Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was June * who agreed to open her accounts for us.

- First name : June*

- Age : 29 years old

- Occupation : specialized teacher

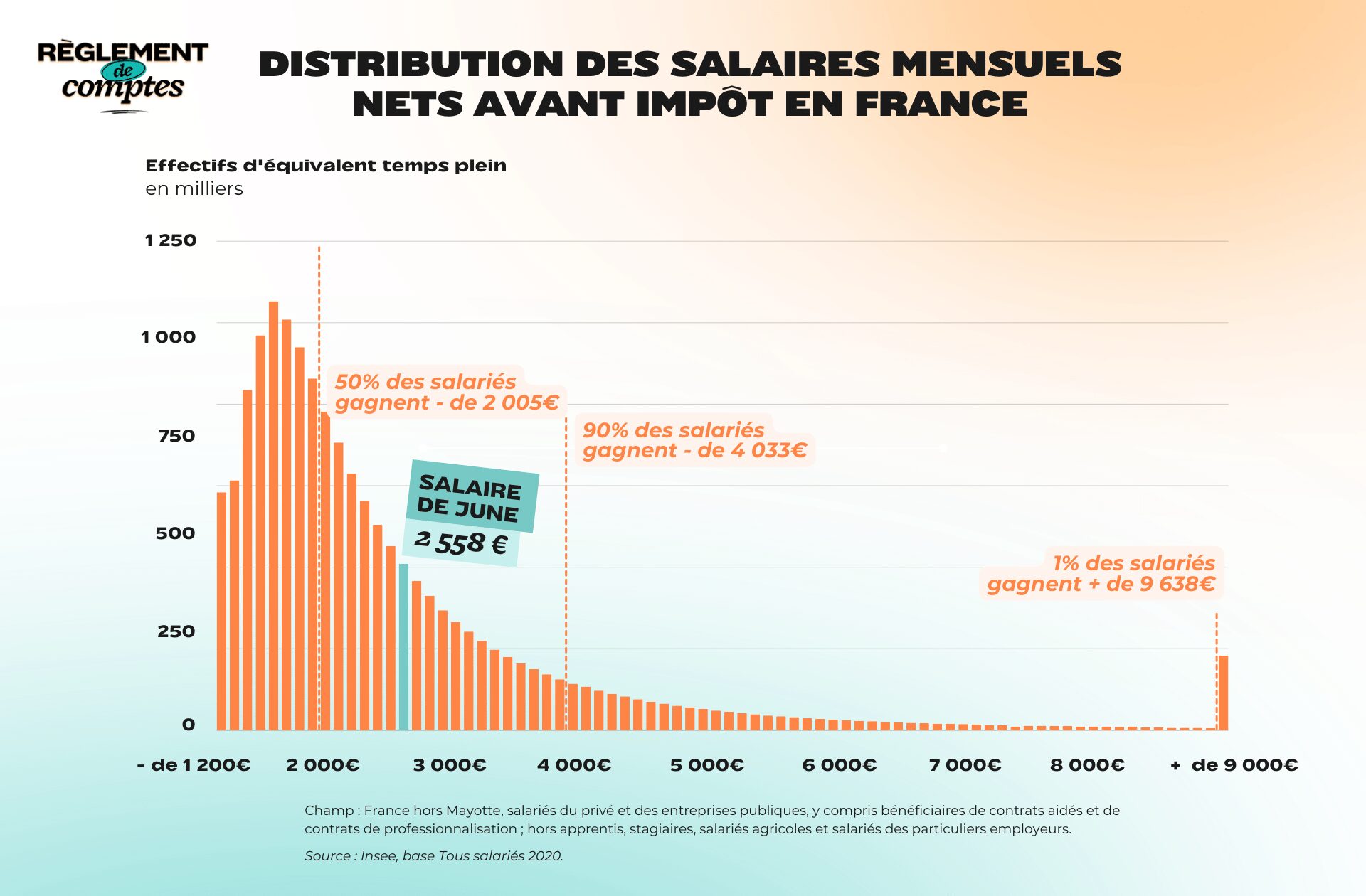

- Net salary before withholding tax : €2,558.39

- Net salary after withholding tax : €2,287.29

- People (or animals) living under the same roof : her partner and their cat

- Place of life : a house on the coast (Nord-Pas-de-Calais)

Situation and income in June

June, almost 30 years old, is specialist teacher in a physical education institute. He has been working there for several years, having taught young people with intellectual disabilities.

“I really enjoy being in class, training in particular areas or skills. This is a job where you are never bored but which can be very addictive. A lot of energy needs to be mobilized at this time, the preparation for this audience is also demanding. Sometimes it is difficult to disconnect even in the evenings and during holidays. »

June lives with her partner – “We will continue a civil union next month” – in a small town on the coast, in Nord-Pas-de-Calais. They are owners since July 2021 of a house of approximately 100 m2.

“We previously lived in a 65 m2 apartment that I owned. »

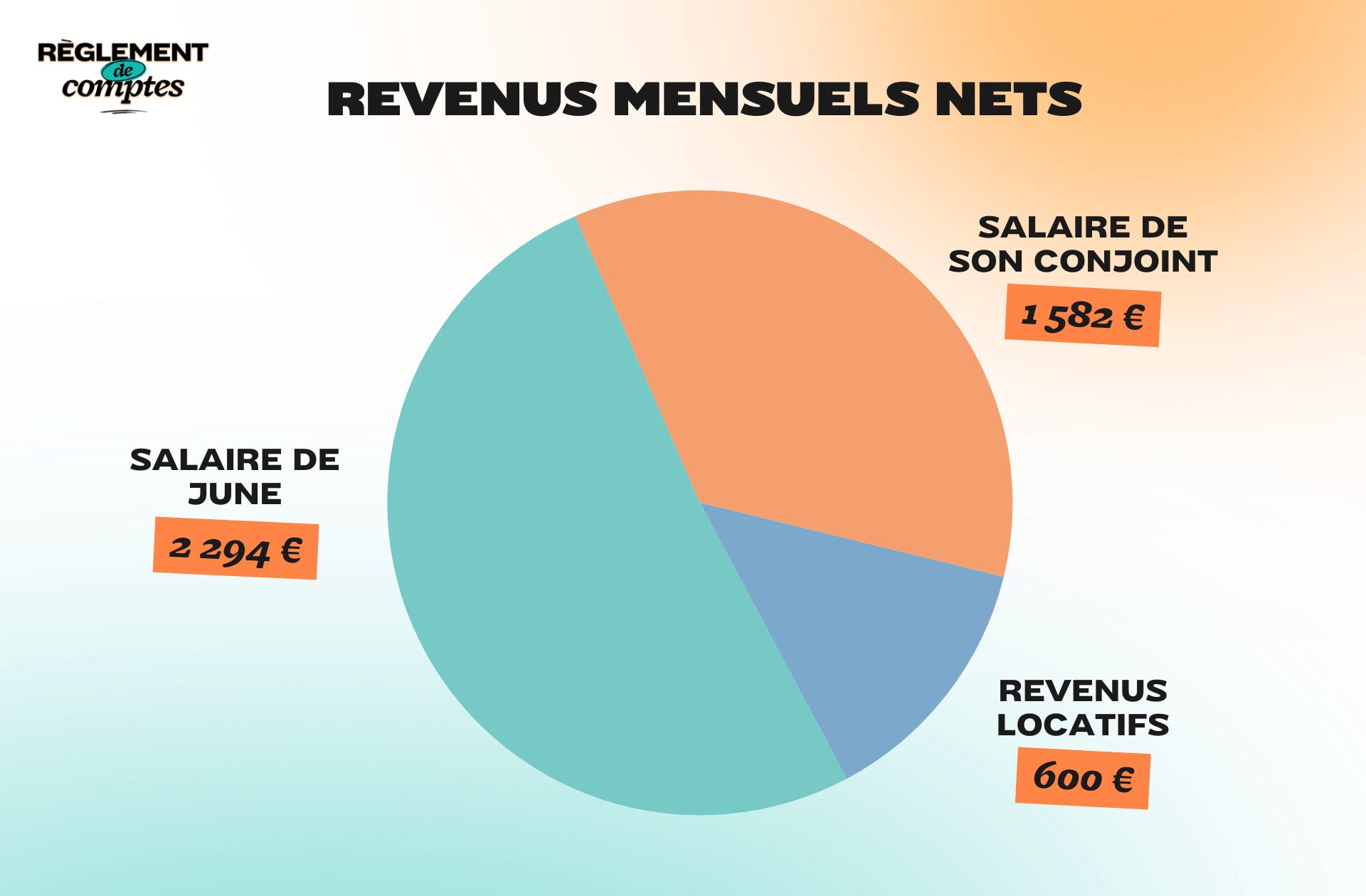

Having become a homeowner, June decided to invest in rental properties while maintaining her apartment, whichrents €600 per month.

It was important to me to preserve this property. I am very happy to have been able to purchase this first apartment five years ago at a lower cost and without a down payment, and to have had my father’s help with the work. I bought it myself because I want to protect myself in case of unforeseen events and then I want to reduce my working hours and have an additional salary. »

For her work as a teacher, June receives a net salary of €2,558.39brought to €2,287.29 net of income tax.

“I feel paid correctly, but I don’t necessarily feel “well” paid in consideration of my studies (bac +5 and specialization), in consideration of inflation and also in consideration of the work done and the mental load. »

June’s partner, for his part, receives a net salary of €1,582. With the rent of June’s apartment, the couple therefore lives every month on 4,476 euros.

June’s relationship with money and her financial organization

June grew up with parents who were far from wealthy but who knew how to manage their budget well.

“We didn’t necessarily go on holiday every year, but I never felt like I missed it. I also feel, looking back, that I had too much. »

By his admission, Nothing was ever missing in June and has always benefited from the financial support of his parents, both to help him finance his license and his studies. “Until we had a steady job, our parents helped us. They still help us even when we don’t ask for it.

“We still worked as soon as possible: for me BAFA then the leisure centre. And when we were younger, good report cards had a value: 15 to 30 euros per quarter and a gift for the Brevet and the Baccalaureate. So I equated “good work” with appreciation through money. »

June is now aware of this value of money thanks to her parents and tries to control her finances as best she can, sometimes even if this means being a little anxious about spending too much.

“I had it a lot tendency to be “afraid” of spending and for me feeling guilty about large expenses (like a PC, a telephone, etc.) but I try to keep these types of objects for as long as possible or reuse them in class during changes. I also buy a lot of books (but I take care of myself!). »

Rarely in excess, June sometimes allows herself a little “folly”even if he always tries to favor quality over quantity.

As for the financial organization you created with your spouse, it includes a joint account for joint expenses and their personal accounts.

“Earning more than him, I proposed a pro rata system or pooling everything and releasing a similar amount from each of our accounts but for the moment he isn’t up to it. »

June expenses

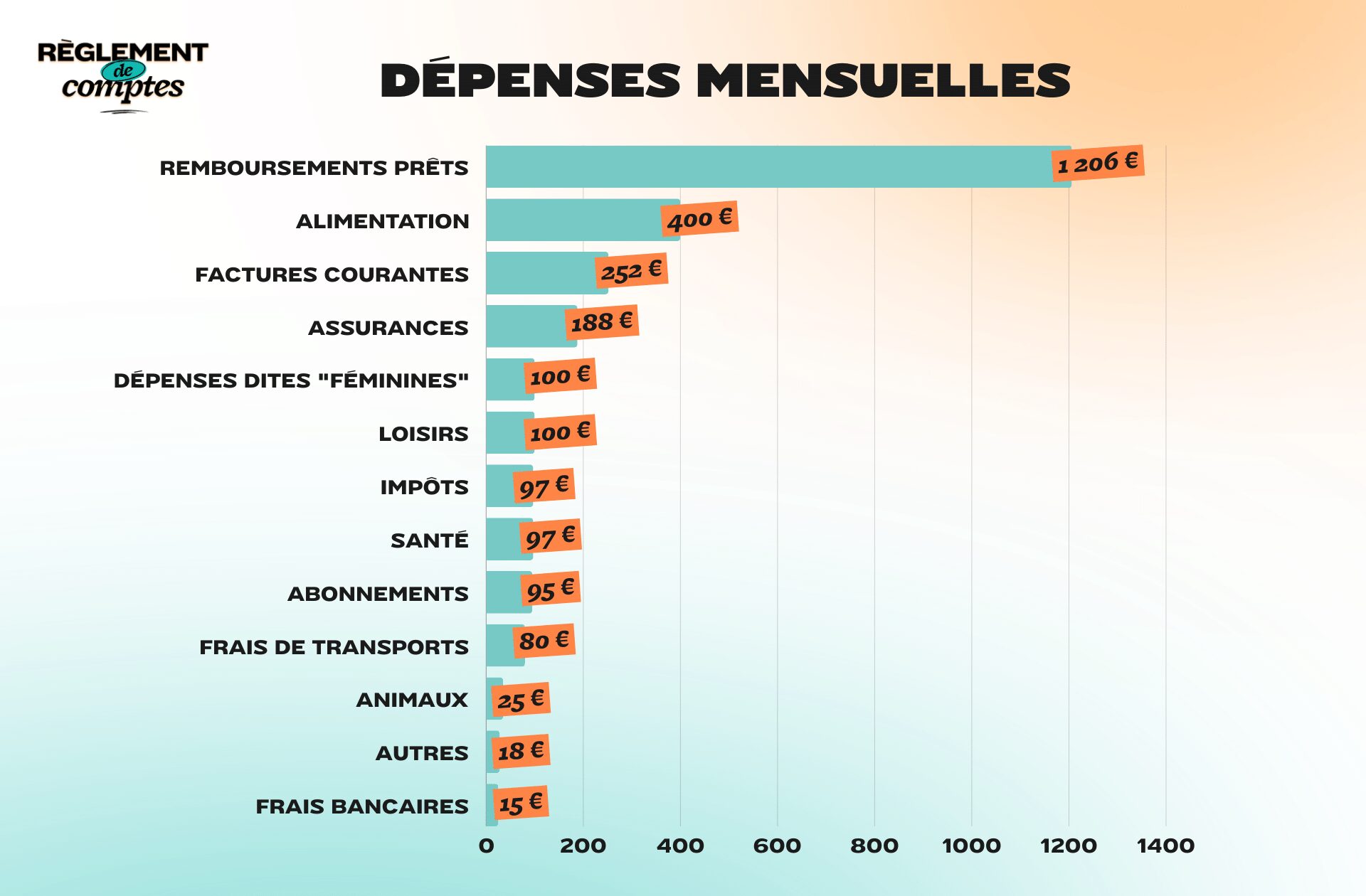

June and her partner’s first expense item is repaying their home loans. For their home, they repay 721 euros per month. June also pays off €485 for his apartment that he rented.

The couple’s fixed expenses include Monthly bills of €252 (€195 for gas and electricity, €57 water supply), €95.50 for various subscriptions (€45 for the telephone, €30 for the Internet, €13.50 for Netflix and €7 for Amazon Prime), €15 bank charges AND €188 for insurance. In details : €113 for two cars, €5.50 for the loan of the apartment, €18.18 for the loan of their house, €37.99 for home insurance e €13.13 as homeowner’s insurance.

As owners, they pay every month property tax of €97 AND Fiduciary fees €18.

June and her partner each have their own car. They use them both to go to work and for leisure, which is their responsibility. €80 total for petrol and parking (€1.20 per day). “Since we are in a small city, public transportation is restrictive. »

From a food perspective, June estimates their monthly expenditure between €350 and €400 per monthmainly in the drive-thru of major brands due to time constraints.

“We don’t pay much attention to brands or organic products, we do it based on promotions. Furthermore, we regularly eat in the canteen of our respective factories. Our meals cost around €3. My partner eats there four times a week and I eat twice, and only during school periods. »

However, there is one expense that June would like to reduce: that of meal delivery.

“We order regularly, often out of laziness. Because it relieves me of a task and mental load, I have had a hard time letting it go. »

In addition to food expenses, June also lists Monthly fee of €25 for your cat and about €100 per month of so-called “female” expenses.which distributes as follows: between 30 and 40 euros per month for armpit and facial hair removal, and 60 euros approximately every two months for products for curly hair.

“I wear makeup that I buy again when it’s empty, so not often. I’m also on a medical budget because I suffer from severe migraines and have to travel to Lille once every two to three months for appointments. »

June also suffers from vaginismus, which forces her to consult various specialists, not always reimbursed by Social Security. “I currently have a check-up once a week with the midwife for perineal rehabilitation (around 65 euros per month). I also have psychological follow-up from time to time (on hiatus because I’m away and it’s also not reimbursed). »

Currently inside “child project” with her partner she no longer has contraceptives and uses menstrual panties.

His next big purchase will be glasses, which are not fully covered by his mutual insurance: €400 not refunded. “I could have chosen less expensive frames, but I think that having to wear glasses every day it’s still more pleasant to have nice ones. Then I can afford it, maybe it’s not always like this, I’m well aware of it. »

Leisure expenses for June

June’s main hobby is reading. “I read a lot but I buy many more books than I read. » He subscribes to a box of books in English, which he receives €55 per monthshipping included. “I’m thinking of stopping it because I have a lot of reading to catch up on, but at the same time it’s my little material pleasure of the month. » She also goes to the library, a hobby that costs her nothing.

The young woman also occasionally practices yoga (€12 per session). She is a member of the gym, she has no intention of renewing her membership because for the moment she runs outdoors to prepare for an inclusive 10 km race.

“My partner and I also have a VOD budget that we pay for together. »

In total, June estimates spend €100 per month on recreational activitieswithout counting the exits. “With friends I intend to go to a restaurant at most twice a month. » She estimates this expense at “€100 per month”smoothed over the year. “But it really depends on the school holidays, during which I really get away from work. »

As for clothing expenses, which she mostly does on Vinted and private selling sites like Showroom and Veepee, June has a bit of trouble calculating them.

“I couldn’t say how much I spend. I recently made two large €180 purchases at private sales, but I know I won’t be repurchasing large pieces for several months unless I have to. »

June savings and future plans

Although the amount varies depending on the month, June regularly manages to put aside some money.

“If I do well, I can save around €500 a month. At the moment, with the work finished, I’m more interested in decorating the last rooms so I’m not saving systematically, but I put €50 less on my PEL. »

June also tries to put her money in different accounts for various projects, such as buying a new car – “mine won’t last much longer” -, future holidays or a future real estate project.

” I hope that invest in a second apartment, then create a small contribution to be able to guarantee my old age and never go to school again before the age of 67, since it is certain that I will not last until then! But for the moment and given the tariffs, it is rather complicated. »

Thanks to June* for opening her accounts for us!

* The name has been changed.

Read another one

Settlement of accounts

-

Lola, 2,244 euros per month and retraining: «This year I spent around 3 thousand euros as a hairdresser»

-

Aria and her partner, 4,296 euros per month: “We chose to save as much as possible”

-

Lucie, 4,363 euros for two a month: «Earning more than my husband, it seems natural to me to cover additional costs»

-

Nadège, formerly over-indebted at 1,766 euros a month: “I had to calculate everything down to the cent”

-

Anaïs, cross-border worker, 4,567 euros per month: “My income has tripled since I started working in Switzerland”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

What if the movie you were going to see tonight was a dump? Each week, Kalindi Ramphul gives you her opinion on which movie to see (or not) on the show The Only Opinion That Matters.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.