The most addicted to online shopping have certainly noticed this: it is becoming increasingly easier to obtain payment facilities on the major brands’ eshop. Apple just announced it plans to roll out a new feature, pay later, which will allow you to pay in 4 installments for free, both online and in person. The Klarna banking service, which also allows you to pay in 3 installments for free, is already integrated in many online stores such as Shein, Boohoo, Uniqlo, Undiz, or even COS. Same thing for Paypal, available almost everywhere. Eshops like Zalando also allow you to order clothes online and only pay for what you decide to keep once everything has been received.

@itcelesta lol there is a future partnership with these companies #afterpay #klarna #financetiktok #fashiontips #designerhandbag #ROMWEGetGraphic

♬ Oh No – Kreepa

@itcelesta lol there is a future partnership with these companies #afterpay #klarna #financetiktok #fashiontips #designerhandbag #ROMWEGetGraphic

♬ Oh No – Kreepa

However, all of these payment facilitation services have the unfortunate tendency to cause many young people to go into debt for lack of adequate financial education.. On Insta and TikTok many people in their early twenties testify to problems caused by politics ” Buy now, pay later (Buy now, pay later, often abbreviated to BNPL).

“If you can’t buy it at once, maybe you shouldn’t even buy it 4 times”

This is the case of a video by influencer Madeleine White who summarized on TikTok to alert her audience:

@madeleinecwhite Afterpay is the only reason none of us 20 whores have any savings #fyp #afterpay

♬ original sound – Maddie White

@madeleinecwhite Afterpay is the only reason none of us 20 whores have any savings #fyp #afterpay

♬ original sound – Maddie White

“Dude, just because you can pay later doesn’t mean you won’t pay anything. $ 400 is still $ 400. And if you couldn’t afford to buy it all at once, maybe that means maybe you shouldn’t buy it. “

In fact, it often happens that young people not used to managing finances are not aware or underestimate the long-term impact of these payment methods, as the SHE American:

“A survey conducted by Piplsay, 43% of Gen Zs missed at least one payment in 2021. A Qualtrics study on behalf of Credit Karma found that more than half of Gen Z and Millennial respondents missed at least one payment, compared to Gen X (22%) and Baby Boomers (10%). NYU marketing professor Scott Galloway called BNPL “the equivalent of the subprime mortgage crisis” for millennials and Gen Z in an episode of the Pivot podcast. “

If the economic reality of the United States is different from that of France, we can still find this illuminating the differences in purchasing power and relationship with money across generations.

When will there be more financial education for everyone?

@ hyacintahyde10 #greenscreenvideo oh sorry I thought it was free 🥲 @Afterpay Australia #afterpay #broke #shoppingaddict #joke #humor #viral #fyp #afterpayit

♬ Damn, my video did the numerisss – taking a long break sorry guys

@ hyacintahyde10 #greenscreenvideo oh sorry I thought it was free 🥲 @Afterpay Australia #afterpay #broke #shoppingaddict #joke #humor #viral #fyp #afterpayit

♬ Damn, my video did the numerisss – taking a long break sorry guys

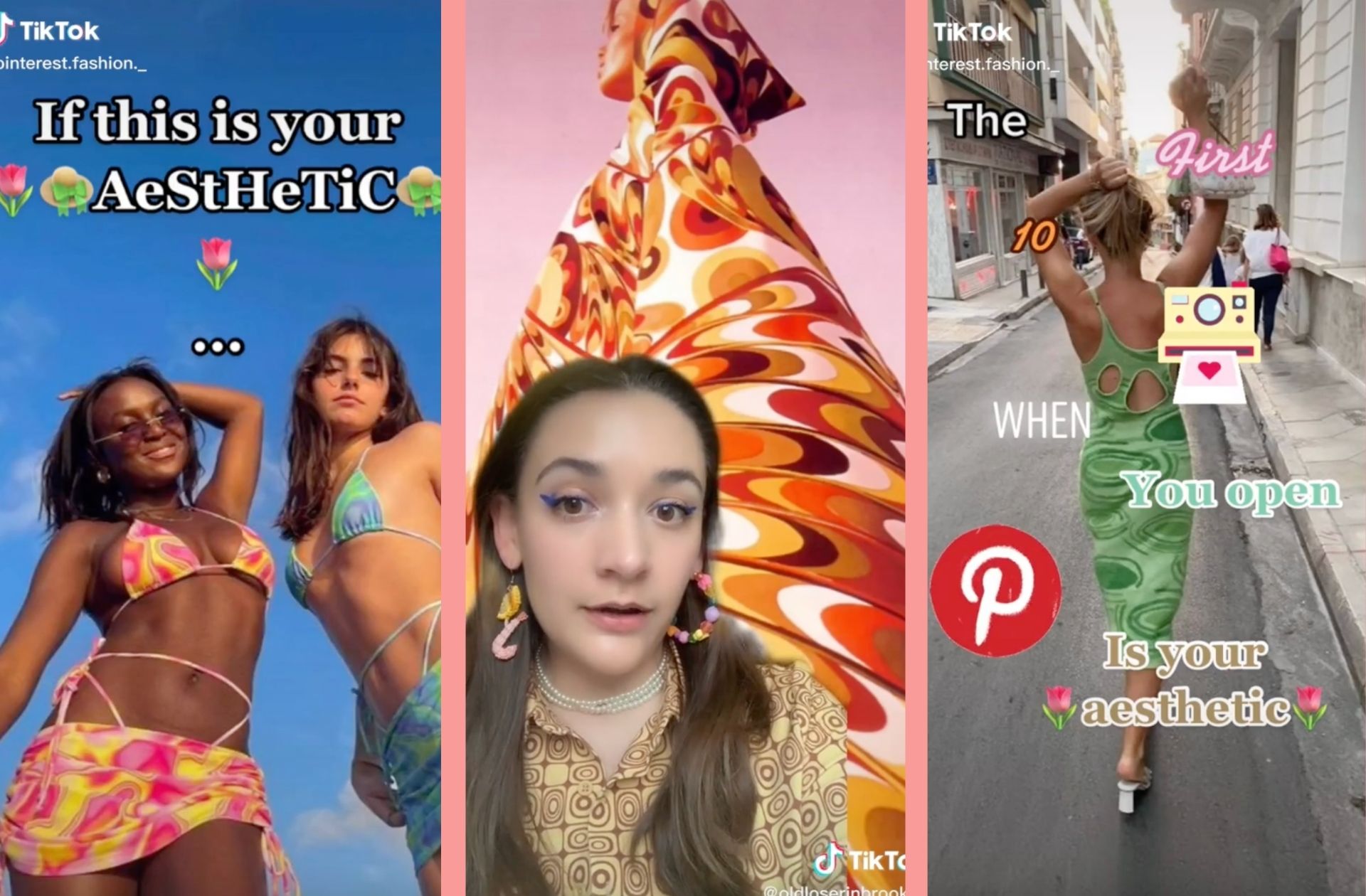

Being able to delay the inevitable in this way can give the impression of having a much larger budget than reality, or even unlimited. This illusion can cause financial disasters, fueled by the acceleration of fashion trends on networks like TikTok and Instagram, where showing off the latest micro-trend can help gain popularity and virality. And as these are increasingly ephemeral fashions, their followers often turn to ultra-fast fashion brands. This throwaway approach to fashion forms a consumerist vicious circle with the multiplication of payment methods into which many young people fall. In short, further arguments for greater financial education.

When will there be classes in high school, for example, to understand your paychecks, pay taxes, take out a loan or not, negotiate it and fully understand what it pays back? In the meantime, it might be time to rejoice in the friction in the act of buying, because having to type in all the numbers on the credit card, the CVV (Card Verification Value: the three small numbers on the back of the card), or even the double authentication with the phone could be less time wasted than thinking opportunities before (c) racking.

Front page photo credit: TikTok screenshot.

Source: Madmoizelle

Lloyd Grunewald is an author at “The Fashion Vibes”. He is a talented writer who focuses on bringing the latest entertainment-related news to his readers. With a deep understanding of the entertainment industry and a passion for writing, Lloyd delivers engaging articles that keep his readers informed and entertained.