The perfumery and cosmetics market in Russia is among the top ten in terms of turnover – 610 companies, more than 4,000 brands and steady growth over the past few years. True, by the end of February this year, most of the market consisted of imported products. Therefore, when large foreign brands and chains of perfumes and cosmetics (such as Sephora) left Russia, high hopes were placed on domestic manufacturers not only to replace foreign brands, but also to preserve the quality of existing products.

With the first, things are quite successful – in the last three years, hundreds of new brands with the prefix “made in Russia” have appeared in Russia. Consumers are less and less prejudiced based on the stereotype that “foreign cosmetics are a guarantee of quality, but Russian cosmetics are not”. With the preservation of the original composition of the funds, it is already more difficult – about 40% of the necessary cosmetic raw materials were imported into our country from Europe and the USA by the end of February. Of course, not all Western companies broke off relations with Russia, but they had to rebuild their supply chains, constantly adapting to new restrictions and increasing the cost of raw materials (1.5-3 times). How do domestic beauty brands live six months after the imposition of sanctions, is it true that there are no raw materials and packaging for the production of cosmetic products in Russia, and is the existing capacity of the factories sufficient for the further development of local brands?

Where do they find the raw material now?

Most Russian cosmetics manufacturers have stocks of foreign raw materials six months or a year in advance, although most (but not all) European distributors have stopped their supplies. However, since no one knows the future of imports, the search for new suppliers continues.

The “logistical shoulder” lengthened, but the supply did not stop. At the same time, yes, we are constantly in search of suppliers not only in Russia, but also in friendly countries,” says Konstantin Kuklin, biotechnologist, technologist-developer of the Eden and Stomatol brands.

In addition to cooperation with domestic producers of raw materials, Russian companies are discovering new importers. They are mainly suppliers from Turkey, India and Asian countries. In this way, technologists manage to find alternatives that are fully consistent with European and American ingredients in terms of quality and chemical composition, and avoid changing formulas. For example, Ekaterina Brem, Director of Research and Development at Natura Siberica, described the successful replacement of ingredients (primarily scarce surfactants and softeners) with analogues without losing the quality of the products. The same successes were shared by the technology experts of the Aravia brand. And Krasnopolyansk Cosmetics representatives have developed their own emulsifiers and launched several new products on it.

Imports from other countries also come to the rescue of brands. For example, you can find and buy European content through China, but only if the manufacturer does not follow up with the final buyer. But despite the entrepreneurial spirit of brands and the possibility of detours that still exist, there are still many, many, many components that cannot be changed.

What imported raw materials cannot be exchanged for Russian ones?

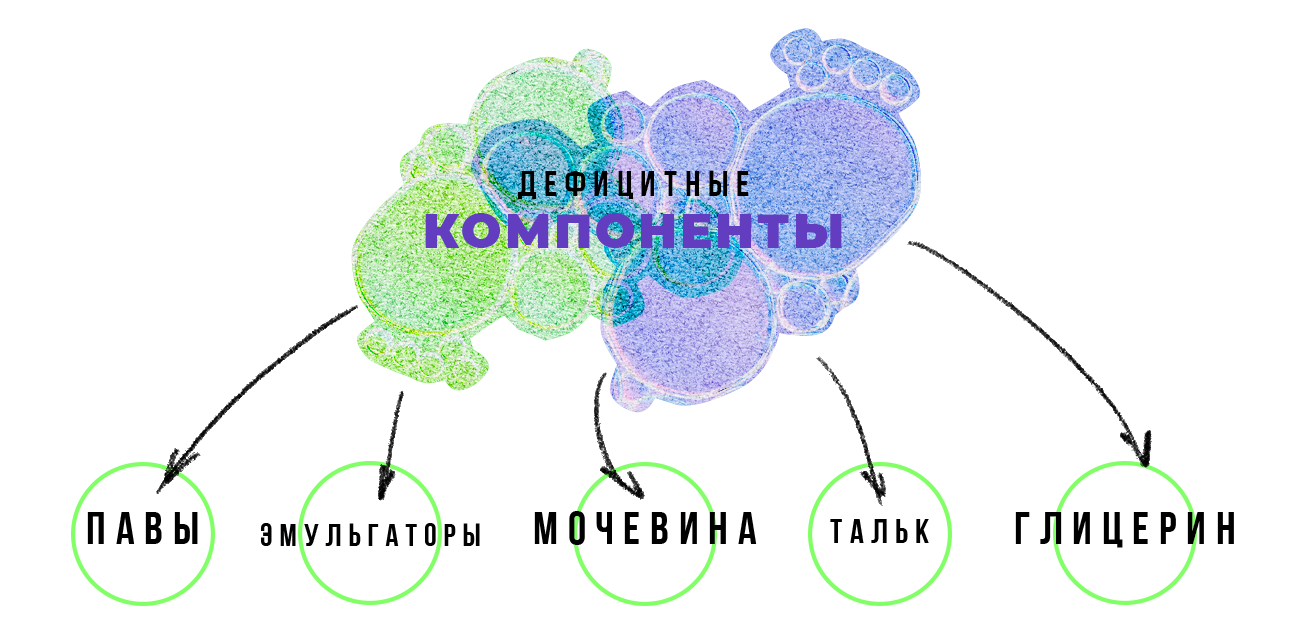

In February, RPKA (Russian Perfume and Cosmetics Association) interviewed our manufacturers and compiled a list of the most sought-after ingredients at risk of under-supply. More than 2000 products have appeared, and 250 of them form the basis of many cosmetic products. It also contains surfactants, emulsifiers, benzyl alcohol, urea, talc, glycerin and others, which everyone knows.

Most of the long-list items are not produced in Russia – there is no expensive equipment and technology to ensure that the quality of components meets international standards. For example, glycerine, which our manufacturers require in the amount of 10,000 tons per year, has always been imported because, according to Tatyana Puchkova, chairman of the board of RPKA and president of the National Association of Cosmetic Chemists, “it is not sufficiently purified for use in cosmetics.”

Another important gap is the lack of production of UV filters in Russia. Adel Miftahova, founder of Don’t Touch My Skin brand, says that all sunscreen manufacturers are short of sunscreen. The fact is that a new generation of physical filters is patented and produced exclusively by BASF, which no longer supplies products to Russia.

What is produced and done well in Russia?

If there is not enough technology for the production of complex components in Russia, you do not have to worry about the lack of biologically active components. We have a wide range of plant extracts and essential oils derived from local raw materials (eg pine, lavender, chamomile or juniper). However, if the brand’s technologists want to add, for example, lemongrass extract or sandalwood oil to their cosmetics, they are unlikely to find them. In this case, some producers are saved by owning their own farm. For example, Krasnopolyanskaya Cosmetics brand has a farm in Sochi where they grow and extract exotic plant extracts and assets (approx. ed. – at the time of publication of the text, the court ordered Krasnopolyanskaya Cosmetics to vacate the leased land, but representatives of the brand plan to appeal the decision). They are the only ones growing aloe vera and prickly pear cactus in Russia. The latter is now gaining momentum and is becoming especially popular in Europe and America.

The Natura Siberica brand also has its own certified organic farms in Siberia and the Far East, but despite this, it continues to look for Russian suppliers and successfully. Representatives of the brand shared with us that they recently successfully tested the new active ingredient ExtPine from the Russian company Greenext – an aqueous extract of the trunk of golden pine with cleansing, antimicrobial and moisturizing properties.

The Kaliningrad company Varseas, the main distributor of Russian marine collagen, is responsible for the supply of marine-derived components. The Arkhangelsk Algae Plant extracts and processes arctic algae and produces from them components that can be used in cosmetics – micronized algae, polysaccharides and various extracts.

Scrubbing particles are produced in Russia by the Ecokremniy company. The product range includes natural brushes made from silicon dioxide, polyethylene, apricot kernels, walnut shells and pine nut shells.

That is why most of the raw materials that Russian companies can supply to cosmetics manufacturers are of natural origin.

But what about the packaging in Russia?

Most of the cosmetic packaging materials and components in their composition are imported. For this reason, brands that benefited from the services of European, Polish and Italian production had problems with logistics. But the brands working on the packaging of domestic and Chinese production were a little luckier. While the Chinese one has become one and a half times cheaper due to the dollar exchange rate, the Russian one has not changed in value.

Currently, only the most popular plastic bottles and some packaging cardboard are produced in Russia, but not in volumes that can meet the needs of all domestic companies.

The packaging issue is particularly acute for eco-brands using materials such as aluminum or glass. The first is produced in Russia by Rusal holding, one of the important suppliers in the world market. But Rusal’s role ends with distribution – foreign companies have always been responsible for the production of aluminum cans and tubes (that is, the transformation of an aluminum sheet into packaging familiar to everyone).

However, domestic manufacturers, various distributors, tubes, etc. specializes in new packaging formats, including In 2023, Russia plans to establish a cardboard factory in Ust-Ilimsk, and recently a large manufacturer of personal care products, cosmetics and household chemicals has applied to the Cotton Club (Ya Samaya, Aura brands) Industrial Development Fund for a loan of 500 million. rubles for the manufacture of packaging for cosmetics. Although such news is not encouraging, the question of our technologies remains – how advanced are they for modern packaging production and can they meet world standards?

Are there enough factories for the production of cosmetics in Russia?

Of course, the general interest and attention shown to domestic producers has a positive effect on production volumes, but can the factories cope with it?

According to Anna Dycheva-Smirnova, General Manager of Reed Exhibitions Russia and organizer of the InterCHARM fair, there are 610 companies in the production of perfumes and cosmetics in Russia. There are 182 manufacturers with their own factories and more than 400 launch brands through contract manufacturing. The latter works according to this scheme – a brand that does not have the necessary capacity to order products from an independent manufacturer, which provides quality control according to the customer’s requirements. And just because there are more and more new cosmetic brands every year, existing factories aren’t always enough.

According to domestic brands, production has really intensified now. For example, at the end of June it became known that Aravia is building a factory in the Moscow region. However, representatives of the brand told the editors that its primary task is to expand production primarily for products under its own brand. Another good news is that a production and logistics complex will be built in the Leningrad Region for LLC Revada, a company specializing in the supply of raw materials for the cosmetics industry and household chemicals. This cannot but give hope that the state is interested in the development of the Russian cosmetics industry, and sooner or later the production will be ready for an ever-increasing volume.

Source: People Talk

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.