Talking about money in France is still a taboo. However, it is a fascinating topic… and feminist, in some respects! In Settling the Accounts, people of all kinds examine their balance sheets, tell us about their financial organization as a couple or alone and about their relationship with money. Today it was Julie who agreed to analyze her accounts for us.

- First name : Giulia

- Age : 32 years old

- Occupation : Manager/Facilitator of a coworking space

- Net salary before withholding tax : €1,550.06

- Net salary after withholding tax : €1,550.06

- People (or animals) living under the same roof : his husband

- Place of life : Charnoz-sur-Ain (Ain)

Julie’s situation and income

Julie, 32 years old, works as a manager of a coworking space in the center of Lyon. Permanent contract for almost 3 yearshe previously worked in the world of video games as a project manager and game designer, before retraining.

“When I say that ‘I take care of the space’ it means that I deal with multiple fronts: administrative, accounting reconciliation and purchasing/sales management, welcoming the public, activities and events, internal and external communication… C It is a job that requires a lot of energy, but where we receive direct feedback from colleagues and people passing by. »

Julie lives with her partner, with whom she is linked by a civil union under the separation of assets regime. After living in the heart of Lyon for their studies and at the beginning of their professional life, they decided to return to live in the countryside a year ago.

Now they ownIt is a single-storey house of 108m² with a plot of approximately 730 m2.

“Our village is small (not even a bakery but there is a school and activities) but close to a ‘town’ located 10 minutes away by bike (where there is a supermarket, a cinema, a train station, etc. ) and also at the motorway entrance. »

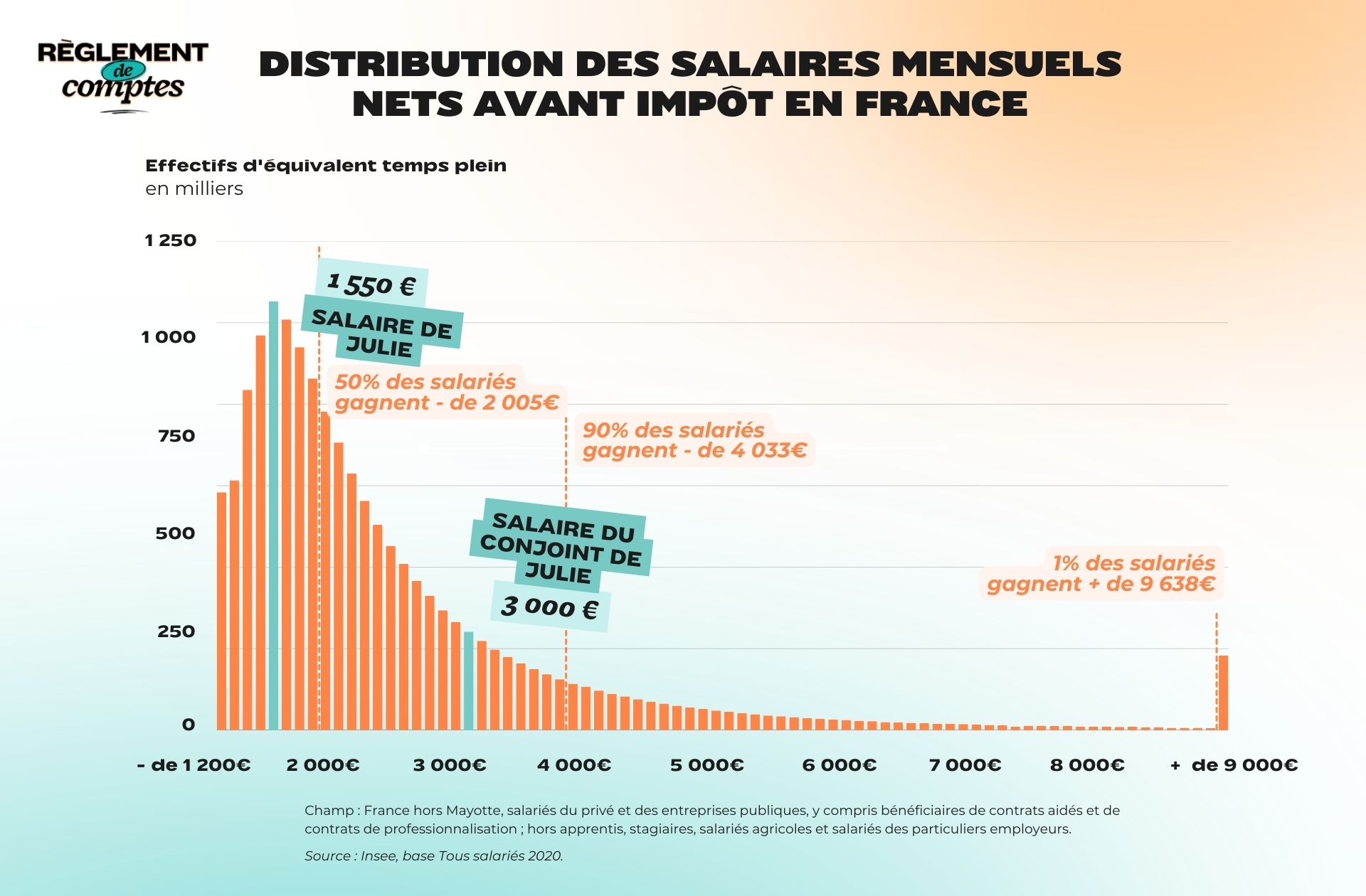

For his work as a coworking space manager, Julie receives a net income of €1,550.

“I don’t think I will receive a salary equivalent to my activities and responsibilities, but my bosses are aware of this and it is my salary that primarily benefits our facility’s earnings. When I arrived, I almost made minimum wage, which I slightly surpassed today. My employers still try to make my salary increases at least as high as the inflation rate. Obviously, given the last few years, my company hasn’t been able to make me increase more than this index to make me gain in terms of living standards, but at least I haven’t lost. »

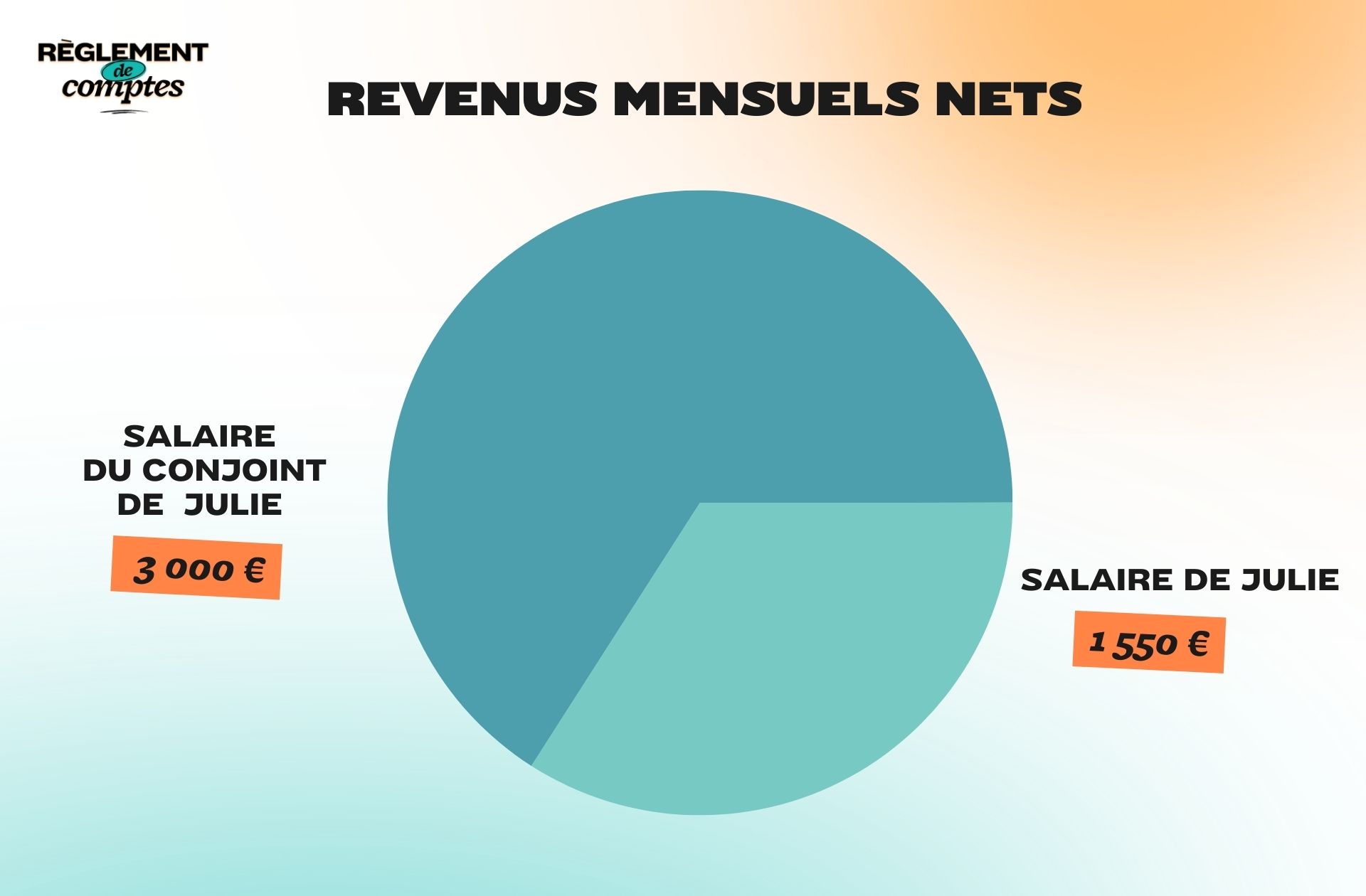

The young woman, however, does not consider herself as such ” poor “ Why she has “the possibility of being an owner” AND “don’t count your money at the end of the month”. She is also in a relationship with a partner “who earns a good living and gives her benefits”: approximately 3,000 euros net per month.

Also because he receives double his incomehe decided to take care of the income tax withholding himself.

“Income taxes are deducted from his salary because, during our PACS, I didn’t pay any and this allowed him to lower his income. »

Julie’s relationship with money and her financial organization

Julie says she grew up with a “father ant and mother cicada”.

“My father has ‘hidden accounts’, meaning my mother doesn’t know how much is in them, which allow him to manage the ups and downs of life.”

The 30-year-old has maintained this upbringing a “unsettling” discoveryand now he is doing everything he can to ensure a “a small mattress” muffle “the tile that can change your life”.

“My priority is always to have this little mattress: I set myself a level to reach in my A booklet and try to make regular monthly transfers to achieve it.

After, I give myself months without this payment, just to have a bit of fun or to offset some expenses (taxes, subscriptions to start-of-year activities, Christmas gifts, etc.). »

In terms of financial organization, Julie and her boyfriend have opted for this since purchasing their house a joint accountin addition to their respective personal accounts.

«At the beginning of each month we make a transfer to the joint account, withdrawing our salary difference quotient (1/3 and 2/3). The joint account is then used for all expenses together and we keep our personal accounts to do our own extras/personal pleasures. »

Something rare enough to point out: Julie has had health issues this year that have resulted in travel expenses. “additional medicine” not reimbursed by your mutual insurance, beyond a certain threshold. After the discussion, Julie’s partner decided to reimburse her for the advance expensesso that he can put this amount on his LDD which they use to save for doing work in their house.

“It also covers some expenses without necessarily notifying me or telling me the amounts paid. » It is the case of everything related to the carand shared shopping paid for with restaurant tickets.

Julie’s expenses

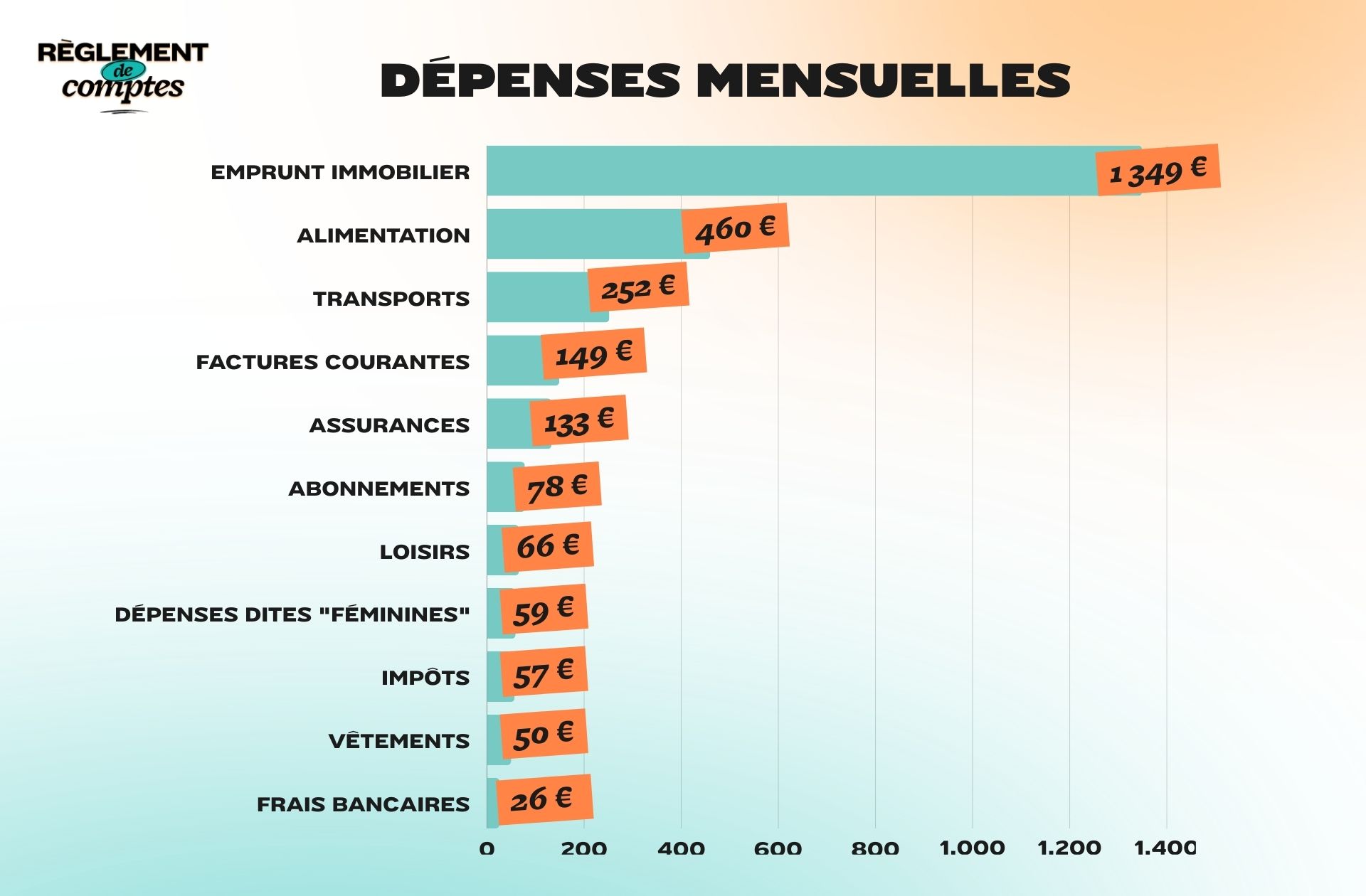

For the house in the countryside that Julie and her partner own repay €1,348.66 each month. This is their first expense item.

Current bills (electricity, water, wood heating) are due to them every month. €149while they pay €133 for insurance (house, mortgage for both and full car insurance).

If Julie’s partner pays income tax alone, they will pay togethera property tax (€57.42). Both also pay for home subscriptions: internet, Netflix, two cell phones and Spotify for a total of €78plus bank charges estimated at €25 for two.

Another important cost for the couple: that relating to transport.

“We are a 30 minute drive from my partner’s work, which is close to Lyon and opposite the metro which allows me to go to work. Since he can telework and that’s not really an option for me, I also take public transportation on days we don’t carpool. »

These daily trips cost them €252 for two per month. The public transport season ticket, the motorway season ticket, the cost of tolls and petrol are included.

“Everything except Temu and Amazon”

As regards the food balance, Julie estimates it at around 460 euros a month for her and her partner.. This includes travel to major brands (Carrefour, Intermarché), as well as to “a wholesale shop in the little town next door”.

“We’re trying to find a compromise between quality and pricebut we haven’t yet identified local producers in our new home (Wednesday morning market, etc.).

I try to buy as little as possible online (and above all not on Temu or Amazon) and favor local and physical brands, but this is not always possible (price, times, choice of products, etc.). »

Julie’s “women’s shopping” budget is largely included in her shopping budget (on average €60 per month). This is especially true for periodic protection, makeup (about 10 euros per month) and soaps and shampoos (30 euros for two).

“I used the cup before the contraceptive change and I tried pads and menstrual panties, but one is quite complicated to manage outdoors and the other doesn’t suit me. »

For hair removal, “there are clearly two seasons” Julie recognizes. “I’m going to the beautician who has to take me €50-60 per passage and intact with razor/strip at home, which should bring a monthly expense of €15-30. » The young woman has an IUD and therefore has no contraceptive costs.

Julie’s leisure expenses

Each month, Julie roughly estimates her spending €66 for recreational activities. This expense includes theater membership (€45 per year) and tennis membership (€342 per year).

“Other than that, I have some creative hobbies, but I’m waiting to get back to them before purchasing new materials. I can set aside €100 per month if necessary for these activities, but I can’t do it every time. These are therefore one-off expenses and more of a lack of time than a lack of funding is at play. »

Julie also enjoys playing video games, but waits until Christmas or her birthday to get new games.

“Above all, I would like to have a defined and larger budget for holidays, being able to go and carry out memorable activities on site. They are important moments because they allow you to take a break, stay in your bubble and have time for yourself so as not to lose track of your daily life. »

When it comes to clothing expenses, Julie says “buy little” and indulge in some pleasure shopping only twice a year, which equates to Monthly expenses around €50. The young woman has no expenses that she would like to limit. On the contrary, she would like to “let yourself go and consume more lightly, without doing market research to make sure you choose well”.

Her last breakdown was in July, when she bought a dress for a wedding ceremony.

“I ended up at Galeries Lafayette, in Bash, where I spent an absolutely indecent amount on a dress that corresponded to what I wanted but which will in fact rarely be used. »

Julie’s savings and future plans

At the end of the month, once all expenses are covered, Julie will have approx €200 savingshalf of which she deposits in her A book, while the other is deposited in her LDD for the work that she and her partner want to carry out in their home.

“What remains drowns in the municipality depending on monthly fluctuations. I still haven’t fully understood ‘how’ I’ve been spending since the mortgage and joint account arrived, so it’s difficult to take stock of ‘leisure/leisure’ expenses, especially with the health problems that have taken off quite a bit in recent months too. and that should calm down by the middle of next year. »

In the future, Julie hopes above all to put an end to her health problems. She would like to do it too “have visibility on work estimates” that they wish to achieve, even just to find out if they will need to ask for a loan.

“Being in my thirties, the family issue is currentbut it is also a big cost to foresee, as well as an upheaval of daily life that has not yet stabilized…”

Thanks to Julie for opening her accounts for us.

Read another one

Settlement of accounts

-

Raphaëlle, salary of 1,340 euros per month: “I consider myself poor”

-

Lili, 1,417 euros per month: “I don’t like money and I’m afraid of running out of it”

-

Isabelle, 11,295 euros for two: “I have a bad tendency to invest in real estate”

-

Lina, 1,854 euros per month: “In business schools they sell us incredible salaries upon leaving, but the reality is very different”

-

Salomé, 1,667 euros per month: “With my boyfriend we don’t do 50/50 because he earns double my salary”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Do you like our articles? You’ll love our newsletters! Sign up for free on this page.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.