Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In the Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today Assia agreed to check her accounts for us.

- First name : Asia

- Age : 27 years old

- Job : Advertising manager

- LIFE allowance and stipend: €1,718 allowance from his company, €280 employer contribution for accommodation and €320 salary for the private lessons he gives together

- Place of life: an apartment he rents in Lisbon

- Lives alone

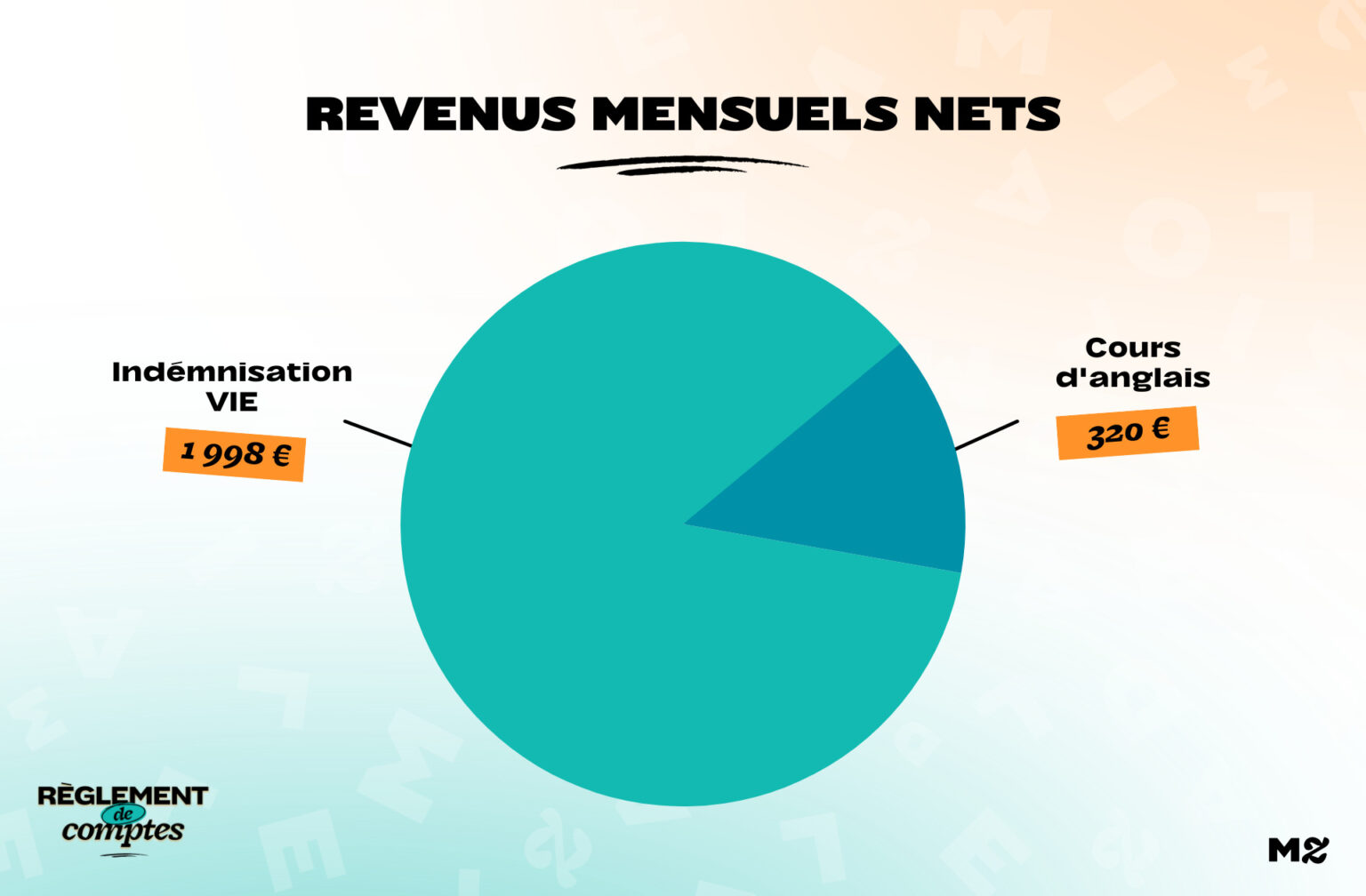

The income of Asia

Assia is an advertising manager and participates in International Corporate Volunteering, a program that enables young people between the ages of 18 and 28 to serve a paid mission overseas.

“There are VIE offers in all sectors, mine is advertising. This contract is special: during its duration (two years in my case, which is the maximum duration), I don’t contribute to social security, to the job center or even to my pension. »

It is paid with a cheque €1,718 per month, plus €280 employer contribution for housing. A salary that you consider very good, compared to the Portuguese average salaries:

“Compared to the local population, I am VERY well paid. The Portuguese minimum wage is €705… However, I would still say they are average. I honestly don’t have an extravagant lifestyle and my salary should more than allow me to make a decent living. but I always find myself negative at the end of the month since my arrival in April.

If I had a Portuguese salary, I don’t know what I would do! »

This is not her only source of income as she also receives €320 per month for private lessons it gives:

“Since January 2023 I have been informally teaching remote English lessons to a former student whom I had mentored through a mentorship programme. It doesn’t hurt my budget! »

In all, it manages a budget of €2,318 per month.

Expenditure of Hesse

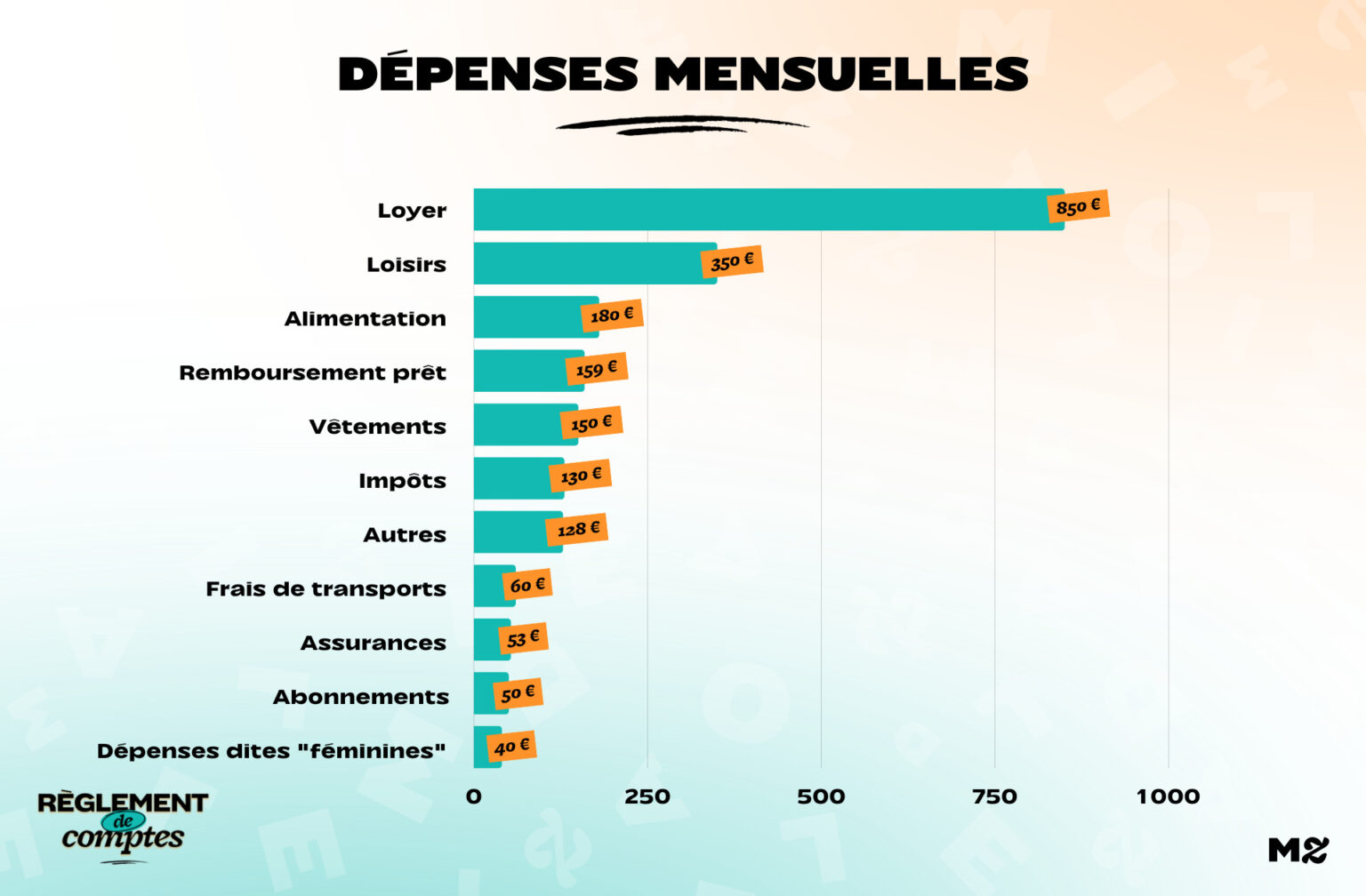

Each month, Hesse’s biggest expense is the rent, which it accounts for €850including expenses:

“Before arriving in Lisbon, I looked for accommodation on specialized websites but it was impossible for me to find what I needed in the city center, in my price range.

My accommodation is 7km away from my workplace, which my colleagues find “far away”. But not wanting to live with a roommate, I had to compromise and settle down a bit further away on my own. My apartment is 45m2 and it’s fairly new, in a somewhat dated building. »

His current bills for water, electricity and heating are included in your rent. His season tickets cost him €50 and includes his phone subscription, YouTube Premium, Netflix and ELLE magazine. Every month she pays €53 for your insurance (civil liability, auto and two life insurance).

He also includes in his fixed costs a student loan taken out for his car, which he repays up to a maximum €159 per monthto which she is engaged until approximately March 2024.

In recent months, he has paid a tax adjustment of €130 per month which ends next month. Then, since his VIE is not taxable, he will no longer pay taxes on his income.

“I would like to reduce my budget for snacks and food delivery”

Hessian purchase costs represent €180 per month he spends in different spaces:

“In Portugal I registered with an AMAP. Every week I will collect a 5 kg basket of fruit and vegetables for 3.9 euros.

Beyond the price which is great, I really wanted to support local agriculture. These are fruits and vegetables whose size does not allow them to be sold in shops. AMAP is also called Fruit Feia (ugly fruit in Portuguese).

I complete this basket with shopping at Lidl, the store closest to my house and which suits me well (but whose assortment is even less varied than in France). »

Food also makes up a big part of your leisure budget of approx €350 per month:

” The food I don’t cook it accounts for a large part of my expenses. It is a source of pleasure and satisfaction, so it’s important! Restaurants, fast food, snacks or lunches can cost me dearly. I don’t have a budget set aside, though I’d like to limit myself to two restaurants a week and two fast food crackdowns a month. I should reduce my budget for snacking and ordering meals via apps.

It’s a pleasure, but it’s also a bit of a guilt. It’s money I often spend on a whim. If I limited myself, maybe I’d take advantage of it a little more by telling myself “I deserved my restaurant”. »

She spends €100 per month for sports sessions with a private coach.

His monthly trips, which cost him about €60often expect short journeys in VTC and would like to avoid these expenses. “Travel is much cheaper than in France, but by abusing these services, the budget they represent can quickly go up”

The last cracks of Hesse

When asked about her latest crush, Assia mentions a shopping session on her latest return to France:

“I fell in love with clothes and shoes from brands that I can’t find in Portugal. I got it for €300 with post-Christmas promotions and private sales. »

She spends on average €150 a month for clothesa budget that evolved in contact with his VIE colleagues:

“In my company we are quite young and many girls like to dress in the same stores, quite expensive French brands. Rather, I tend to buy in traditional shops or on private sales sites, but seeing their way of consuming, I started thinking about mine.

It’s not really social pressure, more a question: shouldn’t I also consume better, be more careful? »

Finally, cracks aside, its budget includes €40 per month of so-called female expenses (make-up, beauty products, shaving/waxing, hygienic protection, etc.). This sum includes, among other things, around €10 a month for hair removal, a manicure a quarter.

“Every month I end up with −200 or −300€ in my account”

When all these expenses add up, Hesse should still have some money left in his account. However, since his arrival in Portugal, he explains that he has closed every month in the red:

“Before COVID and despite my mother’s difficult financial situation, I was by no means thrifty. I lived with my mother (no rent, just helped with the shopping occasionally) and despite that I never saved up, all my salary was spent on shopping or food/restaurants.

I took a liking to saving during the first birth, with being unable to spend out. Then life resumed its course and I kept this awareness that I had to save.

Yet since I’ve been in Portugal, I’ve been consistently overcharged, by around €300. I’m not proud of it. »

The young woman explains that she has trouble explaining where the costs that cause her to go over her budget come from:

“I tried to analyze my expenses a bit (with apps for example), and I didn’t quite understand: I don’t drink alcohol, I don’t go out every night… I think these are small expenses right on the left: a snack here , a VTC trip there. I can’t identify a major expense item that explains why I’m in the red. »

Hessen’s savings

To better manage her budget, Assia decided last September to take out a PEL and life insurance, in order to lock in the money she saves.

“My popular savings account acts as an emergency fund and allows me to bail out when I’m overdrawn. But it’s a pity to use my savings like that.

To avoid this, I transferred some of my savings to a PEL and life insurance. i’m doing a €50 monthly transfer to my PEL, which I would like to raise to 150 € soon. »

For some months she has also been trying to rebalance her budget thanks to Instagram accounts that help her in her financial education, but also to an account on an online bank:

“Furthermore, since October I have had an online account where I can deposit an amount that would serve as my monthly budget (no authorized overdrafts like I can have on my historical bank). At the moment this method is not paying off as December passes… but I hope it will be by February.

In the future, she would like to buy a property herself.

Thanks to Assia for opening her accounts for us!

Settlement accounts look for new profiles! To participate write to us at [email protected] with a short presentation

Front page photo credit: Zino de Groot / Pexels

We need you to build the future of Madmoizelle: take part in our survey!

read another

Settle accounts

-

Olivia, 768 euros a month: “I don’t have a fridge at home”

-

Rose, 2,356 euros per month: “I save 2,000 euros per month”

-

Emma, 900 euros a month: “I’m constantly exposed and it doesn’t stress me”

-

Carole, 2,700 euros a month in Martinique: “The system is a bit unfair to single mothers”

-

Anne, 2,415 euros per month: “I have my own work-study program, I give lessons and I babysit”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.

.png)