Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our section Settlement of accounts, people of all kinds come to analyze their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Lili who agreed to open her accounts for us.

- Presumed name: Lili

- Age : 38 years old

- Work : Class B intermediate civil servant in a state administration

- Family : She and her 14 year old son

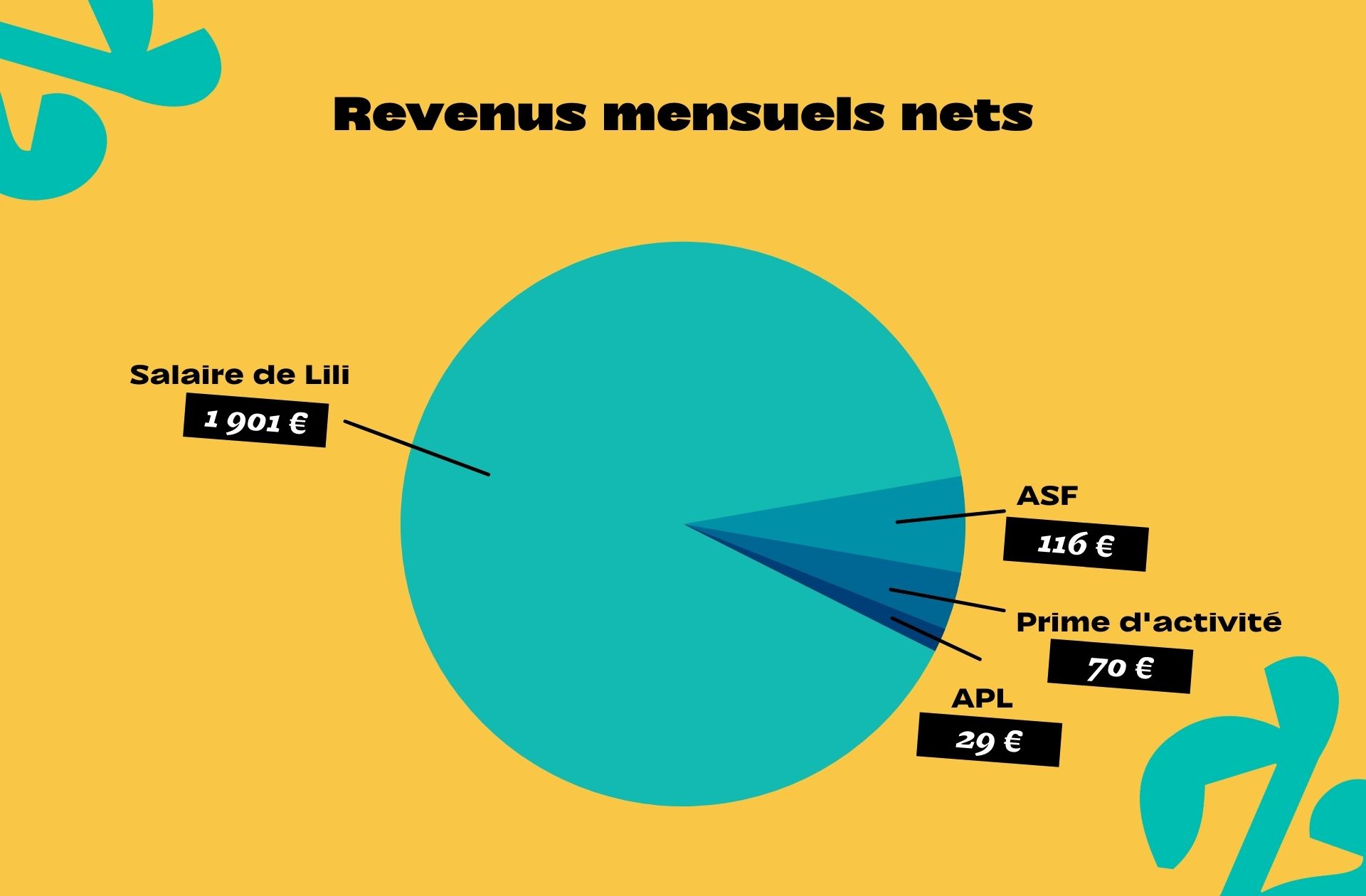

- Monthly salary: €1,901 per month net, net of withholding tax

- Place of living: A low-rent apartment in Île-de-France

Lili’s situation and her financial income

Lili lives alone with her fourteen-year-old son, as her partner died while she was pregnant. Most of their income comes from her salary from her position as a civil servant in a state administration.

A salary that finds not tall, compared to what he could earn in the private sector. But for now he has no choice but to stay there:

“I know that with my experience I could be paid a lot more in the private sector. But being single means I can’t afford to leave and run the risk of getting fired, or having a probationary period end and find myself with nothing overnight…

The problem is that the more time passes, the more I lose: rents increase, APLs decrease, my salary barely increases and the question continues to arise. Am I taking risks? knowing that if I make a mistake my son will suffer the consequences, or am I trying to survive on a salary as a public employee that isn’t enough? »

She perceives too €116 CAF Family Support Assistance, an allowance that helps single parents, €29 of the APL e €70 activity bonuses. In total it is therefore a budget of €2,017 per month which succeeds.

A figure that does not have the same weight when you are a single parent as when you are living together. She explains:

“ I do not have an ex-spouse to provide me with alimony or take care of the child part-time. There are two of us who live only on my salary, without any support, with expenses comparable to those of a couple… And for the smallest amount, over-indebtedness threatens us. »

The expenses of Lili and her fourteen-year-old son

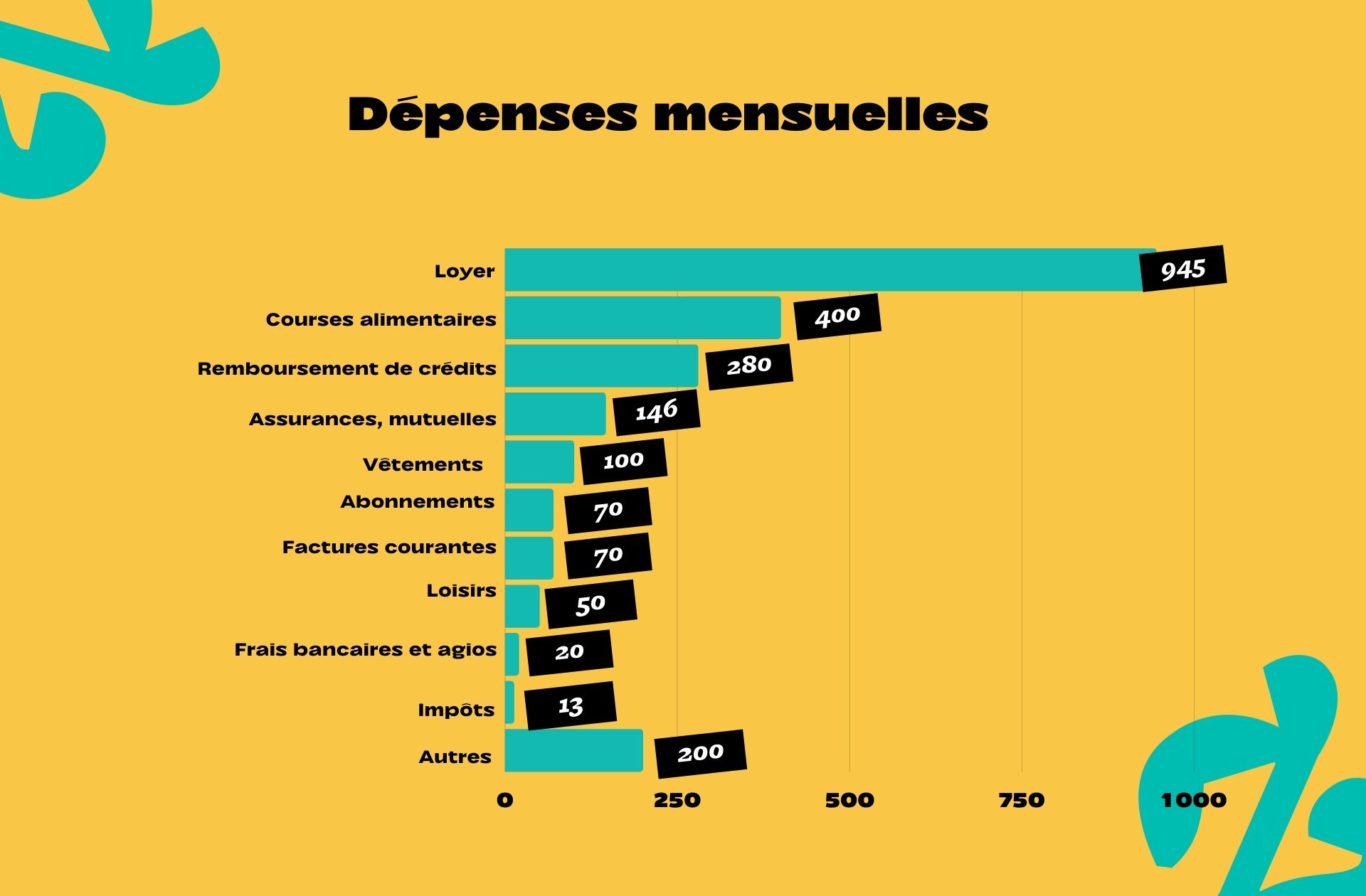

Lili’s biggest fixed expense is rent. For 60 m2 of social housing reserved for public employees in a suburb near Paris, he pays every month €945 rent, almost half of his salary.

«It’s a T3 without a cellar or parking, which I find quite expensive for public housing. We moved in 2018 and since then I have made 45 requests to find cheaper prices, but have never been given priority. It’s more than an hour’s drive from my workplace, but if I try to leave it’s mostly to reduce these expenses. »

But if moving to an apartment was a solution to cutting expenses, this idea also brings its share of anxiety for Lili, who knows the cost. She adds:

“A few years ago I lived in Nîmes. I returned to the Île-de-France after a move to be able to stay with my mother, who was ill. But This move cost me a lot : going back 860 km without anyone helping me move, a month’s double rent, EDF to pay, deposits and guarantees, furniture… »

To cover these costs, Lili had to enter into a contract a loan of almost 10,000 euros, of which today he still has to pay about half. A solution that she would have liked to avoid, but which he had to resort to again to purchase a corset not reimbursed by Social Security for his son, who has health problems.

In total, therefore, reimburse €280 in consumer credits per month.

The lowest costs possible

Fixed costs are added to these €400 spent monthly, which details:

“ I eat lunch at work every day and my son eats all his meals at home. But at his age he eats like an adult! We shop in discount supermarkets or on the Internet, alone, because I can’t always carry the heavy shopping alone.

We eat meat once or twice a week and we are careful. The morning, For example, I need to limit my son’s grain intake. »

Lili pays too Commissions €146 for their mutual insurance (he did not want to take advantage of the one offered by his employer, which was expensive and not very advantageous), for housing and for death.

She pays too €106 for transportcounting the public transport season ticket and about twenty subway tickets a month for his son, €70 current bills, mainly for electricity, e the same quantity for an Internet subscription and for their telephone subscriptions.

As for clothes, Lili explains that she tries to buy as much second hand as possible for her son, who is growing quickly.

“ At 14, my son already wears size 43. I have to buy his clothes from adults! Most of the time I buy them second hand, or I try to anticipate sales. Given that he grows quickly, I’d say this represents average €100 per month.

I don’t buy anything. In my job “appropriate clothing” is required. This means a certain type of clothing, makeup… All this, It’s a budget!

Telecommuting has saved me money lately, but with the return to in-person work, I recently had to go to work in damaged clothes. It’s a shame, but it’s the reality: I can’t do otherwise. »

“ We make sacrifices every day »

To raise her son, Lili enrolled him in a cultural activity that costs approx €50 per month. His taxes, excluding withholding, cost him €13 monthly smooth throughout the year.

Finally, the cost of masks and hydroalcoholic gels, various non-refundable medicines and household cleaning products €200 per month.

However, all these fixed and essential expenses represent approximately 2,200 euros, or 200 euros more than Lili’s monthly income, which every month finds herself in overdraft. This generates premiums and bank charges that amount to €20. A difficult situation, which Lili can’t see the end of even though the expenses are kept to a minimum.

“ I feel like I’m fighting for nothing, though daily sacrifices, commitment and professional development, I count every day and I get very stressed. I promise to always pay my bills, even if I am overdrawn.

Both my parents worked and tried to give me a healthy relationship with money, but today life is too expensive for me to evolve positively. Sometimes I wonder what all this trouble is for…”

Unable to save, Lili confides in him very afraid of the unexpected: a breakdown, a health problem and it would be a financial catastrophe.

“ We can’t put the money aside, and all the cards are managed by the overdraft but this overdraft is never repaid, and is never repaid. Even if you buy everything at the lowest price, there are medical expenses, ink cartridges for printing courses, a Christmas present, a refrigerator that breaks…

It all adds up little by little and we never see the end. Over-indebtedness threatens me, I know this well. »

How to plan ahead?

For Lili it is important to highlight the situation of single parents, without family to support them or ex-spouse to pay them alimony.

“ Even while you work, the expenses related to those of a couple are too high to be managed alone, with a single salary. I’m thinking about finding a second job in addition to my forty hours a week, but it’s difficult to find work on Saturdays and my employer has to give me permission.

Knowing that this will increase my taxes, decrease my aid and deprive me of time with my son, I don’t know if it’s worth it. »

She continues:

Insecurity is not limited to people who do not work or who work part-time. There are also people who work full time and can’t get by. You have to understand that in this kind of situation you can’t plan ahead: people wish me a happy new year, but I know it will be anyway a year of difficulty. »

Thanks to Lili for answering our questions.

If you ever want to comment on this article, remember that a real person is likely reading you, so please be kind and avoid judgment.

To participate in the section write to us at: jaifaitca[at]madmoizelle.com with the subject “Settlement of accounts” and introduce yourself in a few lines.

Read another one

Settlement of accounts

-

Marianne, soldier earning 2,329 euros a month: “Becoming an owner is not in my plans”

-

Katia, between 560 and 1,680 euros per month: «I pay practically everything because my boyfriend doesn’t have a regular income»

-

June, teacher at 2,287 euros a month: “If I do well I can save 500 euros a month”

-

Lola, 2,244 euros per month and retraining: «This year I spent around 3 thousand euros as a hairdresser»

-

Aria and her partner, 4,296 euros per month: “We chose to save as much as possible”

Do you like our articles? You’ll love our podcasts. All our series, urgently listen to here.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.