend so much on something that harms my health… But I have problems, cigarettes, it’s a bit like my decompression chamber in the days of everyone’s life. Someday, I’ll definitely get there! “

Savings and Justine’s projects

In addition to these expenses, Justine puts up every month € 100 separately :

“I save € 50 on my PEL and € 50 on my livret A. The livret A is have a safety net. Later, if I want to pay for something expensive like plane tickets, I will be able to save more, but I have to have a goal.

I would like to buy, but I am single and I am not planning this project alone. I say to myself: “What if I meet someone tomorrow? What if my life was about to change? ”

However, my ELP is used to accumulate savings in order to be able to make a contribution if this project materializes! “

He is also considering moving to a slightly larger apartment.

Thanks to Justine for answering our questions!

Settlement of Accounts is always on the lookout for new profiles and accepts all budgets or financial organizations.

To participate in the section, send us a short presentation of you and your budget at [email protected]with subject Settlement of accounts!

Photo credit: Brooke Cagle / Unsplash

read another

Settle the accounts

-

Fiona, € 2,100 a month in a micro-enterprise: “My goal is not to kill myself at work”

-

Tiphaine, € 4,475 a month: “I see a shrink talking about money”

-

My-Lan, 2,168 euros per month: “My celibacy contributes to the fact that I don’t save”

-

Bravo, 3,070 euros per month: “I don’t understand anything about taxes”

-

Manon, 2,500 euros in two: “I’m constantly in overden”

Source: Madmoizelle

Ashley Root is an author and celebrity journalist who writes for The Fashion Vibes. With a keen eye for all things celebrity, Ashley is always up-to-date on the latest gossip and trends in the world of entertainment.