- First name : Keizya*

- Age : 34 years

- Occupation : Head of animation

- Net salary before withholding tax : €1776.75

- Net salary after withholding tax : not taxable

- People (or animals) who live with you : his 3 children

- Place of life : Orleans (Loiret)

Keizya’s situation and income

For 12 years, Keizya worked as an animation manager. More precisely, she evolves into “the field of social animation”.

“My role essentially consists in coordinating, setting up and supervising activities aimed at socializing and developing people. »

Separated and divorced for 5 yearsKeizya is mother of three children aged 11, 7 and 6of which he has full-time custody (the father has the right to visit and lodge every weekend and half of the school holidays).

He lives in Orléans, in the Center region, in a house of 85 m2 belonging to an allotment, and composed of 3 bedrooms. “I have currently had a lease-joining agreement for almost a year and am in the process of acquiring my property. »

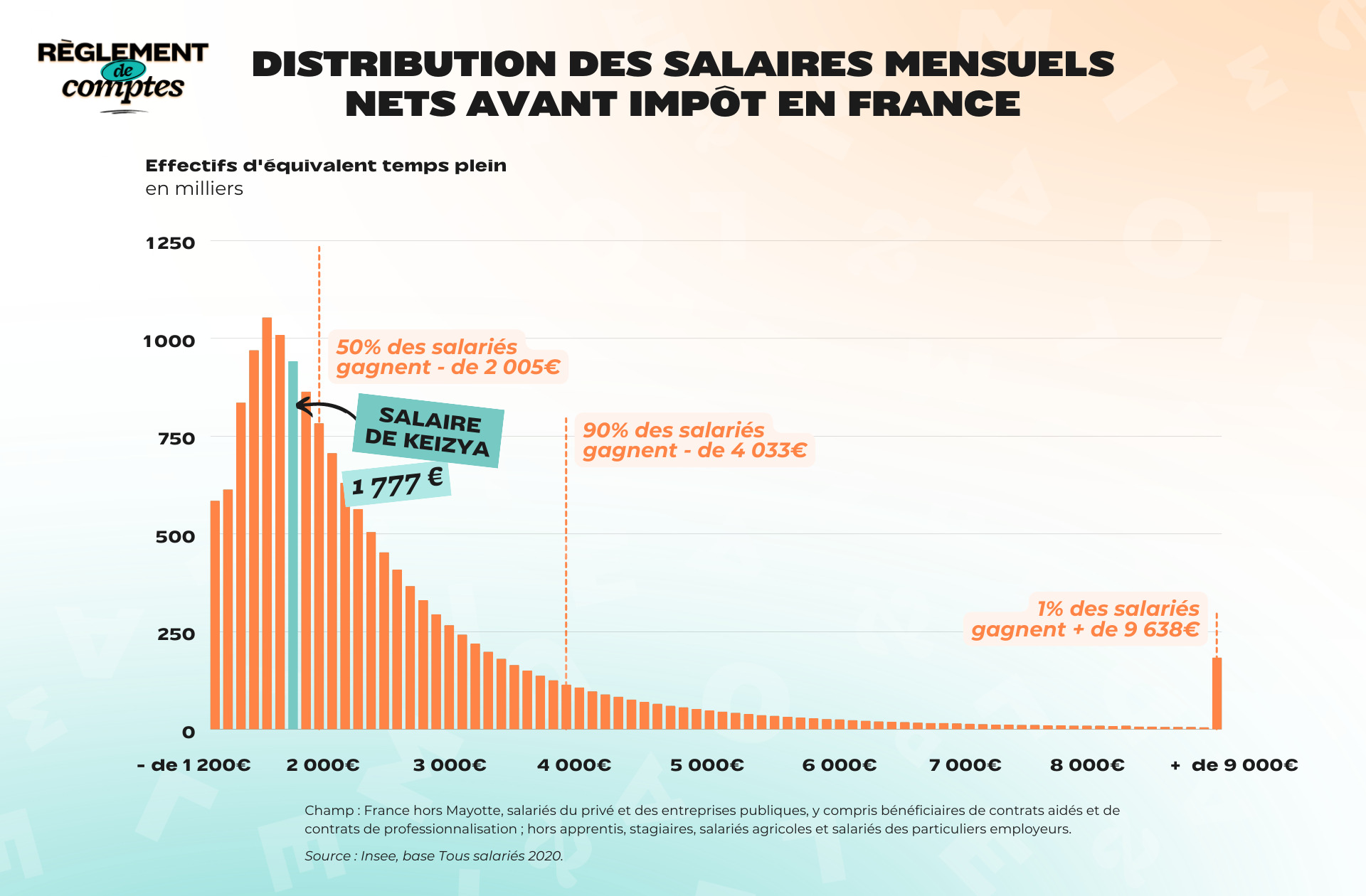

For his full-time permanent job, Keizya earns a net salary of €1,776.75. It is not taxable and is considered “relatively well paid”.

“My workload is getting bigger and I recently got a degree that hasn’t changed my salary. But my salary still allows me to stay in the middle range. With family allowances and alimony, my income increases. But the financial crisis has significantly reduced my standard of living. »

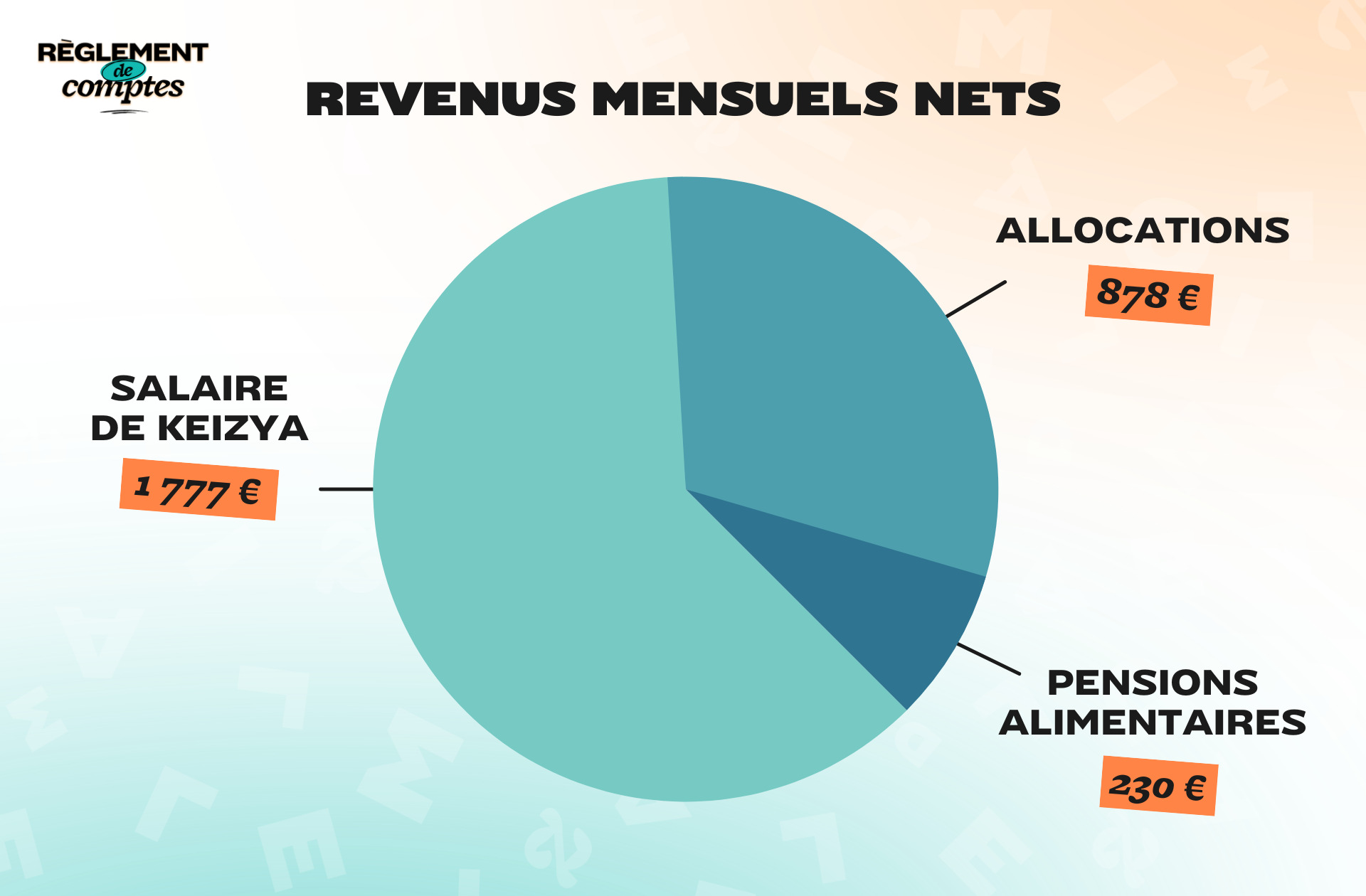

As a single parent of 3 children, Keizya earns monthly €878.00 from CAF. Even her ex-husband pays for it alimony of 230€. In total, he then receives every month 2,884.75 euros for her and her children.

Keizya’s relationship with money and his financial organization

Keizya says her parents, of Congolese origin, were particularly spendthrifts and when she was a child they sent a lot of money to the country. But she assures “having lacked nothing”.

“Unlike my friends, we ate branded products from hypermarkets rather than discount stores. »

Today Keizya has to compose among his wishes for fun – “I can easily put €300 in a pair of designer shoes” – and its tight budget for a single parent.

“I have to be careful because as a single mother I can’t afford to do anything. »

Being currently in rental membership, he can no longer collect Premier League, which weighs heavily on his budget.

“I haven’t adapted yet, it doesn’t take much to find myself out in the open. Being able to save, and especially for my children, relieves me of the guilt of being caught. »

To manage his expenses and income, Keizya currently only has one bank account, but he plans to “will have better control over their accounts”to open a second one to specifically manage the expenses related to the children.

Since January, it also has has opted for the bag system to better manage its food budgetbut also some events such as birthdays, petrol, Christmas, holidays…

“I still use my credit card sometimes, but I still cut back. »

Keizya’s expenses

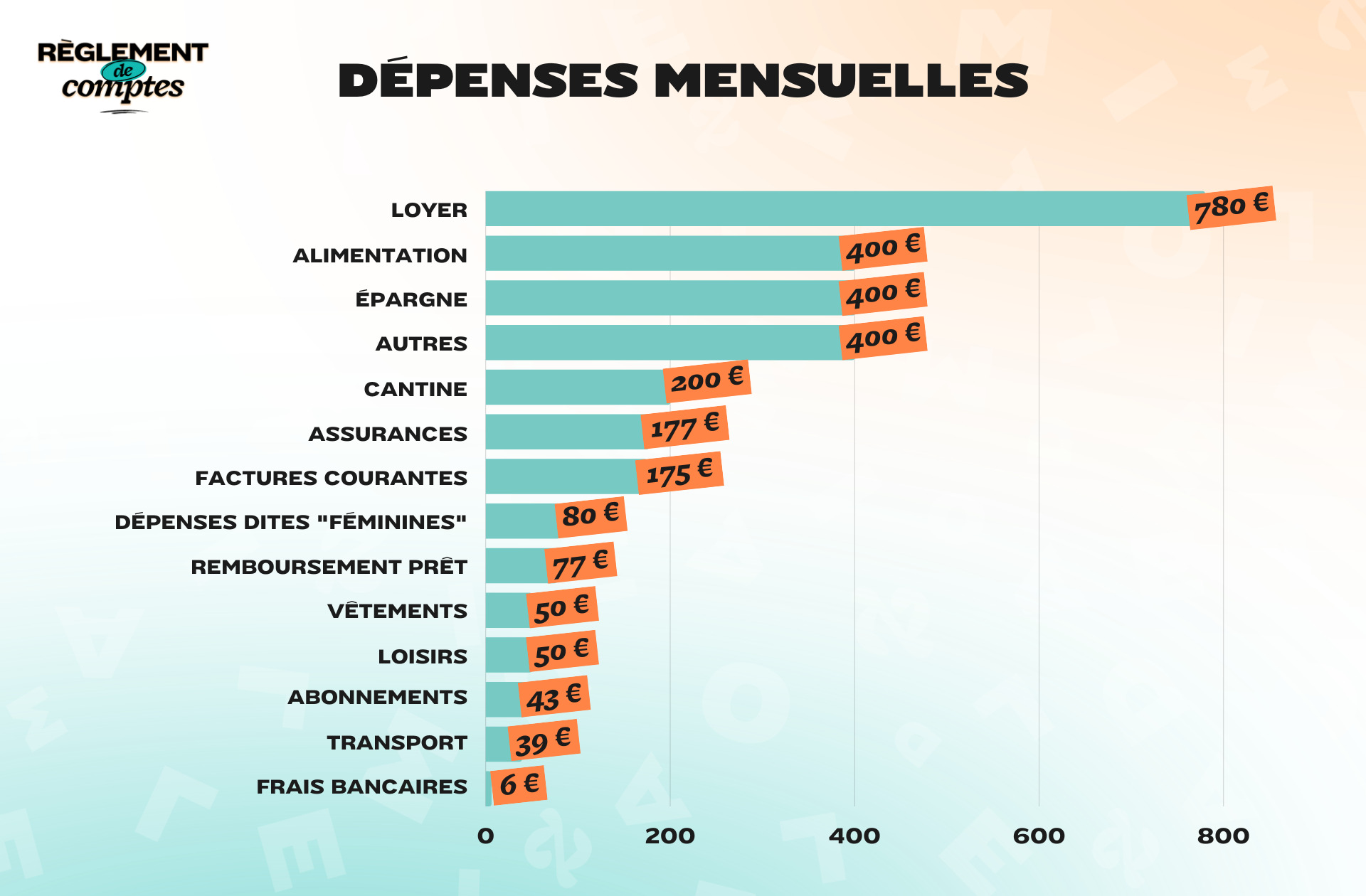

Keizya’s first item of expenditure is obviously accommodation. For her house in Orléans, the 30-year-old pays every month a rent of €780.45.

Then come the current invoices: 135 € electricity, 40 € of water and sanitation, as well as insurance: €93 for car, housing and civil liability insurance and €84 for the health insurance.

Among the other incompressible costs that Keizya has to face were 77 euros a month until May for a mortgage he had taken out to buy furniture, but which he has just finished repaying.

On the other hand, it still pays various bills: €16 phone plan, €27 for your internet subscription, €6 Bank charges.

To get around, Keizya uses public transport. His membership is paid at 50% by his employer, which leaves him with a balance of €39 per month.

“I can’t buy everything local, even if I would like to”

As she is the mother of 3 children, Keizya spends a considerable amount on their food. The canteen (and after school) it costs him €200 and think about spending 400€ spent per monthmainly in supermarkets and butchers for meat.

“I prefer practicality and prices, because with my lifestyle and limited shopping budget, I can’t buy everything local, even if I would like to. »

Keizya has no particular “feminine” expenses. For himself and for her children, he spends on average €40 at the hairdresser. She spends too 40€ a month for her manicureas well as 50 € on average to dressher and her family.

To lighten her budget, the young woman would like to reduce the rent, which she considers too high. For now, Keizya hasn’t splurged… But she might not be long.

“I haven’t caved in yet but I’m squinting at designer pants that cost 300 euros. »

Keizya’s hobbies

As a single mom, Keizya has hobbies mainly focused on his children.

“Once a month we try to create a restaurant (fast food) and an amusement park. The rare times that I don’t have my children, I go to the cinema and more traditional restaurants. »

This expense item costs him approximately €50 per month.

Keizya’s savings and future plans

At the end of the month, once all these expenses have been paid, Keizya has little more than €800. She uses them to save money for her children.

“My children each have an account that I don’t put money into, instead I save it €30 per month. »

She also sets aside €20 of life insurance and, thanks to the envelope system, puts aside €150 for a future trip to Africa.

“Right now, my other savings are mostly used to pay off my overdrafts. »

If the future allows, Keizya wishes he could buy his own property.

“But I am aware that it will require many sacrifices in terms of free time and holidays. I then plan to go back to renting to benefit my children and build up savings to buy an apartment later when my children are grown up. »

Thanks to Keizya* for going over his budget for us!

*Name has been changed.

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read from you!

Do you like our articles? You will love our newsletters! Sign up for free on this page.

read another one

Settle accounts

-

Francesca, 2,185 euros a month: “My goal is to earn 3,000 euros net a month at 30”

-

Céleste, 2,050 euros a month in a roommate: “I put aside 30,000 euros by doing summer chores”

-

Clara, 2,798 euros a month for two: “With a large difference in salary, it is difficult to measure what we put in the common fund”

-

Émilie, 1,036 euros a month: “They’ve already told me: ‘I don’t understand why I have to pay you, it’s a passion job'”

-

Maëva, 5,680 euros for two in Belgium: “In France I certainly wouldn’t have been paid as well for the same type of assignment”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.