Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Virginie * who agreed to open her accounts for us.

- First name : Virginie

- Age : 39 years old

- Occupation : graphic designer

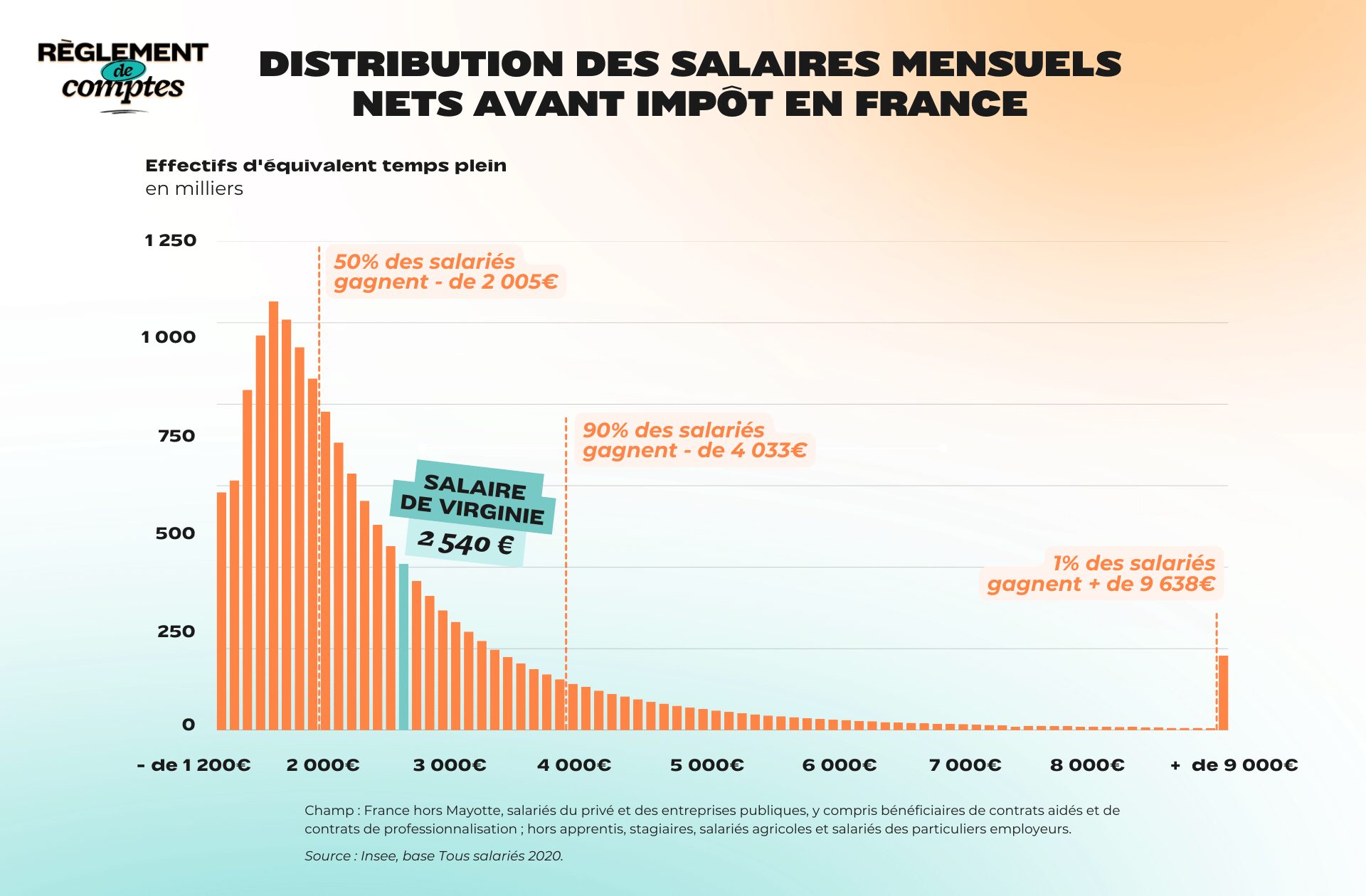

- Income before withholding tax : €2,345 over 13 months, or €2,540 per month

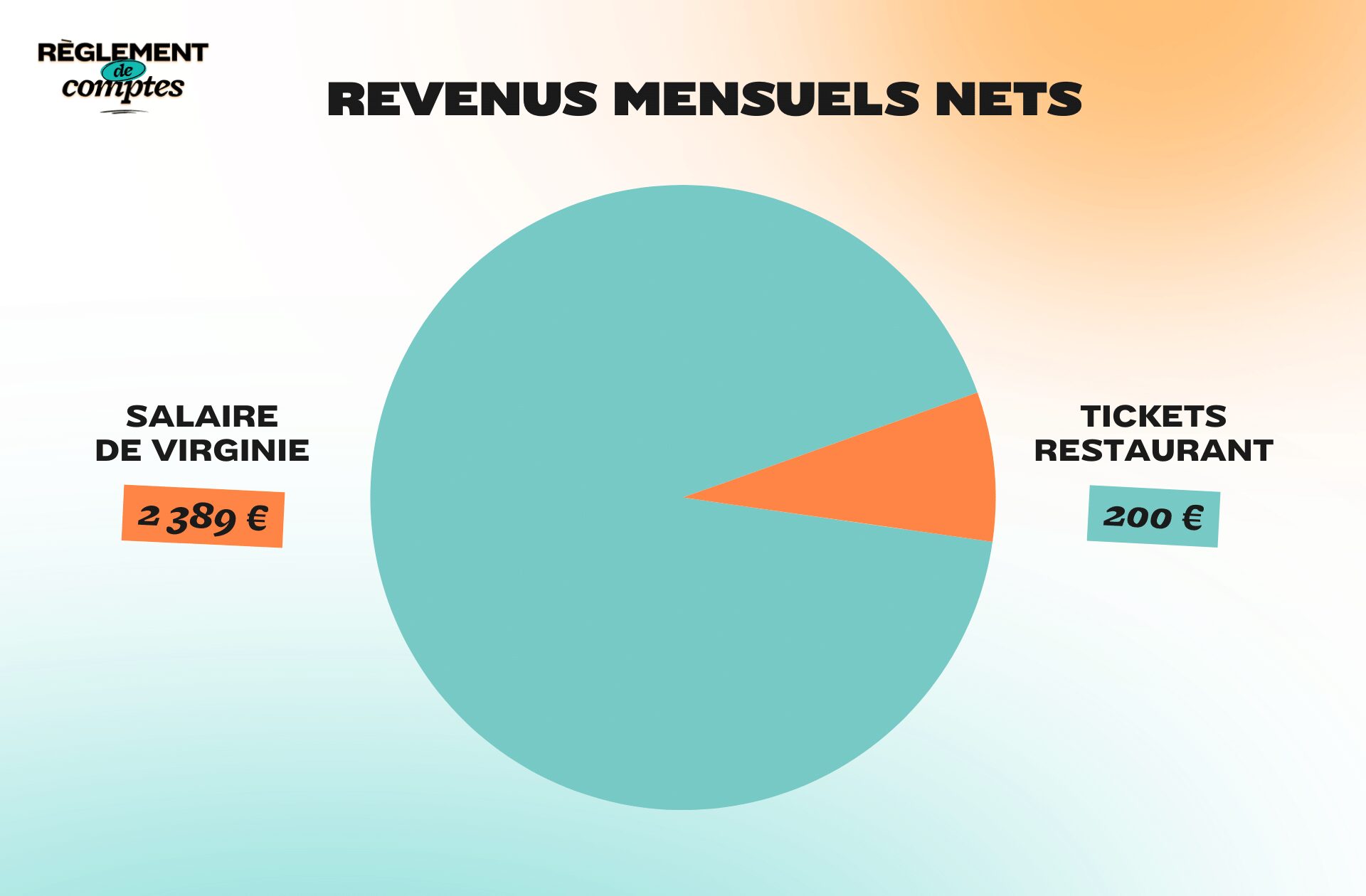

- Net profit after withholding tax : €2,205 over 13 months, or €2,389 per month

- People (or animals) living under the same roof : no one except Virginie

- Place of life : Paris

The situation and income of Virginia

Virginie is a responsible graphic designer, stable manager, in a children’s publishing house.

I have passion for my work, even if, having been in the same position for six years, I’m starting to get bored.

Virginie is single and has no children. She is the owner of her apartment, a 37 m² two-room apartment in the 18th arrondissement of Paris.

I bought this apartment from my parents four years ago. Previously the apartment belonged to them and I rented it from them.

Virginie was able to finance this apartment herself, in particular thanks to her family’s bequests:

I was also able to buy my apartment thanks to donations from my parents and my grandmother’s inheritance. It allows me to have small monthly payments every month, otherwise I couldn’t have this lifestyle in Paris.

For her work as a graphic designer’s manager, Virginie receives €2,205 over 13 months, or €2,389 per month, a salary that suits him. However, she doesn’t feel paid enough:

I consider myself well paid for a job in publishing, but poorly paid given my experience, responsibilities and living in Paris. I consider myself rich, thanks to the contributions I had to pay for my apartment.

In addition to the salary, he explains that he receives bonuses of various non-fixed amounts, which we will not include in the final calculation:

I have profit sharing and participation bonuses that have already risen to 6,000 euros per year, or 500 euros per month. But these amounts are temporarily blocked in an account.

Virginia’s relationship with money and its financial organization

Virginie grew up with parents who taught her the importance of investing:

My parents were wealthy, but that wasn’t always the case. My father started out as a teacher, ending his career as the general manager of a large company. They taught me the importance of investing my money wisely, for example through property, teaching me that money is to be spent and enjoyed.

He tells us about his relationship with money and how reasonable he is in managing his finances:

I’m pretty frugal, I’m always looking for money saving tips, I’ve never been caught. But I’m having fun and I don’t think I’m missing anything.

As for her bank accounts, Virginie thinks she has a classic profile:

I have a checking account in which I receive my salary and carry out my current spending and savings accounts.

Virginia spending

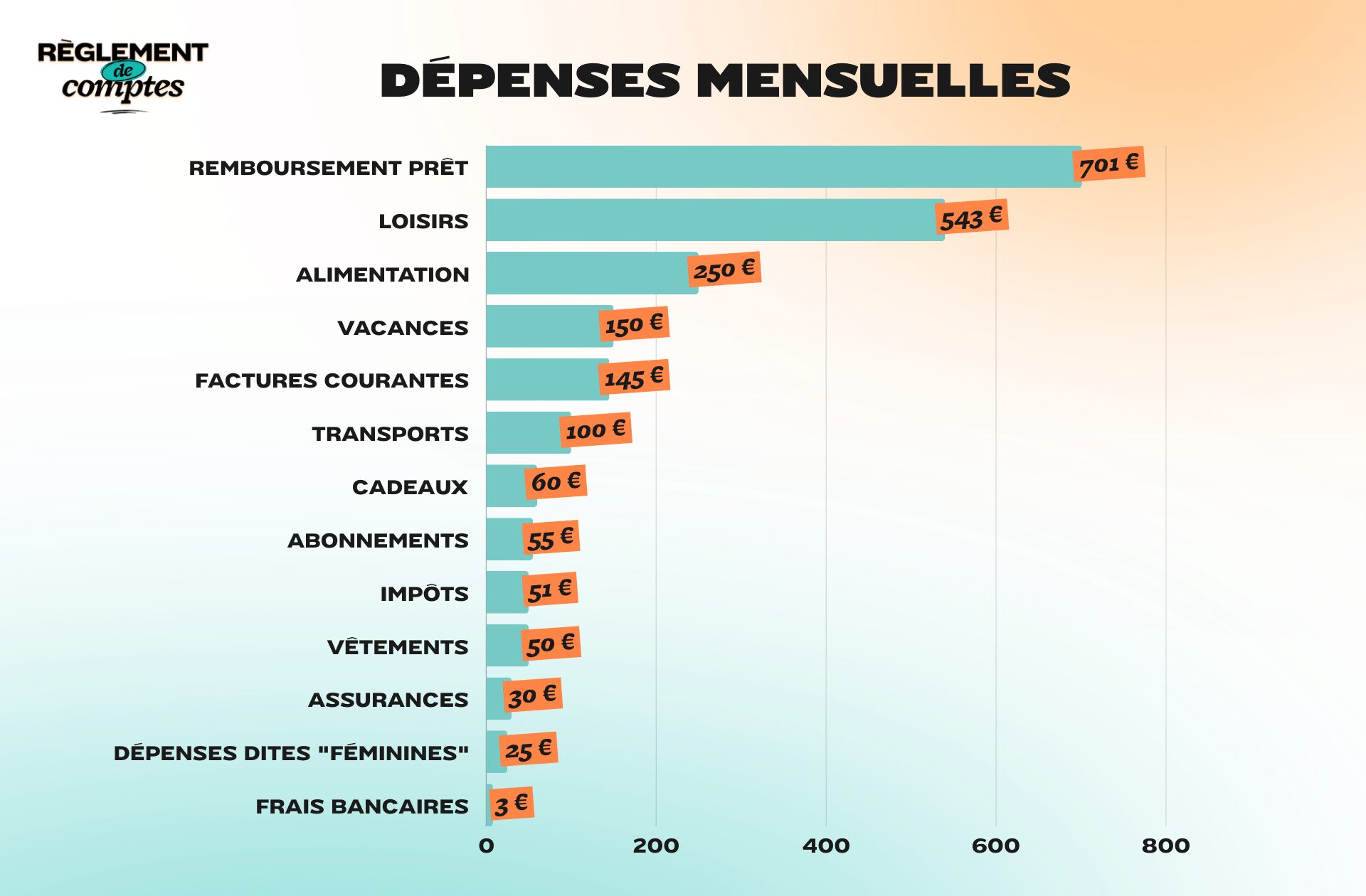

His main expense item is the credit for his apartment, which costs him €701 per month. Virginie does not receive any state benefits or special help.

Among his other accusations, he lists €145 in current bills (€63 for gas and electricity, €70 for apartment expenses, €140 for boiler maintenance per year, or €12 per year), €51 property tax AND Home insurance €30.

The rest of his expenses include €11 Spotify subscription, €30 internet subscription, €14 telephone subscription e €3.72 Bank charges.

To get around, Virginie uses public transport with a Navigo subscription which costs her 86.4 € per month. From time to time he uses the Uber application to €15 per month.

As for food costs, Virginie estimates them at 250 € per month. Furthermore, it perceives €200 restaurant vouchers from your company.

In addition to food purchases, Virginie estimates she spends approx €25 for so-called “female” expenses..

I go to the hairdresser once a year and two or three times to the beautician to have my hair removed. Otherwise I’ll do it myself. I get one pedicure a year. I buy tampons and I estimate this budget at two euros a month. I use condoms as a contraceptive, the cost of which I share with my partners.

Virginia’s leisure spending

To relax and clear your mind, Virginie offers numerous activities and leisure activities. This position costs him €533 per month and shares his organization with us:

I do clowning once a week, also kamihimo (Japanese paper) furniture workshops once a week. I go to the gym and go to the cinema almost every week.

I often go to restaurants with friends and regularly go to the theater and see concerts. Being single and passionate about art, this is fundamental for me. This allows me to nourish myself intellectually and have social connections.

His latest breakdown?

I fell in love with an original illustration by my favorite illustrator, for 200 euros – he gave me a friendly price – and a computer for 3,000 euros, with the idea of starting my own business. I also bought a used sofa for €350.

Virginie would like to reduce the food budget item which costs her, as mentioned above, 250 euros a month:

I alternate the ready-to-cook baskets (Quitoque) with shopping at the supermarket. I used to go to La Louve, the first cooperative supermarket in Paris: we work there 3 hours a month and in exchange the products cost 20 to 30% less than elsewhere, and they are excellent quality products. I took a break, but I would like to resume.

Currently, my food budget with ready-to-cook baskets is more expensive than when I shop at La Louve.

For clothes, Virginie estimates she spends Around €50 per month :

I buy a lot at sales, private sales or second hand. Never at full price.

They should also be added to your leisure budget €10 books per month, €60 gifts for loved ones on their birthdays or other holidays, as well as the sum of €150 monthly, which he says he spends on weekends or holidays.

Virginia’s savings and future plans

Virginie arrives save between €200 and €300 of each month:

These savings are used for unexpected events, such as construction, repairs, purchasing furniture, etc.

He reveals his plans for his future:

I’m considering changing companies or starting my own business. I need new projects and new challenges. I’ve been trying to change companies for a long time, my CV is good, but when I talk about my salary expectations I get stuck. My salary is quite high for a salary in publishing, they prefer to hire junior guys to pay them less.

But I will have finished paying off my apartment in a short time, which will allow me to take on more professional and financial risks by starting my own business, for example.

Thanks to Virginie for opening her accounts for us!

*The name has been changed

To testify for our sections Settlement of accounts OR When we love we matter (for parents’ budget), write to us at:

[email protected] with subject “Silver testimony”

We can’t wait to read you!

Read another one

Settlement of accounts

-

Agostino and her husband, 5,400 euros a month: «I find I wear out too many clothes»

-

Manon, 1,874 euros per month: “Since I separated, I get much more from my money”

-

Lili, single mother, 2,017 euros per month: “we make sacrifices every day”

-

Marianne, soldier earning 2,329 euros a month: “Becoming an owner is not in my plans”

-

Katia, between 560 and 1,680 euros per month: «I pay practically everything because my boyfriend doesn’t have a regular income»

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Listen to Laisse-moi kiffer, Madmoizelle’s cultural advice podcast.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.