Talking about money in France is still a taboo. However, it is a fascinating and in some respects… feminist topic! In our Account Settlement section, people of all kinds come to consult their budget, to talk to us about their financial organization (as a couple or alone) and their relationship with money. Today it was Lucie * who agreed to open her accounts for us.

- First name :Lucia*

- Age : 34 years

- Occupation : Human resources manager in the local civil service (I am a permanent employee), municipal councilor and volunteer firefighter

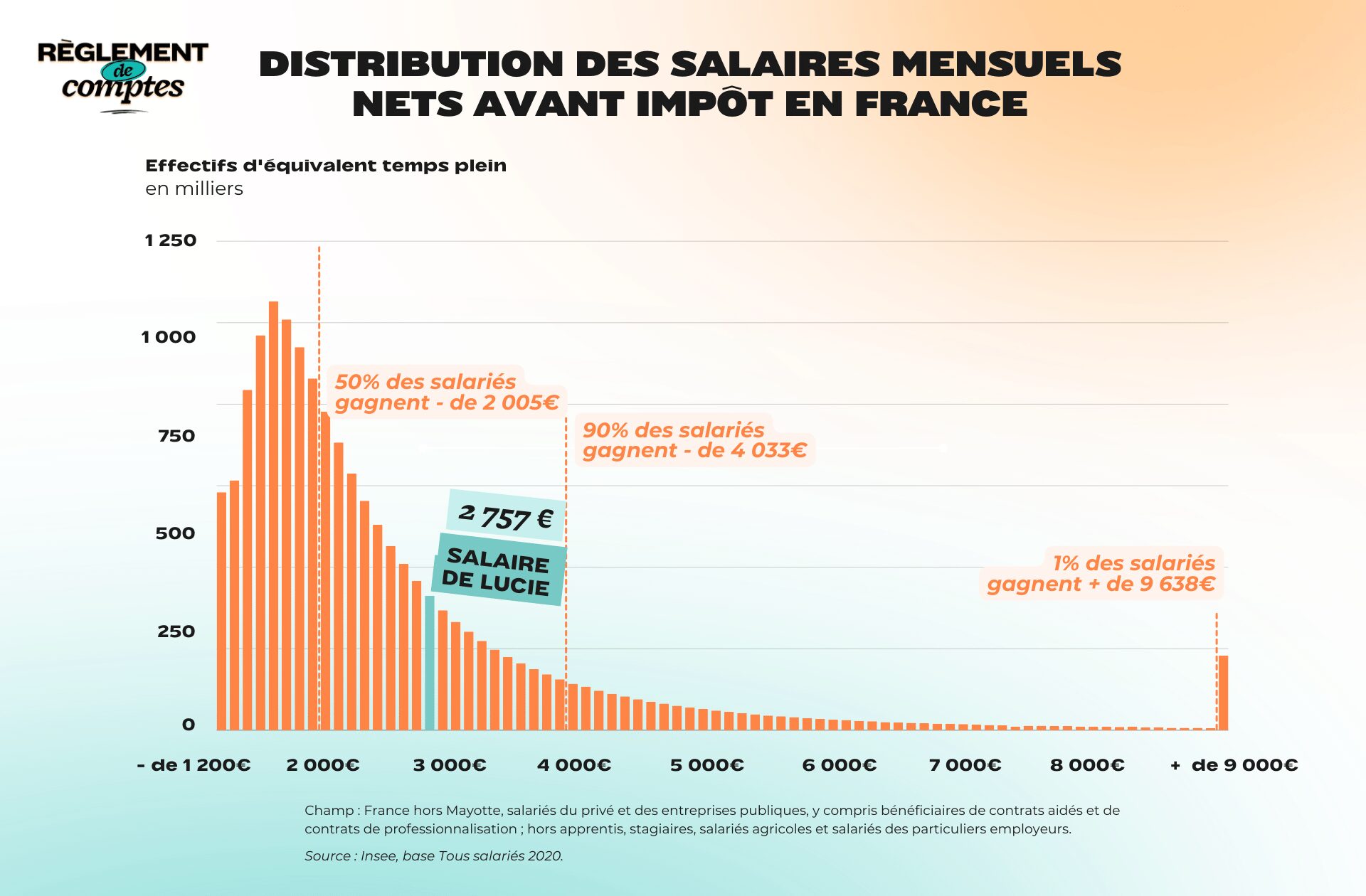

- Net salary before withholding tax : €2,757 (of which €51 pension)

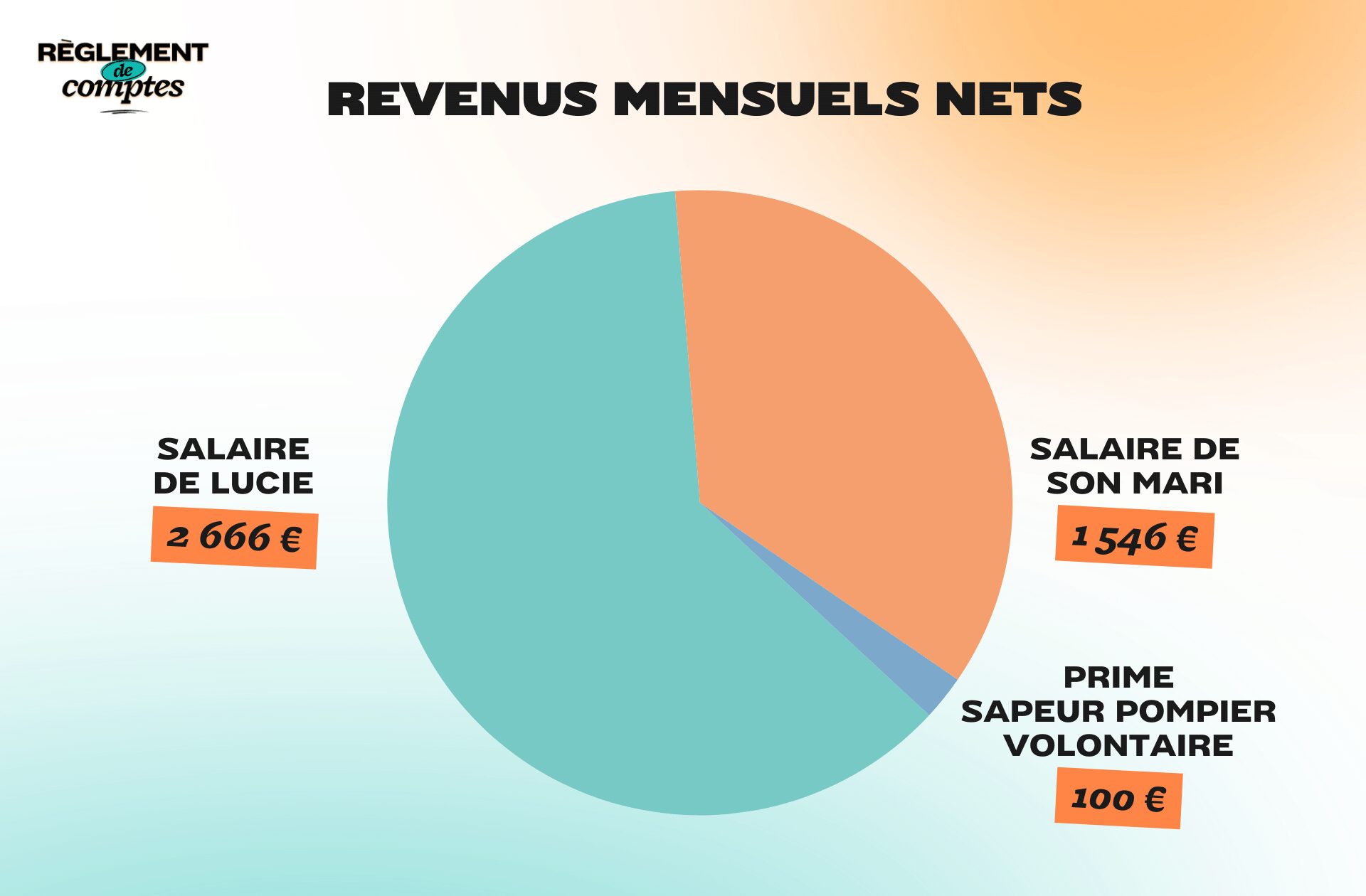

- Net salary after withholding tax : 2,666 euros, of which 52 euros as a municipal councilor and approximately 100 euros as a volunteer firefighter; 1,546 euros for her husband

- People (or animals) living under the same roof : her husband, 2 bitches, 2 goats, 2 goats, a ewe and a sheep

- Place of life : in the countryside, 30 minutes from Rennes (Ille-et-Vilaine)

Lucie’s situation and income

Lucie, 33, is Director of Human Resources (HRD) in the territorial civil service. After having practiced this profession for seven years as a contract worker, she has now been employed on a permanent basis for three years. Which guarantees him ten years of seniority in this position. Very busy, the young woman holds the position of municipal councilor and it’s Volunteer firefighter.

“During the year I take on the role of city councilormaximum eight hours per month, between municipal councils and commissions. My minimum activity as a firefighter takes me 60 hours a month, which include an on-call shift, a weekend of on-call duty plus a morning of sports and firefighter training. This quota may increase depending on the number of interventions.

What I like, like my job in the local civil service, is doingbe at the service of my country and the population. As a former soldier, helping others is really important to me. »

Married for three yearsshe lives with her husband in the Breton countryside, a five-minute drive from the town “which has everything (supermarket, clothing and shoe shop, doctor’s office, butcher, bakery, bar, restaurant, etc.)” and thirty minutes from Rennes. Together they purchased a 140 m house in March 20212 with 5,000 m2 of land, where they live surrounded by their animals: two dogs, two goats, two goats, a sheep and a sheep.

For her work in human resources, Lucie receives a net salary of €2,666. To this remuneration are added Salary as city councilor €52 AND Around €100 a month for his work as a volunteer firefighter. «For information, an hour of on-call duty (on-call) is paid 0.72 euros per hour and interventions and training 8.34 euros. »

Her husband touches a monthly net salary of €1,546and is not subject to income withholding tax. In total, the couple then receives €4,363.

When we ask Lucie how she feels about her pay, she says she feels that way “paid correctly” even if he aspires to earn more in the short term.

«In fact my role requires a lot of technical skills, unpaid overtime (category A in the public sector) and evening meetings. I don’t consider myself rich, but a little above average. Regarding the total compensation in our report, we are average because my husband earns much less than me. »

Lucie’s relationship with money and her financial organization

Lucie grew up in an experienced middle class family “serious financial difficulties” when she was a child, when her father lost his job.

“We had to move and go to Restos du Coeur, I didn’t always eat my fill. »

Often exposed, Lucie’s parents don’t always have the ability to choose her career path, especially when she prioritizes her well-being, even if it meant cutting her salary. “We have already discussed this in the past. »

Today Lucie is very organized in financial managementeven if it sometimes makes some deviations.

“I try to budget for everything. I’m never overdrawn but I can barely save. I’m generous by nature and love to entertain, so my food budget can easily increase when I host meals at home. »

From an organizational point of view, she and her husband have a checking account to pay their daily bills. They have too everyone kept a current account for their personal expenses. “This organization fully satisfies us and allows everyone to do what they want with what they have left. »

Lucia’s expenses

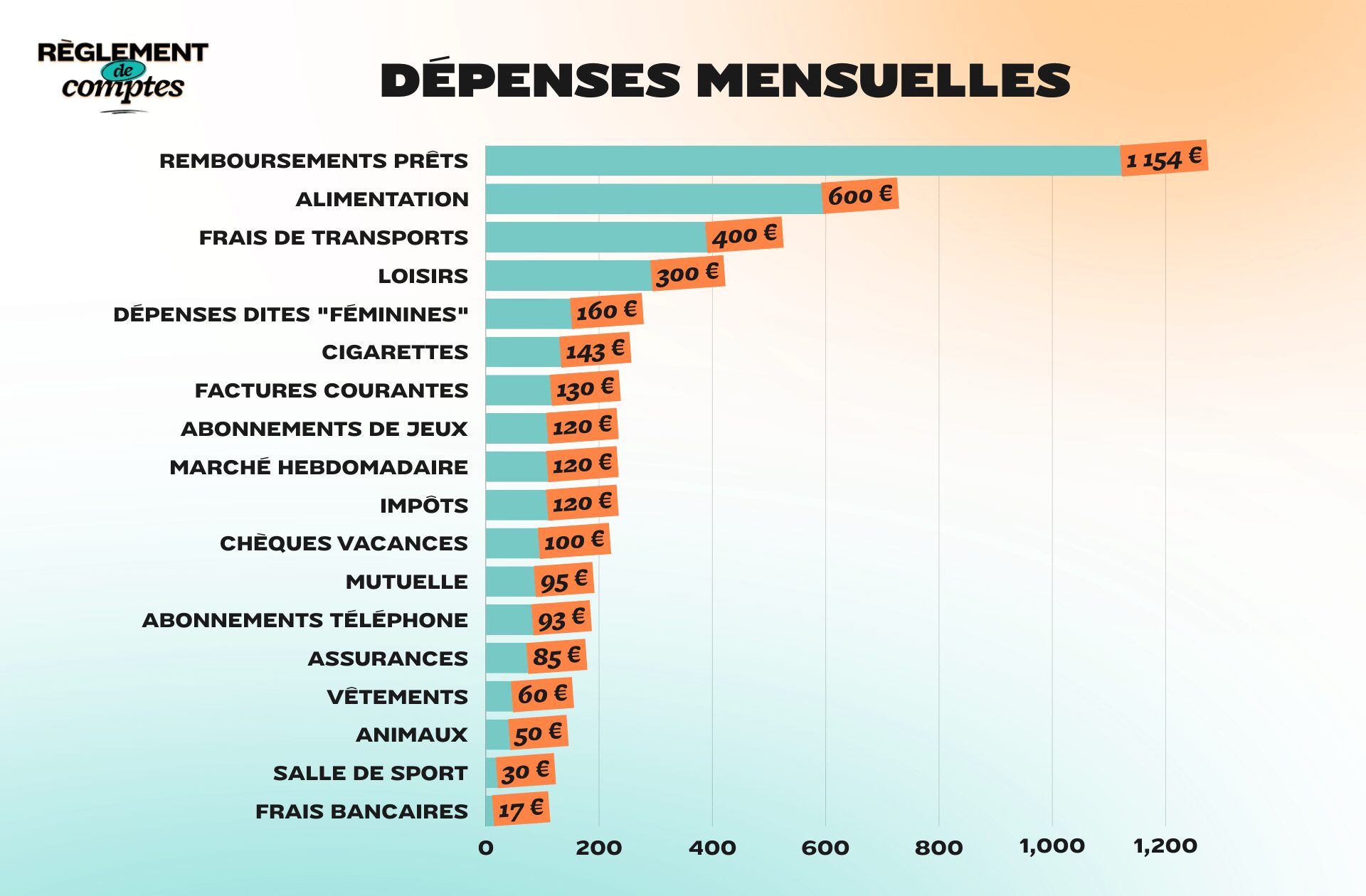

Like many of us, Lucie and her husband’s biggest expense is housing: their real estate mortgage costs them 1,050 euros. They also refund €104 per month for the installation of a heat pump.

As owners, Lucie and her husband have to pay property tax – it costs them €120 per month. They also perform €100 FES invoice AND €30 of water per month. The insurance goes to them €85 : €30 for Lucie’s car, €30 for her husband’s, €15 for their house and €10 life accident insurance. They settle down Monthly mutual insurance from €95 for two.

Another important expense item for the couple: telecommunications and subscriptions. For their two phones, Lucie and her husband pay €60 per monthas well as 1Internet subscription €5. They add to this €18 per month for Netflix, Disney+ and MyTF1 AND €120 video game subscriptions. Lucie pays these last two sums herself.

The couple also pays €17 bank charges (€12 for Lucie, €5 for her husband).

Transportation weighs on their budget: Lucie has to pay €250 of petrol every month; her husband €150.

“I live in the countryside and my only means of transport is the car. My area is not sufficiently served by transport, otherwise I would gladly take it. »

“My husband has very high energy needs”

Each month, Lucie and her partner spend on average on food €720 : €600 at Lidl and around €120 at the market “for fruit, vegetables and seafood”.

“I prefer the composition of foods, their origin and if possible organic. I like to buy local. For lunch I prepare baskets for my husband and I and have lunch outside once a week for €25-30 a week. »

Lucie is currently fully responsible for this considerable budget, which she justifies as follows:

“My husband is also a firefighter and has worked in the sports field for twelve years and has very high energy needs. He has just changed jobs but still plays sports as much. Earn more than my husband, It seemed natural to me to cover these costs and that’s fine with us. »

Furthermore, the couple has many animals to take care of. For the purchase of hay, kibble, wormers, Lucie pays on average herself €50 per month.

As for the so-called “female” expenses, the thirty-year-old places them at Around €160 per month. This sum includes expenses for the hairdresser, the nail technician, but also for beauty treatments and make-up.

“I had laser hair removal three years ago and I have a contraceptive implant. I spend around ten euros a month on health protection. I would like to switch to washable protection but I am very afraid of leaks, having very heavy periods. For makeup, the annual budget is around €100. Instead, every month I spend €40 to get my nails done, €60 at the hairdresser (I have very long hair that needs maintenance) and €40 for beauty treatments. »

Finally, the last expense that weighs on Lucie’s budget: cigarettes, which cost her €143 every month.

Lucie’s leisure expenses

Lucie likes going to the movies, dining out and playing sports, which she does indoors. And these free time activities have a cost that she estimates to be around €330.

Her gym membership costs her 30 euros a month and she pays an annual cinema pass of 16 euros, which allows her to pay 5.50 euros for a ticket instead of 10.20 euros. It’s a profitable investment, as he goes there about twice a month.

For clothing, Lucie spends approx €60 per month.

“I purchase on Vinted mainly for everyday use, I am very in favor of used cars for obvious ecological reasons but when I need something specific for work, I buy from Helline, which is a site with very good quality clothing. »

In the end, the spouses order holiday vouchers: they cost them 50 euros each over eight months. Enough to make sure they pay less when they’re on the run.

Lucie’s savings and her future plans

Even though she says she can’t save much, Lucie manages to do so regularly set aside between 300 and 500 euroswhich he puts in an A booklet or uses to furnish his new home.

“These are purchases that I take care of, as I have more income. I have little savings because it paid for our wedding in 2020, for which we both took an equal share from our savings. »

In the near future, Lucie plans to change cars, hers to give up the ghost here “two or three years at most”. And, in a year or two, she would like to take a nice trip to Japan with her husband.

Thanks to Lucie* for opening her accounts for us.

* The name has been changed.

Read another one

Settlement of accounts

-

Nadège, formerly over-indebted at 1,766 euros a month: “I had to calculate everything down to the cent”

-

Anaïs, cross-border worker, 4,567 euros per month: “My income has tripled since I started working in Switzerland”

-

Elsa, 4 thousand euros a month: «I earn two-three times more than my boyfriend»

-

Noémie, 2,950 euros a month for two: «With a passion for work we will never be rich»

-

Tania, student and 2,038 euros a month: “Having few expenses is not a reason to spend a lot”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Do you like our articles? You’ll love our newsletters! Sign up for free on this page.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.