Talking about money in France is still a taboo. However, it is a fascinating topic… and feminist, in some respects! In Settling the Accounts, people of all kinds examine their balance sheets, tell us about their financial organization as a couple or alone and their relationship with money. Today it was Valentine * who agreed to analyze her accounts for us.

First name : Valentino*

Age : 27 years old

Occupation : in communication and management of cultural projects

Gross salary : €2,903.33

Net salary before withholding tax : €2,110.52

People (or animals) who live with you : 1 dog

Place of life : province of Walloon Brabant (Belgium)

Valentine’s Day situation and income

Valentine, 27, is Belgian. She is hired on a permanent basis in ABSL (non-profit association) for two years in a concert hall as Head of communications and cultural projects.

«I organize festivals especially for young audiences. I like my profession because it is very varied, I meet lots of people and it allows me to exercise my organizational skills. Furthermore, I am passionate about music. It’s a really rewarding first job, in an industry I love, with a mentality I appreciate. »

Single, lives with his dog the province of Walloon Brabantsouth of Brussels, a a 60m2 apartment2 of which she has been a tenant since July.

“It’s a 1 bedroom apartment with a small garden, in a quite green but urban area. I used to live in a shared apartment in Brussels, but I felt the need to be alone with my business and to be closer to my workplace. »

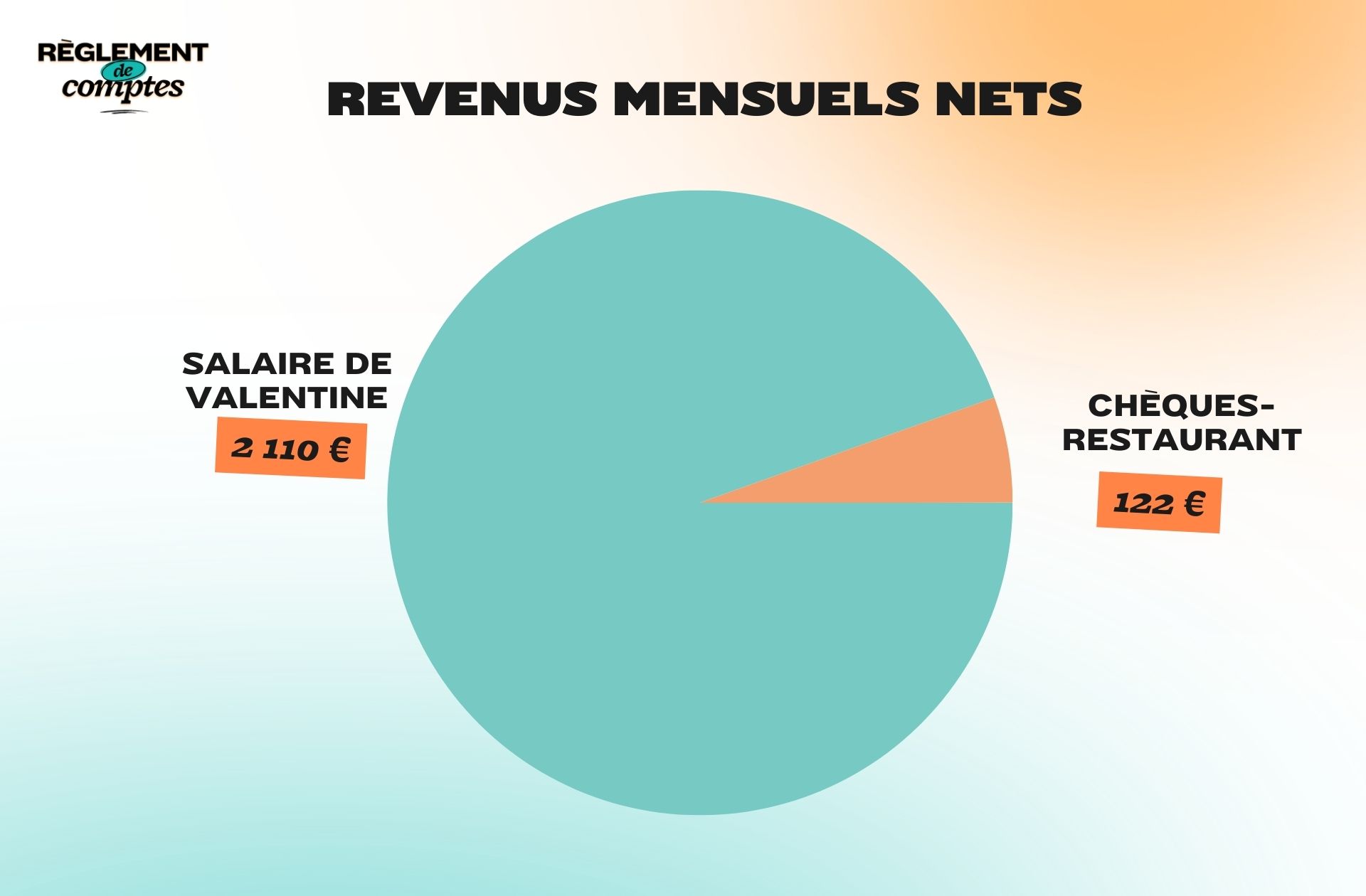

For his work within a cultural association, Valentine receives a gross salary of €2,903which means he still has it €2,110 net to live on. He specifies that he can only count on his salary, sometimes supplemented by “ small jobs (babysitting, proofreading documents, etc.) ».

“I find that I am relatively well paid for the cultural sector. My salary is comfortable, I manage to save several hundred euros every month. »

If the young woman manages to save it is also because she doesn’t have a car. “I couldn’t afford it now, but I can do without it. I go to work on foot or with an electric scooter. I’m average. Luckily I get meal vouchers [d’un montant de 122 €, ndlr] who help me pay for food. »

As for the amount of income tax she will have to pay, Valentine estimates that for last year it will be 800 euros, but she is not absolutely sure. But this amount is due to the fact that she worked part-time for six months. “We will see the ‘real data’ for my full time in 2024. »

Valentine’s relationship with money and his financial organization

Valentine grew up in a family “not rich at all”.

“When I was little we often tightened our belts and went on camping holidays nearby, or took trips to Europe. »

From her parents, the young woman believes she has inherited “their stress” at the prospect of running out of money. Often out in the open, Valentine’s parents however did not “I have never had debt”. “Sometimes I felt a little heartbroken for them.”remember.

“No one is rich in my family. I would like to be rich, but in my professional field this is just not possible. It’s not a big problem, I like the cultural environment, I feel comfortable there and it’s more important than money. »

Today Valentine believes he manages his money well. Never out in the open, he tries to save whenever he can, although he doesn’t hesitate to do so “buy the things you want, remaining reasonable”.

“After doing some marketing during my studies, I often analyze my purchasing behavior and I can easily recognize my favorites; I never waste my money on stupid things.

On the other hand, I have a lot of trouble not saving or withdrawing money from my savings account, but I’m not sure why. As if I needed to have security, to protect it as much as possible even if at the moment I have no investment plans. I am very aware of the value of money and I get angry when I stupidly lose it. »

As for his financial organization, Valentine has a checking account and a savings account, into which he pays part of his income at the end of the month.

Valentine’s Day expenses

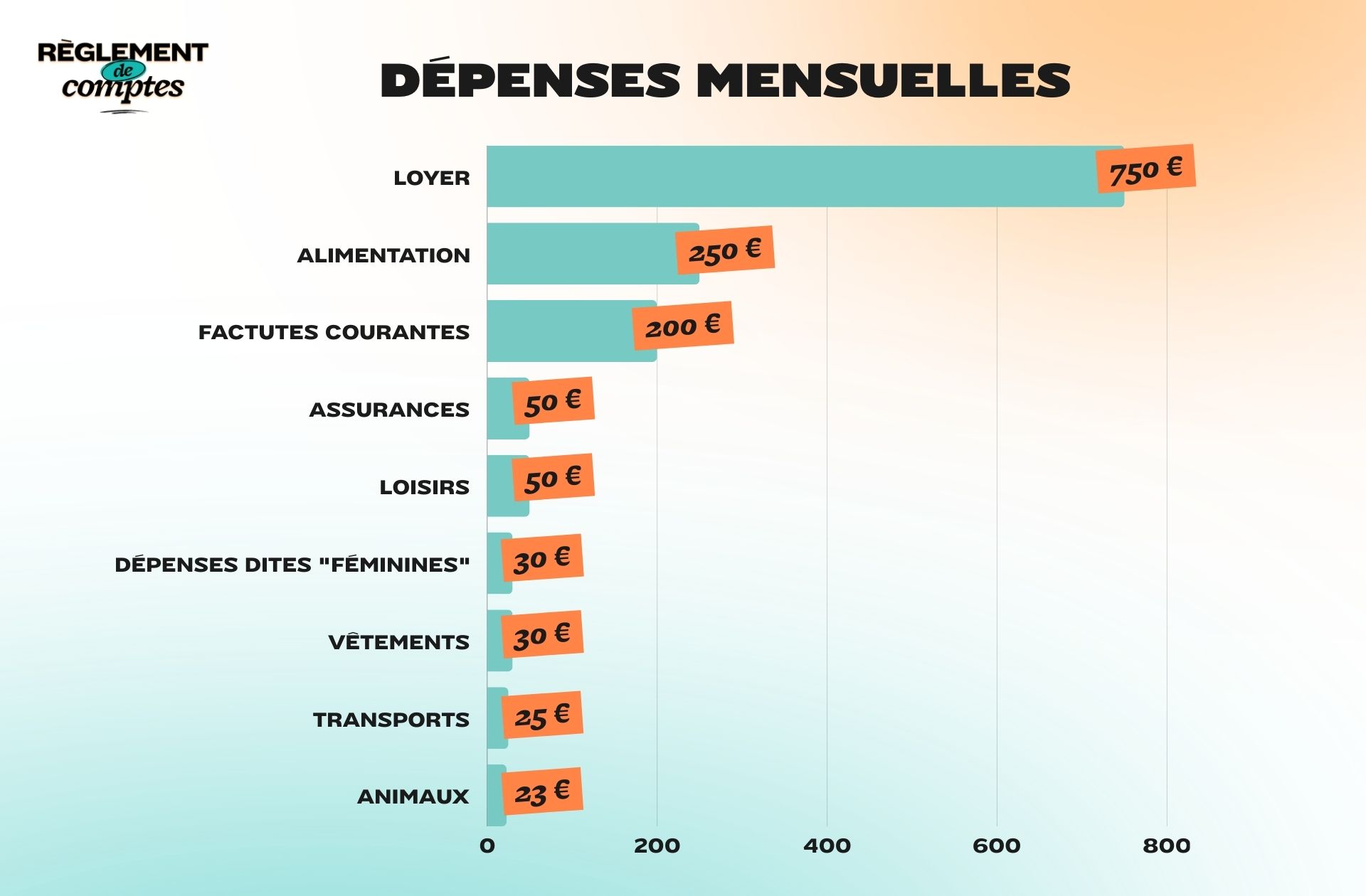

Valentine’s main expense is rent: he pays it every month €750 for your 60m2 apartment2 south of Brussels.

The current invoices are due to him €200 monthly for gas, electricity, hot and cold water.

She rules €30 for your internet subscription AND €15 for your phonebut he doesn’t pay for Netflix or Spotify, since his father offers him these two services.

For his mutual insurance and home/liability insurance, Valentine pays every month €50.

Twenty-year-olds travels on foot or by scooter to go to work, which therefore costs him nothing. His professional expenses are also reimbursed. But he gets it “rent a car to go to another city for one of your recreational activities”. This expense is estimated at Around €25 per month.

“My biggest expense is my dog”

To feed himself, Valentine calculates the expense €250 per month, which he pays for in part with meal vouchers provided by his employer. To do her shopping she goes to the Belgian supermarket chain or Carrefour, as well as to organic food shops “vegetables are often cheaper”.

“I rarely buy meat, but when I do I buy quality (organic from supermarkets) because I grew up that way and white label products often disgust me due to unpleasant past experiences. »

Valentino completes his purchases by going to the market a few times, especially for fruit and vegetables.

He pays insurance for his dog and spends 80 euros on kibble every month and a half. Rounded up over the year, this is around €23 per month.

“My biggest expense is my dog: toys, food, vet visits, training… Not to mention the items that she destroys and that I have to replace. »

For his so-called “feminine” expenses, Valentine says they are “close to zero”.

“I have been using period panties for almost three years. I had to buy two packs of pads in a year and a half. I don’t buy many beauty products, they last a long time. »

His last order cost him €20 and dates back to last January. In terms of makeup, estimate the expense €30 per year on average and shave with an epilator bought for €30.

«I go to the beautician a couple of times a year, let’s say on average 25 euros a year. My contraception costs me more than 110 euros a year but my health insurance reimburses me half of it. I don’t share with a partner because I don’t have one, but when I do, he pays for the condoms. »

In total, leveled out over the year, all these expenses amount to €30 per year.

Valentine’s Day leisure expenses

For his free time activities, Valentine spends on average €50 per month. It includes a singing lesson (360 euros per year, payable in two installments) and language lessons (75 euros per year).

“I’m lucky enough to be able to attend concerts at work, but culture is central to my life. »

The young woman also occasionally buys books around €20 per month.

“I often take my dog out, run and it’s all free. I like going to the opera but I go with press tickets. I bought a refurbished Switch a few months ago and I never fall in love with the games (I plan to ask for one for Christmas). »

His latest cracks to date? An electric scooter to go to work (500 euros), a tattoo (80 euros) and concert tickets for her and a friend (110 euros). After her recent move she also had to buy some furniture, including a sofa.

“But I collect a lot of furniture from right to left, in decoration I am the queen of resourcefulness. »

When it comes to clothing, Valentine spends little: average €30 per monthin particular on Zalando xux Petits Riens – “a sort of Belgian Emmaus”.

“I try to do little shopping, it’s something that makes me feel good so sometimes I struggle a bit to resist. But because I immediately feel guilty, it’s quite limited. »

Valentine’s Day savings and future plans

Once all these expenses are met, there should be a few more €750 on Valentine’s Day to end the month. But other costs “hidden” undermine this great saving.

“I have to count the outings, the gas when I use my parents’ car, the extras for my dog…”

There is also “The osteopath’s treatment is reimbursed very little, so sometimes I have to think about it before going for treatment”adds Valentine, who nevertheless succeeds save between €300 and €600 per month.

“I deposited them into my savings account without really knowing what to do with them. I don’t have enough savings to buy a house yet. »

However, in the long term, it is the project he aspires to. Ideally, within five years she would like to own a home.

“I don’t have any other big plans, I’m not very interested in travelling, so I don’t need to see the world, maybe one day when I’m really comfortable financially. I’m still adjusting to just paying rent and bills, to maintaining some balance between free time and savings. I’m quite happy with my life as it is, I know it’s made up of months with more expenses and months where I can save more, of course I’d like to meet someone and start a family, but since that’s not current, I I only take care of myself and my dog. »

Thanks to Valentine* for opening his accounts for us!

* The name has been changed.

Read another one

Settlement of accounts

-

Camélia, 400 euros of income and 1,190 euros of aid per month: “There are many deprivations and sacrifices”

-

Coralie, 5,179 euros a month for two: “I always try to earn more”

-

Clémence, 2,245 euros per month: “In our region the cost of living is very high”

-

Julie, 1,550 euros per month: “My partner is responsible for many common expenses”

-

Raphaëlle, salary of 1,340 euros per month: “I consider myself poor”

To testify about Madmoizelle, write to us at:

[email protected]

We can’t wait to read you!

Do you like our articles? You’ll love our newsletters! Sign up for free on this page.

Source: Madmoizelle

Mary Crossley is an author at “The Fashion Vibes”. She is a seasoned journalist who is dedicated to delivering the latest news to her readers. With a keen sense of what’s important, Mary covers a wide range of topics, from politics to lifestyle and everything in between.