Talking about money is still taboo in France. Still, it’s a fascinating topic… and feminist, in some respects! In Settle accounts, people of all kinds examine their budget, tell us about their financial organization as a couple or alone and their relationship with money. Carole agreed to check her accounts for us today.

- First name : Carol

- Age : 39 years old

- Work : Executive assistant

- Net monthly salary after withholding tax: €2,500

- Lives with : her 4-year-old daughter and their rabbit

- Place of life: an apartment of which she is a tenant in Schoelcher, Martinique

Carole’s income

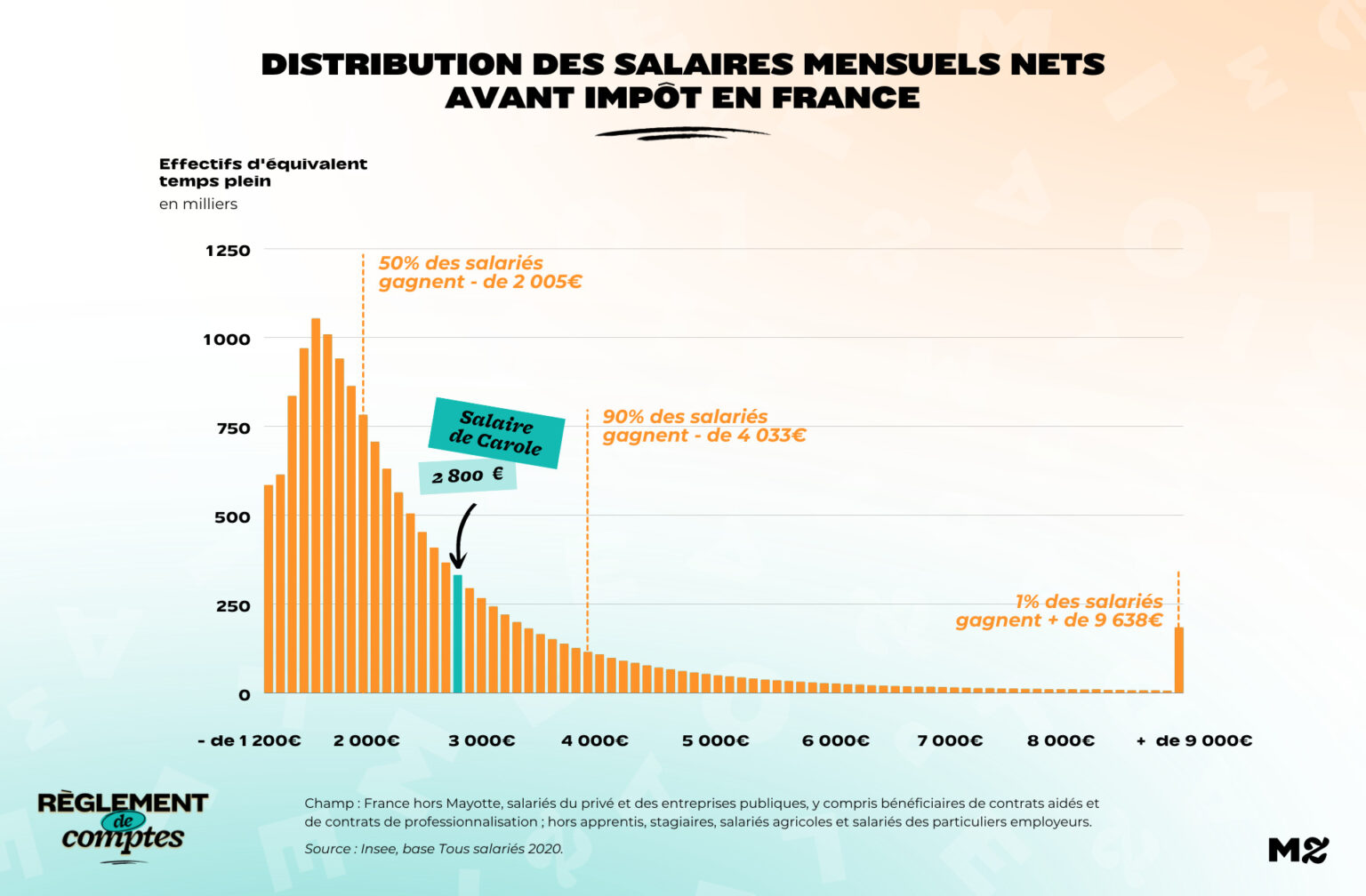

Carole is a management assistant in a large group, where she was hired for 4 years on a permanent contract 40 hours of work per week. Before withholding tax, he receives 2,800 euros a month, ie 2,500 euros net. A salary she considers herself lucky to receive:

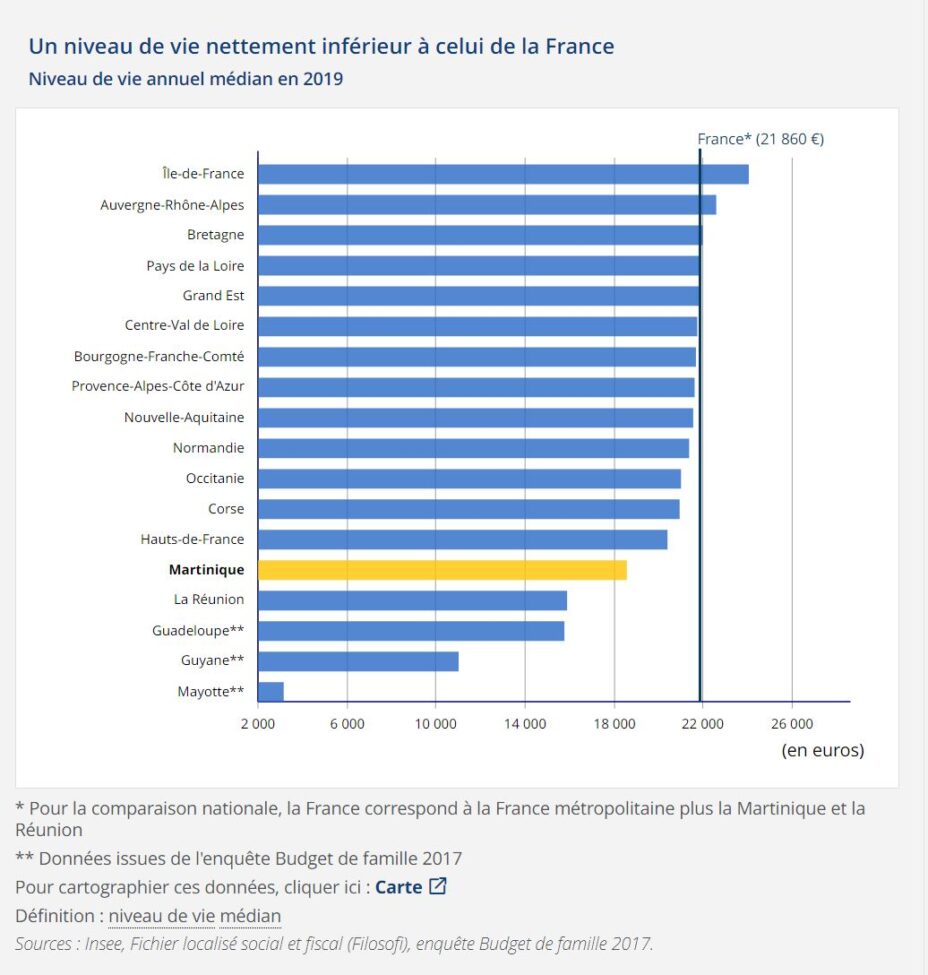

“I consider myself very well paid compared to the average salaries here in Martinique. My management was clearly sensitive to my situation as a single mother when negotiating my salary; is a group with great family values and I don’t think I would have touched that much anywhere else. In my job category, people are often on minimum wage, and given the cost of living, it’s very hard to get by. »

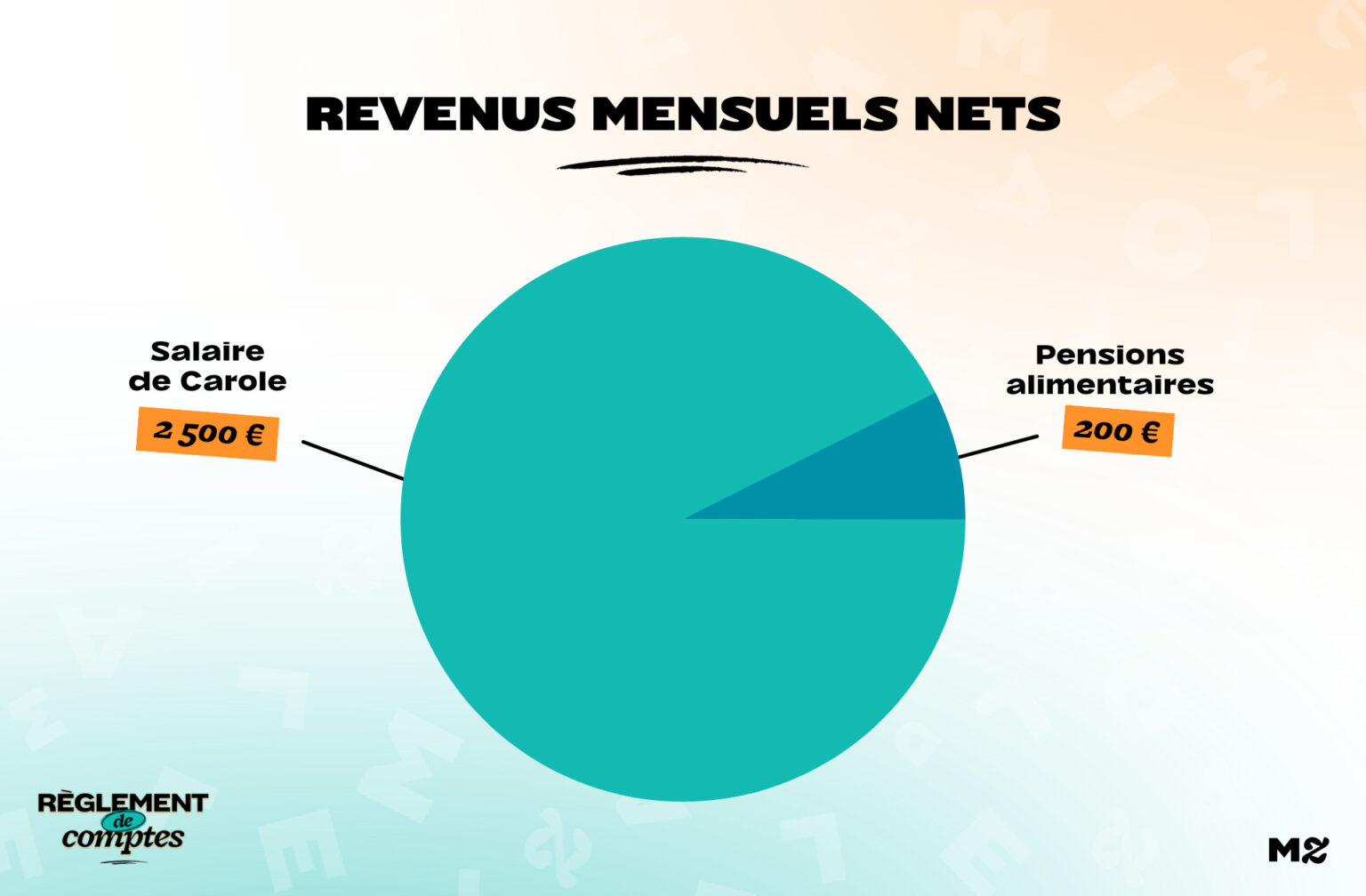

Her employer pays her occasional bonuses, the amounts of which vary, which she prefers not to include in her monthly budget. Separated from the father of her 4-year-old daughter, of whom she has sole custody, she perceives €200 of alimony per month.

“My daughter’s father lives abroad and only comes once a year, so I don’t know about joint custody. But he recognized him as his son, so I’m not entitled to any help and I pay for everything as a family with two parents! I find the system a bit unfair to us single mothers…”

Carole’s relationship with money

In Carole’s family, money has never been an issue: she explains that she has never lacked for anything.

“My father saves a lot and has passed on this need for security to us; my mother is more spendthrift and lives for the day; I think I’m a little bit of both!

Money doesn’t stress me out, I’m careful and keep my head on my shoulders. When there is, I take advantage of it. When there is none, I deal with it without getting sick. I have known very difficult situations before and have always managed to get out of them. »

At the beginning of each month he does the math and calculates his remaining life. So he checks his finances every day to avoid unpleasant surprises. In general, she considers herself wealthy:

“My daughter lacks for nothing, but we don’t live in luxury either, because in Martinique everything is expensive!

I’m not complaining because I know I’m a more than privileged single mother, and very often I think of others and wonder how they are here. Having said that, when I sometimes work over 50 hours a week and have to weigh the pros and cons before buying myself a €20 top, I tell myself there are some questions to ask…”

The expenses of Carole and her daughter

Carol is tenant of an F3 apartment of 86 m² since four years. When her daughter was born, she sold her flat F2, which had become too small.

“I hope to be able to buy an F3 but at the moment I have not been able to make a sufficient contribution and property prices here are excessive. I live in the city in a fairly residential area and this penalizes me a lot : I could buy elsewhere, but I have to stay close to my parents who go to pick up my daughter from school in the evening, otherwise the organization gets complicated. »

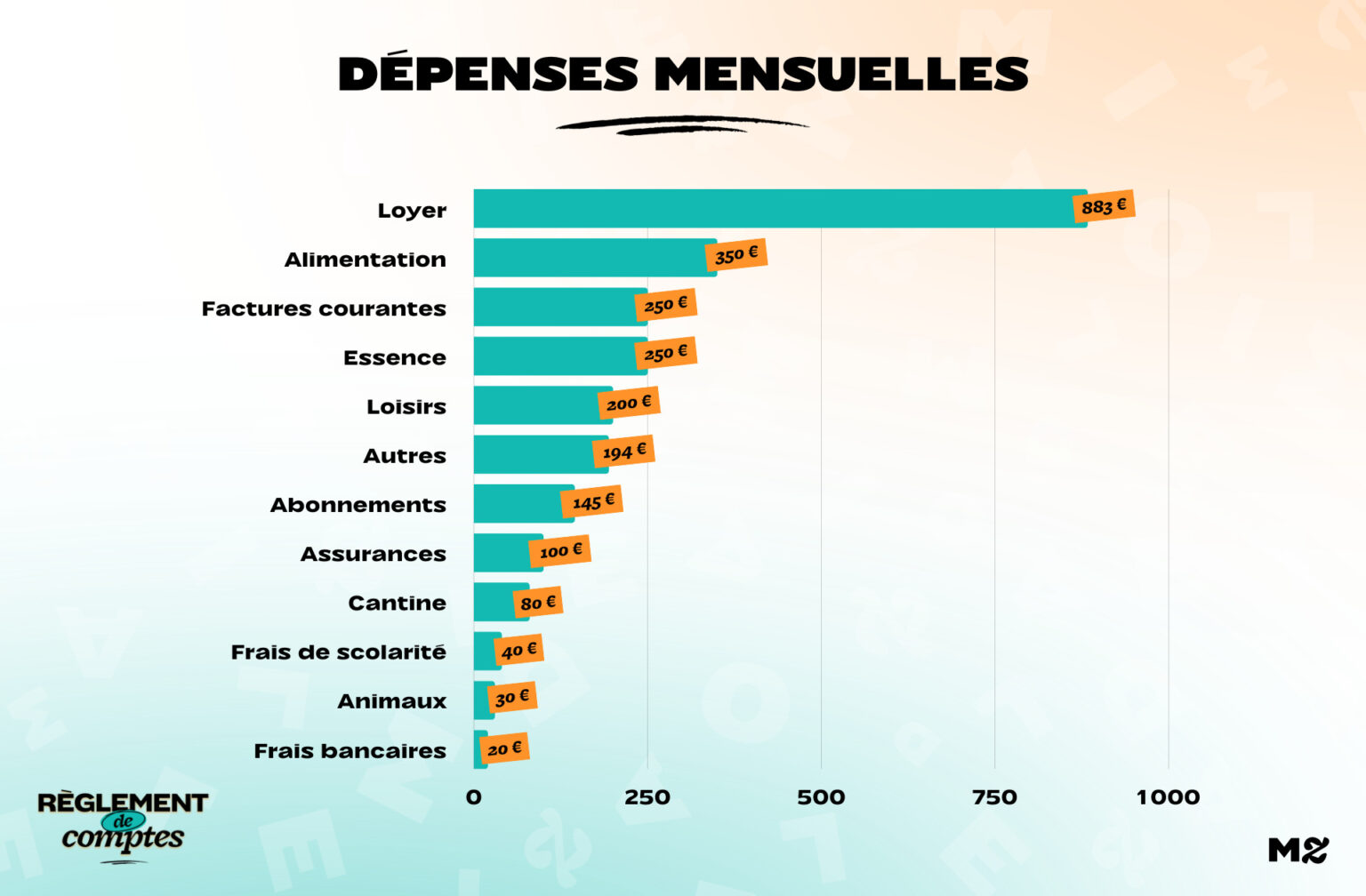

His rent is €883 per month charges included, plus 250 € of invoices network (for water, electricity and gas). He estimates that his subscriptions have a very high monthly cost: €45 to access the television, €40 for his phone, e €60 for your internet subscription (fibre).

“I find this budget too high. Before, there was almost no competition so I didn’t have much choice, but today this is no longer the case and I would have to look elsewhere to spend less. I haven’t had time to look into it yet. »

Its fixed costs also include €20 per month for your card and bank account, ea one hundred euros of insurance his housing, his car and his daughter’s school insurance.

The daughter’s canteen, where she eats during the week, costs her €80 per month.

“Shopping can quickly become a luxury”

In 2015, according to INSEE, food cost almost 40% more in Martinique than in mainland France. One difference that is felt enormously on Carole’s budget:

“Food is very expensive here. You have to be very careful, because many things quickly become a luxury as almost everything is imported. I try to limit myself to 300 euros per month maximum but in general, I prefer to spend 350 €. It’s huge considering what we buy: I eat out for lunch with my restaurant tickets which I manage pretty well, and my daughter is in the cafeteria. I only buy the essentials for the house, snacks and breakfast and a light dinner.

The prices at the supermarket are mind-boggling: nothing costs less than 3 euros. A President camembert costs around 9 euros, the hygiene products are too expensive. For a 150ml Cadum shower gel, I pay almost 7€, a basic balm costs 12€. »

She does most of her shopping in supermarkets or online, but due to the very high prices, she no longer buys fresh fruit or vegetables there.

“Now we trade fruits and vegetables with friends: many of us can grow things and we trade. »

After more than a week of riots in Guadeloupe and Martinique, several internet users, such as Mathilde Lamarre, (@__thilde__) decided to highlight one of the main problems: the price difference for the same item sold in France. pic.twitter.com/Axh73w7BYN

— AJ+ French (@ajplusfrancais) November 30, 2021

She spends approx €200 of petrol per month to get around, and describes public transport in his city as “a prison without a name”.

Carole and her daughter’s hobbies

Every month, Carole spends €40 for her daughter’s ballet lessons. She has no personal hobbies:

“Before I did yoga but I gave up the subscription which cost me 80 euros a month. I don’t really go crazy for myself, I deprive myself of everything so my daughter doesn’t want for anything.

She counts Budget of €200 for outings and free time with your daughter :

“We are often alone together, so I do everything to keep him bored and we go out a lot! On weekends we often fall in love with a fast food or a small restaurant, a cinema/show… It’s a small pleasure that you don’t refuse it. »

He relies on his employer’s outstanding bonuses to pay for slightly larger expenses: clothes or travel.

“I save most of the extra income to give ourselves a few days off at the hotel once in a while. Given the price of tickets, since it was born, we have only managed to leave once… for Guadeloupe, 45 minutes away by plane! Which still cost me more than €1,000 for three days. »

Carole’s savings

The single mother saves on several financial products each month to protect her daughter:

” I put €16 per month for capital guaranteed upon my death, €115 per month on life insurance, e €60 on death insurance

Once you have exceeded your fixed expenses, your savings and your current expenses, if you have any budget left, often happens in small unexpected events: a pair of shoes to change, an invitation to go out, or a breezy center during the school holidays.

He also has savings available that he doesn’t pour money into on a regular basis, just in case of exceptional cash flow. In the future, he would like to be able to buy an apartment or invest in real estate.

Thanks to Carole for answering our questions!

The settlement of accounts accepts all types of budgets and profiles. Do not hesitate to participate by sending us an email with a short presentation at [email protected]

We will get back to you with the procedure to follow!

Cover photo credit: Sai de Silva / Unsplash

read another

Settle accounts

-

Anne, 2,415 euros per month: “I have my own work-study program, I give lessons and I babysit”

-

Audrey, 1,856 euros a month: “I should check my expenses one by one, but I can’t start”

-

Laure, single mother with 1,796 euros a month: “We often talk about money with my daughter”

-

Allyson, 2,010 euros a month: “I’m discovered every month”

-

Marine, 2,257 euros a month: “I do the garbage for the shopping”

Source: Madmoizelle

Elizabeth Cabrera is an author and journalist who writes for The Fashion Vibes. With a talent for staying up-to-date on the latest news and trends, Elizabeth is dedicated to delivering informative and engaging articles that keep readers informed on the latest developments.