Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today Lina agreed to check her accounts.

- name: Lina

- age: 29 years old

- profession: responsible for supporting social entrepreneurship

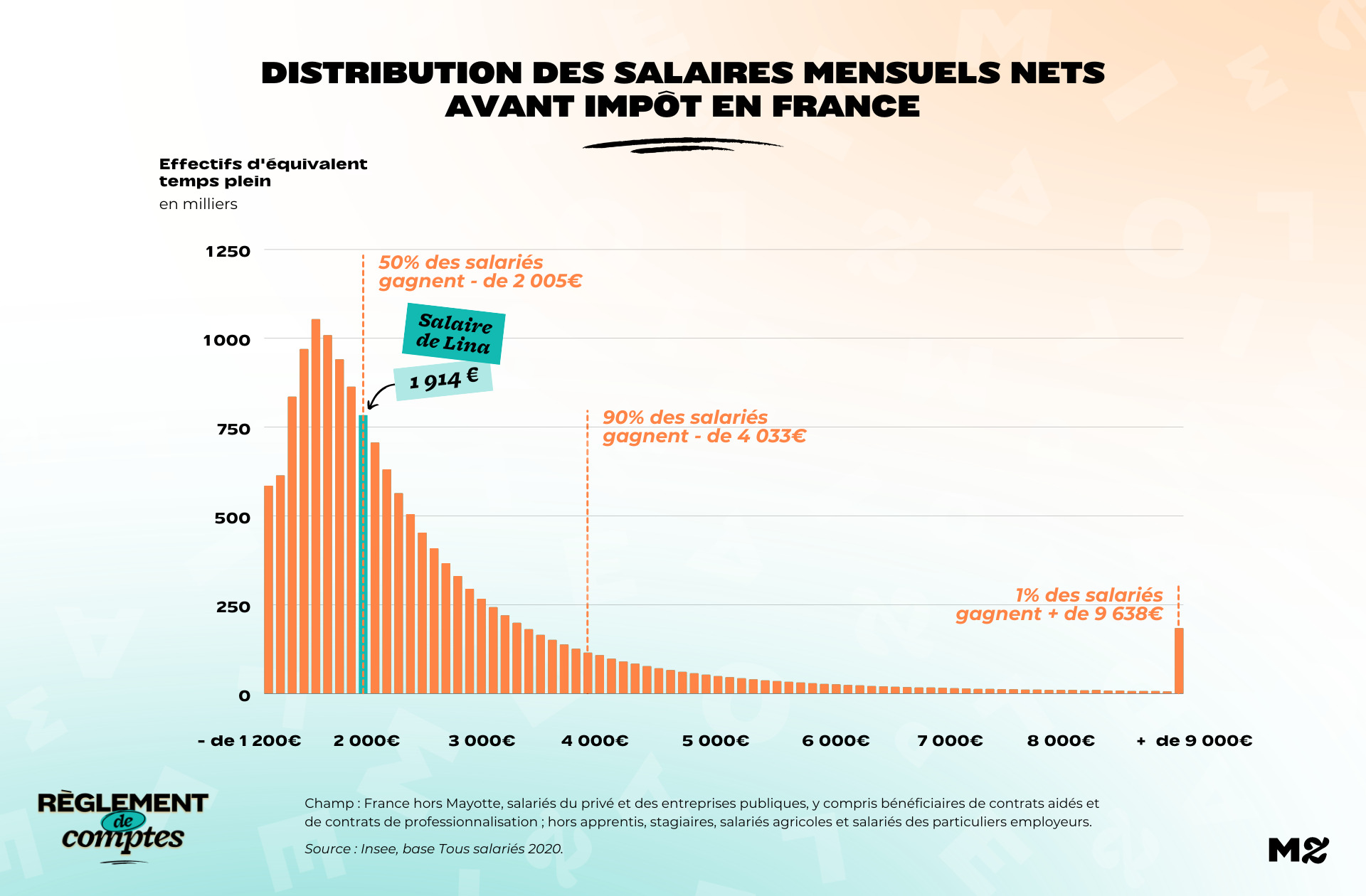

- monthly salary: €1914 before withholding tax, €1846 after withholding tax

- lives with: his spouse, who has 952 euros a month of unemployment benefits, and his cat.

- living space: an apartment they own in the Nantes region

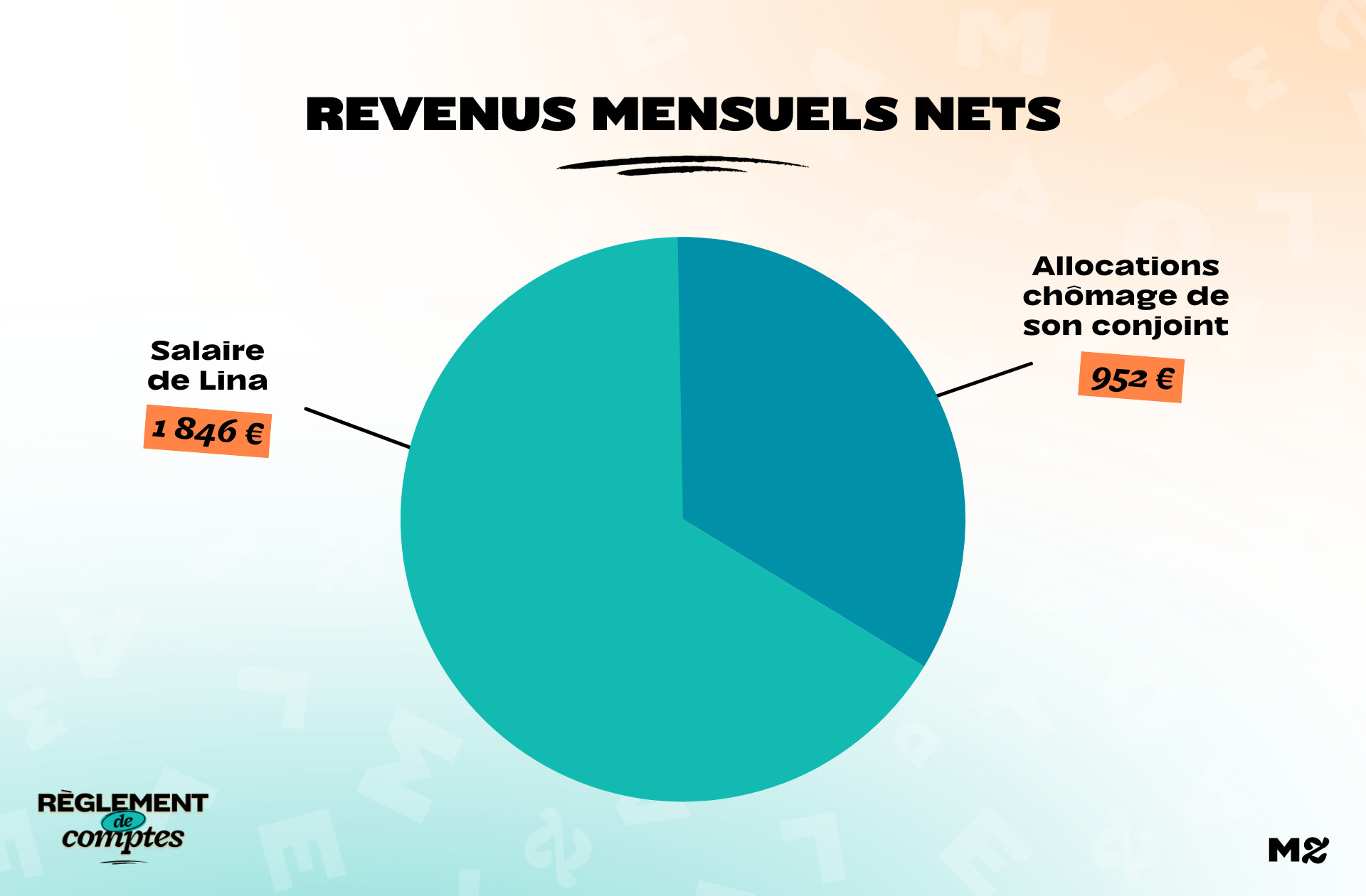

The income of Lina and her partner

Lina is an employee with a permanent contract of an association that helps people who want to start their solidarity business project. A profession that she is “at the crossroads between the world of entrepreneurship/enterprise and the associative, militant world”. When asked if she considers herself well paid, he replies:

“I think I’m pretty well paid compared to other employees in the corporate world. If, on the other hand, I compare my salary with the income of a consultant/entrepreneurial expert… I know that my income is much lower. »

He lives with his partner, currently unemployed, who receives a €952 per month. Together they manage a budget of 2,798 euros.

Lina’s financial organization and her partner

The nearly 30-year-old and his wife are in a PACS. To organize their finances they use three bank accounts: one individual each and one joint account from which common expenses are deducted. Since her partner’s income is much lower than hers, Lina and his wife had to think a lot about the choice of their operation.

They have decided to adjust according to budget items: 50/50 or pro rata, it all depends on the objective.

“At the beginning of the month, each of us automatic transfers – proportional to our income. My boyfriend is currently unemployed so we thought about a distribution that seemed as fair as possible, we discussed it a lot. We have created a tracking table to automatically calculate the fair distribution of fixed expenses.

We decided to go 50/50 for the repayment of the loan. It’s a way to invest equally and really own the same share. For fixed expenses we have read a lot on the subject and decided to make the breakdown in proportion to our income.

On “rest to live”, he is a little more anarchist! We originally wanted to be 50/50, but realized it didn’t work for my boyfriend’s budget. To ensure the financial stability of both, we have to adjust. It’s not always easy to have a big difference in salary and measure what you put in the common fund! »

For the couple, money has never been a source of conflict. “Rather a source of reflection, discussion, learning…” explains Lina.

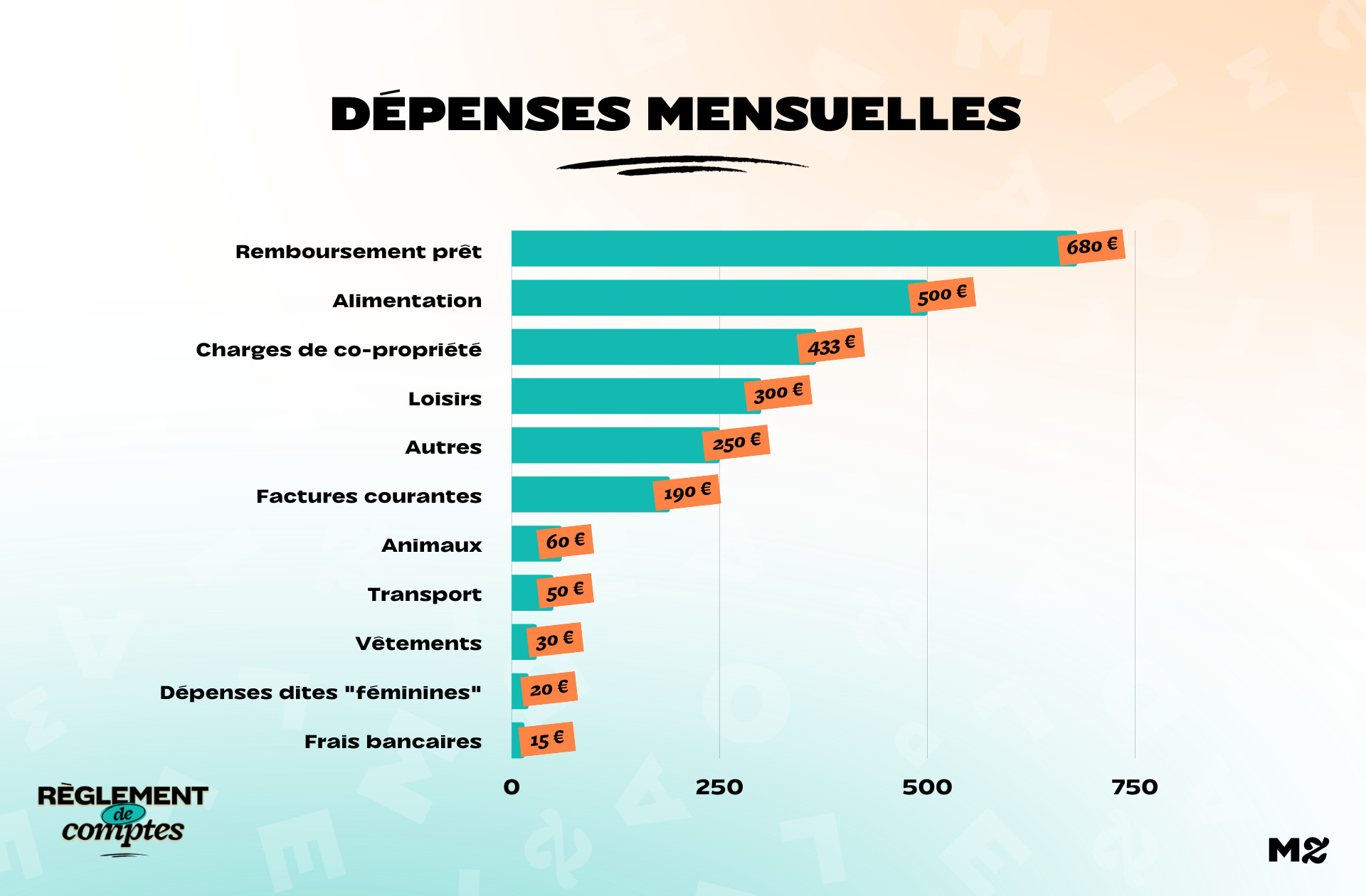

The expenses of Lina and her spouse

Every month, Lina and her partner repay approximately Home loan of 680 euros for their apartment, which they then share 50/50.

“We live in an apartment of nearly 100 m² on the outskirts of Nantes, in a building we love. We bought this apartment last year, it was a big step and the buying window was pretty tight: finding the ideal apartment while my boyfriend was still on a permanent job and before bank rates went too high. The price of the apartment was quite low compared to the very tight real estate market in Nantes, but our rates are very high. »

To this they add fixed costs of co-ownership of € 366 and which include the common areas, the heating and the co-ownership fund to which they must contribute on a monthly basis. They don’t know the amount of their property tax yet.

They are counting €190 in monthly bills for the various insurances (car, house, mortgage) and for access to water, internet and electricity. They’ve reduced that amount since they discontinued all of theirs stream : ‹‹ We are now fans of the municipal library and of the free streaming Art service ». For their three accounts and their two bank cards, they pay €15 monthly fee.

“We can’t organize ourselves to go to the market”

Every month, Lina and her spouse count €500 spentmost often in supermarkets.

“Ideally I would like to buy 100% local products, but in practice this is not the case! Not for a matter of budget but rather for a matter of practicality… The supermarket closest to us is a large hypermarket, and we are unable to organize ourselves to go to the market and avoid the large shopping centre. On the other hand, I buy all my vegetables from the producers who come once a week to my work and our building. »

She would like to buy slightly less processed productsand therefore lower the score of the races a little.

Between them they spend €50 per month to travel: €20 transport and €30 petrol. “ Most of the time I travel by bicycle explains Lina. They also count €60 per month to buy food, litter and medicines for your cat.

The couple’s leisure expenses

For their free time, Lina and her husband spend approx €300 per month. He has dance lessons for her in an association, around fifty euros each for cultural outings, as well as a few outings with friends in bars and restaurants. Plan already a big budget for a birthday in 2023:

“This year, most of my friends will be turning 30. Every month I will have a good item of expense for weekends, holidays and gifts to celebrate! »

It also has an average €250 per month rounded off in the year on holidays and weekends, also to visit family or friends.

Lina says she has a lot of cracks when it comes to money. When it comes to expensive things, it is often very thoughtful and enduring:

“For example, I offered myself a 300 euro dress for my sister’s wedding… But it’s a dress from a small, sustainable and responsible brand, and I’m happy to set aside this budget for an important event! »

Lina’s relationship with money and savings

Lina explains it, she is often afraid of spending too much:

” My parents were quite thrifty, they taught me to think before you buy, to compare prices… I need to save regularly, for future projects. Since I became a homeowner, it’s not easy to accept saving less than before. I tell myself that having bought a property is also a way to save money! »

It is almost never discovered: if it is in the red, it fills with its savings:

“Before, I was able to save 500 euros a month. Since we have the loan, it’s more complicated and quite random from month to month. I’d say it’s more around €200 a month, which I put in my savings book A. I take for holidays or bigger buying plans. »

In the future they would like to work in their apartment and maybe cross the Atlantic. Thanks to Lina for answering our questions!

read another

Settle accounts

-

Salma, 1,890 euros a month: “My bank has completely changed my mind”

-

Pamela, 4,015 euros a month for two: «Some months I save up to 1,000 euros»

-

Karine, 2,157 euros per month: “Being as a couple but living apart has advantages”

-

Asmahan, 756 euros a month: “I worked for two years without being paid”

-

Lina, 1,863 euros a month: “Compared to my peers, I consider myself very high average”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.