Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today Lina agreed to check her accounts for us.

- First name : Lin

- Age : 24 years

- Work : civil service contract engineer

- Net salary : 1,863 euros per month. It is not yet taxed at source

- Lives with : his rabbit

- Place of life: a 45 m² apartment that he rents in Nancy

Lina’s income

Lina is an engineer and works in public administration as a contractor. You therefore have a fixed-term contract, and you are waiting to pass a public employment competition, which would allow you to obtain a permanent contract within your structure. You mainly deal with issues relating to the environment and its protection.

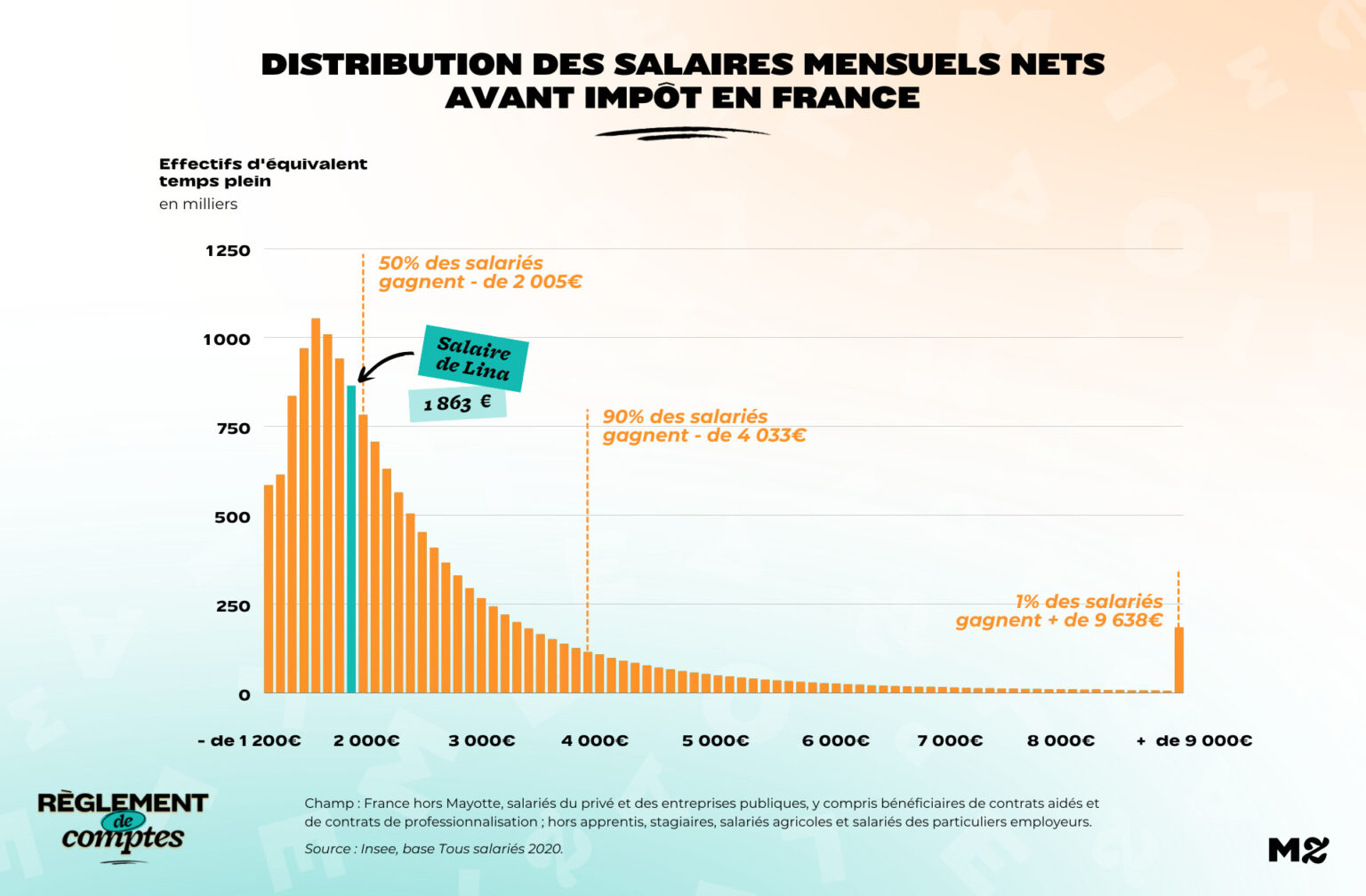

She believes her salary puts her in the middle, even upper-middle:

“My salary allows me to meet my basic needs and more, as I can have hobbies and shop (books and skincare) without tightening my belt.

Compared to people of my age, I consider myself in the high average++, and compared to the whole French population, I consider myself in the average. I particularly appreciate the fact that the public service pays according to a salary grid, avoiding the gaps between men and women (still too present) and allowing me to be increased every year without having to complain! »

Lina’s relationship with money

Lina finished her studies a year ago, after several years of training and work-study. Her income has gradually increased and she explains that she has learned to manage a budget step by step:

“My parents supported me financially during the beginning of my studies so that I didn’t miss anything without having to live ric-rac. I also benefited from APL. I was also encouraged to work a summer job. In this logic, I finished my study-work studies to acquire financial independence and manage my money and no longer that of my parents.

After my studies, for the first few months I kept a detailed account of all my expenses, from the rent to the purchase of a croissant. Doing it on paper has allowed me to have more visibility on my accounts and to categorize my expenses between purchases, compulsory taxes, free time… It has helped me to see more clearly what I have left to do at the end of each month. »

One method that helped her figure out her budget and needs, so she didn’t have to think about it so often:

“When several months passed, I was able to better understand my budget and stop sticking to it so strictly.

Now I follow the movements of my bank account regularly, that’s all. I’ve never been out in the open, I watch it closely. »

Pay attention to his accounts, but try to keep small regular pleasures:

“Even if I am careful with my accounts, I do not deprive myself of small pleasures from time to time (mulled wine at the Christmas market, croissant for breakfast, etc.).

My goal is to enjoy every moment without getting exposed. »

Lina’s expenses

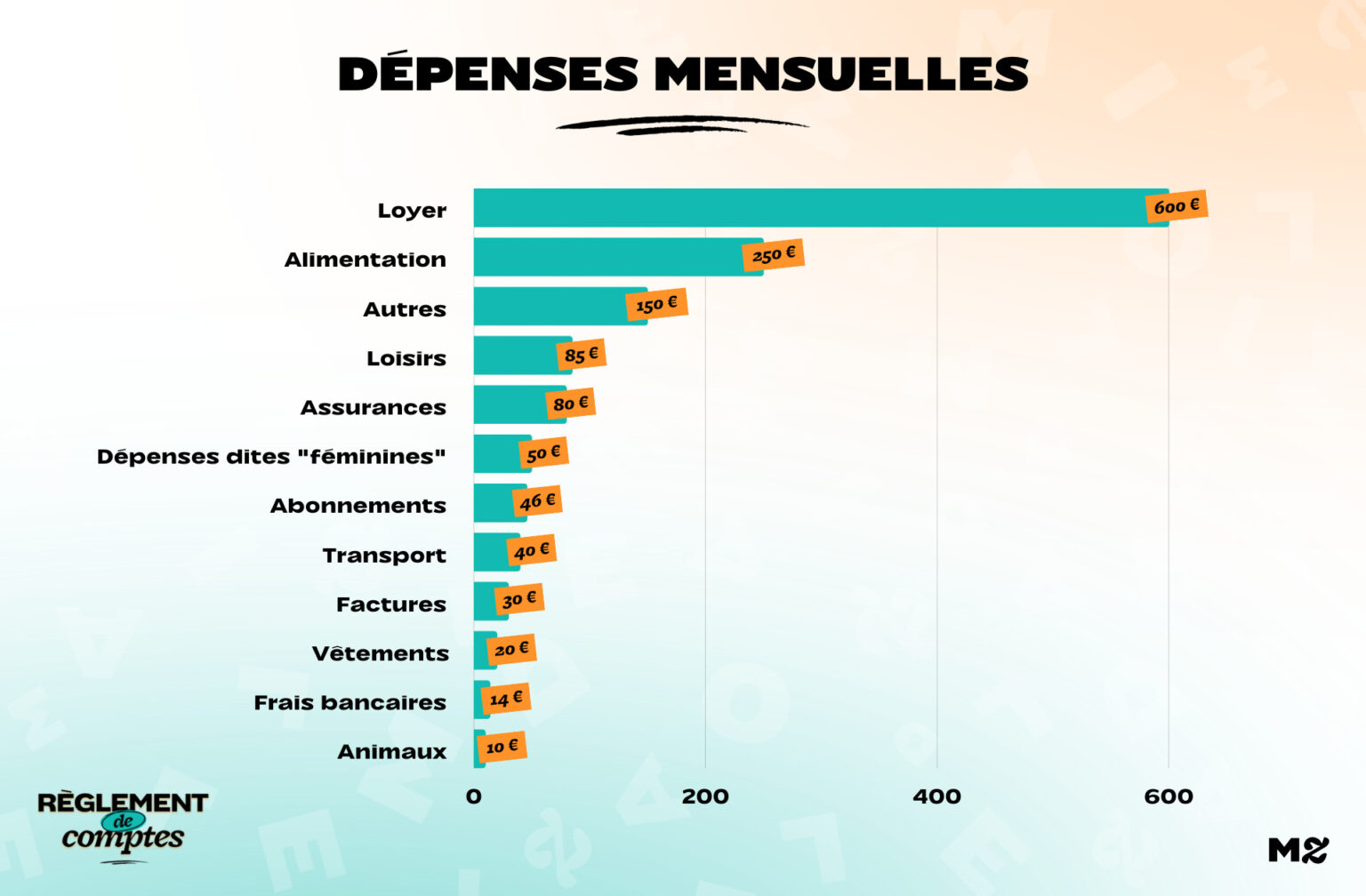

Representing nearly a third of the young woman’s budget, Lina’s rent is her largest expense. For her 45 m² apartment in the city of Nancy, Lina pays 600 euros a month.

“Being in a student city, there is an ‘offset’ in house prices. That is to say that, in a somewhat caricatured way, under €500, I would have studio apartments, rather old, without parking… While, if we exceed the €550 rent threshold, we access larger, newer apartments, with balconies, with parking. I know that this figure represents a large part of my budget, but reducing it means losing quality of life, and today I don’t want that. »

She is satisfied with her apartment, the location of which is very convenient in her daily life:

“I live a 10-minute walk from my workplace and a 5-minute walk from a large supermarket. The location of my accommodation allows me to do almost all my travels on foot. »

The fact that her house is new also has some advantages: She explains that her building is “at the top in terms of insulation”. This allows it to turn on the heat quite late in the year, plus it never goes above 19 degrees. His gas and electricity bills are 30 euros a month.

Your monthly fixed costs include 46 € of subscriptions for Internet and Netflix, 80 euros of car insurance, accommodation and supplementary health insurance, as well as 14 euros of bank charges, a figure he hopes to reduce soon:

“I consider it too expensive, but I needed the options for this card once and I haven’t had time to change it yet. »

Count approximately €40 per month to travel: about ten euros for a full tank of petrol (he rarely uses the car, just for fun), a few euros to take the tram once in a while, and train tickets to see his family.

“I am fully reflecting on my way of consuming”

The engineer explains that he spends about 250 euros a month on groceries, especially in the department stores near his home. However, he is thinking about changing his way of consuming:

“I eat a lot of vegetables, I prefer seasonal products, French and ideally purchased at the local market of my city. For me, consuming local is an important point. I’d rather pay a little more for my operator in the Vosges than have a cheaper product to buy in bulk on the other side of the world.

I’m thinking about changing my riding style, I would like to focus even more on the local, but the AMAP close to home doesn’t quite suit me. Continues ! »

She counts too €10 per month litter and food for your rabbit.

Lina’s hobbies

In her regular spending on recreation, Lina spends around €85 per month smoothing out your expenses for your sports activities throughout the year:

“I practice fitness once a week with my city’s MJC, which allows me to have access to a quality, low-cost exercise session every week. I am also a longtime rider and this activity is particularly close to my heart. When I have free time, I run or hike near my home.

I am also a great reader, and my dream is to one day have a large bookcase in the living room (which serves as an excuse to buy lots of books…). I regularly trade my books in the book trees near my house and will figure out how to register with the library. »

Count for the year his membership of his MJC’s fitness and its annual package (€184), a federal license and a riding package (€684) as well as occasional courses (about €80). This year you also bought sports equipment for one hundred euros.

Adds approx. €150 per month, leveled up over the year, in an “other” budget that covers weekends in other cities from time to time, one restaurant a month, a few outings in bars or clubs, and more rarely outings to the cinema, theater or opera.

He hopes to be able to maintain this leisure budget, which he considers important for his development:

“Leisure and weekends are substantial parts of my budget. At the same time, these are the elements that make me happy, so today no reduction in the advance, although it will certainly happen one day.

However, I am aware that the day I have credits to repay or more substantial expenses (children, illnesses, contingencies, etc.) this budget will have to be revised sharply downwards. »

Lina’s savings

Once these expenses are done, Lina saves between €200 and €800 every month, a figure that varies according to the bills to be paid (which fall every two months, quarterly or annually for the vast majority.

She explains that her parents saved up for her during her childhood.

“When I was 18, they had saved up approx 15,000 euros for me. With my summer jobs as a student and the average of €500 a month I’ve saved since I started working a year ago, I now have savings of around €20,000. . »

When she returned to working life, she made an appointment with her bank, who advised her to get a savings account and life insurance.

“Today, I pay my money first into my savings account, but I know my life insurance is already open for later.

When I sign a CDI, I would like to own a house with a small garden in the countryside, and make trips that are a little more expensive such as going to Canada. »

read another

Settle accounts

-

Assia, 2,318 euros a month: “I don’t understand why I’m always in the red”

-

Olivia, 768 euros a month: “I don’t have a fridge at home”

-

Rose, 2,356 euros per month: “I save 2,000 euros per month”

-

Emma, 900 euros a month: “I’m constantly exposed and it doesn’t stress me”

-

Carole, 2,700 euros a month in Martinique: “The system is a bit unfair to single mothers”

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.