Talking about money is still taboo in France. However, it is a fascinating and feminist subject in some respects! In Settle the accounts, people of all kinds review their budgets, talk to us about their financial organization as a couple or alone and their relationship to money. Today Cynthia agreed to answer our questions.

- Name: Cinzia

- Age: 33 years old

- Profession: Secondary language teacher, United Kingdom

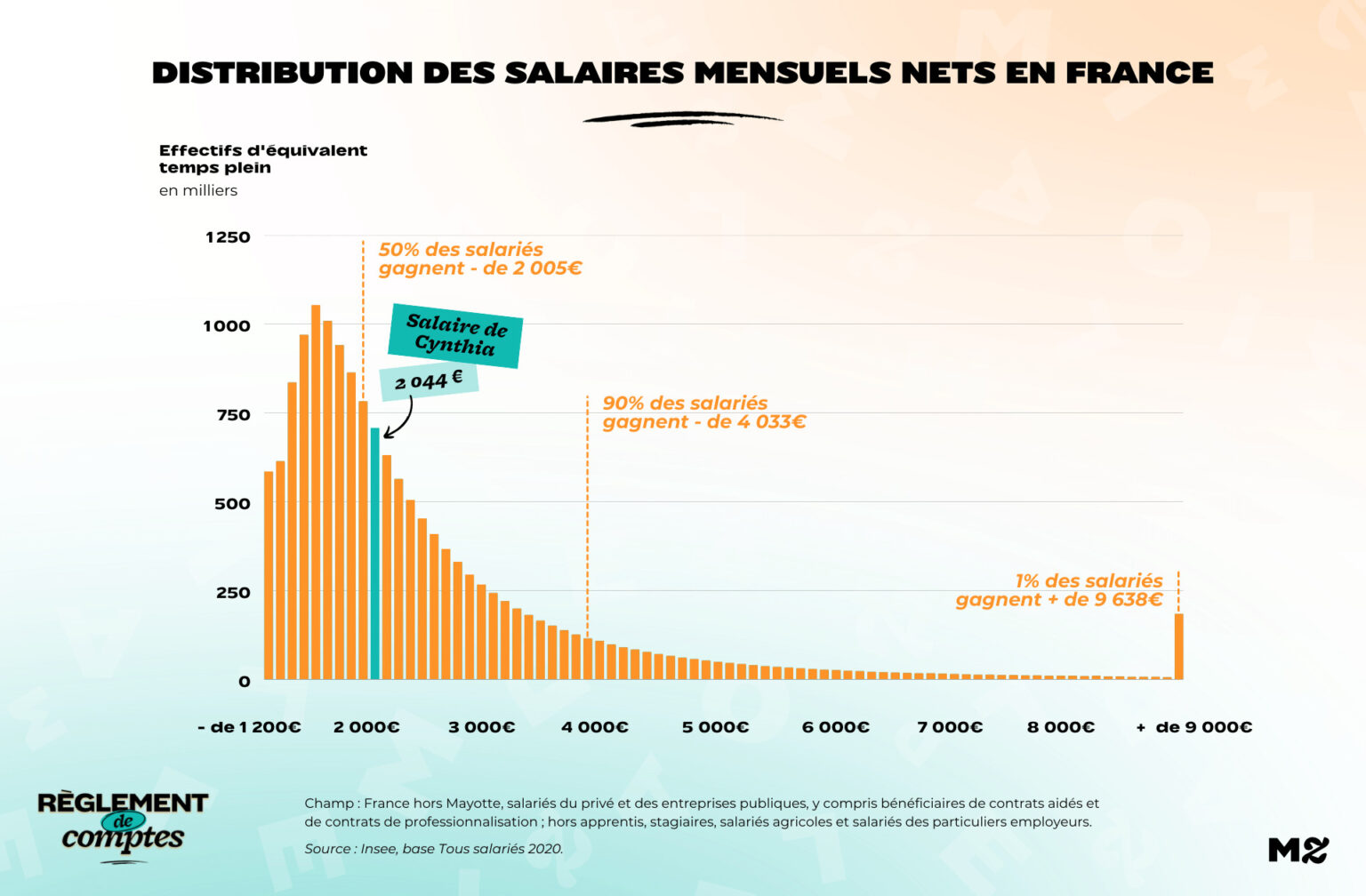

- Net monthly salary: £ 1,740 or € 2,044 to conversion when Cinzia sent us her testimony, in July 2022. Today the amount in euros should be around 1,990 euros.

- Lives with: his 2 cats Patoune and Frimousse

- Place of life: a house of about 70 m² that he rents in Leeds, England

Cinzia’s earnings

Cynthia is a teacher at a public college / high school in the UK. She teaches modern languages, French and Spanish, full-time and with a permanent contract. For this position, you receive £ 1,740 per month, which was around € 2,044 when he sent us his testimony. Today the exchange rate is expected to be around 1,990 euros.

A salary that does not consider up to the challenges of his job:

“The work of a teacher has many responsibilities and the working hours are endless. My salary is therefore insufficient if we compare it to other sectors of activity here: I consider myself below average. “

The teacher explains that her salary allows her to meet her needs, but that she has to make choices:

“The prices are very high and my salary does not allow me to save money and have free time at the same time. “

Cinzia’s expenses

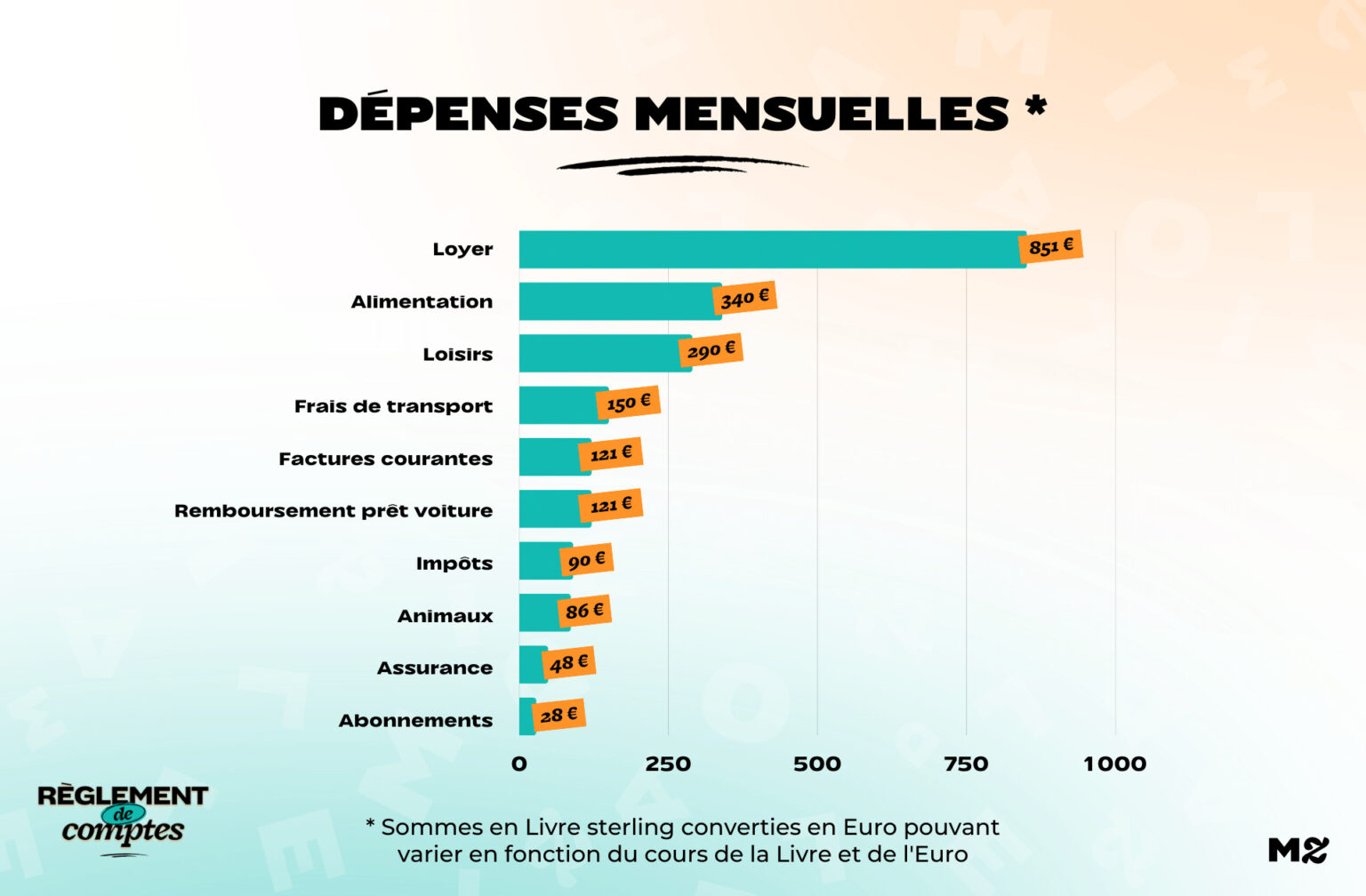

Cynthia’s number one expense is rent.

Given the economic and energy crisis that is affecting Europe and in particular the United Kingdom, Cynthia’s expenses are not stable: prices have been rising for several months and she is adjusting.

His main expense is his accommodation. She’s been renting a little house for about 4 years, which costs her 851 € per month:

“This is a typical Leeds house called ‘back-to-back’. My neighborhood is very lively, there are supermarkets, bars, pubs etc. and are only 40 minutes walk from the city center or 10 minutes by bus.

It is a mixed neighborhood, there are students, families, young professionals sharing a flat or as a couple, and even a few people in their fifties. The area of my accommodation must be approximately 70 m². “

Add to this 121 € bills for water, gas and electricity, a growing expense for all British households. She explains that she is very careful about her consumption, but that she cannot lower it further to reduce bills.

“I had to cut down on my hobbies to increase my food budget”

“In England there is Aldi, a chain of discount supermarkets where I do basic shopping. I also go to Asda, which must be the equivalent of Intermarché. For a little more specific shopping, I go to Morrisons, which has to be the equivalent of Carrefour.

I had to reduce my leisure budget to invest more in my food budget : with inflation at 9.4%, all prices have risen. “

His expense accounts for 340 € per month in its balance sheet.

Cynthia explains that she avoids being restrictive when it comes to food:

“I pay attention to prices, but I don’t limit myself to food either. I used to have jails with a lot of money, so today, food is sacred.

Travel in a car that you own and refund up to 121 € monthly. Your credit will expire in two and a half years. It consumes about € 150 of petroland insure your vehicle for 48 € per month. In total, therefore, his travels have cost him € 319 every four weeks.

For food, litter and insurance for these two cats, he spends € 86 per month. She pays too € 28 in season tickets for your phone and internet connection. Finally, it is imposed every month by € 90 in the name of the municipal taxa local tax.

Cinzia’s hobbies

Each month, Cynthia grants herself a check for € 290 for its recreational activities. He spends most of it on trips:

“Going to the pub to see friends is my most assiduous hobby: I dedicate almost all of my free time budget (250 € per month) to it.

Having no family here and being very sociable is a necessary expense for me! At the end of the month, we go to one or the other. I also have a low budget restaurant or to spend time in another city. “

He explains that he does not want to reduce any item of expenditure in his budget: everything is already optimized and designed not to spend too much, without sacrificing too much.

“If I don’t go out on the weekend, sometimes I still do € 50 at the end of the month and in this case either I take the liberty of buying clothes or going to the hairdresser.

If I don’t need it, I set aside a savings account for a future apartment purchase. This account is also used in case of a technical problem of the type of car or dentist (which is not refunded here). “

Cinzia’s savings

In the future, Cynthia dreams of buying a house or apartment. A wish for the moment difficult to fulfill:

“My salary it doesn’t allow me to save money and have free time at the same time. Buying yourself is very difficult here …

At the moment I am waiting for the end of my car loan that would allow me to save, and I am crossing my fingers that the price of the goods will go down and my salary will go up soon. “

The latest changes in Cynthia’s budget

Since July 2022, when Cynthia sent us her budget, the economic situation in the UK has evolved. First, inflation has risen to catch up 10% in October.

“The cost of food has risen and I am spending it 50 € more per month compared to what I had calculated a few months ago. ” To explain the teacher.

The government has also implemented measures to help families cope with the rising cost of energy:

“The government supplies us approximately 70 euros per month to cover the increase energy prices, which is a bit of a relief. Having had a rather mild autumn, I did not turn on the heating in October (an earlier one!), But this winter I expect fabulous bills and I already foresee decreasing my consumption (which was not excessive at base). “

Finally, he received a raise:

“As teachers, we have received a 5% salary increase, which helps with inflation. But my standard of living is well below what I hoped for as a permanent employee. “

According to Cynthia, the Conservative government plans to cut the public education budget. “I expect a reduction in my leisure budget and just to get by. ” It also indicates that his profession, like many other professions, plans to go on strike in the coming months.

Thanks to Cinzia for answering our questions!

Photo credit: Chad Madden / Unsplash

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

read another

Settle the accounts

-

Sarah, her husband and their 3 children, € 5,301 per month: “Me, bills, him credits and big expenses”

-

Marine, 1,845 euros per month for two “I pay about a third of our common expenses”

-

Justine, 1,630 euros per month: “Social professions are not recognized at their fair value”

-

Fiona, € 2,100 a month in a micro-enterprise: “My goal is not to kill myself at work”

-

Tiphaine, € 4,475 a month: “I see a shrink talking about money”

Source: Madmoizelle

Ashley Root is an author and celebrity journalist who writes for The Fashion Vibes. With a keen eye for all things celebrity, Ashley is always up-to-date on the latest gossip and trends in the world of entertainment.