Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Katia * who agreed to open her accounts for us.

- First name :Katia*

- Age : 29 years old

- Occupation : Independent translator

- Net salary before withholding tax : between €800 and €2400

- Net salary after withholding tax : between €560 and €1,680

- People (or animals) living under the same roof : her boyfriend and their two cats

- Place of life : a city on the Rhone (60)

Katia’s situation and income

Katia is 29 years old and is freelance translator for five years, under the status of author. Work for publishing houses or intermediaries to translate manga and anime. Katia has already worked before, but never in the field of literary translation.

“Unfortunately, having a permanent contract with this job is often a fantasy. There are a few on offer here and there, but they are often poorly paid for and not in great condition. There are certain companies that are good, obviously, but hey… you have to have the contacts to open the doors, let’s say. »

That said, she loves being independent because of the freedom it gives her. In general she says that she really likes her work.

«But I don’t like the fact that many publishing houses take the opportunity to step on our toes because there is no one behind us to support us. »

However, her work tires her a lot, “especially mentally”.

“The clients I work for leave me little time to produce quality work for them. So I often log hours in the middle of the night, in the evenings or on weekends. It is physically exhausting and therefore mentally demanding to form meaningful sentences. »

This is all the more difficult for the young woman as she currently suffers from mental health problems, which affect her professional life and therefore her finances.

” I was diagnosed with ADHD last year, which helped me understand some of the difficulties I sometimes have concentrating. Depression only makes this problem worse and sometimes it takes me several hours or even days before I can start a project. »

Katia lives as a couple with her partner and their two cats, in an apartment in a town on the Rhôneof which they have been tenants for four years.

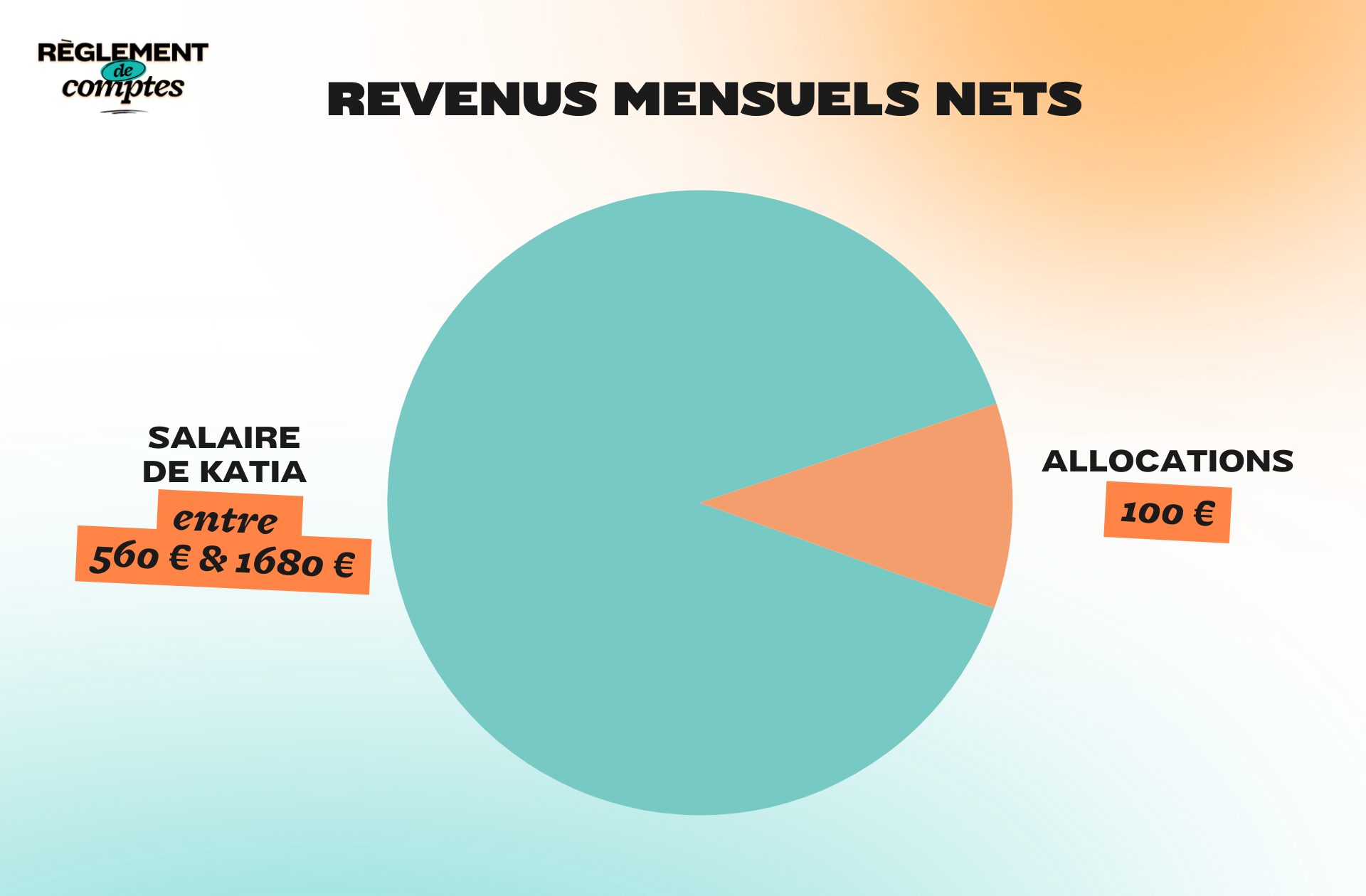

For her work as a freelance translator, Katia does not receive a fixed income, but which varies depending on the projects entrusted to her: between €800 and €2,400 gross depending on the month. The young woman is not subject to withholding tax, but must donate approximately 30% of these revenues to various organizationssuch as URSSAF and IRCEC, as contributions.

He therefore has between 560 and 1,680 euros to live on.once these expenses have been deducted, which you consider too small considering the time your business requires.

“Like many other translators, I am quite poorly paid. Many publishing houses don’t want us to sign a contract or pay royalties, and prefer to go through studios that pay us by the sling… We are at the end of the chain and you can feel it. »

Katia’s boyfriend doesn’t no regular income at the momentbut he benefits from it Activity bonus of €100.

Katia’s relationship with money and her financial organization

Katia grew up with “very fussy” parents:

“All my life I watched my mother pay attention to prices. My father was the one who brought the most money into the house because my mother only knew how to do a few odd jobs, she spent her time taking care of us. »

Katia tries every day favor low prices and save as much as possible, but he admits it’s complicated.

“Lately I often find myself in overdraft because I cover the cost of the rent alone. I also find it very difficult to work due to depression, so it doesn’t help fill the bank account. »

Regarding their financial organization, Katia and her boyfriend each have a personal checking account, but no savings account.

“I already have two personal accounts (one professional and one personal), so I don’t see myself having another one to manage. »

Currently, their management of common expenses is unbalanceddue to the professional situation of Katia’s partner.

“I pay practically everything because my boyfriend doesn’t have a regular income. It’s fairly recent, because before, he took care of the rent and I paid for everything else (insurance, groceries, etc.). »

Katia’s expenses

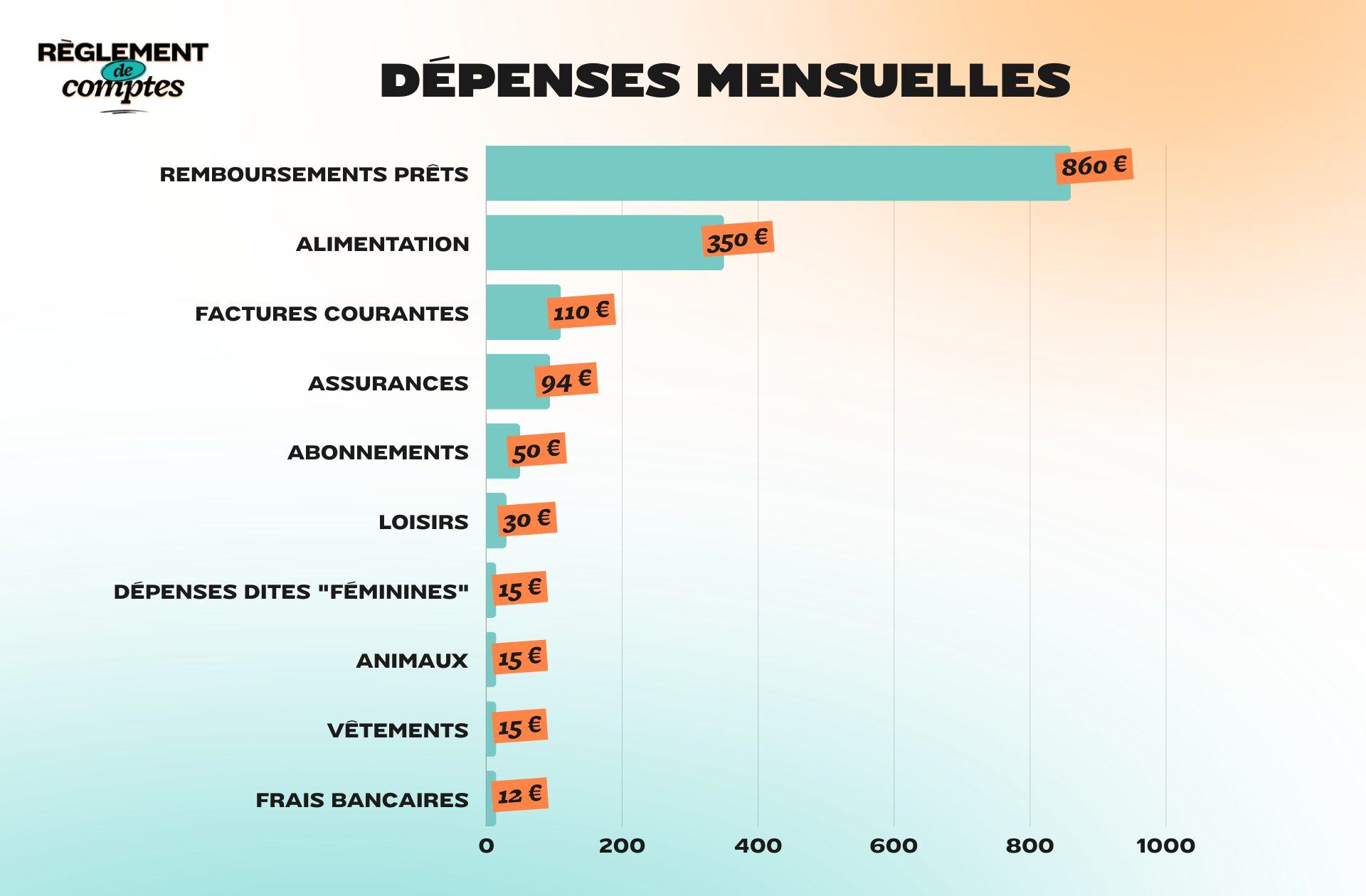

Katia currently guarantees payment of the entire rent, which amounts to €860 monthly. This is its main expense item.

Among the other charges he deals with, he lists €110 of current bills (€40 gas, €40 electricity and the rest of the expenses) e Subscriptions €50 (Telephone subscription €11, Office suite for €7, two Patreon subscriptions for €8). «I also give 4 euros to a friend to steal her Netflix account. » She pays too €94 for insurance (€18 home insurance, €41 mutual insurance and €35 insurance for “older cat” of Katia), and €12 bank charges.

Katia travels mainly on foot It has no regular shipping costs and due to his low income, he is not not subject to income tax.

As for food costs, Katia estimates them at €350 a month for twoespecially in supermarkets.

“I prioritize practicality above all. I don’t have a car and my wrists are bad from work, so I prefer to avoid carrying groceries for too long. »

In addition to purchasing food for herself and her boyfriend, Katia spends €15 per month for their cats AND €15 for so-called “female” expenses..

“I don’t wear makeup, so I only buy razors and pads. »

Furthermore, Katia pays for a session with a psychologist every month, for an amount of €55.

Katia’s leisure expenses

To relax and clear her mind, Katia loves to create “little things”. As an artist he therefore dedicates all his “free time” budget to purchasing equipment: €30 on average.

“I spend what I can on it. Sometimes nothing, sometimes a few tens or even hundreds of euros. For me it’s very important, it’s kind of what allows me to thrive outside of work. »

His latest breakdown? His registration for a conference to try to sell his creations. “I paid a few hundred euros for a stand. »

Katia makes a cost estimate for the clothes Around €15 per month.

«I have evened out my expenses, I tend to spend 50 or 60 euros when I can afford it (two or three times a year, generally). I try to favor good quality clothing (I liked Uniqlo for this, but that’s not really the case anymore…) so that they last a bit over time, otherwise it’s up to Vinted & co to try to find the cheapest. »

Katia’s savings and her future plans

It’s difficult right now for Katia to put money aside once she’s paid all the monthly expenses she and her boyfriend have.

“Lately I haven’t saved anything. Usually it is about a hundred euros. »

In the future Katia plans to travel abroad with her parents.

“It’s hard to say if I’m happy every day, but we make sure I am! »

Thanks to Katia* for opening her accounts for us!

* The name has been changed.

Read another one

Settlement of accounts

-

June, teacher at 2,287 euros a month: “If I do well I can save 500 euros a month”

-

Lola, 2,244 euros per month and retraining: «This year I spent around 3 thousand euros as a hairdresser»

-

Aria and her partner, 4,296 euros per month: “We chose to save as much as possible”

-

Lucie, 4,363 euros for two a month: «Earning more than my husband, it seems natural to me to cover additional costs»

-

Nadège, formerly over-indebted at 1,766 euros a month: “I had to calculate everything down to the cent”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Listen to Laisse-moi kiffer, Madmoizelle’s cultural advice podcast.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.