From the moment the giants of the mass market such as Zara, H&M, Bershka, Stradivarious and Uniqlo left the domestic market, shopping turned from therapy to an endless search for alternatives. After almost half a year in a kind of fashion isolation, we all seem accustomed to the idea that it will not be the same as before, and we began to study the Russian market. It turned out to be a lot of cool stuff – all this time in our country there were hundreds of local brands that did things much cooler, more relevant and (most importantly) better than we were used to seeing on the shelves of the mass. market. Are you looking for crazy things in the style of Julia Fox – easily, if you want the minimalism of Rosie Huntington Whiteley – yes, you will repeat the images of Kim Kardashian – here are ten brands for you. And although there is no minus that overlaps with all the above pluses, according to the “and they lived happily ever after” scenario, everything would be like in a fairy tale.

This minus is the high prices that the domestic consumer cannot get used to. If earlier jeans could be bought for 3 thousand rubles, now a valuable pair of jeans is two or even three times more expensive. However, in an age where there is no such alternative, do not rush to accuse local domestic brands of wanting to make money from you. We offer to understand the situation in the market and listen to the founders of Russian brands.

We gathered the latest analytics, talked to top designers, and tried to figure out why there are so many zeros on the new price tags.

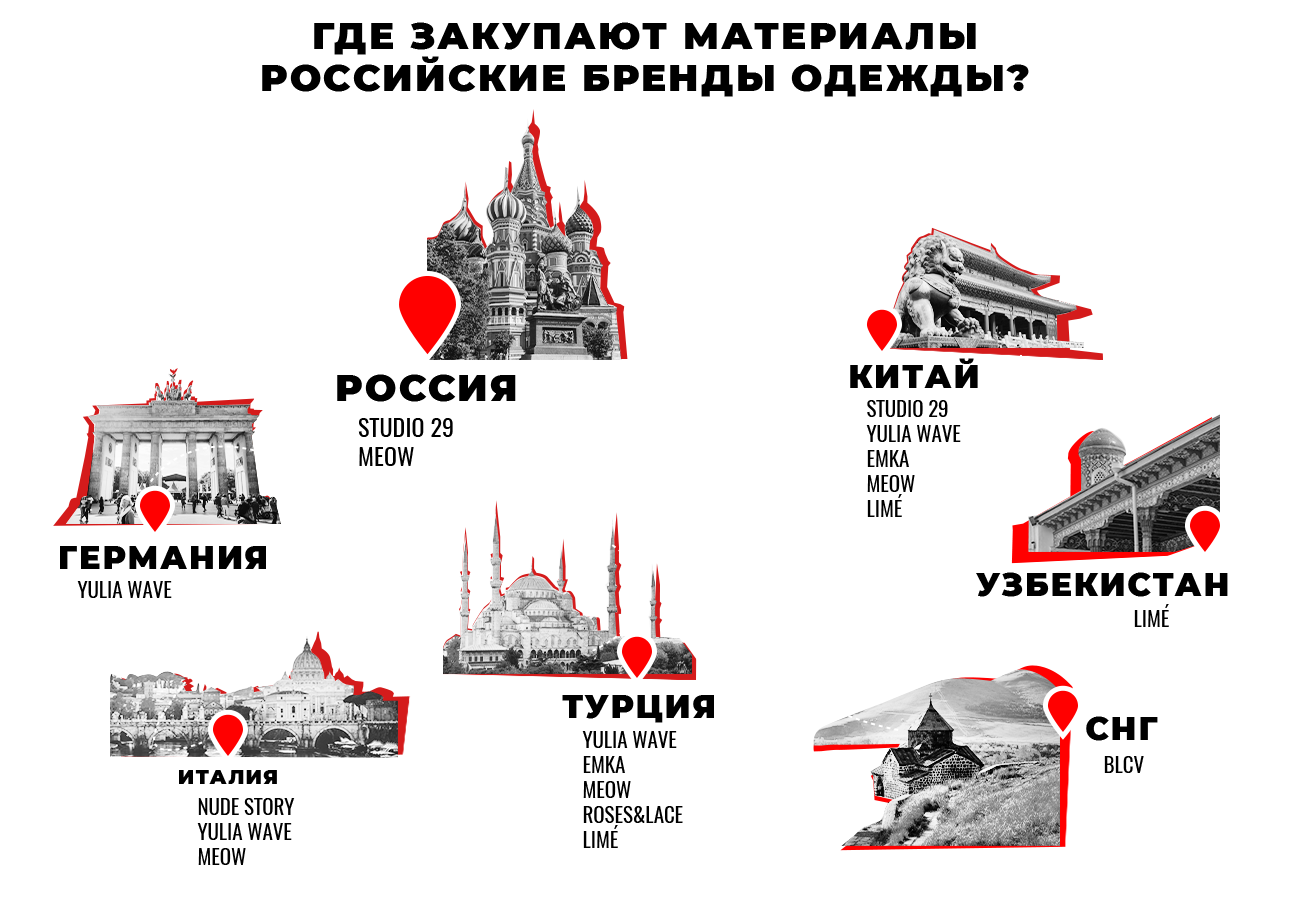

Do you have overseas fabrics?

The first question we asked the founders of Russian brands was about fabrics and accessories – what they are made of and then sent to the showroom rails. Clearly favorites include Italy, Turkey, and China, as well as Germany, Uzbekistan, and Russia. However, precisely because of the difficulties posed by these events, many had to refuse or rethink cooperation with foreign factories. For example, Tatyana Fomicheva, the founder of Studio 29, said that previously fabrics and accessories were purchased in Turkey, Italy, China and Russia, and now only the last two countries remain. Nude Story both bought and continues to buy yarn from Italy. Yulia Vasilevskaya, the founder of YULIAWAVE, shared that the fabrics are supplied from Italy and Turkey, but the fixtures come from Germany and China.

However, LIMÉ’s production is based on the principle of outsourcing. Design and development is carried out in Russia, with the team transferring production to partners in Turkey, China and Uzbekistan. To date, the main share in the production of materials and finished products is occupied by China.

Meanwhile, the Emka brand cooperates with suppliers working with Massimo Dutti and Cos. Not without the CIS countries. You must have heard of the BLCV brand and their iconic jeans. Therefore, in the production of denim products there is an important feature – the stage of cooking and processing. This severely limits the number of players in the market. The main part of production is located in Russia, but materials are purchased in countries where cotton cultivation is traditionally localized.

What about prices?

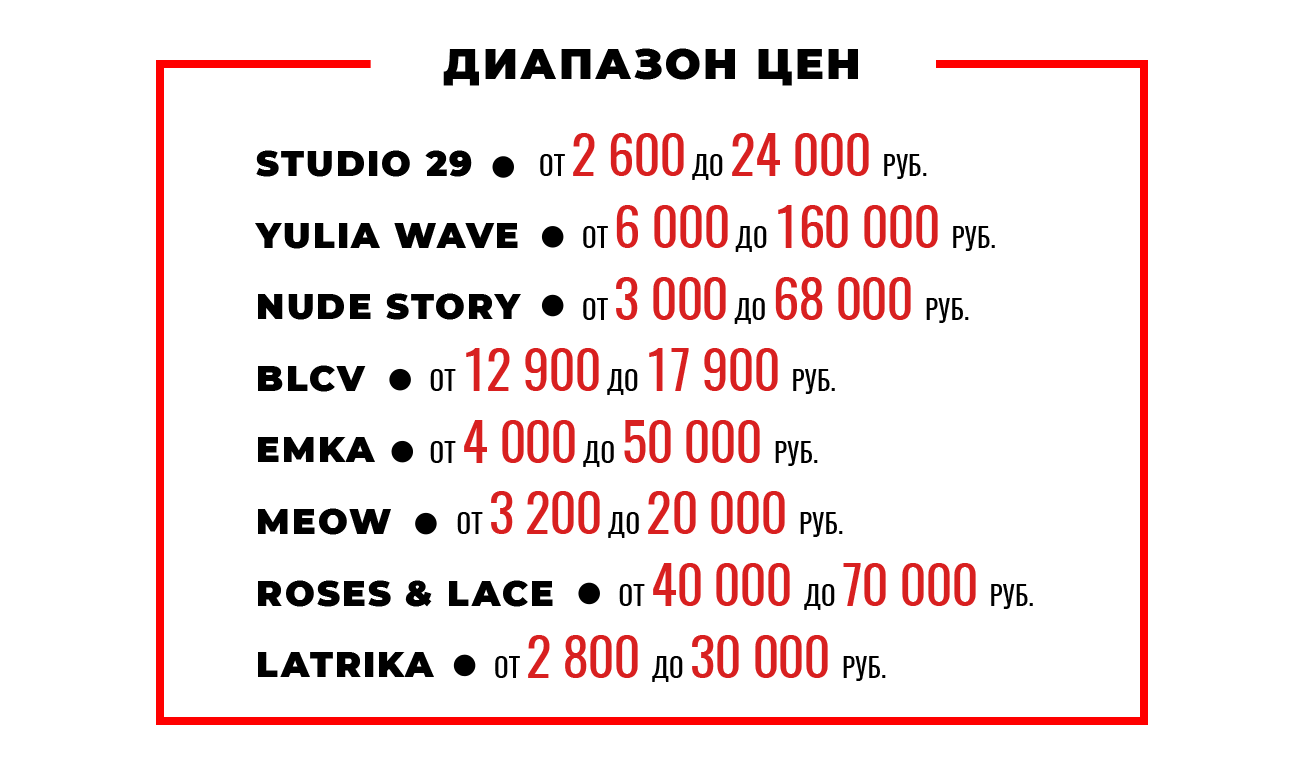

Before starting the analysis of the “flights”, we invite you to take a look at the plate, which shows the approximate price range (for calculation we selected the cheapest and most expensive product from the range). This will make it easier to understand what we are dealing with.

adding zero

After the February events, the prices of almost everything started to increase exponentially. At least remember the cost of the iPhone and the number of memes associated with it. The situation was quite expected – many prices on the market were formed taking into account the dollar and euro. And if you go back a few paragraphs and look again at the picture of the countries from which Russian brands buy materials, you can understand why prices did not rise only for imported products without outside help. We asked the brand representatives to tell us how much the cost of the products increased.

In general, the situation of the Russian brands surveyed is approximately similar. With the onset of spring, both the cost of delivery and raw materials increased. As a result, finished product prices increased by 10-30%. Alina Kamalova, founder of Nude Story, said that fabric prices increased by 30% on average due to rising electricity, gas and water prices in Europe. But Yulia Vasilevskaya (aka the mother of the brand YULIAWAVE) shared that due to fluctuating exchange rates, suppliers have not been able to even determine the cost for a while. Thanks to the team’s work, the prices of knitwear products remained the same, but increased 20-25% for the brand’s DNA – leather.

-

nude story -

nude story

Towards the end of the spring, when the exchange rate started to normalize, some brands returned the prices to their previous levels. Emka is one of these brands. General Manager Alexander Arutyunov shared that in March it was decided to increase the cost by 30%, but now the prices are comparable to the prices in January this year.

-

emka -

emka

There are also cases when price increases are planned. This scenario was followed in the BLCV brand. The founder of the brand, Ilya Bulychev, said that the planned growth is already planned for the spring. “We couldn’t postpone it and in March we increased prices for some of the varieties by 17-19%. At the same time, iconic models of the brand remained the same price at 12,900 rubles.

However, the biggest problem that no brand can avoid is logistics. If earlier delivery to Russia can be made in a week, now you have to wait about a month, or even more. The founders of Roses&Lace brands, Maria Zotova and Anastasia Barysheva, unanimously declare this.

-

LEMON -

LEMON

Everyone, without exception, has to adapt to the new reality. For example, the LIMÉ brand has turned deliveries from rail and plane to a combination of all modes of transport. Depending on the load on one or another route, the team selects the most suitable routes at this time.

Value consisting of “what, what, what”?

If you’ve ever taken business economics classes at university and listened to at least one teacher, you probably know that prices aren’t set at the ceiling, but based on many factors. These are supplies, electricity and equipment, supplies from other countries, and the amount of retail space. Did you forget the salary of the employees? What about marketing activities?

-

YULIWAVE -

YULIWAVE

In our conversation with Yulia Vasilevskaya (founder of YULIAWAVE), she said something very true: “For some reason people are still obsessed with the myth that if it’s made in Russia, it has to be cheap.” And this phrase perfectly describes the whole attitude of the Russian consumer to shopping. At the bottom of brand posts, you can often find negative reviews such as “And a lot of zeros on the price, probably by mistake”.

And this situation is quite understandable – well, whoever wanted to buy a white T-shirt for 3 thousand rubles, for this amount you could previously buy three or even four at once. But sooner or later you will have to come to terms with the new reality.

-

BLCV -

BLCV

This is more likely not a new reality, though a new attitude towards shopping. You can buy or pick five things that will last through the season, but very high quality. As a result, the purchase will more than justify itself. This approach is also supported by the designers of local brands.

“We adhere to the slow fashion philosophy and create things that will live in the wardrobe for a long time. We protect the planet’s resources, our customers’ time and money. We also provide a two-year warranty on the jeans. During this time, you can buy 5 more budget pairs or wear BLCV. And this election is not about money, it is about a different consumption culture,” Ilya Bulychev shared.

-

meow -

meow

Anastasia Barysheva, founder of the Meow brand, shares the same opinion: “You can find the same t-shirt on the market for a thousand rubles, but you cannot guarantee that it will not stretch or fall apart after the first wash. stitch.”

Maria Zotova: “We are committed to the Zero Waste concept and Zara is also working non-stop, which leads to an increase in the exploitation of natural and labor resources. Since we want our products to serve out of season and for a long time, we do not aim to be in the fast fashion chain and this is quality.”

-

Roses and Lace -

Roses and Lace

But Zara can! Why can not you do?

Here it is very important to understand that local brands are not a mass market and their turnover is radically different. And the statement of the founder of LaTrika Lesya Nikonova assures this: “We do not strive to be Russian Zara, we are closer to a more intimate version with a limited edition and an individual approach to the client.”

-

LaTrika -

LaTrika

Tatyana Fomicheva (founder of Studio 29): “Compared to the same Zara, we have a completely different business model: different conditions, batch sizes, raw material prices. It is difficult to compare our segment and the European mass market, which is sold in large quantities all over the world. Certainly the turnover must be tens of thousands of times the current figures.”

-

Studio 29 -

Studio 29

Anastasia Barysheva: “As far as I remember, Zara’s 2020 turnover was about 40 billion rubles, and this is only in Russia. To reach these figures, we need production capacities in different countries, well-organized internal and external logistics and, of course, large investments in development.”

Interested in local brands. And what will the domestic mass market say? This, of course, is about LIMÉ – the brand that literally everyone is running after the closure of its Western analogues. The company states that they see the current situation as an opportunity for improvement. Even now, after the redistribution of the audience, the influx of new buyers is felt with the naked eye. The price range of the brand is slightly higher than the traditional Zara, so this alternative turned out to be quite acceptable for the pocket of the domestic consumer. Therefore, the question “What to do to sell at the Western mass market level” came to the right place.

“There are not so many big players in the Russian market yet, most domestic brands are represented in a niche business model, with a limited assortment and sales channels. Such a business model does not allow a price to be offered to the market in the mass market segment. To replace Zara, brands need to be prepared to significantly strengthen their product teams, produce the number of models the market expects, and increase production and sales space. It is necessary to have resources for rapid growth. Any development, the creation of new lines requires a lot of investment and time,” he said.

And now let’s summarize. In order for prices to be affordable for any buyer, large production capacities are needed, which no domestic brand currently has. The question of “Will we ever reach this high” remains open, so we can only wait and hope. In the meantime, the “miracle” did not happen, we recommend that you reconsider your attitude to shopping, take the current situation as an excuse to be more environmentally friendly, and stop shopping in a hurry.

Source: People Talk

I am Anne Johnson and I work as an author at the Fashion Vibes. My main area of expertise is beauty related news, but I also have experience in covering other types of stories like entertainment, lifestyle, and health topics. With my years of experience in writing for various publications, I have built strong relationships with many industry insiders. My passion for journalism has enabled me to stay on top of the latest trends and changes in the world of beauty.