Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Manon who agreed to open her accounts for us.

- First name : But it is not

- Age : 25 years old

- Occupation : Peddler

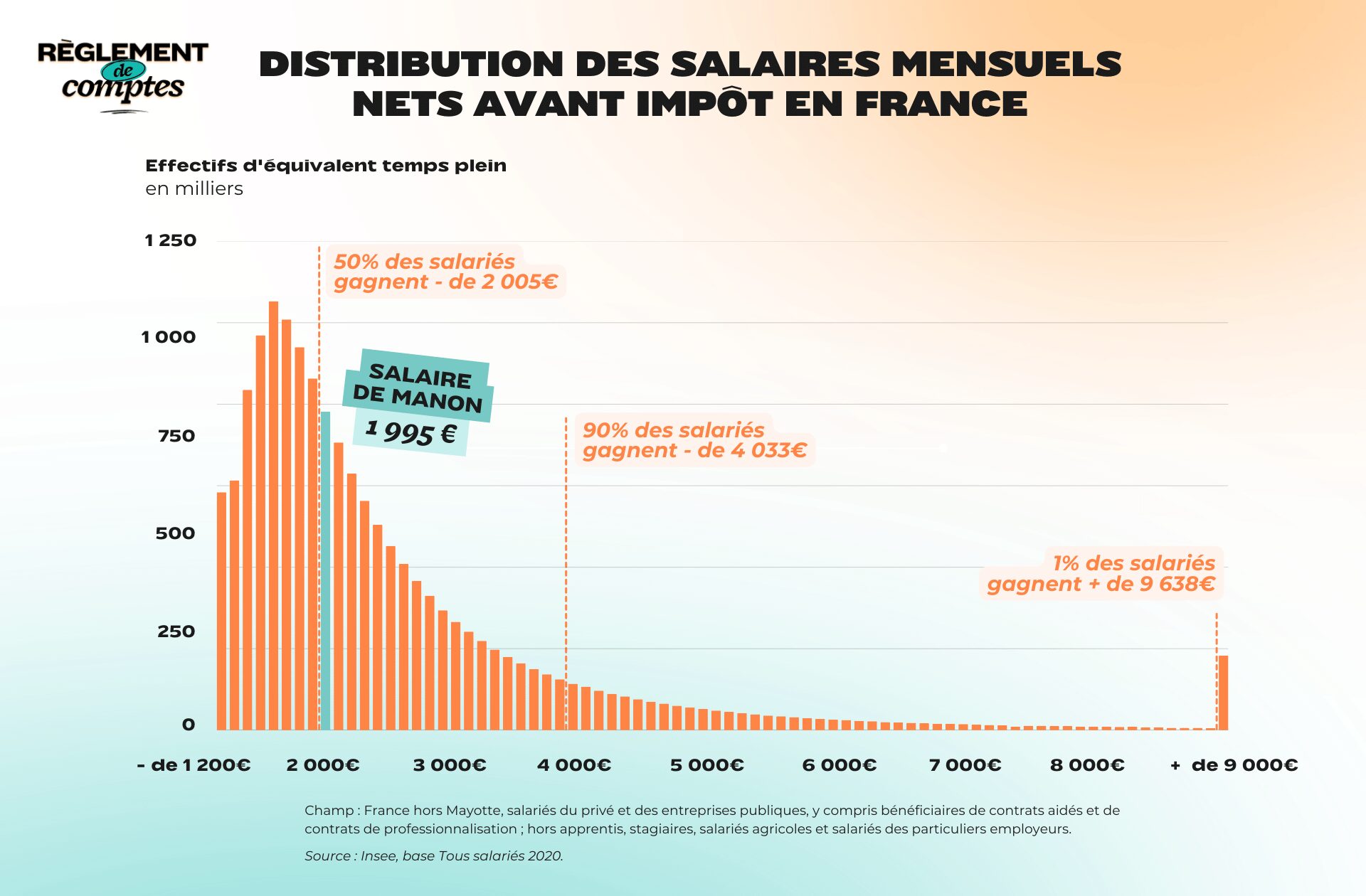

- Income before withholding tax : €1995

- Net profit after withholding tax : €1874

- People (or animals) living under the same roof : a cat

- Place of life : Provence

Manon’s situation and income

Manon has been a permanent street sales assistant in the food sector for five months. She has been living alone for two months, after having had a seven-year relationship with her ex-partner, with whom she lived. Before obtaining this permanent contract, Manon had worked in this profession for three years under a work-study alternation regime, then one year with a previous permanent contract.

I currently work in a company that operates internationally, but is still “young”, as it was created less than 10 years ago.

After the separation from her ex-partner, Manon changed her relationship with money:

Until recently I was living with a partner, but the person I was with wasn’t stable at all. The relationship with money has always been unbalanced. I always paid more, even when I earned less. We had a joint account and our personal accounts.

Overall I paid 90% of the expenses and he paid more for the extras. But he was still short of money and didn’t have a job with a steady salary.

Since I’ve been separated I’ve had a lot more fun; Also, over the last couple of months, I’ve been dipping into my savings a lot.

Manon saw her cat, In an apartment in Provenceof which it has owned since March 2022:

I live in an apartment in a medium-sized city that I bought myself last year. I was able to take advantage of a good rate and a good price just before everything exploded. It has 80 m2 of living space with a large 14 m2 terrace and a 10 m2 loggia.

Manon was able to finance this apartment on her own, in particular thanks to a substantial contribution:

I was able to purchase it thanks to an inheritance received – 30,000 euros – following the sale of the family home. My mother died when I was young, so her share went to me.

For her job as a traveling saleswoman, Manon receives €1874 per montha salary suitable for him, with interesting advantages:

I consider myself very well paid, especially because I have significant advantages: I have a company vehicle for which I don’t pay for petrol, which means it takes care of my entire garage, including weekends and holidays.

This is reflected in my paycheck, but I come out a winner given the km I personally do. Furthermore I have €12 worth of meals a day to spend which is reimbursed from my box. Since I eat little, I use it to do my monthly shopping (which represents a budget between 180 and 240 euros per month depending on the days I work). Likewise, my company pays for my Internet subscription.

Manon’s relationship with money and her financial organization

Manon grew up with parents for whom talking about money was taboo:

We didn’t talk much about money at home. It was more of a taboo topic, we were simply encouraged to save the money we received from our birthdays.

She tells us about her relationship with money, which has “become healthier” and evolved since her breakup:

I started a relationship at a very young age with a man who, on the contrary, was a very spendthrift. So I compensated him a lot, even though he earned more than me. This meant I had a long period where I was overdrawn every month, because I lent him money, paid his fines or rent…

Back then I could be called a cheapskate because I was careful about everything. I was never satisfied, I thought of him first. I paid absolutely everything for “us”. I was constantly anxious about having nothing left.

Over time my relationship with money has evolved. Before I was afraid of being left without it, now that I have my own apartment I’m more at peace. Having separated also allowed me to spend more on myself. I’m also a little excessive right now because I’m burning through my vacation savings. But at least I’m having fun.

I have a healthier relationship with money. I rarely buy things on impulse.

Every day Manon does not spend too much on her purchases, especially when it comes to food, thanks to her professional advantages:

I shop at department stores, but I don’t look at prices at the moment, because it is reimbursed by my company. I’m lucky enough not to pay for food for my cat, I only pay for it. litter around €20 per month.

Manon’s expenses

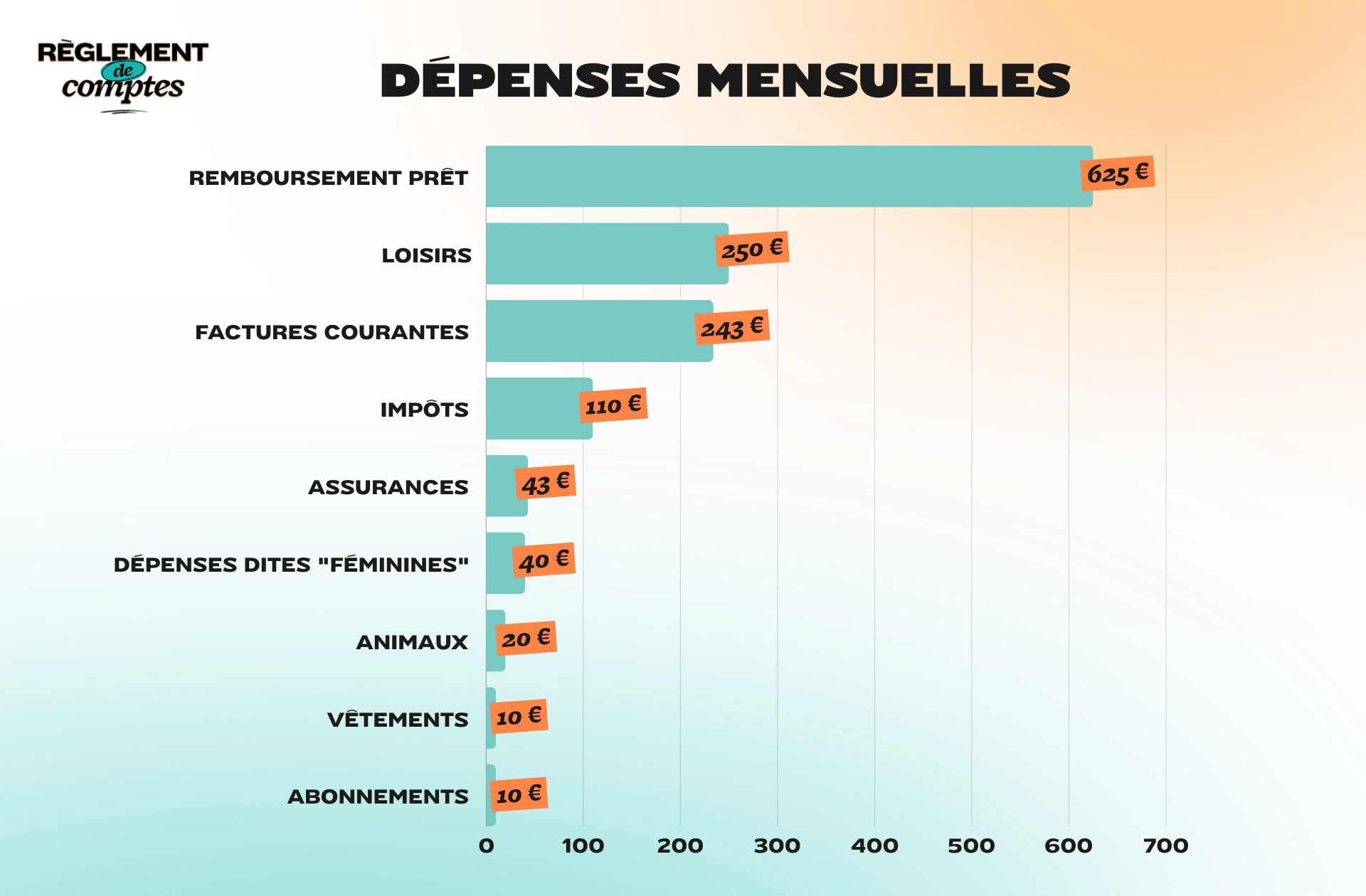

His main expense item is the credit for his apartment, which costs him €625.25 per month. Manon does not receive any benefits from the state, nor any special help.

Among his other accusations, he lists €234 in current bills (€54 electricity and €180 co-ownership expenses), Tourist tax of €110 AND Telephone subscription €9.99.

Today my biggest expenses are related to my apartment: I pay 110 euros in advance on real estate tax and I had to pay a little more for utilities: 270 euros in the last 3 months instead of 180 euros. It’s taking a toll on the budget, but I’m still doing very well.

The rest of his expenses include Insurance €43.40 (€20.71 home insurance, €14.79 mortgage insurance, €7.9 legal protection insurance), but also Bank charges €2.

As for food costs, Manon estimates them at 180 and 240 eurospaid thanks to her professional benefits, as she explained above.

In addition to food purchases, Manon estimates she spends approximately €40 for so-called “female” expenses..

I have menstrual panties that I have been using for 6 months. It must have cost me around €150.

Every month I spend €22 on treatments (manicure and hair removal). I’m lucky enough to have a friend who does my nails (simple manicure) for €10 and my eyebrows cost €12.

I buy very few beauty products, maybe €100 a year.

Manon’s leisure expenses

To relax and clear her mind, Manon loves skiing and hiking. His free time budget It varies depending on the month, but she estimates it €250 per month :

After my separation I invested in ski equipment and spend every weekend there. A day costs me between 50 and 60 euros (including toll and flat rate).

For a weekend we tend to spend between 200 and 250 euros. This is my biggest hobby post at the moment.

Otherwise I go on many excursions (free) or sports competitions (between 2 and 3 per month) which cost me around 40 euros.

His latest nervous breakdown? Equipment for your passion, for €700:

My last big break was the purchase of all the ski equipment which must have cost me around 700 euros.

However, Manon does not intend to reduce any budget item:

I’m just learning to balance my budget.

For clothing Manon estimates the expense Around €10 per month.

I buy very few clothes and they are mostly second hand.

When it comes to books or movies, he shares his organization with us:

For books I tend to go to my city’s media library. The subscription is free, just bring a stamped letter with your address once a year to receive the subscription card.

I don’t have a streaming or music subscription.

Manon’s savings and her future plans

Manon arrives save the sum €500 of all months, which places it in different categories:

I save around €500 per month: €350 for my trips or trips, €50 in PEA and €100 in life insurance.

I have 19,000 euros saved in total, 7,700 euros in an LEP for emergency savings and various investments I had in my former companies.

I also invested in crowdfunding for €1,500.

I must have around 1,400 euros in savings for my free time activities.

He reveals his plans for his future:

I would like to continue saving and above all treating myself!

Thanks to Manon for opening her accounts for us!

Read another one

Settlement of accounts

-

Lili, single mother, 2,017 euros per month: “we make sacrifices every day”

-

Marianne, soldier earning 2,329 euros a month: “Becoming an owner is not in my plans”

-

Katia, between 560 and 1,680 euros per month: «I pay practically everything because my boyfriend doesn’t have a regular income»

-

June, teacher at 2,287 euros a month: “If I do well I can save 500 euros a month”

-

Lola, 2,244 euros per month and retraining: «This year I spent around 3 thousand euros as a hairdresser»

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Discover BookClub, Madmoizelle’s show that questions society through books, in the company of those who make them.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.