Talking about money is still taboo in France. However, it is a fascinating subject… and feminist in some respects! In our section Settle the accounts, of the people of all kinds come to peel their budget, tell us about their relationship with money and their financial organization as a couple or alone. Today, My-Lan agreed to open her accounts for us.

- Name: My-Lan

- Age: 30 years old

- Profession: School teacher

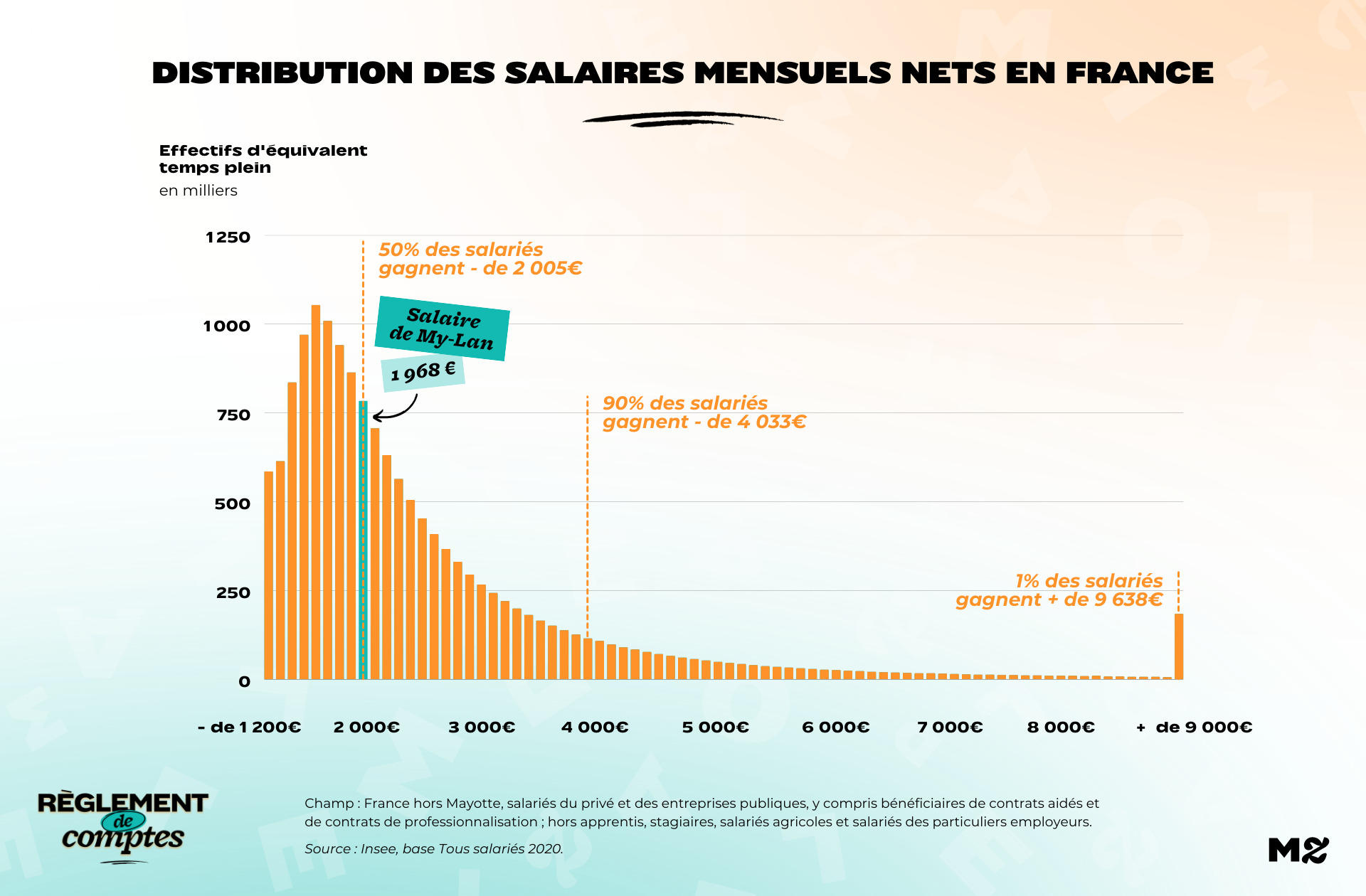

- Net salary net of deduction at source: 1,968 euros

- Place of life: a 45 m2 apartment in the Paris region, where she lives alone

Enter My-Lan

My-Lan is a civil servant and has been working as a school teacher since 2018. In this position, she makes money 1,968 euros net per month after deduction at source. If you find this salary correct, remember that you also have some expenses to be able to exercise:

“I am a little more paid in National Education than I was before in the associative sector. Unfortunately, in relation to my level of studies and the workload of the teaching profession, Sometimes it seems a bit inconsistent to me. I am about 30 hours a week in front of students, but I also have 10 to 20 hours of personal work depending on the period …

The profession also entails many expenses that are not covered as in the private sector : no restaurant tickets, no works councils, no expense reimbursements … Some colleagues spend almost nothing on their class but personally, I always want to buy little things for my classroom organization: it can range from small supplies to even furniture. “

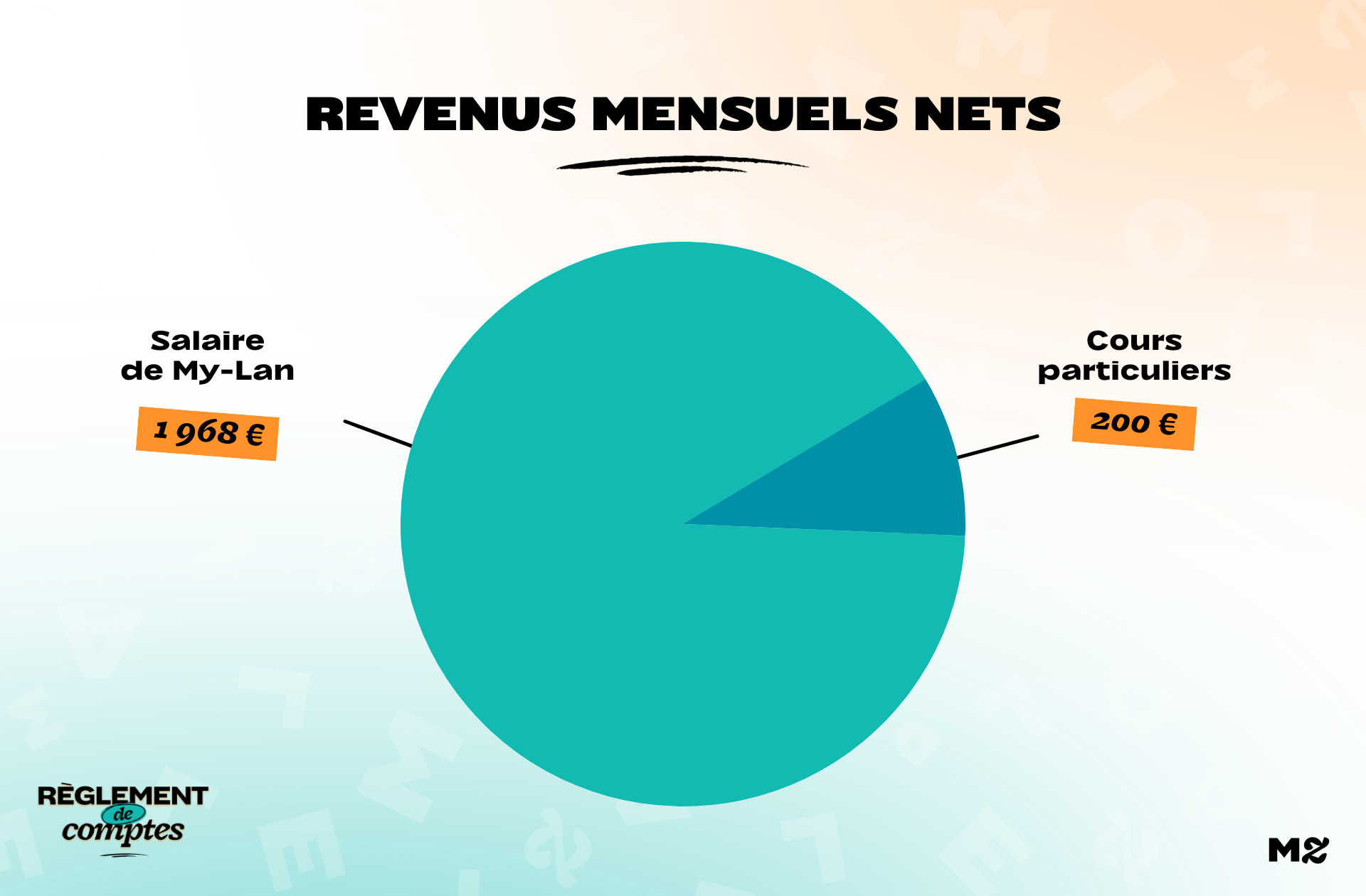

Throughout the year, it also offers 7 to 8 hours of private lessons per week, to offset its transportation costs. It earns it approx € 200 extra per month. In all it therefore manages a budget of € 2,168.

My-Lan charges

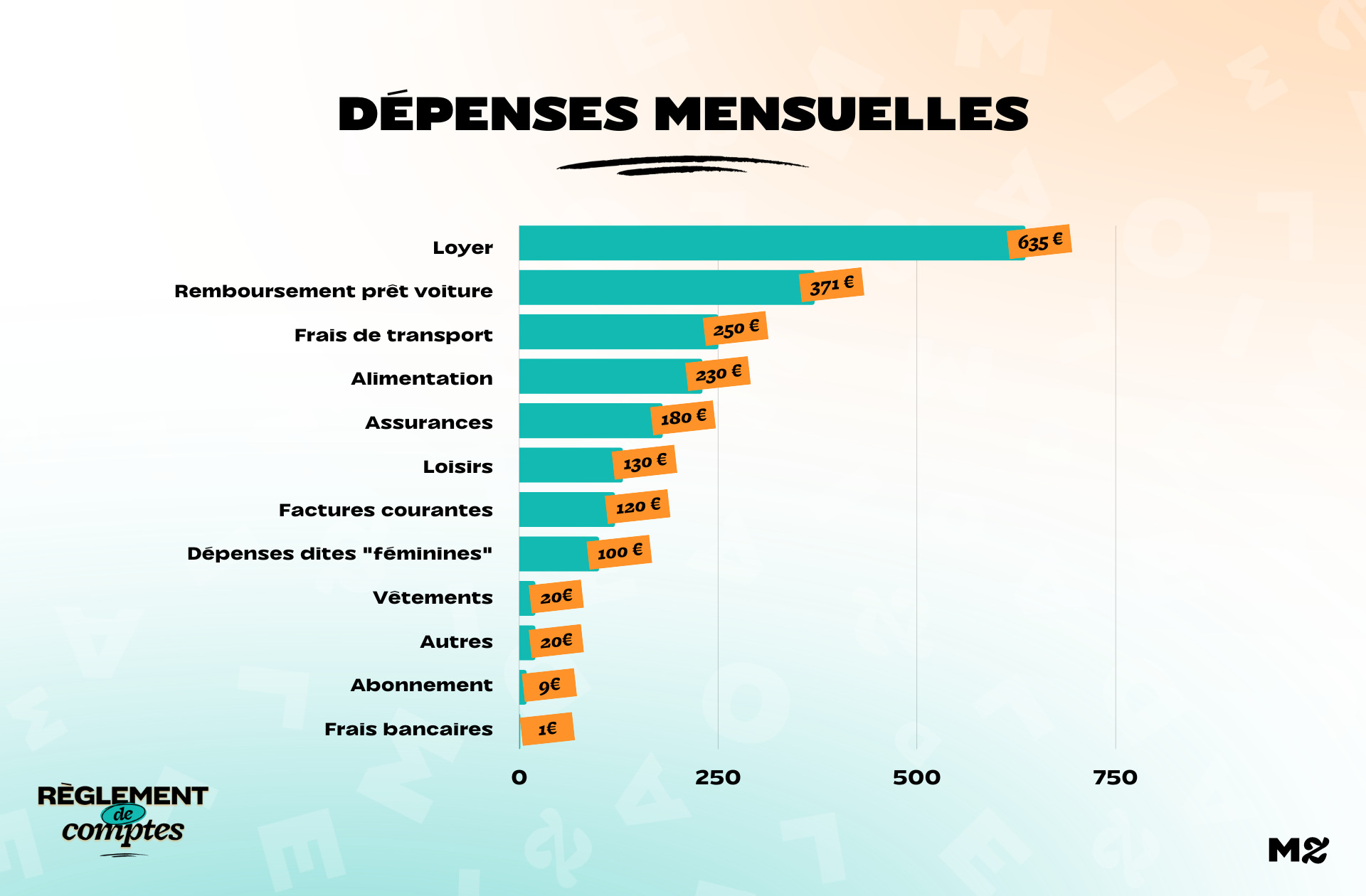

Each month, My-Lan pays a rent of € 735 for a 45 m² two-room apartment in the great Parisian suburbs.

“I live in Île-de-France, in the center of a city of 10,000 inhabitants. I had to get away from my hometown and my job a bit to be able to rent an apartment within my budget. “

His rent includes the consumption of water, gas heating and the expenses for his apartment. You pay more € 20 monthly of electricity.

Aside from his accommodation, his biggest expense is in his primary means of transportation: his car. It has been reimbursed since February monthly installments of € 371 for the purchase of your vehicle. His insurance costs him € 50to which they are added From 240 to 280 € of petrol per month.

“I live 30 kilometers from my workplace. In my department it is almost essential to have a car to go to school, but our gas costs are not reimbursed …

In recent months, these fees have skyrocketed. Sometimes I wish I could afford to live much closer to my workplace to save on gasoline. “

In all, it is about 670 euros per month, almost one third of the monthly budget of the teacher.

For the organization of his class and his work, he expects to spend approx € 30 per month.

“Until a few months ago I had a huge beauty budget”

Its fixed costs matter € 1 per month of bank charges, € 80 reciprocal, € 5 professional insurance for educational professions, € 20 home insurance, € 25 personal insurance, e € 9 Disney Plus subscription.

On the shopping side, My-Lan spends 230 € per month, mainly in fresh products:

“I prefer quality for meat, fruit and vegetables, fresh products. For the past few months, I’ve been trying to eat a healthier diet and avoid buying ready-made meals as much as possible. I try to cook as much as possible, so I prefer to have a quality of products that I don’t find in all brands. “

In the year it counts € 100 per month of beauty budget:

” Until a few months ago I had a huge monthly beauty budget: I did my nails and eyelash extensions every month (approx € 80 Every time). I try to detach myself from it, but it’s not easy, it’s one of the things I need to feel “prepared”. On the contrary, I spend very little on makeup or care.

I reduced this expense during the summer, because I pay for these expenses with the money of my private lessons, but this summer I did not have any … So it was not possible to pay! “

She also tries to cut down on this expense to focus on one of these hobbies: her gym membership, which costs her 40 € monthly.

My-Lan’s hobbies

In addition to the gym, My-Lan is dedicated to approx 90 € per month at your convenience.

“ I go to restaurants quite often, 3 or 4 times a month, for around 25 euros each time, and I go to at least two or three concerts a year. These are important moments for me, because many of my friends live in Paris and these are occasions to see them, I who am a bit isolated in the suburbs.

I also try to go abroad at least once a year and take advantage of the school holidays to disconnect at least 4-5 days each time. “

Count between 20 and 40 € shopping for clothes.

My-Lan’s relationship with money

My-Lan explains that for a long time she was extremely frugal: the cost of her studies, and in particular that of a loan for a business school, forced her to spend very carefully.

“ As soon as I started working and no longer had to pay my student loan, I think I became more and more of a spendthrift. I can’t help but think that I “deserve” it, what a hard work to please myselfespecially with the private lessons I do in addition. “

The time she started working coincides with the time she became singlewhich had a significant influence on its management money :

“ I became single after a long time in a relationship with someone very stingy, so I really wanted to take advantage of that. There were times when I was always on the edge of the overdraft before becoming a civil servant and today I’m back, but I still struggle to limit myself.

I think my long-term celibacy also contributes to this I don’t feel the need to save more. For years I said to myself “I would wait for someone to leave the house, I would wait for someone to travel …” but today I prefer to live for the day and above all do what I want, like going on a trip on a whim. “

It is especially important for her to show that a single woman can get by financially. This is what motivated her participation in the section:

“ I want to prove that a single woman can live and have fun, without needing a man to split her bills when for years, I am encouraged to put myself in a relationship with the first comer be more comfortable financially. I feel like I get more out of my salary than some of my friends in a relationship and in the end I’m quite proud of it ! “

My-Lan savings

My-Lan does not save, or very little. If she begins to consider becoming an owner, she is not in her priorities:

“ I would love to be in a savings process … but I believe it Psychologically I can’t take it anymore. I would say I can get around 100 € separately per monthbut very quickly I spend them on vacation, traveling, or to get some small “gifts”.

Sometimes I recover and tell myself that I should be able to save some money to hope to buy an apartment, but, after all, buying alone still scares me too much and I love my current apartment. “

Thanks to My-Lan for answering our questions!

Photo credit: Jenny Hueberberg / Unsplash

read another

Settle the accounts

-

My-Lan, 2,168 euros per month: “My celibacy contributes to the fact that I don’t save”

-

Bravo, 3,070 euros per month: “I don’t understand anything about taxes”

-

Manon, 2,500 euros in two: “I’m constantly in overden”

-

Clémentine, 4,460 euros a month for two: “I’m already buying back quarters”

-

Delphine, € 1,805 per month: “I manage the budget like a professional”

Source: Madmoizelle

Ashley Root is an author and celebrity journalist who writes for The Fashion Vibes. With a keen eye for all things celebrity, Ashley is always up-to-date on the latest gossip and trends in the world of entertainment.