Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today, Audrey agreed to check her accounts for us.

- First name : Audrey

- Age : 35 years

- Work : director’s assistant in the civil service

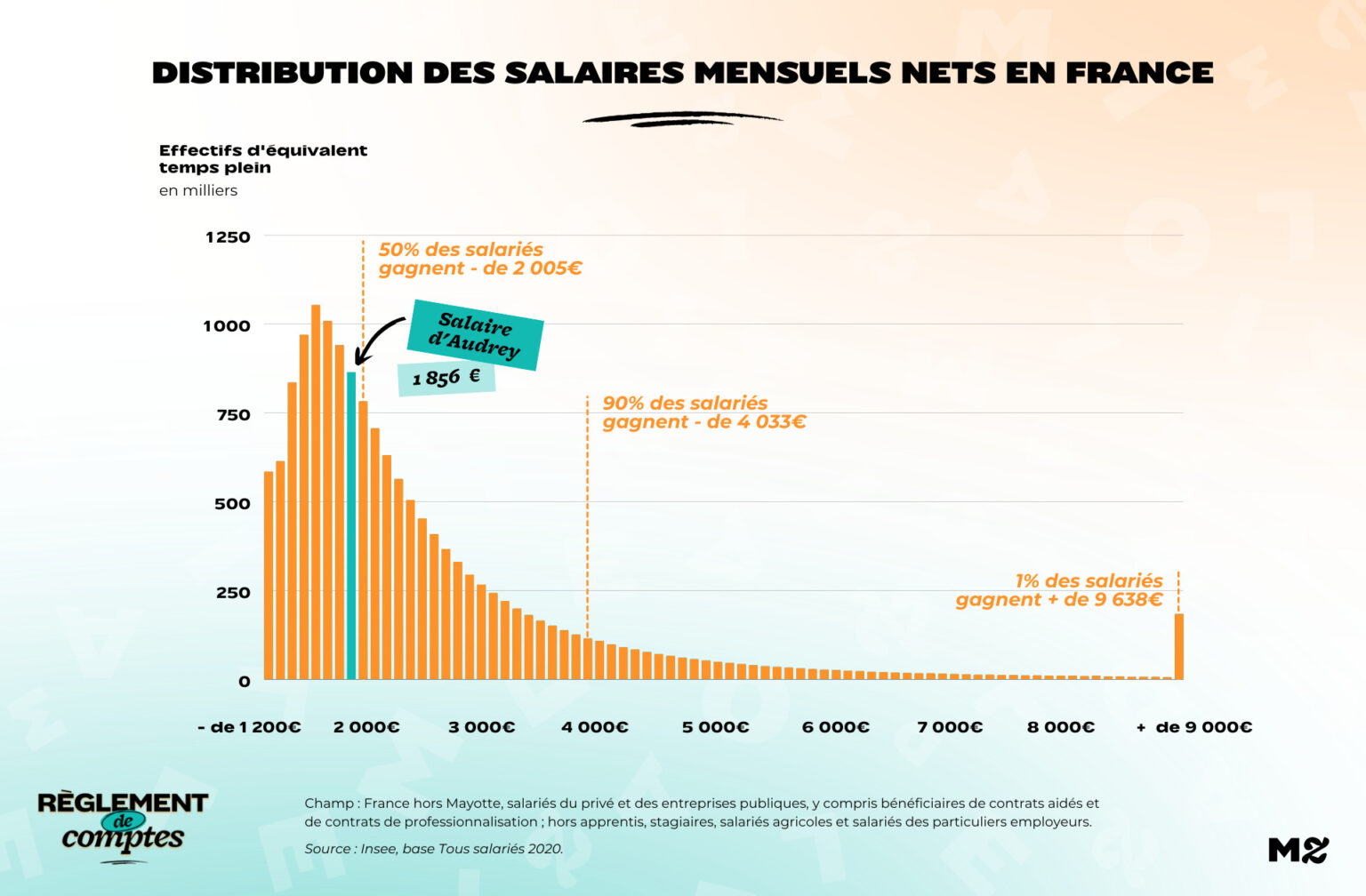

- Net monthly salary after withholding tax: €1,856

- Lives with : a cat

- Place of life: an apartment for rent in the Dijon conurbation

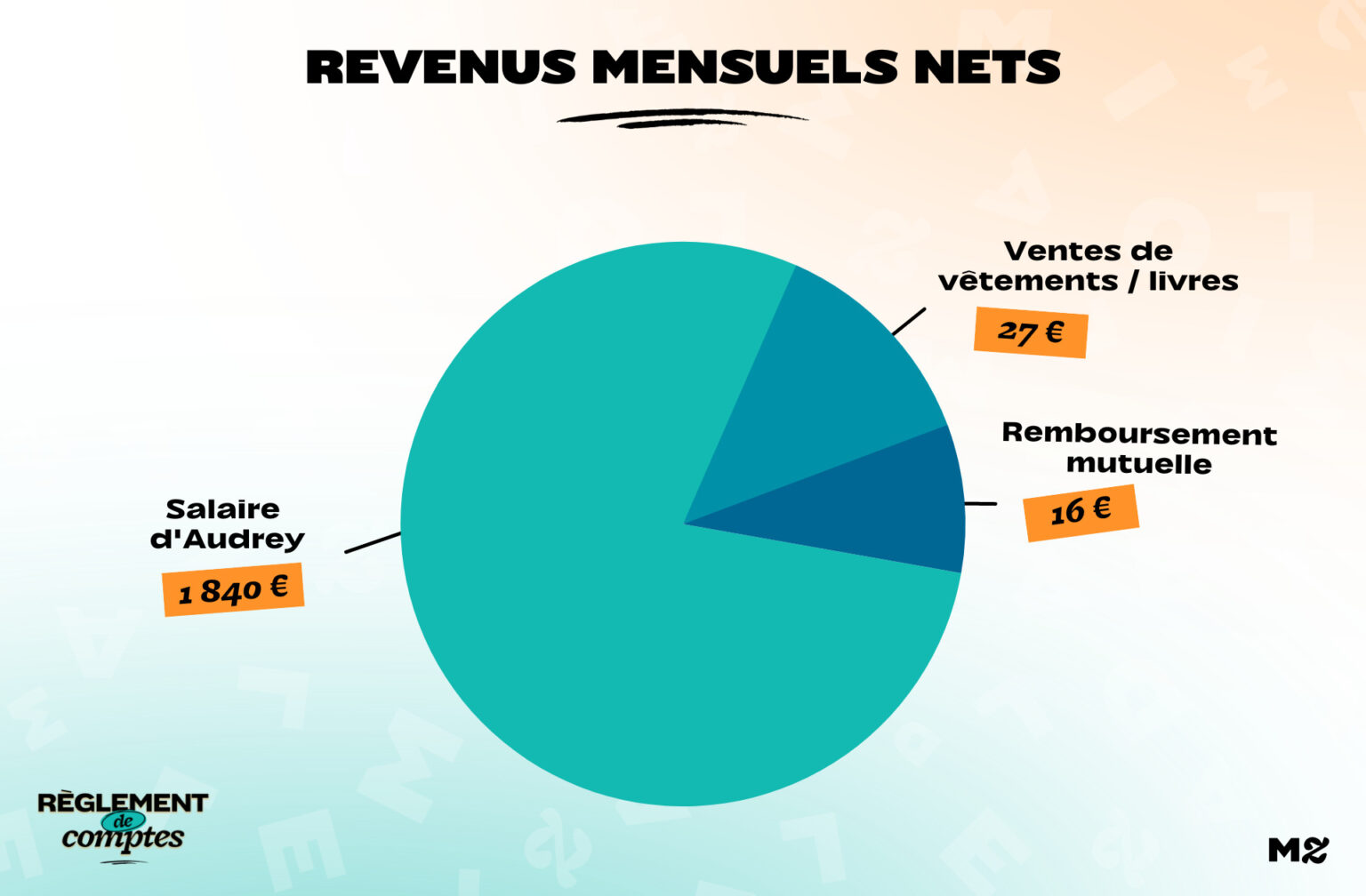

Audrey’s income

For her job as assistant manager in the state public administration, Audrey receives a salary of 1,856 euros net per month, of which 16 euros is reimbursement of mutual insurance expenses by her employer. She considers herself an average person, but paid little compared to the qualifications required by her position:

“I don’t think I’m well paid for an intermediate profession where you can have big financial responsibilities and a team to lead. There are bonuses, but they aren’t huge.

It is a salary considered normal in public service and I consider myself financially average. However, I would like to have a slightly higher salary so that I don’t have to think about every expense. »

She regularly sells books and clothes on Vinted and estimates it earns her around 27 euros a month. In all, it manages a budget of 1,883 euros per month.

Audrey’s relationship with money

The 30-year-old believes she maintains a fairly healthy relationship with money: She’s never overdrawn and draws on her savings account as needed to fund her checking account. She checks her accounts once a week to see if she can afford certain expenses.

“I should check all my expenses one by one at the end of the month, but I can’t start because the cuts in my checking account are not always clear, and I can’t remember how much money it corresponds to! The only way would be to note all my expenses every day on an excel sheet, but I know I would have a hard time complying with it. »

He says he tries to optimize each of his spending items to save money:

“My rent, insurance, electricity, phone and health insurance are direct debit. I pay my insurance once a year to avoid monthly direct debit fees. I use my phone as a wifi point so I don’t have to pay a subscription for a box. For my litter and cat food, I buy in bulk. I would like to do the same for food, but I don’t have enough space in my house. »

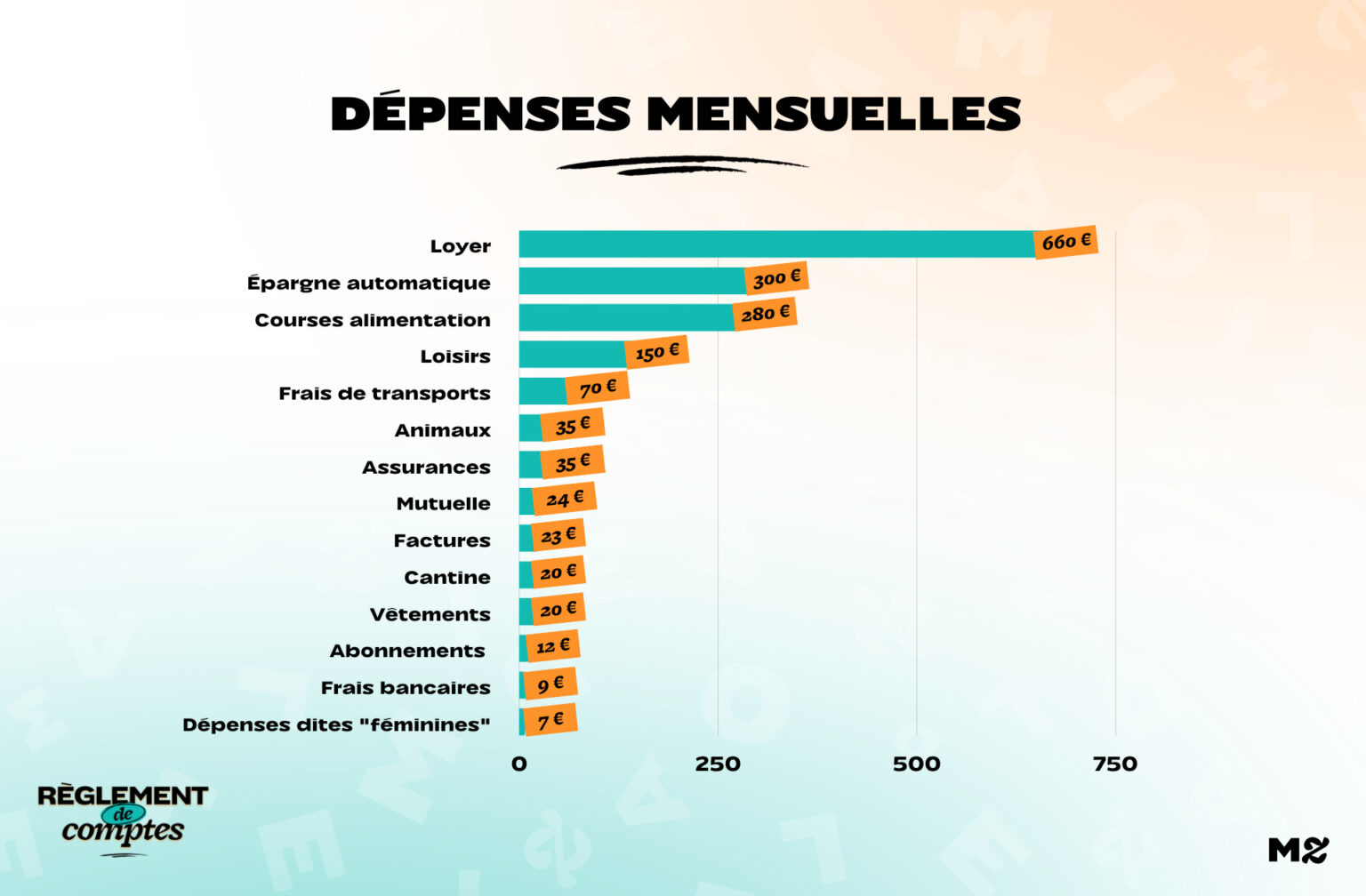

Audrey’s expenses

Audrey has been a tenant of a for 2 years 45m2 apartment in the urban area of Dijon.

“I chose it because it had an external terrace overlooking a large park. So not opposite and my cat can go out without too much risk of being hit by a car. There are also some strips of land that have allowed me to plant aromatic herbs. I rent until I can buy.

His monthly rent costs him €660 which includes utilities, water and heating. Also dedicate each month €23 to their electricity bills, €12 to your telephone subscription which also serves as your Internet access e €12 his home insurance (€154 a year, which he pays in one go).

He owns a car, which has been his main means of transportation for several months:

“At the moment I take the car for all my trips, because the city’s public transport has been on strike for months. It costs me €70 of petrol per month. I’m avoiding long country drives to save gas at the moment.

Before the strikes (and inflation) I spent 40 euros a month on petrol and 40 euros a month on public transport passes (half reimbursed by my employer). »

In addition to petrol, his car costs him 274 euros in annual insurance, that is €22 per month.

Finally, its fixed costs include €24 health insurance (of which €16 reimbursed by your employer) e €9 Bank charges.

“Some ends of the month are a little tight”

As for shopping, the assistant manager spends 280 euros a month, which he divides between the supermarket and agricultural products:

For fruit and vegetables, I’m lucky enough to have a farm 5 minutes by car from my house where vegetables aren’t really expensive because you can pick them yourself. For the rest, I usually go to a supermarket once a week.

Sometimes she has lunch in her work cafeteria, which costs her €20 per month. For her cat, she buys bulk products that come back to her €35 monthly.

Every three months she goes to the hairdresser to keep her hair cut short.

“It costs me about 7 euros a month flattened out over the year, and I hate having to pay double as men when I’m just 10 centimeters long on my head! »

On her overall budget, Audrey wishes she could reduce some expense items:

“Some ends of the month are a little tight. I would like to reduce the food budget item but I am intolerant to many foods. So I have to rely on gluten-free or lactose-free products that are only found in supermarkets (or organic shops, which cost too much).

I would also like to reduce my bank charges, which seem very expensive to me, to let the money sleep in my accounts. I’m thinking of renting a cheaper apartment while waiting to buy, but there are very few offers with an outsider in my prices in Dijon. Even my health insurance costs me too much for the few (reimbursed) doctors I see during the year. »

“Free time is very important to me”

There are few cracks in Audrey’s budget – everything is thought out. However, she leaves an important place for her hobbies, which she reserves for €150 per month.

“I try to carry out various manual activities quite often (ceramics, glassware, jewellery, etc.) through Wecando-type workshops. These are quite expensive workshops (minimum €50), so I can’t afford to go there in the months when I have a big expense (car repair for example).

We also do a simpler manual workshop (origami, painting, etc.) a week with friends, where we meet in one of our houses. It’s free and we take the opportunity to have lunch together!

I buy a lot of used books. About once a month I go out with friends to try new restaurants, once a week we go to a nice cafe. It’s something we hold dear because we all LOVE to eat. »

Audrey’s savings

Every month, the 30-year-old automatically saves 300 euros in her Livret A account or in her CASDEN account (the civil service cooperative bank). A reflex inherited from her parents:

“My parents taught me to put away very early. My mother put a small amount into my savings account each month so that I would have a small amount of money available when I turned 18. They also taught me the importance of avoiding loans or installments, to avoid additional costs. »

Save up to become an owner quickly.

“Dijon is a very expensive city for its size. I’m looking for accommodation of at least 60m2 with a small garden, so the prices are sky-high and unaffordable in the metropolitan area with my salary. I hesitate to invest in the countryside where prices are more decent, but at the moment it would cost me too much in petrol to get to work. »

Thanks to Audrey for opening her accounts for us!

The Clearance of Accounts is always looking for new profiles. To participate, send us your short presentation to the email address: [email protected], with subject “Account settlement”! We will get back to you with the procedure to follow.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

Photo credit: Jonathan Borba / Unsplash

read another one

Settle accounts

-

Laure, single mother with 1,796 euros a month: “We often talk about money with my daughter”

-

Allyson, 2,010 euros a month: “I’m discovered every month”

-

Marine, 2,257 euros a month: “I do the garbage for the shopping”

-

Aimée, 2,422 euros a month: “I give money to my mother to have fun”

-

Cynthia, 2,044 euros a month in England: “With inflation at 9.4% I have reduced everything I could”

Source: Madmoizelle

Elizabeth Cabrera is an author and journalist who writes for The Fashion Vibes. With a talent for staying up-to-date on the latest news and trends, Elizabeth is dedicated to delivering informative and engaging articles that keep readers informed on the latest developments.