Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In the Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Today Rose agreed to check her accounts for us.

- First name : Pink

- Age : 26 years

- Professions: construction lawyer

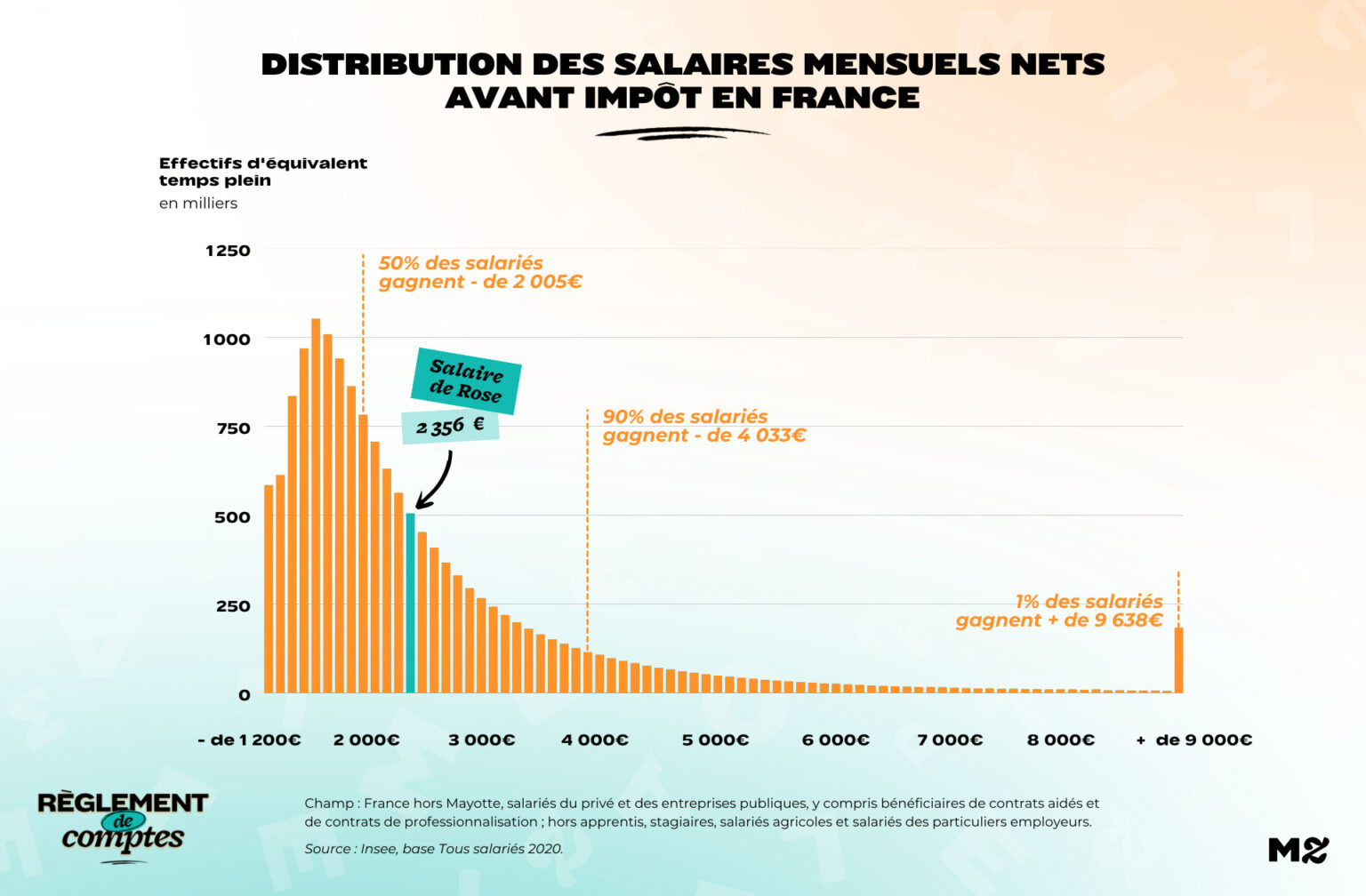

- Net monthly salary after withholding tax: €2,356

- Lives alone

- Place of life: a 28 m2 apartment in Île-de-France purchased with the help of his parents

Rose’s income

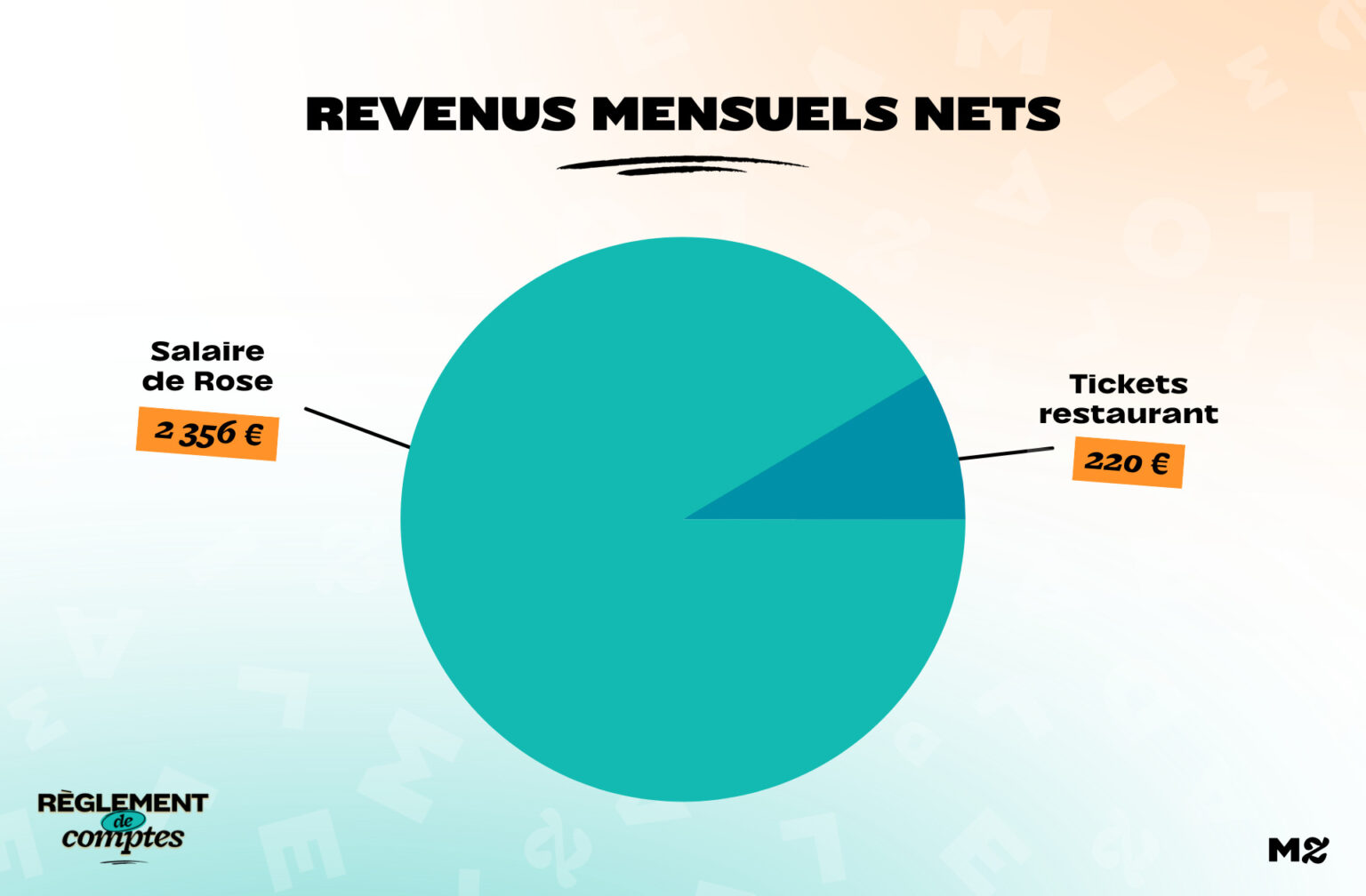

Rose is an employee of CDI as a lawyer in an SME For just over a year. In this position, €2,500 is paid before withholding, ie €2,356 per month after tax. His employer also gives him access to €220 in restaurant vouchers. She considers herself well paid, but not rich for all this:

“I consider myself well paid in relation to my experience. On the other hand, I don’t consider myself rich. Wealth, in my view, can only be valued against others and I believe that inequalities in France are so great that in today’s inflationary environment, earning €2,000 to €2,500 does not equal wealth. »

He has no other source of income. In all, it therefore manages a budget of €2,556 per month.

The relationship with pink silver

Rose’s parents raised her to thrifty money management. She explains that she has always lived chichement:

“My parents come from a working class background. My father was a factory worker all his life and my mother worked at the bank teller. They had no assets or inheritances in the family, but my father’s employer has a reputation for being one of the best paid workers (bonuses, benefits, etc.).

They always paid attention to all their spending and educated me on the value of everything, besides the need to save money. I was told to save very often and I began, by imitation, to deposit in the bank the money they could offer me for Christmas or my birthday, without really knowing why. »

She says she started working with summer jobs at the age of 17 in various sectors (cleaning in nursing homes, maintenance, then internships in her field of study). However, since he entered the full-time job market, his relationship with money has changed dramatically:

“Ever since I started working full time, I’ve realized how hard it is to make money, get up every morning giving his time to an employer in exchange for remuneration. Therefore, I decided to keep all my expenses to a minimum and buy as few “worthless” things as possible. I’m the only one to limit myself so for the moment this choice is only about me. The day I have children, I will revise the meaning of my priorities. »

In fact, every month Rose spends 25% of her salary and saves the rest.

“My parents helped me buy my own apartment”

If the young woman is able to put away such a large part of her income, it is because she became the owner of her apartment about a year ago, thanks to a donation from her parents. She explains:

“I never thought about becoming a homeowner at that age. At the end of my studies, having saved up a youth booklet and a booklet A with the money for summer jobs, birthdays and other extraordinary income, I had between €15 and €20,000 in reserve.

I didn’t know my father had such huge savings until he offered to help me buy an apartment to save me rent. With their help, I bought A two-room apartment of 28 m2 in a suburban city near Paris that costs €158,000 notary fees not included, without having to credit. »

In this apartment, you pay €53 in common invoices (water, gas, electricity). He explains that in winter he doesn’t turn on the heating, since his apartment is very poorly insulated: “I often wear pantyhose and socks under jeans.”

All the year, its condominium expenses are around €50 per month and its property tax is approx €39 (€471 per year).

She is attentive to the savings she can achieve by avoiding some subscriptions:

“I was able to reduce my internet budget by returning my internet mailbox and using my phone plan in connection sharing. My 140 gig package cost me €26 a month but I negotiated it at €19 playing the competition: I gave the current prices elsewhere to my operator, saying I was leaving and insisting a bit, IThey lined up. »

Rose’s expenses

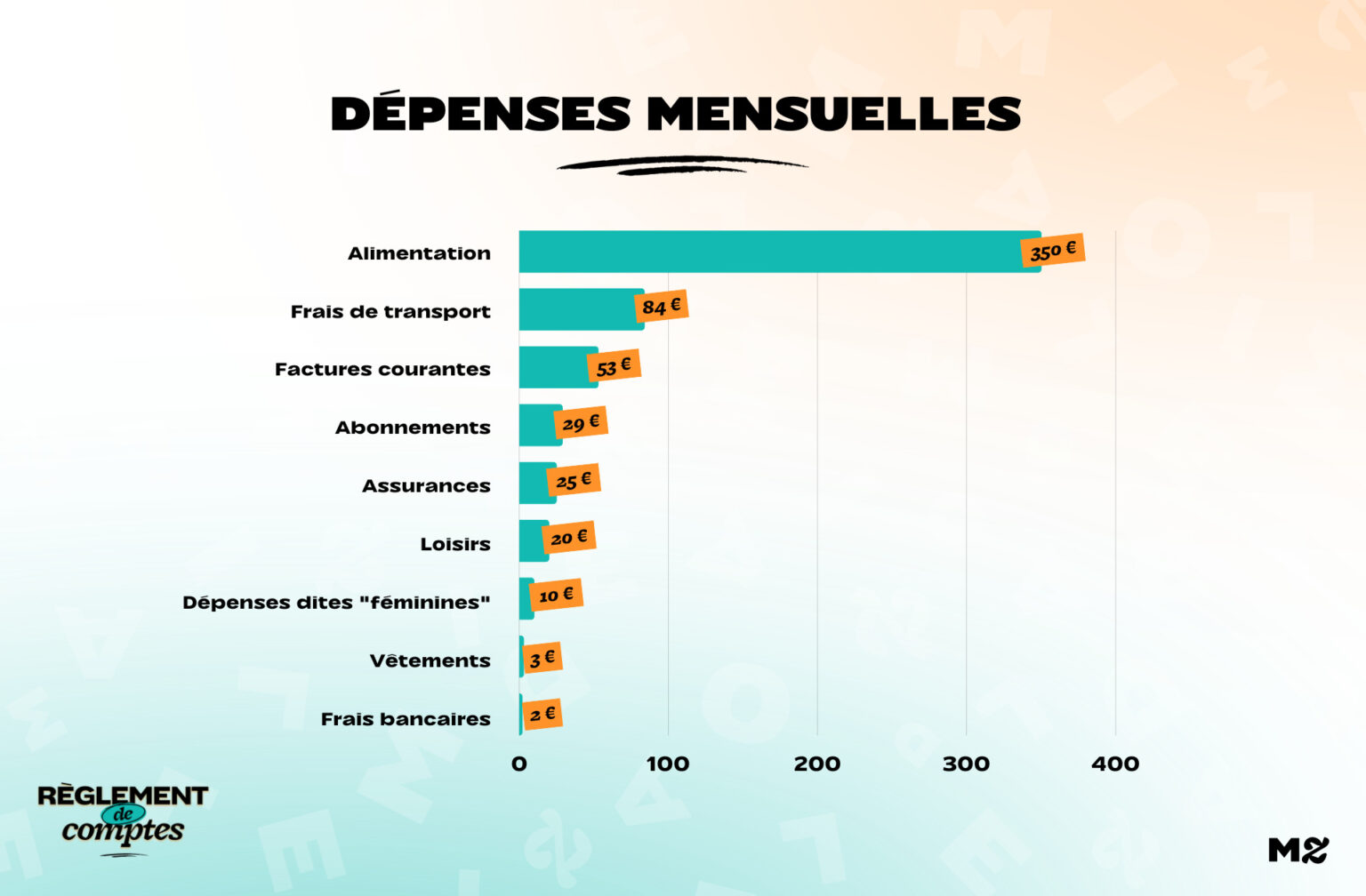

Rose’s biggest budget item is food. She spends on average €350 a month for shopping and eating out :

“I shop as often as possible at a discount supermarket, if I can’t I go to the Franprix downstairs. Sometimes I do Too god to go. I prefer the price but as far as meat is concerned I prefer to eat less, but buy it from the butcher. I also like to take organic eggs, for example. »

For lunch at work, use the restaurant tickets to which your employer entitles you:

“I would like to cut my budget for lunch at noon but I don’t have a canteen and I don’t find it practical to bring a box with a home cooked meal. I recently discovered the Picard lunch trays for 2 euros and therefore I take two every lunchtime. Once a week I also do a restaurant that doesn’t cost more than 15 euros. »

She believes that food is the only expense item she could reduce, but also the one she likes to indulge the most:

“I like to eat well, I can easily pay for a burger or an Asian restaurant!” That’s why my food budget it’s a bit high. However, I try to buy as many “commodities” as possible (eggs, pasta, rice, tomato coulis, greens and fruits, canned vegetables, oatmeal) and limit processed dishes. »

€83 in public transport passes, €2 in bank charges and €25 in civil and home insurance are added to this budget each month.

Rose’s hobbies

In addition to the restaurants, Rose has taken out an unlimited cinema pass for her free time, which costs €20 a month all year round.

“For the moment, I have no other leisure activities, except a few aperitifs with friends, but it remains very marginal. When I arrived in Paris, I idealized Parisian life a lot and I went out a lot and spent a lot at parties.

I have long distanced myself from some people and found myself more alone, with fewer outings. Since Covid, I hardly go out anymore so I don’t have to spend on the terraces anymore. For once it’s a bit of a situation and I think if I meet nice people, I’ll enjoy spending money on going out again! »

You can buy very few clothes, only on sale, and it’s about €30 a year for this budget location:

“When I was going out more, I liked to dress well, so I’ve been stockpiling a lot of clothes right now. Now that I work in construction, I rarely get the opportunity to put myself on my 31st birthday! I don’t think I could ever put more than 40€ into clothes. I like simple things, I don’t buy anything I don’t need. »

His latest crush? “Cologne at €20 for 35cl, at Roger Gallet”

Pink savings

Once these expenses are made, Rose saves on average €2,000 per month. Since buying her own apartment and with the help of a big bonus from her former employer, she has to date reconstituted savings of €29,000.

“My number one priority is to sell my apartment and buy one, A little bigger and a little closer to Paris to feel less isolated. I’ve always fantasized about Parisian life, about children who might grow up in or near Paris. I want to be able to offer a little of both worlds to my kids, a little of my mindset to me, and a little of the mindset here. »

In the medium term, he would like to become “financially independent”:

“I would like to have paid for my main house in full and own one or two income-generating flats, thus not being entirely dependent on my salary.

I do not aspire to quit working at all, but simply to prevent any inconvenience that may arise in life. »

Thanks to Rosa for answering our questions

The settlement of accounts accepts all types of profiles and incomes. To participate in the section, write to us at [email protected] We will get back to you with the procedure!

Photo credit by one: Anna Shvet/Pexels

Read another

Settle accounts

-

Emma, 900 euros a month: “I’m constantly exposed and it doesn’t stress me”

-

Carole, 2,700 euros a month in Martinique: “The system is a bit unfair to single mothers”

-

Anne, 2,415 euros per month: “I have my own work-study program, I give lessons and I babysit”

-

Audrey, 1,856 euros a month: “I should check my expenses one by one, but I can’t start”

-

Laure, single mother with 1,796 euros a month: “We often talk about money with my daughter”

Source: Madmoizelle

Elizabeth Cabrera is an author and journalist who writes for The Fashion Vibes. With a talent for staying up-to-date on the latest news and trends, Elizabeth is dedicated to delivering informative and engaging articles that keep readers informed on the latest developments.