Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settlement of Accounts, people of all kinds check their budget, tell us about their financial organization as a couple or alone, and their relationship with money. Today it is Alexandra * who has agreed to analyze her accounts for us.

First name : Alexandra*

Age : 32 years old

Occupation : public service manager

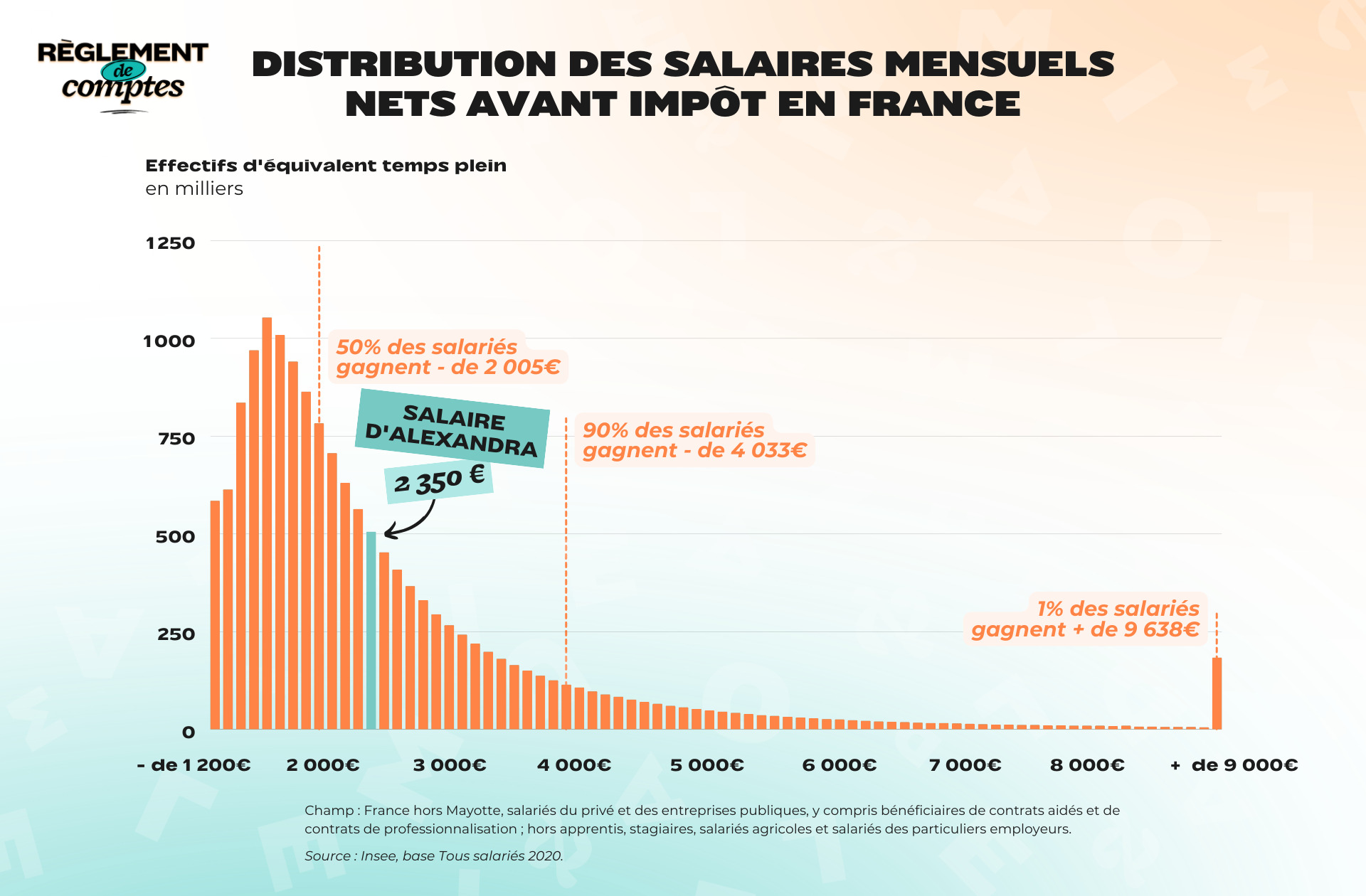

Net salary before withholding tax : 2 775 €

Net salary after withholding tax : €2,530

People (or animals) living under the same roof : 1 cat

Place of life : a large provincial city

Alexandra’s situation and income

Alexandra is a permanent executive in the public service. For reasons of anonymity, you do not wish to further specify your budget.

Engaged to, currently she lives alone in a house of 80m2 with garden in a large provincial city, of which she is owner for 5 years. She also manages her parents’ house, which he inherited when they died, and which he has rented out.

“The emotional charge is too great for me to part with. The rent allows for its maintenance and conservation. »

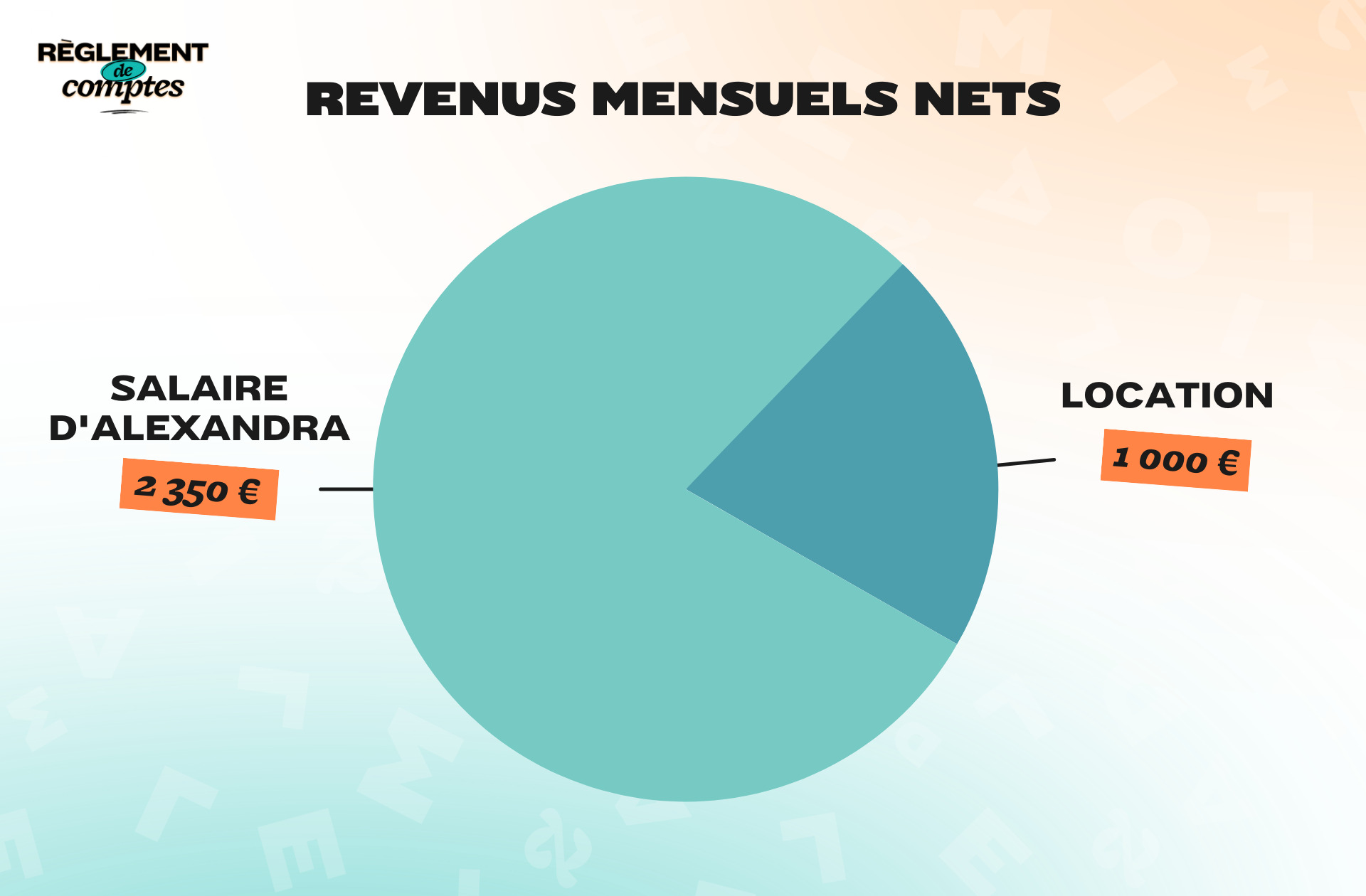

Jeanne thus combines two incomes: his salary, set at 2,530 euros a month subject to withholding at the source, and the €1,000 rent paid to him monthly by the inhabitants of his parents’ house. That’s a total monthly income of €3,530 per month.

Alexandra is aware that she is in a comfortable financial situation due to her income “allows you to have a good standard of living and wealth”.

“Paradoxically, I don’t feel that my work is recognized at its fair value compared to that of some colleagues. In the civil service, remuneration is based on seniority and not on the requirements of the position, workload or satisfaction given to the hierarchy. »

Alexandra’s relationship with money and her financial organization

Alexandra grew up in a family where she never lacked for anything. She recognizes it: “I had a comfortable lifestyle during my childhood”. But things changed when her parents died.

“I found myself in the bosom of Childhood Social Assistance with children from much less privileged social and economic backgrounds. Due to the discrepancy with other children (clothing, behavior, speech), I was particularly isolated and harassed by other children. This has marked me deeply, I am still very isolated without loved ones or family due to lack of success in building relationships. »

Growing up without her parents also affected Alexandra’s relationship with money.

“Having found myself relatively young in foster care, I did not have a financial education and did not have an example of family life. So, I had absolutely no idea to my majority of the money needed to live, the frequency of contingencies affecting the financial situation. »

The young woman has thus saved a lot, despite a lower salary than she receives today, to prepare for possible life accidents.

“It is over time that I understood what I really need to live. However, I keep in mind that I don’t have relatives who could help me in case of economic difficulties, so I’m reassured that I have a small amount of capital just in case.

However, I consider myself quite lucky, most of the young people who leave hostels find themselves not only very socially isolated but also in great precariousness. Thanks to my parents, I was able to avoid experiencing financial misery, even on the street, when I left home. »

This does not prevent Alexandra from feeling a great sense of guilt in relation to this money that her parents left her. “I don’t think I deserve it, even if they worked hard to get it. »

“Part of this money was used to pay for my studies. Since I have my income, I no longer touch this money that has been invested. I feel a certain responsibility towards investing this money, I feel obligated to have a relevant and responsible management strategy (more so than the savings from my salary). »

This is why Alexandra never exposed herself and took office a solid financial organization : You have an account for salary transfer and payment of all your personal expenses and expenses, as well as an account for collecting rent and deducting rent related expenses. His spouse, with whom he does not live, manages his budget independently of him.

Alexandra’s expenses

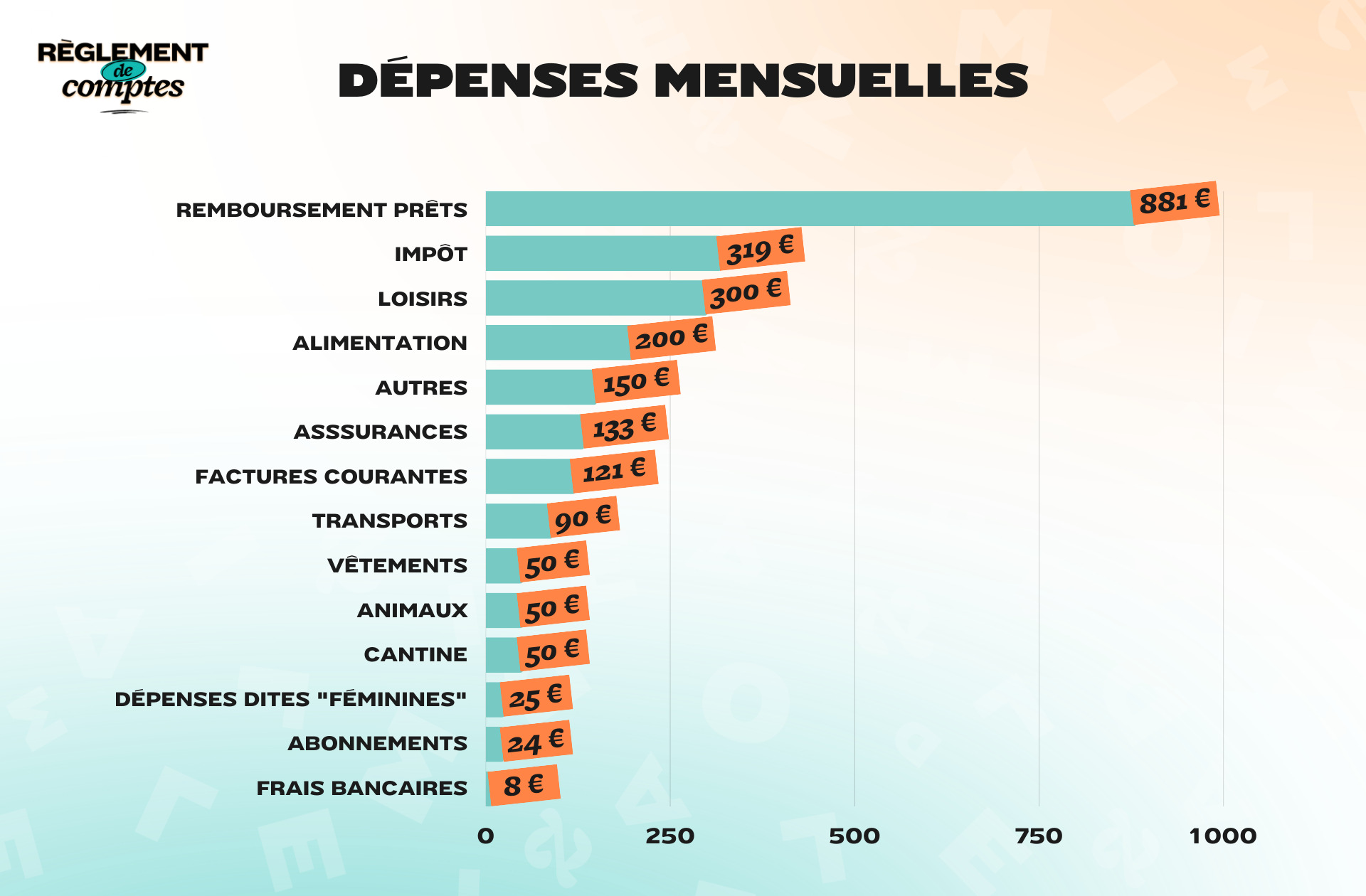

Like most of us, housing is Alexandra’s biggest expense. For the house with a garden in the city that she owns, the 30-year-old repays every month a loan of €881.88, including loan insurance.

Among the other recurring and incompressible expenses of the young woman comes the insurance: it pays every month €32.50 car insurance, €25 home insurance, €14.75 non-occupying owner insurance AND €61.50 mutual insurance.

Alexandra also pays monthly €13 of water AND 108 € electricity (including heating), €8 mobile phone subscription, €16 for fiber and €8 Bank charges.

Being the owner of two houses, Alexandra has to pay double property tax : €171 for rent and €103 for your own accommodation, plus a €45 financial contribution from companies (CFE). That is €319 in total per month. He also has to pay 130 euros for union dues, food and maintenance of the accommodation.

To get around, Alexandra has a car but also uses public transport on a daily basis. She pays every month 20€ to take the busand spends on average €40 petrol AND €30 maintenance for your car.

“I prefer local products and more environmentally friendly products”

Food is an important item of expenditure for Alexandra. Every month she pays on average 200 euros in groceriesnot counting the Company restaurant €50.

“I go to the market for fresh produce and a walkway every two weeks for groceries and non-food items. I prefer local products and those that are more environmentally friendly. Being alone, the additional cost associated with this mode of consumption is very reasonable. »

For her cat, the young lady also spends money: €50 per month in food, litter and veterinary expenses.

The so-called “feminine” expenses weigh little on her monthly budget: around €25, for make-up, beauty products and hair removal. Also use menstrual panties, cheaper over time and “more environmentally friendly”.

“From time to time I use disposable sanitary pads because it is more practical in certain situations (especially important business trips where it is not possible to change panties discreetly when the days are at least 12-13 hours) and sanitary pads for the swimming pool because they can i use the cups I think it must be 2 packs of pads a year and 1 pack of tampons. »

As for her contraception, it is reimbursed by her health insurance. “And if we need condoms, my partner usually pays. »

Out of ecological conviction, Alexandra spends little on clothing: €50 a month on averagemostly second hand.

Alexandra’s hobbies

Because she works a lot and volunteers for an animal charity, Alexandra has little time for her hobbies.

Most of his budget – around €300 – is dedicated to culture: visits to museums, representations of operas… He also boxes in a club.

“Free time is important to me, it allows me to cut myself off from everyday life. However, the cut and the well-being it brings do not depend on the budget dedicated to it; volunteering brings me as much relaxation as the free time I pay for. »

Alexandra’s savings and future plans

Because she makes a good living and diligently manages her monthly budget, Alexandra doesn’t have a lot of “crackers” to report, except for the creation and outfitting of her terrace.

“I don’t see a budget to reduce without losing quality of life, I’m not ready for it and it’s not financially necessary for my budget. »

Thanks to this discipline, Alexandra manages to save a very large sum every year: about 15,000 euros per year.

“Some of this money is deposited in diversified accounts and the other is invested in construction or home maintenance. »

In the future, Alexandra would like to be able to start a family. In order to be able to dedicate yourself, she therefore imagines taking up a part-time job, “more compatible with family life, and therefore assumes a loss of income and higher expenses”.

Thanks to Alexandra* for going over her budget for us!

*Name has been changed.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

Do you like our articles? You will love our newsletters! Sign up for free on this page.

read another one

Settle accounts

-

Palin, 1,950 euros a month: “I have a very free relationship with money, I’m often discovered”

-

Jeanne, I study-work for 900 euros a month: “I went from eating organic and local at my parents’ house to eating Lidl!”

-

Keizya, 2,884 euros a month: “The financial crisis has significantly reduced my standard of living”

-

Céleste, 2,050 euros a month in a roommate: “I put aside 30,000 euros by doing summer chores”

-

Léa, 3,936 euros a month for two: “I refuse to share the cost of contraceptives with my partner”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.